Table of Contents

Introduction

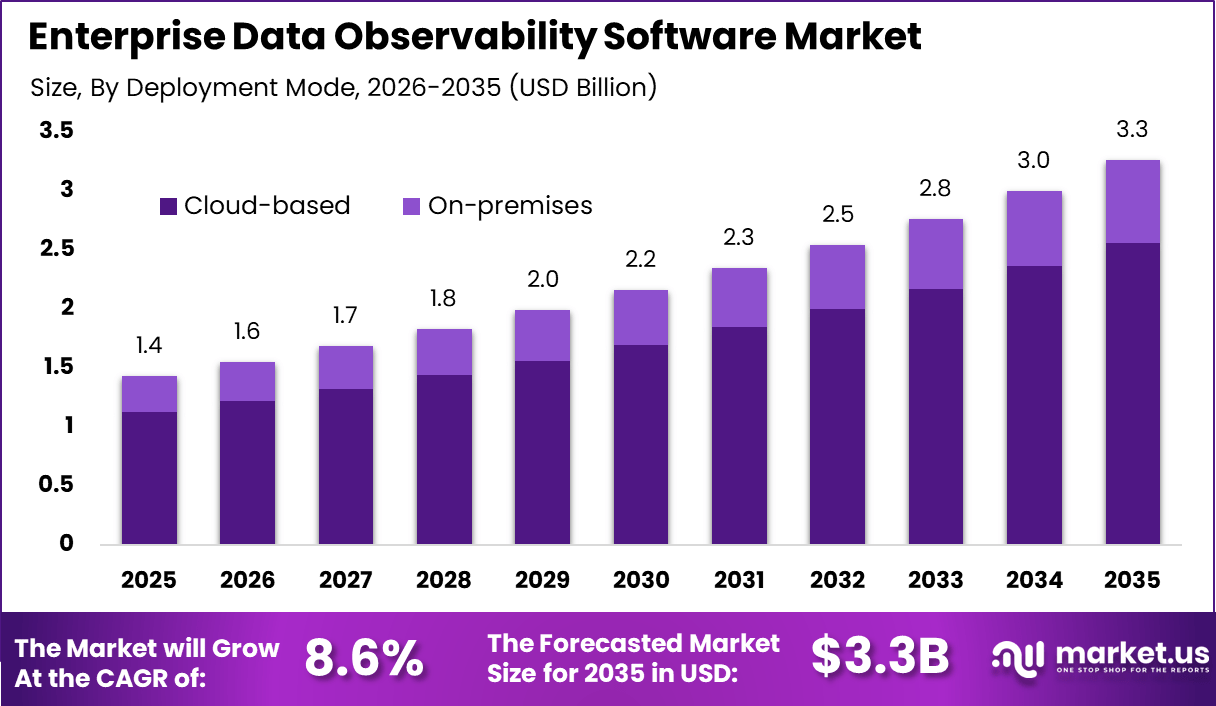

The global Enterprise Data Observability Software market was valued at USD 1.4 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 3.3 billion by 2035, expanding at a CAGR of 8.6% from 2026 to 2035. This growth is driven by increasing reliance on complex data pipelines and the need for consistent data quality across enterprise systems. Organizations are adopting observability software to improve data reliability, governance, and operational transparency.

The enterprise data observability software market refers to platforms that monitor, analyze, and ensure the health of data across enterprise data ecosystems. These solutions track data quality, freshness, volume, lineage, and distribution across pipelines and analytics systems. Enterprise data observability software supports reliable reporting, analytics, and operational decision making. Adoption is common among large organizations with complex data architectures. These tools help maintain trust in enterprise data assets.

Market development has been influenced by the increasing complexity of enterprise data environments. Organizations operate across cloud, hybrid, and on-premise systems with multiple data sources. Traditional monitoring tools often fail to detect subtle data issues. Data observability platforms provide proactive and continuous monitoring. As data becomes mission critical, observability gains strategic importance.

One major driving factor of the enterprise data observability software market is the rising impact of data errors on business outcomes. Inaccurate or delayed data can disrupt operations and decision making. Enterprises seek tools that detect issues before they affect users. Observability software enables early identification of anomalies. Risk reduction drives adoption.

Another key driver is the growing reliance on real-time analytics. Enterprises increasingly depend on live data for operational and strategic decisions. Real-time pipelines increase the risk of silent failures. Observability tools provide continuous oversight. Reliability requirements support market growth.

Demand for enterprise data observability solutions is influenced by expansion of data-driven business models. Organizations embed analytics into daily operations and customer interactions. High data dependency increases the cost of failure. Observability ensures consistent data availability. This dependency strengthens demand.

Demand is also shaped by organizational accountability for data reliability. Data teams are responsible for delivering trusted datasets to business users. Observability tools support proactive issue resolution. Reduced firefighting improves team efficiency. Accountability pressures increase adoption.

Top Market Takeaways

- Cloud-based deployment leads with a 78.6% share, reflecting demand for scalable and centrally managed observability platforms.

- Large enterprises account for 73.9%, driven by complex data pipelines and strict governance needs.

- Data quality monitoring dominates applications with 36.8%, highlighting focus on accuracy and trust in analytics and AI outputs.

- BFSI captures 41.5%, supported by regulatory compliance, risk controls, and real-time data integrity requirements.

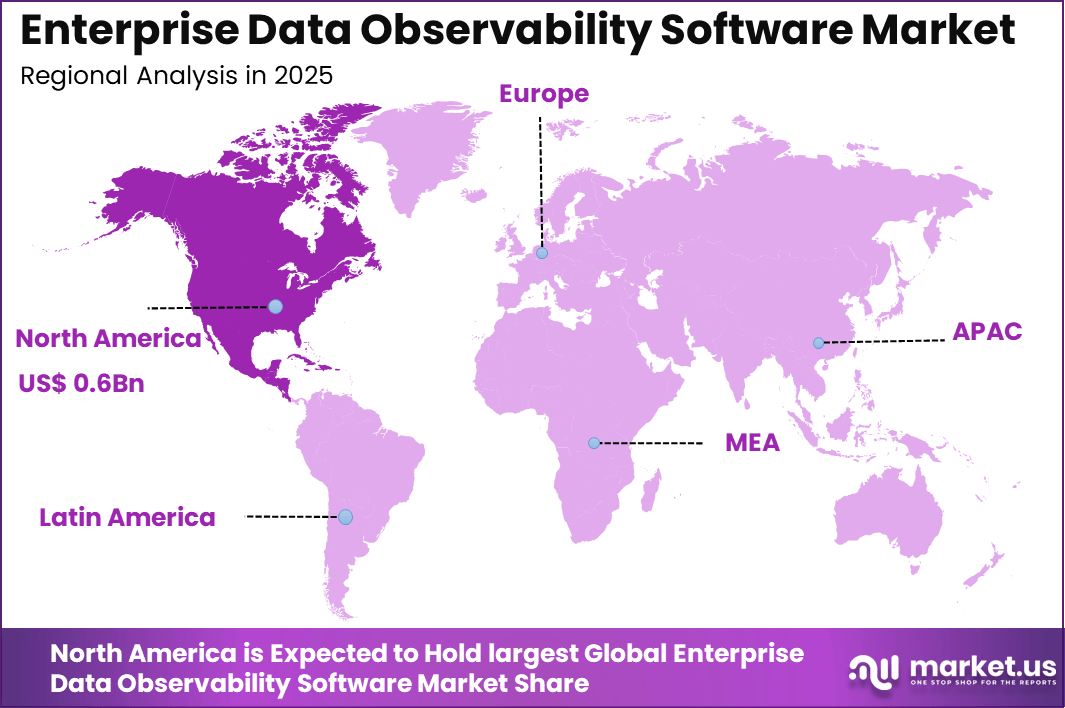

- North America holds 45.6%, backed by advanced cloud adoption and mature data ecosystems.

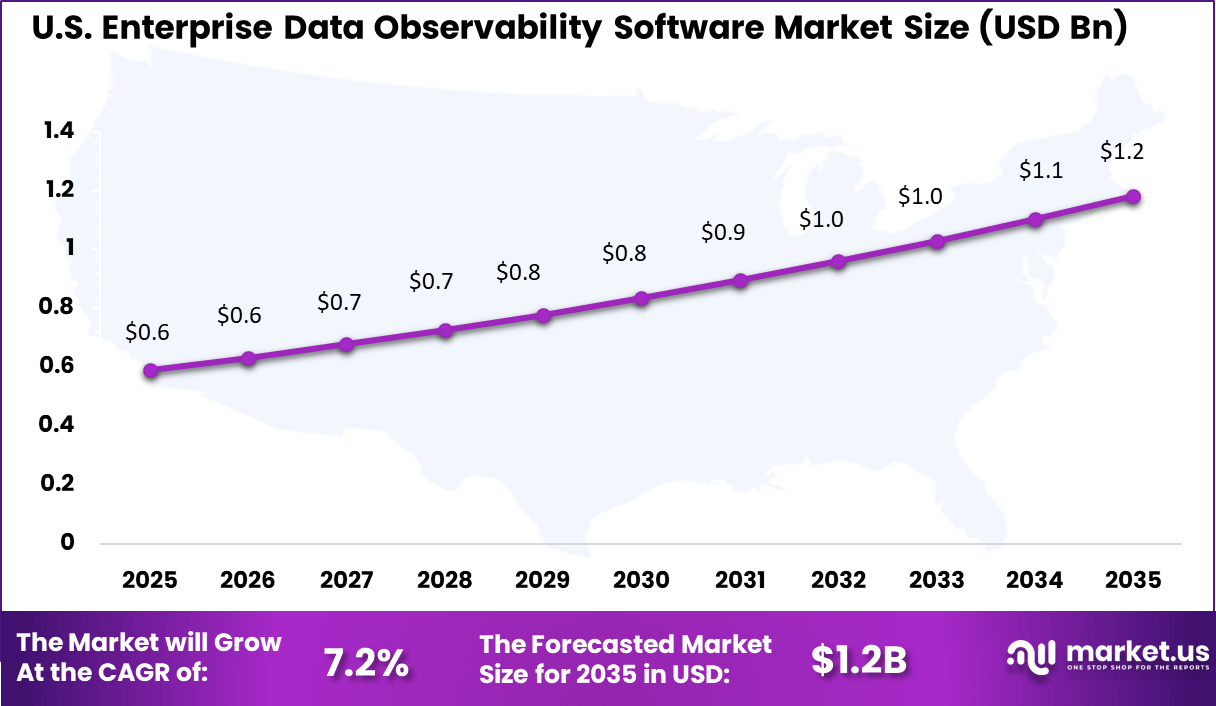

- The U.S. market reached USD 0.59 billion in 2024 and is growing at a 7.26% CAGR, driven by analytics modernization and pipeline observability.

Quick Market Facts

- Poor data quality costs organizations about USD 12.9 million annually.

- Data incidents now take 15 hours to resolve on average, up from 9 hours year over year.

- About 92% of data leaders rank observability as a top priority over the next 1–3 years.

- Around 83.9% of executives plan to increase spending on data and analytics tools this year.

- Data quality issues impact roughly 31% of business revenue on average.

- Data teams spend nearly 50% of their time fixing data issues instead of analysis.

- Observability adoption can cut investigation time by up to 50% through faster detection and root-cause analysis.

- Enterprise data volumes are expanding at about 63% per month, increasing reliance on automated observability solutions.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 45.6% of total revenue. The region generated around USD 0.6 billion, supported by early adoption of advanced analytics platforms and strong enterprise IT spending. High concentration of large scale data driven organizations strengthened regional leadership. As a result, North America continues to influence adoption and development trends in enterprise data observability software.

The United States reached USD 0.59 Billion with a CAGR of 7.26%, reflecting steady market growth. Expansion is driven by increasing data volumes and analytics usage. Enterprises continue to strengthen data monitoring practices. Observability software remains essential for data reliability.

Increasing Adoption Technologies

Machine learning technologies play a key role in observability adoption. Models analyze historical patterns to identify abnormal behavior. Automated detection reduces manual rule creation. Continuous learning improves accuracy over time. Intelligent monitoring supports scalability. Cloud-native technologies also support adoption. Modern observability platforms integrate with cloud data stacks and services. Scalable infrastructure supports high data volumes. Seamless integration reduces deployment friction. Cloud alignment improves accessibility.

One key reason enterprises adopt data observability software is improved data trust. Early detection of quality and pipeline issues prevents incorrect reporting. Teams gain confidence in analytics outputs. Reliable data supports effective decision making. Trust improves collaboration across functions. Another reason is operational efficiency for data teams. Automated monitoring reduces time spent on manual checks. Teams focus on improvement rather than troubleshooting. Reduced workload improves productivity. Efficiency gains support growth.

Investment and Business Benefits

Investment opportunities in the enterprise data observability software market exist in platforms offering end-to-end visibility. Solutions that cover ingestion, transformation, and consumption attract enterprise interest. Comprehensive coverage reduces blind spots. Investors favor platforms with broad scope. Full lifecycle visibility supports differentiation. Another opportunity lies in integration with governance and security platforms. Enterprises prefer unified data management solutions. Observability combined with governance improves control. Integrated offerings simplify adoption. Convergence supports market expansion.

Enterprise data observability software improves operational stability by preventing downstream data failures. Early alerts reduce system disruption and rework. Consistent monitoring improves data pipeline performance. Stability supports business continuity. Reliability strengthens enterprise operations. These solutions also improve decision quality across the organization. Accurate and timely data improves insight reliability. Leaders make decisions with greater confidence. Improved outcomes support strategic goals. Data reliability enhances overall performance.

Regulatory Environment

The regulatory environment for enterprise data observability software includes data protection and governance requirements. Enterprises must monitor sensitive and regulated data flows. Observability tools support access control and auditability. Compliance with privacy laws is essential. Secure data handling reduces regulatory risk.

Regulations related to reporting accuracy and data retention also influence adoption. Enterprises must demonstrate control over data processes. Observability platforms support documentation and traceability. Audit readiness improves compliance posture. Regulatory alignment supports responsible deployment.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Data Quality Monitoring

- Data Pipeline Monitoring

- Data Lineage & Governance

- Incident Detection & Resolution

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Retail & E-commerce

- Healthcare

- Manufacturing

- Others

Top Key Players in the Market

- Datadog, Inc.

- Splunk, Inc.

- Dynatrace, LLC

- New Relic, Inc.

- Monte Carlo Data, Inc.

- Acceldata, Inc.

- Bigeye Data, Inc.

- Observe, Inc.

- Metaplane, Inc.

- Anomalo, Inc.

- Soda Data, Inc.

- Unravel Data Systems, Inc.

- IBM Corporation

- Oracle Corporation

- Informatica, Inc.

- Others

Driver Analysis

The enterprise data observability software market is being driven by the growing dependence of organizations on complex data pipelines to support analytics, reporting, and operational decision making. As enterprises scale cloud and hybrid data architectures, data flows become more distributed and interdependent, increasing the risk of data quality issues, delays, and silent failures. Data observability software enables continuous monitoring of data freshness, volume, schema changes, and lineage across pipelines. This visibility supports early detection of issues before they impact downstream systems or business users.

Another important driver is the rising expectation for trusted and reliable data across business functions. Executive teams, analysts, and operational users increasingly rely on real time dashboards and automated insights to guide decisions. When data accuracy is compromised, business confidence and productivity are directly affected. Enterprise data observability tools strengthen trust by providing transparency into data health and automated alerts, allowing teams to respond proactively rather than reactively to data incidents.

Restraint Analysis

A key restraint in the enterprise data observability software market relates to implementation complexity in large and diverse data environments. Many enterprises operate with a mix of legacy systems, modern cloud platforms, and custom data pipelines, which makes unified observability challenging. Integrating observability tools across these heterogeneous environments often requires significant configuration, technical expertise, and alignment with existing data governance practices. This complexity can slow deployment timelines and increase operational effort.

Another limiting factor is the skills gap within enterprise data teams. Effective use of data observability platforms requires familiarity with data engineering concepts, metadata management, and incident response workflows. Organizations with limited data maturity may struggle to operationalize observability insights or fully leverage automation capabilities. Without proper change management and training, the perceived value of observability software may be reduced, impacting adoption momentum.

Opportunity Analysis

Strong opportunities are emerging as enterprises shift toward real time analytics and automated decision systems. As data is increasingly used to trigger operational actions rather than just inform reporting, tolerance for data errors becomes significantly lower. Enterprise data observability software can evolve into a core reliability layer that ensures data products meet defined service expectations. This creates opportunities for observability platforms to support data service level objectives and cross team accountability.

Another opportunity lies in the convergence of data observability with artificial intelligence and automation. Advanced platforms can apply machine learning to detect anomalies, predict failures, and recommend corrective actions based on historical patterns. This reduces manual intervention and accelerates resolution times. As organizations seek to scale data operations efficiently, solutions that move beyond monitoring toward intelligent remediation are well positioned to gain strategic relevance.

Challenge Analysis

A central challenge facing the enterprise data observability software market is managing alert fatigue while maintaining meaningful visibility. Large enterprises generate massive volumes of telemetry and metadata, which can result in excessive alerts if not properly contextualized. When teams are overwhelmed with notifications, critical issues may be overlooked. Designing observability systems that prioritize high impact incidents and provide clear root cause context remains a complex task.

Another challenge is aligning observability insights with business impact. Technical indicators such as schema drift or pipeline latency do not always translate clearly into business consequences. Bridging the gap between data engineering signals and business outcomes requires strong lineage mapping and collaboration between technical and business stakeholders. Without this alignment, observability efforts may be perceived as operational overhead rather than strategic enablers.

Emerging Trends

One emerging trend in the enterprise data observability software market is the shift toward metadata driven monitoring. Instead of relying solely on row level checks, platforms increasingly use metadata and lineage graphs to understand how data issues propagate across systems. This approach improves root cause analysis and helps teams assess downstream impact more effectively. Metadata centric observability also scales better in large environments with numerous data assets.

Another notable trend is the growing adoption of observability as part of data product thinking. Enterprises are beginning to treat datasets as products with defined reliability standards, ownership, and performance expectations. Observability tools are being used to enforce these standards and provide transparency across teams. This trend reflects a broader cultural shift toward accountability and operational excellence in data management.

Growth Factors

Growth in the enterprise data observability software market is supported by the continued expansion of cloud data platforms and distributed analytics architectures. As organizations ingest data from more sources and at higher velocity, the risk of unnoticed data issues increases. Observability software becomes essential for maintaining stability and trust at scale. The need to support remote and globally distributed data teams further reinforces demand for centralized visibility tools.

Another growth factor is the increasing regulatory and compliance pressure around data accuracy and reporting. Enterprises are required to demonstrate control over data quality, lineage, and usage across systems. Data observability platforms support these requirements by providing auditable records of data health and incident response. As data governance expectations rise, investment in observability solutions is expected to remain a priority for large organizations.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 1.4 Bn |

| Forecast Revenue (2035) | USD 3.3 Bn |

| CAGR(2026-2035) | 8.6% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)