Table of Contents

Market Overview

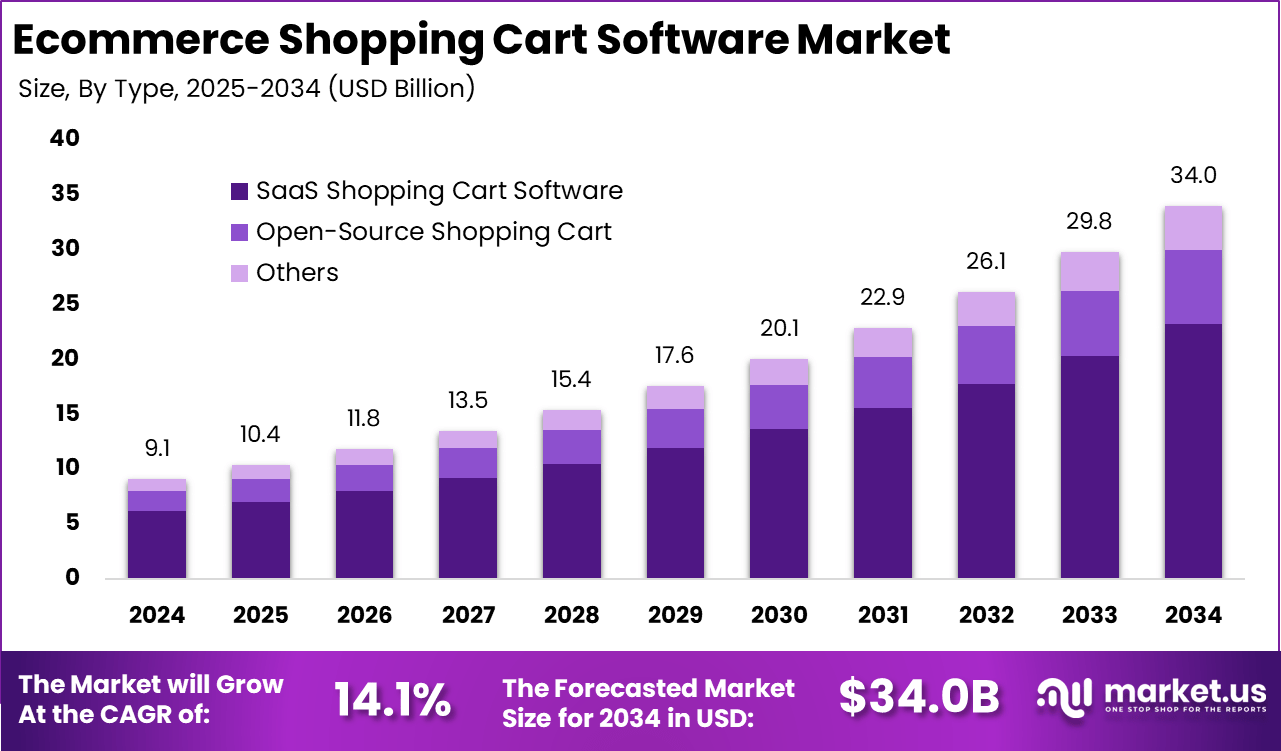

The global E commerce Shopping Cart Software market was valued at USD 9.1 billion in 2024 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 34.0 billion by 2034, expanding at a CAGR of 14.1% from 2025 to 2034. This growth is driven by rising online retail activity and increasing demand for seamless checkout and payment integration. Merchants are adopting advanced shopping cart solutions to improve user experience and conversion rates.

The ecommerce shopping cart software market refers to digital platforms that enable customers to select, review, and purchase products online. These solutions manage product selection, pricing, discounts, taxes, and checkout workflows. Shopping cart software integrates with payment gateways, inventory systems, and order management tools. Adoption spans small online stores to large enterprise ecommerce operations. These platforms form the core transaction layer of online retail.

Market development has been influenced by the rapid growth of digital commerce across regions. Online retailers require reliable and scalable checkout systems to handle increasing traffic. Traditional systems often struggle with performance and flexibility. Modern shopping cart software offers improved speed and customization. As ecommerce activity grows, robust cart functionality becomes essential.

One major driving factor of the ecommerce shopping cart software market is the need to reduce cart abandonment. Complex or slow checkout processes lead to lost sales. Shopping cart software streamlines the checkout journey. Faster and simpler experiences improve conversion rates. Conversion optimization drives adoption. Another key driver is the expansion of omnichannel retail strategies. Retailers sell through websites, mobile apps, and social platforms.

Shopping cart software supports consistent checkout across channels. Unified cart experiences improve customer satisfaction. Omnichannel needs support market growth. Demand for ecommerce shopping cart software is influenced by growth in small and mid-sized online businesses. Entrepreneurs seek easy-to-deploy solutions that reduce technical complexity.

Shopping cart platforms offer ready-to-use features. Lower setup effort increases adoption. This segment contributes significantly to demand. Demand is also shaped by enterprise-level customization requirements. Large retailers require advanced pricing, promotions, and integration capabilities. Shopping cart software supports these complex needs. Flexibility improves scalability. Enterprise demand remains strong.

Key Takeaway

- SaaS shopping cart software led the market with a 68.2% share, supported by scalability, low maintenance requirements, and cost-efficient cloud deployment.

- Small and medium enterprises dominated adoption with 81.4%, reflecting strong demand for affordable and ready-to-launch digital storefront solutions.

- The business-to-consumer model accounted for 74.3%, driven by expanding online retail penetration and direct brand-to-customer engagement.

- Subscription-based pricing models captured 56.4%, as monthly and annual plans became the preferred structure for continuous feature access and technical support.

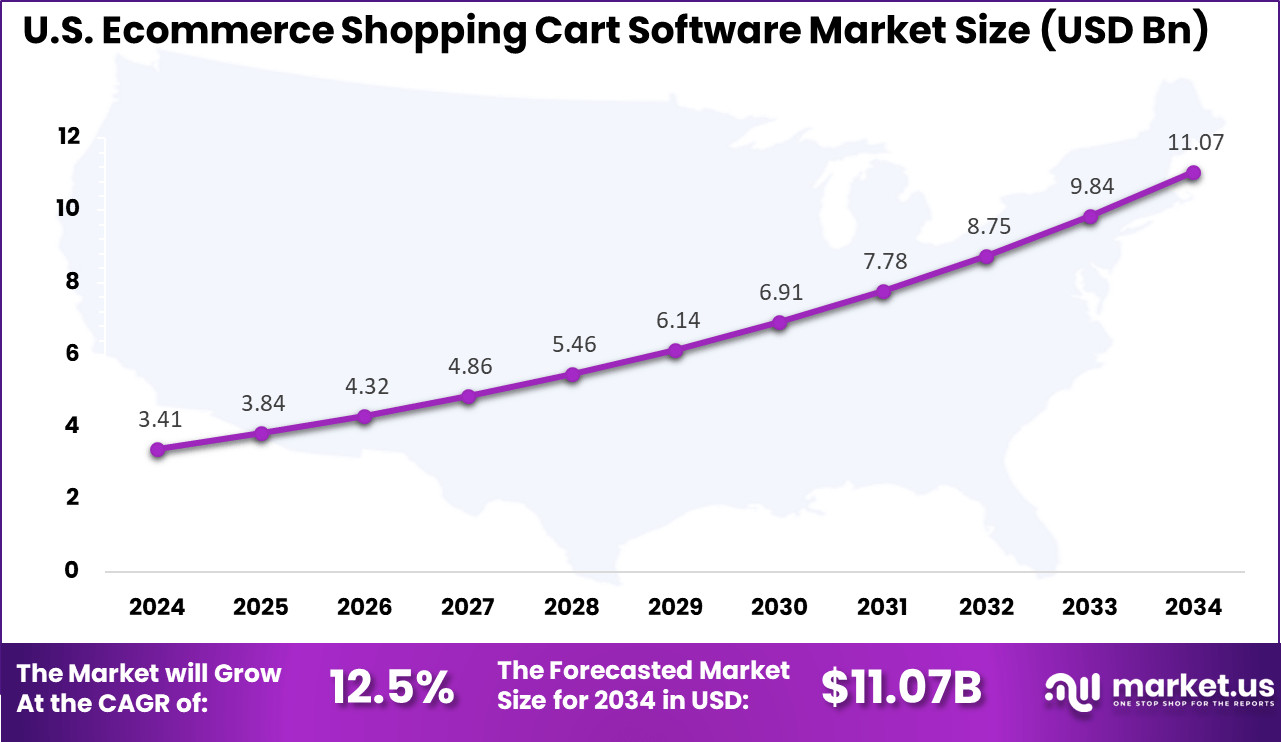

- The U.S. market reached USD 3.41 Billion in 2024, growing at a 12.5% CAGR, supported by advanced e-commerce infrastructure and integrated checkout technologies.

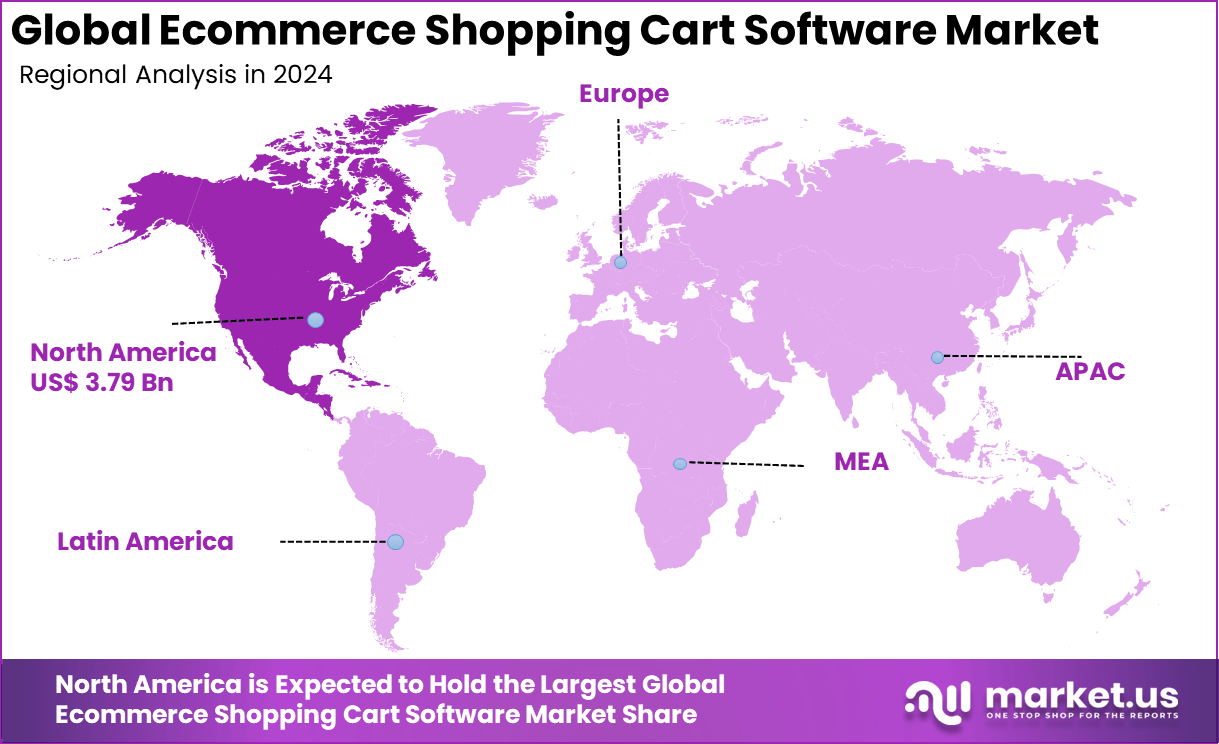

- North America maintained leadership with over 41.7% share, underpinned by high digital maturity, strong payment gateway ecosystems, and widespread cloud adoption.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 41.7% of total revenue. The region generated around USD 3.79 billion, supported by a mature e commerce ecosystem and high adoption of digital retail platforms. Strong investment in cloud based commerce tools and payment technologies strengthened regional leadership. As a result, North America continues to shape adoption trends in the e commerce shopping cart software market.

The market for E-commerce Shopping Cart Software within the U.S. is growing tremendously and is currently valued at USD 3.41 billion, the market has a projected CAGR of 12.5%.

Increasing Adoption Technologies

Cloud computing technologies play a key role in adoption. Cloud-based shopping cart software offers scalability and high availability. Retailers handle peak traffic without infrastructure upgrades. Cloud deployment reduces operational burden. Accessibility improves adoption speed.

Application programming interfaces also support adoption. APIs enable integration with third-party services. Payment, shipping, and analytics tools connect seamlessly. Integration flexibility improves system value. Modular architectures support customization.

One key reason businesses adopt ecommerce shopping cart software is improved transaction efficiency. Automated calculations reduce pricing and tax errors. Faster checkout improves customer satisfaction. Efficient processing supports higher sales volume. Reliability supports growth. Another reason is enhanced security and compliance. Shopping cart software supports secure payment processing. Built-in controls reduce fraud risk. Compliance with payment standards improves trust. Security remains a strong adoption factor.

Investment and Business Benefits

Investment opportunities in the ecommerce shopping cart software market exist in platforms offering mobile-first checkout experiences. Mobile commerce continues to grow. Optimized cart solutions improve conversion on small screens. Mobile focus attracts users. Investors target responsive solutions. Another opportunity lies in AI-enhanced shopping cart features. Personalized recommendations and dynamic pricing add value. Intelligent carts improve engagement. Advanced features differentiate platforms.

Innovation supports market expansion. Ecommerce shopping cart software improves revenue generation by increasing conversion rates. Streamlined checkout reduces friction. More completed purchases improve sales performance. Revenue predictability improves planning. Financial outcomes strengthen. These platforms also improve operational efficiency. Automated order processing reduces manual work. Inventory and payment integration improve accuracy. Efficiency gains lower costs. Operations scale smoothly.

Driver Analysis

The e-commerce shopping cart software market is being driven by accelerating online retail adoption and the need for seamless, intuitive checkout experiences that support conversion and customer satisfaction. As more merchants expand digital storefronts to meet consumer demand, shopping cart platforms have become essential for managing product selection, pricing logic, tax calculation, and cart abandonment recovery. These solutions enable retailers to centralise basket management and integrate with payment gateways, inventory systems, and customer engagement tools to reduce friction in the purchase journey.

The emphasis on mobile-first and omnichannel commerce amplifies demand for cart experiences that deliver fast loading, secure transactions, and consistent performance across devices. Simultaneously, competition among online merchants has elevated expectations for personalised and friction-free shopping experiences.

Shoppers increasingly anticipate features such as saved carts, persistent session continuity, dynamic pricing, and real-time inventory visibility. Shopping cart software that incorporates analytics and behavioural triggers helps merchants understand abandonment causes and optimise checkout flows to enhance conversion rates. Organisations deploying advanced cart solutions are better positioned to support sophisticated merchandising strategies, which strengthens their digital competitiveness and drives broader adoption.

Restraint Analysis

A notable restraint in the e-commerce shopping cart software market arises from integration complexity with legacy enterprise systems and third-party platforms. Many retailers operate legacy ERP, inventory, or customer management systems that do not natively align with modern cart software, creating technical hurdles in synchronising real-time data such as stock levels, pricing, and promotions.

Achieving seamless integration often requires custom development, middleware, or API orchestration, which can increase implementation timelines and cost. These technical challenges can deter smaller merchants or those with limited IT resources from adopting feature-rich cart solutions. Another restraint concerns security and compliance requirements associated with payment processing and customer data handling.

Shopping cart systems must adhere to stringent standards such as PCI DSS and evolving data privacy regulations in multiple jurisdictions. Ensuring secure transmission of payment information and protecting shopper data adds operational complexity and can require specialist expertise. Retailers lacking strong security governance may face barriers to adoption due to concerns about liability, trust, and potential regulatory penalties.

Opportunity Analysis

Emerging opportunities within the e-commerce shopping cart software market are linked to the integration of artificial intelligence and predictive analytics to enhance personalisation and upselling. AI-augmented cart modules can recommend complementary products, anticipate customer preferences, and optimise pricing strategies based on behavioural patterns and purchase history.

These capabilities support increased average order value and stronger merchandising effectiveness. There is also significant opportunity in supporting global commerce with multi-currency pricing, local taxation logic, and region-specific checkout experiences that cater to diverse international markets. Another growth opportunity lies in the expanding adoption of headless commerce architectures, where shopping cart functionality decouples from front-end presentation layers to support bespoke, cross-platform experiences.

This enables brands to deliver custom user interfaces across web, mobile, in-store kiosks, and IoT devices while maintaining unified cart continuity. Platforms that can adapt to headless environments and support flexible API-driven workflows are poised to capture interest from enterprises seeking agility and modernisation in digital commerce ecosystems.

Challenge Analysis

A central challenge confronting the e-commerce shopping cart software market relates to balancing feature richness with performance and user experience. While advanced capabilities such as dynamic bundles, personalised recommendations, and complex discounting engines add value, they can also increase cart page load times and complicate user flows if not optimised effectively.

Slow checkout experiences are a common contributor to cart abandonment, and retailers must ensure that enhancements do not degrade responsiveness. Achieving an optimal balance between sophisticated functionality and fast, intuitive user interactions demands attention to performance engineering and seamless UI design.

Another persistent challenge is maintaining consistent and secure payment experiences across diverse devices, gateways, and regional requirements. Cart systems must support evolving payment methods, digital wallets, and regulatory compliance with secure tokenisation and fraud mitigation tools. Coordinating these capabilities without introducing unnecessary friction requires careful orchestration between cart logic, payment platforms, and backend systems. Retailers must continually adapt to new payment innovations and evolving security threats while preserving convenience.

Emerging Trends

Emerging trends in the e-commerce shopping cart software landscape include the increasing use of AI-driven personalisation at the point of purchase, such as real-time product suggestions based on shopper intent and predictive analytics that anticipate order completion likelihoods. Another trend is the integration of conversational commerce and voice-enabled interfaces that allow customers to add items to carts and complete purchases via natural language interactions.

Progressive web applications (PWAs) and accelerated mobile pages (AMP) are also gaining traction to further reduce friction and enhance mobile shopping experiences. Additionally, seamless buy-now-pay-later options and localised checkout journeys are becoming standard expectations among digitally savvy shoppers.

Growth Factors

Growth in the e-commerce shopping cart software market is supported by the continued expansion of online retail adoption and rising expectations for tailored, efficient checkout experiences. Increased consumer demand for convenience, speed, and secure transactions continues to influence merchants’ investment in cart technologies. Advances in cloud-native platforms and modular commerce architectures enable more scalable, flexible deployment of cart solutions that support peaks in traffic and evolving business needs.

Expansion into emerging markets and cross-border commerce further amplifies demand for cart systems that can manage regional variations in payment, tax, and user experience requirements. Collectively, these factors reinforce the strategic importance of shopping cart software as foundational infrastructure in modern digital commerce ecosystems.

Key Market Segments

By Type

- SaaS Shopping Cart Software

- Open-Source Shopping Cart

- Others

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-User Application

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Business-to-Business-to-Consumer (B2B2C)

- Direct-to-Consumer (D2C)

By Pricing Model

- Subscription-Based (Monthly/Annual Fee)

- Transaction Fee-Based

- License Fee (One-time or Annual)

- Open-Source (Free Core Software)

Top Key Players in the Market

- Shopify

- WooCommerce

- Wix

- Squarespace

- Adobe Commerce (Formerly Magento)

- BigCommerce

- Salesforce Commerce Cloud (Demandware)

- SAP Commerce Cloud

- HCL Commerce (Formerly IBM WebSphere)

- PrestaShop

- Oracle Commerce

- Commercetools Inc.

- Elastic Path

- Shift4Shop

- Volusion

- Ecwid

- Snipcart

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.1 Bn |

| Forecast Revenue (2034) | USD 34 Bn |

| CAGR(2025-2034) | 14.1% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)