Table of Contents

Introduction

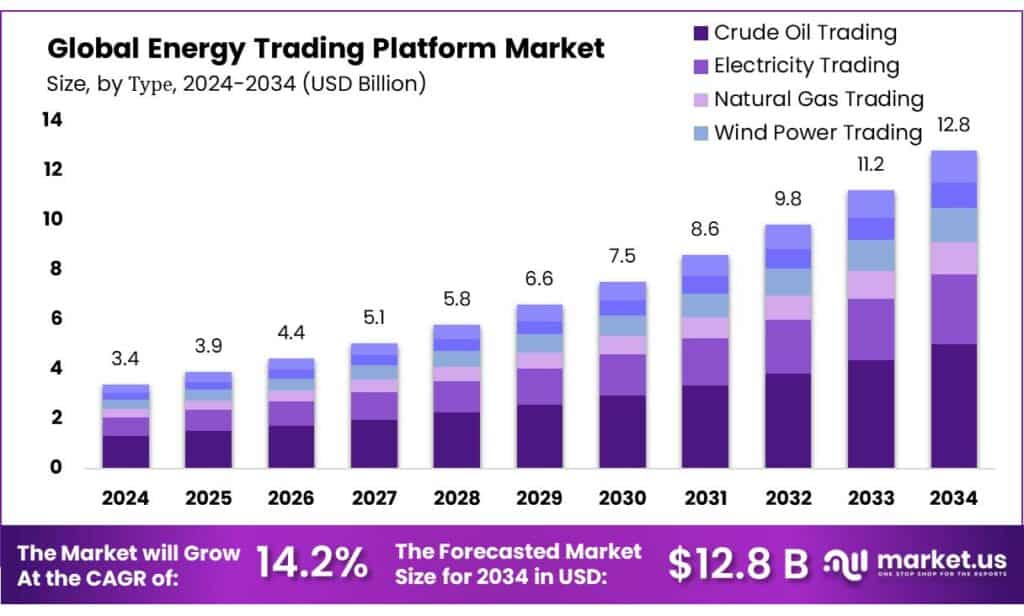

The global Energy Trading Platform market is expected to grow from US$ 3.4 billion in 2024 to approximately US$ 12.8 billion by 2034, registering a CAGR of 14.2% during the forecast period. This significant growth is driven by increasing energy demand, digital transformation in energy markets, and the rising adoption of blockchain and AI technologies to enhance trading efficiency and transparency. Energy trading platforms facilitate real-time transactions across electricity, oil, gas, and renewable energy sectors, promoting seamless integration and market liquidity worldwide.

How Growth is Impacting the Economy

The expansion of the Energy Trading Platform market profoundly impacts the global economy by improving energy market efficiency and transparency. By enabling faster and more secure transactions, these platforms reduce trading costs and enhance price discovery, benefiting producers, consumers, and investors. The growth supports job creation in IT, data analytics, and energy sectors, driving innovation and economic diversification. Additionally, streamlined energy trading encourages investment in renewable energy projects, accelerating the global energy transition. Improved market liquidity helps stabilize energy prices, fostering economic stability and growth, especially in energy-dependent regions. Enhanced cross-border trading further promotes international cooperation and economic integration.

➤ Get valuable market insights here @ https://market.us/report/energy-trading-platform-market/free-sample/

Impact on Global Businesses

Energy trading platform growth compels global businesses to invest in advanced technologies to maintain competitive edges. Rising costs for digital infrastructure and cybersecurity require strategic budget allocation. Supply chains adapt to accommodate fluctuating energy prices influenced by real-time trading data. Businesses in utilities, oil & gas, and renewables sectors face operational shifts as trading platforms optimize resource allocation and risk management. Integration challenges between legacy systems and new platforms demand technical expertise and partnerships. Overall, companies must embrace digital transformation to capitalize on market efficiencies and respond swiftly to dynamic energy demands.

Strategies for Businesses

Businesses should invest in scalable, secure trading platforms incorporating AI and blockchain to enhance transparency and reduce fraud. Developing flexible systems capable of integrating various energy sources ensures adaptability. Partnerships with technology providers and regulatory bodies facilitate compliance and innovation. Fostering data analytics capabilities helps anticipate market trends and optimize trading strategies. Prioritizing cybersecurity and continuous employee training minimizes risks. Moreover, expanding platform accessibility to emerging markets can unlock untapped opportunities and enhance global reach.

Key Takeaways

- Energy Trading Platform market to reach US$ 12.8 billion by 2034

- CAGR of 14.2% driven by digitalization and rising energy demand

- Platforms improve market efficiency, liquidity, and transparency

- Businesses face rising infrastructure and cybersecurity costs

- Strategic adoption of AI and blockchain essential for competitiveness

➤ Buy Full PDF report here @ https://market.us/purchase-report/?report_id=139302

Analyst Viewpoint

Currently, the Energy Trading Platform market is experiencing robust growth fueled by technological advancements and increasing energy sector digitization. The future outlook is optimistic, with blockchain and AI technologies poised to revolutionize trading processes. As renewable energy integration intensifies, platform adaptability becomes critical. Emerging markets present significant growth potential. Overall, sustained innovation, regulatory support, and cross-sector collaboration will propel the market forward, enabling efficient, transparent, and secure energy trading globally.

Regional Analysis

North America and Europe dominate the Energy Trading Platform market due to advanced digital infrastructure and supportive regulations. Asia Pacific is emerging rapidly, driven by growing energy demand and investments in smart grid technologies. Latin America and the Middle East & Africa show increasing adoption as governments seek to modernize energy markets and integrate renewables. Regional growth is shaped by economic development, energy policies, and technological readiness, requiring tailored approaches to platform deployment and market penetration.

➤ Discover More Trending Research

- Chatbot Marketing Market

- Voice AI in Smart Homes Market

- Conversational Commerce Market

- Web3 in Gaming market

Business Opportunities

Opportunities include developing AI-driven predictive analytics, blockchain-enabled secure transactions, and cloud-based trading solutions. Expansion into emerging markets offers significant potential due to increasing energy needs and modernization efforts. Providing integrated platforms supporting multiple energy commodities and renewable sources enhances value propositions. Collaboration with regulatory bodies to ensure compliance and facilitate market access is critical. Additionally, services like risk management and real-time market intelligence represent lucrative niches. Overall, innovation and regional customization drive business growth in this evolving market.

Key Segmentation

The Energy Trading Platform market is segmented as follows:

Energy Type

- Electricity

- Oil & Gas

- Renewable Energy

Deployment

- Cloud-Based

- On-Premises

End-User

- Utilities

- Traders & Brokers

- Industrial Consumers

These segments reflect diverse user needs and technological preferences.

Key Player Analysis

Market leaders focus on integrating AI, blockchain, and IoT technologies to enhance trading transparency and efficiency. They invest heavily in cybersecurity and data analytics to offer predictive insights. Strategic partnerships with energy producers, regulators, and technology firms strengthen their ecosystem. Emphasis on scalable, modular platforms facilitates customization for different market requirements. Geographic expansion and compliance with local regulations support global presence. Continuous innovation in user experience and platform interoperability differentiates top players in this competitive sector.

Recent Developments

- Launch of blockchain-based energy trading platforms enhancing transaction security in 2024

- Introduction of AI-powered predictive analytics tools for energy price forecasting in 2023

- Strategic partnerships to expand cloud-based trading solutions across Asia Pacific in 2024

- Integration of renewable energy assets into trading platforms to support decarbonization goals in 2023

- Enhanced regulatory frameworks promoting digital energy trading adoption in Europe in 2024

Conclusion

The Energy Trading Platform market is set for strong growth driven by digital transformation and rising energy demands. Businesses leveraging advanced technologies and regional strategies will unlock significant opportunities in this dynamic market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)