Table of Contents

Report Overview

Environmental, Social, and Governance (ESG) consulting has emerged as a pivotal domain within the sustainability landscape. This field assists businesses in integrating ESG criteria into their operations, aiming to align corporate strategies with sustainable development goals. ESG consulting not only addresses regulatory compliance but also enhances brand reputation, manages risks, and identifies sustainable investment opportunities.

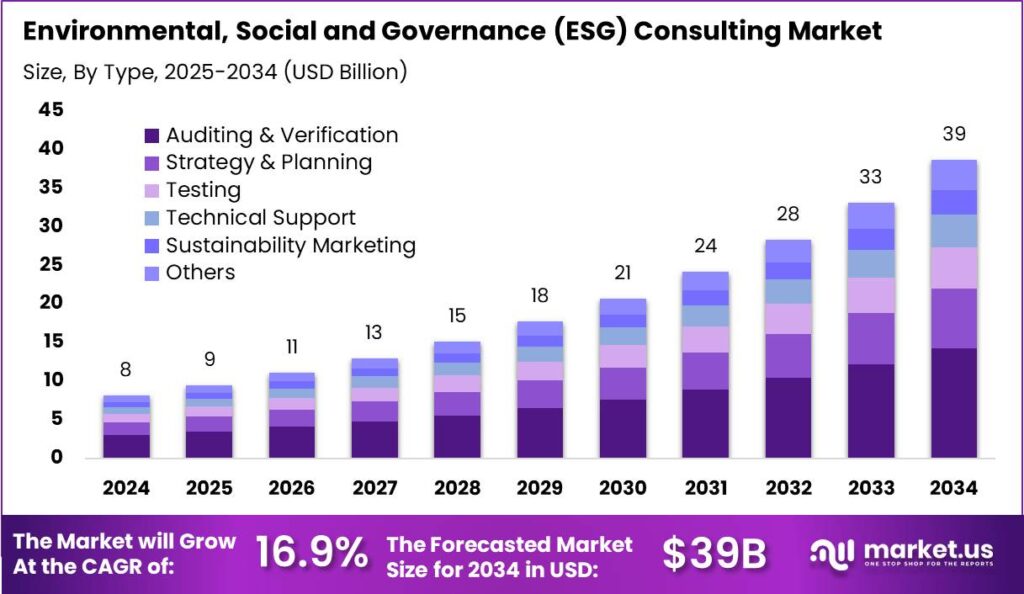

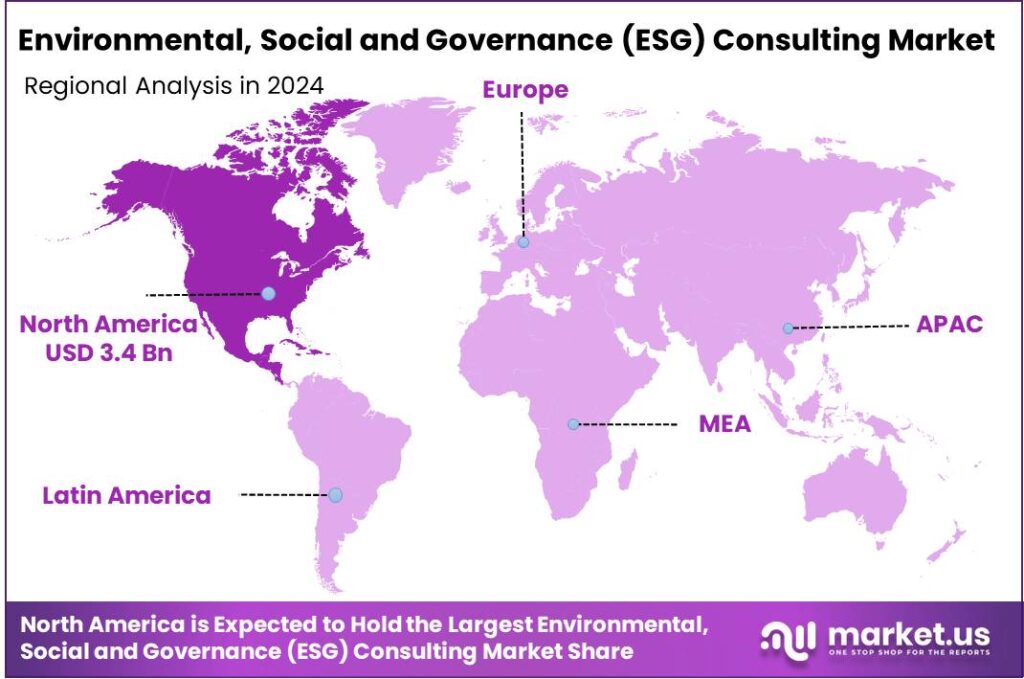

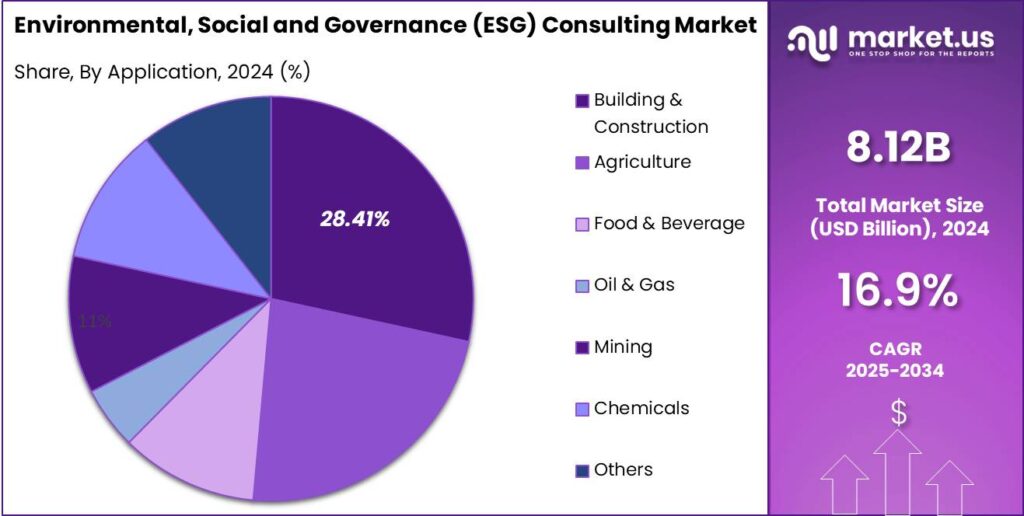

As per the Market.us report findings, The Global Environmental, Social, and Governance (ESG) Consulting Market is projected to reach a value of approximately USD 39 billion by 2034, up from USD 8.12 billion in 2024. This growth represents a robust compound annual growth rate (CAGR) of 16.90% between 2025 and 2034. In 2024, North America dominated the market, holding a substantial share of over 42.15%, with revenues amounting to USD 3.4 billion.

ESG consulting opens up numerous opportunities for businesses. It enables companies to pioneer sustainable practices that can lead to cost savings, such as energy efficiency and waste reduction. Additionally, ESG integration offers a pathway to tap into new markets and consumer segments that prioritize sustainability. There is also a strategic advantage in leveraging ESG consulting to enhance stakeholder engagement and communication, fostering stronger relationships with investors, regulators, and the community.

However, the path of ESG consulting is not devoid of challenges. The lack of standardization in ESG metrics and reporting can create confusion and inconsistency in implementation. Companies may also face significant upfront costs in establishing or restructuring their operations to comply with ESG criteria. Moreover, there is a critical need for skilled ESG consultants who can provide expert advice and insights, which are currently in short supply.

Among the emerging trends in ESG consulting is the increasing use of technology and data analytics to monitor and report ESG performance. Artificial intelligence and blockchain are becoming more prevalent in tracking supply chain sustainability and ensuring transparency. Another trend is the growing emphasis on social governance, including diversity and inclusion, which is becoming as critical as environmental stewardship in the ESG domain.

The ESG consulting market is set to expand significantly in the coming years. This growth is facilitated by the increasing global focus on sustainable development and the integration of ESG factors into core business strategies. Expansion is particularly noticeable in regions like Europe and North America, where regulatory frameworks are more developed. However, Asia-Pacific is also catching up rapidly, driven by both local and international pressures for sustainable practices.

Key Takeaways

- The Global ESG Consulting Market is projected to grow from USD 8.12 billion in 2024 to USD 39 billion by 2034, reflecting a CAGR of 16.90% from 2025 to 2034.

- Auditing & Verification will continue to dominate the market, holding over 36.8% of the total share in 2024.

- The Building & Construction sector is also a major player, accounting for over 28.41% of the ESG consulting market in 2024.

- North America leads the market with a 42.15% share in 2024, generating USD 3.4 billion in revenue.

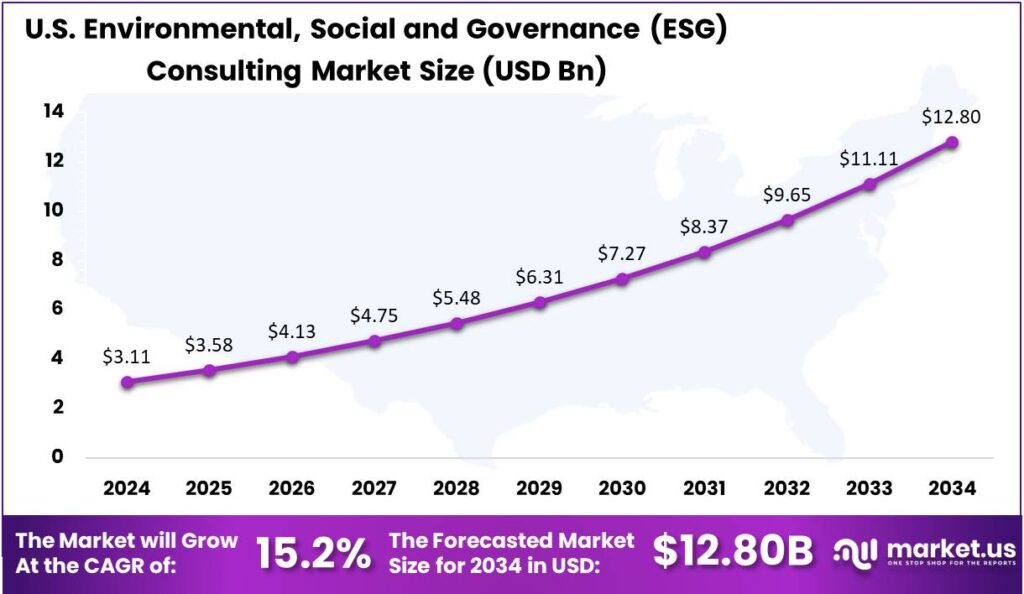

- The U.S. ESG consulting market alone is set to reach USD 3.11 billion by 2024, growing at a CAGR of 15.2%.

Key Market Drivers

The growing imposition of ESG-related regulations globally is a primary driver. Governments and regulatory bodies are enhancing ESG compliance requirements, compelling companies to adapt to these norms to avoid penalties and manage risks effectively. This regulatory pressure not only helps in maintaining environmental and social governance but also drives businesses to seek specialized ESG consulting to navigate these complex landscapes.

There is a rising demand from investors and consumers for greater transparency and sustainability in corporate practices. This shift is motivating companies to integrate ESG principles into their core strategies to attract environmentally-conscious investments and customer bases. ESG consulting plays a crucial role in helping firms articulate and implement these strategies, thereby making companies more appealing to a broader market

Impact Of AI The Market

- Enhanced ESG Reporting and Compliance: AI tools significantly enhance the efficiency of ESG reporting by automating data collection and analysis. This not only speeds up the process but also reduces human error, leading to more accurate and consistent ESG reports.

- Streamlined Auditing Processes: The integration of AI in ESG auditing simplifies data verification and consolidation, allowing for streamlined workflows. This technology enables auditors to manage and analyze data more effectively, thus improving the quality of ESG audits.

- Improved Decision-Making and Benchmarking: AI assists ESG consultants in making informed decisions by providing them with tools to benchmark performance against industry standards. This is achieved through the aggregation of diverse data sources, which allows for precise comparisons and better insights into ESG performance.

- Facilitating Responsible AI Practices: Companies are increasingly recognizing the importance of developing AI responsibly. This involves aligning AI initiatives with ESG values to mitigate risks and enhance business practices focused on sustainability and ethical considerations.

- Financial and Operational Benefits: AI’s role in decarbonization efforts is proving to be financially beneficial for companies. By automating tasks such as emissions measurement and reduction planning, AI enables businesses to achieve substantial operational efficiencies and cost savings, which translate into significant financial gains.

U.S. Market Growth

The market for Environmental, Social, and Governance (ESG) consulting in the United States is forecasted to achieve a valuation of $3.11 billion by the year 2024. This growth is anticipated to proceed at a compound annual growth rate (CAGR) of 15.2%. This robust expansion underscores the increasing prioritization of sustainable and ethical business practices among corporations.

The growing awareness and regulatory focus on environmental, social, and governance (ESG) factors are driving companies to seek ESG consulting services. These firms help businesses comply with regulations and improve market perception, which can influence investor decisions and consumer behavior. As demand rises, ESG consulting firms are expanding their services to integrate ESG principles into core operations.

Moreover, the expansion of the ESG consulting market is also facilitated by the evolving expectations of stakeholders, who demand greater accountability and transparency in corporate activities. Businesses are responding by integrating ESG criteria into their long-term strategic plans, which not only mitigates risk but also opens up new avenues for growth through sustainable practices.

In 2024, North America maintained a leading position in the Environmental, Social, and Governance (ESG) consulting market, securing over 42.15% of the global market share. The region generated revenues amounting to USD 3.4 billion, reflecting its significant influence and commitment to ESG principles.

The dominance of North America in the ESG consulting market can be attributed to several factors, including stringent regulatory frameworks, a high level of corporate governance, and the proactive stance of businesses and investors towards sustainability. The region’s advanced infrastructure and the presence of numerous multinational corporations have also played a crucial role in fostering a conducive environment for ESG consulting firms to thrive.

The increasing societal awareness and demand for corporate transparency have boosted the need for ESG consulting services in North America. Companies are integrating ESG strategies to improve competitiveness and attract socially and environmentally conscious investors. This trend is expected to fuel the growth of the ESG consulting market in North America as businesses align with global sustainability goals.

Market Segmentation

Type Analysis

In 2024, the Auditing & Verification segment emerged as a dominant force in the ESG (Environmental, Social, and Governance) consulting market, commanding a significant share of over 36.8%. This dominance can be attributed to the increasing demand for transparency and accountability in corporate sustainability efforts. As companies face greater pressure from stakeholders, regulators, and investors to demonstrate their commitment to ESG goals, the need for rigorous auditing and verification services has surged.

Application Analysis

The Building & Construction segment also played a pivotal role in the ESG consulting market in 2024, holding a dominant share of over 28.41%. This can be attributed to the growing recognition of the environmental impact of construction activities and the increasing regulatory and consumer pressure to adopt sustainable practices. In this sector, ESG consulting focuses on integrating green building standards, reducing carbon footprints, ensuring compliance with environmental regulations, and promoting social responsibility within construction projects.

Emerging Trends

- Enhanced Regulatory Frameworks: Governments worldwide are implementing stricter ESG regulations, compelling companies to seek expert guidance to ensure compliance and avoid potential penalties.

- Integration of Artificial Intelligence (AI): AI technologies are being increasingly utilized to improve the accuracy and efficiency of ESG data collection and analysis, enabling more effective sustainability strategies.

- Focus on Climate Adaptation and Resilience: Businesses are prioritizing investments in infrastructure and strategies that enhance their ability to withstand climate-related risks, reflecting a shift towards proactive climate resilience.

- Emphasis on Diversity, Equity, and Inclusion (DEI): Companies are intensifying efforts to create inclusive workplaces, recognizing that robust DEI initiatives contribute to better organizational performance and societal impact.

- Specialized ESG Consulting Services: There is a growing trend of companies engaging niche ESG consulting firms that offer tailored and innovative solutions, moving away from traditional large consulting entities.

Top Use Cases

- Navigating Regulatory Compliance: ESG consultants assist companies in understanding and adhering to evolving regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD), ensuring compliance and mitigating potential risks.

- Enhancing Brand Reputation and Stakeholder Trust: By developing and implementing sustainable practices, ESG consultants help organizations improve their public image and build trust with stakeholders, including investors, customers, and employees.

- Identifying Opportunities for Sustainable Growth: ESG consultants spot trends and innovations in sustainability, aiding companies in exploring new markets, developing eco-friendly products or services, and implementing efficient processes that reduce costs and improve operational efficiency.

- Improving Risk Management: By assessing ESG risks such as environmental degradation and human rights abuses, consultants help organizations prevent and mitigate issues that could impact their reputation and financial performance.

- Attracting and Retaining Talent: Companies prioritizing ESG initiatives, with the guidance of consultants, often become more attractive to employees seeking workplaces committed to ethical practices and social responsibility.

Major Challenges

- Data Availability and Quality: Collecting reliable ESG data is difficult due to inconsistent reporting standards and limited access to comprehensive information. This inconsistency hampers accurate assessments and informed decision-making.

- Lack of Standardization: The absence of universally accepted ESG reporting frameworks leads to variability in disclosures. This lack of standardization makes it challenging to compare ESG performance across organizations.

- Materiality Assessment: Determining which ESG issues are most relevant to a company’s operations can be subjective. Conducting thorough materiality assessments requires careful analysis and stakeholder engagement to identify significant ESG risks and opportunities.

- Shortage of Expertise: There is a notable lack of professionals with the necessary skills to effectively implement ESG strategies. This shortage can hinder the development and execution of robust ESG initiatives.

- Evolving Regulatory Landscape: Constantly changing ESG regulations require organizations to stay updated and adapt their practices accordingly. Navigating this evolving landscape demands significant resources and expertise.

Conclusion

In summary, the Environmental, Social, and Governance (ESG) consulting market is experiencing significant growth as businesses increasingly prioritize sustainability and responsible practices. This demand is driven by heightened awareness among stakeholders, regulatory changes, and a growing desire for companies to demonstrate their commitment to ethical and sustainable operations. ESG consultants are playing a crucial role in guiding organizations through complex regulations and helping them implement strategies that promote environmental sustainability, social responsibility, and robust governance frameworks.

As ESG considerations continue to evolve, the market is expected to expand further, with more companies integrating these practices into their core business models. The focus is not only on risk mitigation but also on creating long-term value through sustainable and socially responsible actions. ESG consulting firms will continue to be instrumental in helping businesses navigate this shift and achieve measurable, positive impacts across environmental, social, and governance domains.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)