Table of Contents

Introduction

eSIM Statistics: Embedded Subscriber Identification Module (eSIM) technology. A digital successor to traditional physical SIM cards represents a revolutionary shift in the telecommunications industry.

Unlike conventional SIM cards, which are removable and tied to a specific network, eSIMs are integrated directly into devices, offering greater flexibility, convenience, and scalability. ESIMs enable users to switch carriers and plans effortlessly without needing a physical SIM swap.

This technology not only simplifies device activation and management but also unlocks new possibilities in connected devices, ranging from smartphones and tablets to wearables, IoT devices, and even automobiles.

Its compact form factor and remote provisioning capabilities make it an essential enabler of the Internet of Things (IoT) ecosystem.

With eSIM adoption on the rise, it’s poised to redefine how we connect and communicate in an increasingly digital world. It offers users more choices and service providers new opportunities for innovation and service delivery.

Editor’s Choice

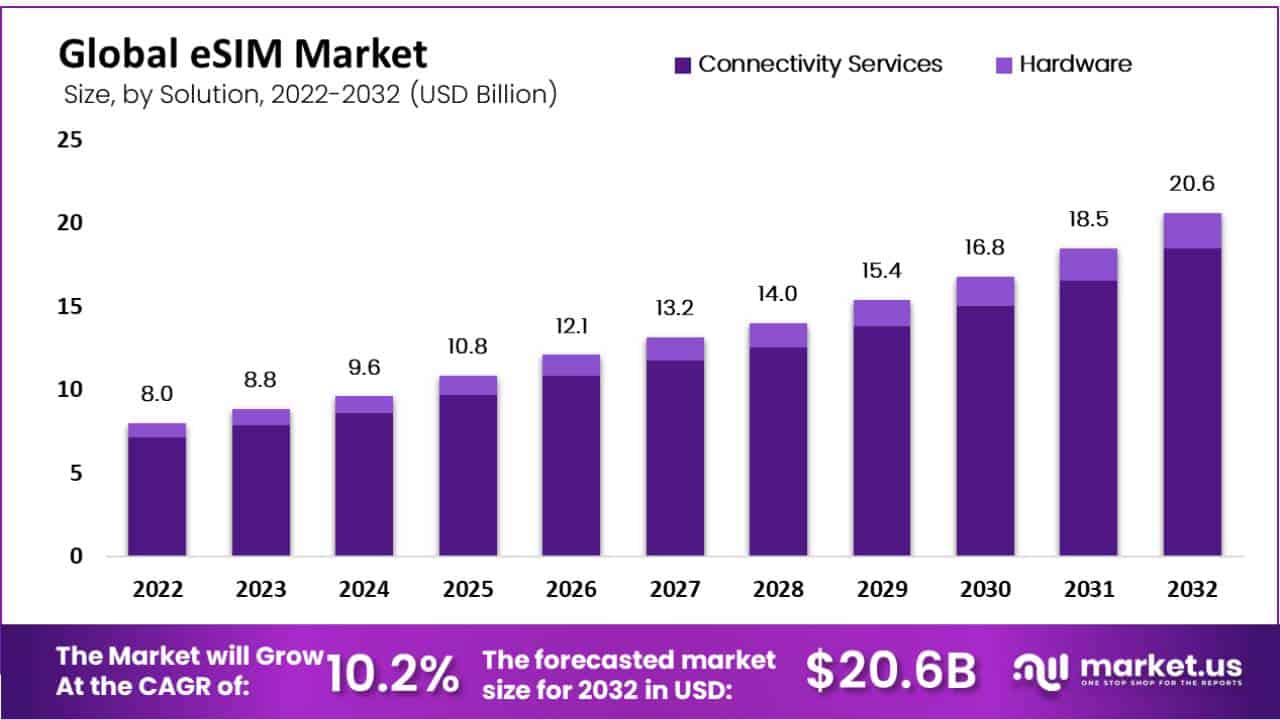

- In 2022, the eSIM market was valued at $8 billion, marking the initial adoption of this technology.

- In 2032, a significant milestone is projected with a market size of $20.6 billion, highlighting the eSIM’s pivotal role in connectivity.

- Apple leads the pack with a 22% adoption rate, signifying a significant portion of smartphone users who prefer iOS-based devices.

- Among the youngest demographic, aged 18 to 24, there is a substantial 24% adoption rate for eSIMs, indicating a keen interest in and willingness to embrace this advanced technology.

- Among users still relying on 3G networks, there is a moderate 17% adoption rate for eSIMs. Indicating a gradual transition from traditional SIM cards.

- Tablets, while still popular, have a slightly lower adoption rate at 23%. Suggesting that they serve specific purposes in the digital ecosystem, such as entertainment and productivity.

- Consumer awareness of eSIM technology varies across different countries. Reflecting disparities in education and marketing efforts.

Global eSIM Market Size Statistics

- In 2022, the eSIM market was valued at $8 billion, marking the initial adoption of this technology.

- The market continued to grow, reaching $8.8 billion in 2023, showing a 10% increase in just one year.

- Projections indicate that the market will expand to $9.6 billion in 2024, reflecting the demand for eSIM’s convenience.

- By 2025, the market is anticipated to reach $10.8 billion, showcasing eSIM’s widespread acceptance.

- In 2026, the market is expected to exceed $12 billion, highlighting the transformative impact of eSIMs.

- This growth trend continues with a market size of $13.2 billion in 2027.

- Subsequent years show further expansion, with the market reaching $14 billion in 2028 and $15.4 billion in 2029.

- By 2030, the market will be valued at $16.8 billion, driven by 5G and IoT adoption.

- Looking ahead, 2031 is expected to witness a market size of $18.5 billion.

- In 2032, a significant milestone is projected with a market size of $20.6 billion. Highlighting the eSIM’s pivotal role in connectivity.

(Source – Market.us)

Adoption of Consumer by eSIM Statistics

By Smartphone Brand

- Apple leads the pack with a 22% adoption rate, signifying a significant portion of smartphone users who prefer iOS-based devices.

- Samsung follows closely behind, boasting a 19% adoption rate, showcasing the enduring popularity of their Android-based smartphones.

- Huawei, with a 17% adoption rate, has a notable presence in the market. However, it has faced challenges due to geopolitical factors affecting its global reach.

- Finally, the “Other” category holds a 20% adoption rate, encompassing various smartphone brands that collectively contribute to the smartphone landscape.

- These figures provide valuable insights into consumer preferences and the competitive dynamics within the smartphone industry.

(Source – GSMA)

Consumer By Age

- The adoption of eSIM technology exhibits variations across different age groups, reflecting a range of preferences and tendencies.

- Among the youngest demographic, aged 18 to 24, there is a substantial 24% adoption rate for eSIMs. Indicating a keen interest in and willingness to embrace this advanced technology.

- This enthusiasm carries forward to those aged 25 to 34, with a notably higher adoption rate of 27%, suggesting a solid affinity for eSIMs in this age group.

- In the 35 to 44 age group, there remains a considerable adoption rate of 23%. Indicating that eSIMs are gaining traction among individuals in their prime working years.

- However, as we move to older age groups, the adoption rates gradually decline.

- For those aged 45 to 54, the adoption rate is 18%, showing a decrease in eSIM usage relative to younger demographics.

- Among individuals aged 55 to 64, the adoption rate drops to 14%. Reflecting a reduced interest in and use of eSIM technology in this age group.

- The 65 and older demographic demonstrates the lowest eSIM adoption rate at 12%. Highlighting the relatively limited embrace of eSIMs among senior citizens.

- These findings underscore how age plays a significant role in adopting this innovative technology, with younger generations more willing to adopt it than their older counterparts.

(Source – GSMA)

By Network Generation

- The adoption of eSIM technology varies significantly across different network generations, reflecting the evolving telecommunications landscape.

- Among users still relying on 3G networks, there is a moderate 17% adoption rate for eSIMs, indicating a gradual transition from traditional SIM cards.

- In contrast, those on 4G networks exhibit a higher adoption rate at 21%, reflecting the increasing prevalence of eSIMs among individuals already benefiting from the enhanced capabilities of 4G technology.

- However, the most notable adoption rates are observed among users connected to 5G networks, where the adoption rate stands at an impressive 29%.

- This finding highlights the strong alignment between eSIM technology and the next generation of wireless connectivity. Underlining how eSIMs are at the forefront of the telecommunications industry’s evolution.

- As 5G continues to roll out and gain broader coverage, eSIM adoption will likely continue to grow as it complements the high-speed, low-latency capabilities that 5G networks offer.

- In summary, these adoption rates provide valuable insights into the intersection of eSIM technology and different network generations. With 5G standing out as a driving force behind its increasing acceptance.

(Source – GSMA)

By Ownership of Other Mobile Device

- Ownership of other mobile devices demonstrates a range of adoption rates, reflecting the diverse ways people integrate technology into their daily lives.

- Smartwatches emerge as the most widely adopted among these devices, with a significant 41% ownership rate.

- This indicates a strong interest in wearable technology that goes beyond just smartphones.

- Following closely behind are wearable fitness trackers, with a respectable 28% adoption rate, highlighting the growing emphasis on health and fitness monitoring.

- Tablets, while still popular, have a slightly lower adoption rate at 23%, suggesting that they serve specific purposes in the digital ecosystem, such as entertainment and productivity.

- Finally, traditional computing devices like laptops or desktop PCs exhibit a 19% adoption rate, showing that while they remain essential tools, their ownership has become less dominant as more portable and specialized devices like smartphones and tablets have gained prominence.

- Collectively, these adoption rates offer valuable insights into the choices consumers make when it comes to supplementary mobile devices, reflecting their evolving needs and preferences in an increasingly digital world.

(Source – GSMA)

eSIM Smartphone Connection, By Region Statistics

According to eSim Statistics, the distribution of eSIM and traditional SIM smartphone connections varies across regions, offering insights into the global mobile technology landscape.

APAC eSIM Statistics

- There are 483 million eSIM smartphone connections and 1,016 million traditional SIM smartphone connections, indicating a substantial presence of both technologies in this diverse and rapidly growing market.

- In India, there are 316 million eSIM smartphone connections alongside 706 million traditional SIM smartphone connections, showing a substantial reliance on traditional SIM technology despite eSIM’s emergence

- China stands out with 375 million eSIM smartphone connections compared to 1,126 million traditional SIM smartphone connections, reflecting a significant adoption of traditional SIM cards, likely due to the sheer size of the Chinese mobile market.

(Source – Statista)

Europe eSIM Statistics

- The numbers are more evenly balanced, with 282 million eSIM smartphone connections and 281 million traditional SIM smartphone connections, indicating a growing acceptance of eSIM technology in the region.

(Source – Statista)

Latin America (LATAM) eSIM Statistics

- There are 247 million eSIM smartphone connections and 300 million traditional SIM smartphone connections, with eSIMs making headway.

(Source – Statista)

MENA (Middle East and North Africa) eSIM Statistics

- The region demonstrates 197 million eSIM smartphone connections and 394 million traditional SIM smartphone connections, showing a preference for traditional SIM cards.

(Source – Statista)

North America eSIM Statistics

- There are 184 million eSIM smartphone connections and 172 million traditional SIM smartphone connections, with eSIMs gaining traction.

(Source – Statista)

SSA (Sub-Saharan Africa) eSIM Statistics

- The region has 173 million eSIM smartphone connections alongside 503 million traditional SIM smartphone connections, reflecting the dominance of traditional SIMs in the area.

- Finally, the CIS (Commonwealth of Independent States) region has 124 million eSIM smartphone connections and 202 million traditional SIM smartphone connections, suggesting a gradual shift towards eSIM adoption.

(Source – Statista)

Consumer Awareness of eSIM, By Country Statistics

- Consumer awareness of eSIM technology varies across different countries, reflecting disparities in education and marketing efforts.

- In Italy, Poland, and South Korea, there is a relatively high level of awareness, with all three countries boasting a 26% awareness rate, indicating that a quarter of the population in these nations is familiar with eSIMs.

- Brazil and Russia follow closely behind with 25% and 24% awareness rates, respectively, suggesting that eSIM technology is gradually gaining recognition among consumers in these regions. Japan, Germany, and Sweden exhibit similar awareness rates of 22%, demonstrating that eSIMs have made moderate inroads into the consumer consciousness in these countries.

- Spain falls slightly behind with a 21% awareness rate. At the same time, Argentina, the United States, and Mexico have awareness rates of 18%, 17%, and 16%, respectively, indicating that there is still work to be done in these markets to educate consumers about the benefits of eSIMs.

- Australia, France, and South Africa have relatively lower awareness rates, ranging from 15% to 13%, suggesting that eSIM adoption is still in its early stages in these countries.

- Canada and the UK have awareness rates of 12% and 13%, respectively, indicating a need for increased efforts to promote eSIM technology in these markets.

(Source – GSMA)

eSIM Environmental Statistics

- 4.5 billion plastic SIM card shipments were shipped in 2020.

- It is anticipated that the volume of plastic SIM card shipments in 2022 will decrease from 4,36 billion units in 2021 to 3,93 billion units in 2022.

- The SIM card sector accounts for approximately 140,000 tons of carbon dioxide equivalent emissions (CO2e) annually.

- Plastic SIM card has a carbon footprint of 229 grams during their three-year lifetime.

- The carbon footprint of an eSIM is 123 grams during its three-year lifetime.

- The carbon footprint of plastic SIM cards is approximately 46% higher than that of eSIMs.

(Source – Statista)

eSIM Market Leaders Statistics

Gemalto

- A world leader in digital security, Gemalto offers a range of eSIM solutions for consumer and IoT devices.

- Its annual revenue is $ 3.2 billion.

- Its eSIM technology is used by major mobile network operators and manufacturers worldwide.

Giesecke+Devrient

- G+D is a leading provider of secure technologies, including eSIM solutions for smartphones, tablets, and wearables.

- Its annual revenue is $ 2.53 billion.

- Its eSIM technology is based on the latest GSMA standards and offers secure remote provisioning.

Deutsche Telekom

- One of the largest telecommunications companies in the world, Deutsche Telekom, has been at the forefront of eSIM adoption.

- Its annual revenue is 114.4 billion euros.

- Its eSIM solutions are used by a growing number of device manufacturers and mobile network operators.

STMicroelectronics

- A global leader in semiconductor solutions, STMicroelectronics offers a range of eSIM solutions for consumer and industrial applications.

- Its annual revenue is $ 16.13 billion.

- Its eSIM technology is designed to be highly secure and flexible, supporting multiple operator profiles.

NXP Semiconductors

- NXP is a leading provider of secure connectivity solutions, including eSIM technology for consumer and industrial devices.

- Its annual revenue is $ 16.13 billion.

- Its eSIM solutions are designed to be highly scalable and secure, with support for remote provisioning and management.

(Source – GSMA)

Recent Developments

Acquisitions and Mergers:

- Thales acquires Gemalto: In 2023, Thales, a global leader in digital security, completed its acquisition of Gemalto, a major player in eSIM technology, for $5.4 billion. This acquisition enhances Thales’ capabilities in eSIM provisioning and digital identity management, positioning it as a key player in the growing eSIM market.

- Apple strengthens partnership with Truphone: In mid-2023, Apple deepened its partnership with Truphone, a global eSIM provider. As part of its strategy to expand eSIM capabilities across iPhone models. This partnership supports Apple’s move towards completely eSIM-only smartphones.

New Product Launches:

- Apple launches eSIM-only iPhone models: In 2023, Apple introduced its first-ever eSIM-only iPhone models in select regions, eliminating the need for physical SIM cards. This launch marks a significant shift in mobile technology, with Apple leading the transition towards fully digital SIM provisioning.

- Samsung introduces eSIM support in Galaxy devices: In early 2024, Samsung announced that its new Galaxy S24 series would include built-in eSIM capabilities, targeting both consumer and business markets. This move supports the growing adoption of eSIM technology in smartphones.

Funding:

- Truphone secures $100 million in funding: In 2023, Truphone, a global leader in eSIM provisioning, raised $100 million to expand its platform and improve its global connectivity offerings. The funding will be used to further develop eSIM services, focusing on enterprise and IoT markets.

- eSIM.net raises $50 million: eSIM.net, a provider of global eSIM services for travelers, secured $50 million in early 2024. This funding aims to enhance its eSIM offerings, particularly for international mobile users and IoT applications.

Technological Advancements:

- eSIM for IoT Expansion: The use of eSIM technology in IoT devices is rapidly growing. By 2025, it is projected that over 30% of IoT devices will be connected via eSIM. Due to its ability to simplify device management and provide greater flexibility in remote provisioning.

- Remote SIM Provisioning (RSP) Advancements: Advances in Remote SIM Provisioning (RSP) are making it easier for mobile operators to remotely manage and switch between carriers. By 2024, 40% of mobile operators are expected to adopt advanced RSP systems to offer more seamless eSIM management to their customers.

Market Dynamics:

- Growth in eSIM Market: The global eSIM market was valued at $1.4 billion in 2023 and is expected to grow at a CAGR of 15.7% from 2023 to 2028. This growth is driven by the increasing demand for eSIM technology in smartphones, wearables, and IoT devices, which offer greater convenience and flexibility compared to traditional SIM cards.

- Rising Demand in IoT and Automotive Sectors: The automotive and IoT sectors are major growth drivers for the eSIM market. By 2025, the automotive industry is expected to account for 25% of the eSIM market. As car manufacturers adopt eSIM for connected vehicles, enabling real-time data exchange and remote diagnostics.

Conclusion

eSIM Statistics – In conclusion, Embedded Subscriber Identification Module (eSIM) technology is poised to transform the telecommunications landscape. Offering a seamless and flexible approach to device connectivity.

Its integration into various devices, from smartphones to IoT devices and beyond, simplifies activation and management. Reducing the need for physical SIM cards and enabling effortless network switching.

The eSIM’s impact extends far beyond convenience, with potential applications in industries such as healthcare, automotive, and industrial IoT, driving innovation and connectivity.

As eSIM adoption continues to grow, it stands as a testament to the ever-evolving nature of technology, reshaping how we connect and interact in a digitally interconnected world.

FAQ’s

An eSIM, or Embedded Subscriber Identification Module, is a digital SIM card embedded directly into a device’s hardware. It replaces the physical, removable SIM card traditionally used for mobile network connectivity.

eSIMs work by storing subscriber data and network profiles electronically on a device. Users can switch between carriers and plans by remotely activating or provisioning the eSIM with the desired network credentials.

eSIMs offer several benefits, including switching carriers without changing physical SIM cards, support for multiple profiles on a single device, reduced physical space requirements, and improved security through remote management.

eSIM technology is supported by a wide range of devices, including smartphones, tablets, wearables (e.g., smart watches), laptops, and IoT devices such as connected cars and smart meters.

There are several advantages to using eSIMs, including the ability to switch carriers or plans without needing a physical SIM card. No risk of losing or damaging a SIM card, and the potential for cost savings when traveling internationally using local eSIMs.

While eSIMs offer many benefits, all carriers or devices may not support them, and the technology is still relatively new, so not all regions or countries have widespread eSIM support. Additionally, some users may prefer the physical SIM card for its simplicity and universality.