Table of Contents

Introduction

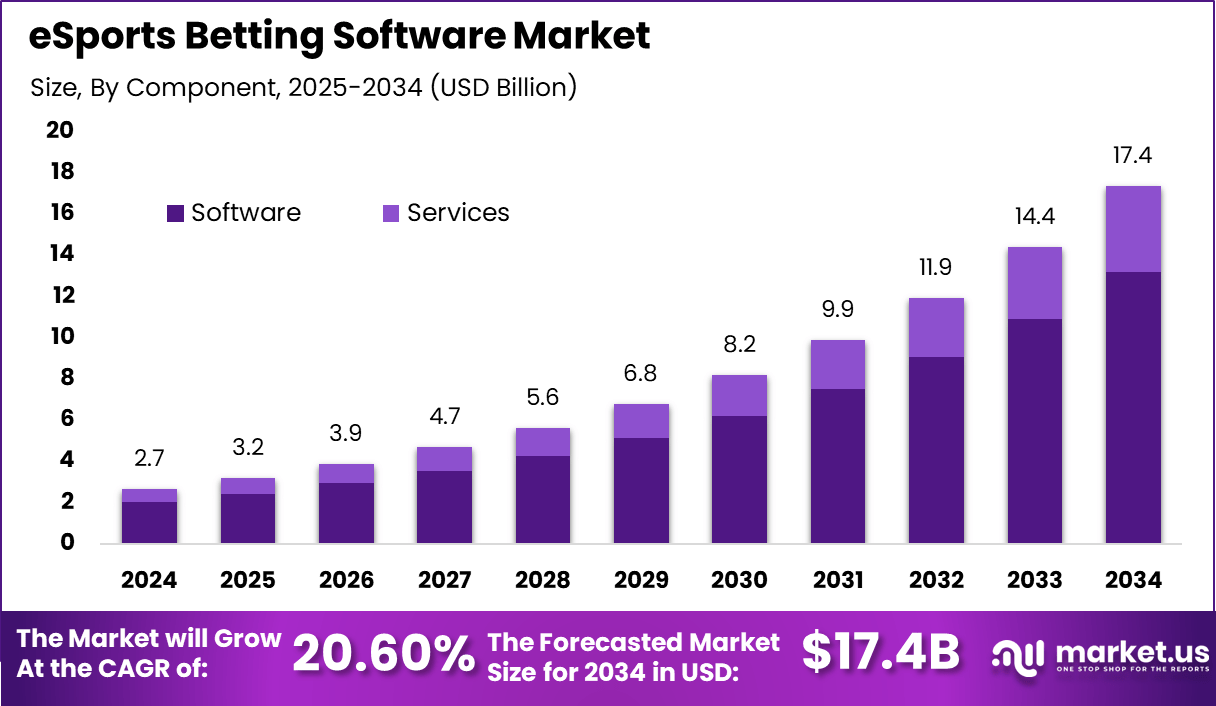

The global eSports Betting Software market generated USD 2.7 billion in 2024 and is expected to expand rapidly during the forecast period. Revenue is projected to increase from USD 3.2 billion in 2025 to approximately USD 17.4 billion by 2034, reflecting a CAGR of 20.60% throughout the forecast span. This growth is supported by rising popularity of competitive gaming and increasing legalization of online betting platforms. Improved software platforms and real time data integration are further driving market expansion.

The eSports betting software market refers to technology platforms and solutions that enable betting on competitive video gaming events. These software systems provide user interfaces, odds calculation, risk management, payment processing, and live wagering capabilities tailored to eSports competitions. Operators deploy eSports betting software across websites and mobile applications to attract bettors interested in titles such as League of Legends, Dota 2, Counter-Strike, and other popular games. The market supports bookmakers, gaming platforms, and technology providers seeking to extend betting experiences into digital sport entertainment.

In 2024, North America held a dominant position in the global market, accounting for more than 36.8% of total revenue. The region generated around USD 0.98 billion, supported by strong digital infrastructure and high engagement with eSports events. Favorable regulatory developments and widespread adoption of online wagering platforms strengthened regional leadership. As a result, North America continued to shape market growth and technology adoption trends.

Top Market Takeaways

- Software led the market with a 75.8% share, reflecting strong demand for integrated betting platforms that support real time analytics, odds management, live feeds, and secure payment processing.

- By device type, desktop platforms dominated with a 56.3% share, as experienced bettors preferred stable connectivity, advanced interfaces, and multi screen usability. At the same time, mobile platforms continued to gain momentum.

- Commercial operators accounted for 70.2% of total usage, including sportsbooks, betting platforms, casinos, and enterprises monetizing eSports betting audiences.

- By game type, first person shooter (FPS) titles led with a 45.6% share. High engagement around competitive games such as Counter Strike, Valorant, and Call of Duty supported consistent betting volumes.

- North America held around 36.8% share, supported by regulatory progress, strong digital infrastructure, and high eSports viewership.

- The U.S. market reached approximately USD 0.84 billion in 2025, reflecting rapid adoption of regulated eSports betting platforms.

- Market expansion continued at a 17.2% growth pace, supported by legalization in several states, technology upgrades in betting software, and increasing global eSports audiences.

Revenue and Usage Statistics

- The global online eSports betting audience expanded sharply, rising from 21.9 million users in 2017 to more than 74.3 million by 2024, indicating strong long term adoption.

- Average revenue per user reached USD 33.59 in 2024 and increased to USD 34.90 in 2025, showing steady monetization growth.

- Average wager size remained high, with eSports bets averaging EUR 29, significantly above the EUR 5 average seen in football betting during late 2024.

- Engagement frequency strengthened, as about 32% of global online bettors participated in eSports betting at least once per month.

- Mobile usage continued to rise, with nearly 58% of all eSports wagers in 2024 placed through mobile applications, highlighting a clear shift toward app based betting.

- Platform engagement indicators remained strong, as one major provider recorded a 126% increase in active players and a 33% rise in total bets during the third quarter of 2025, reflecting sustained user activity and market momentum.

Top Driving Factors

One major driving factor of the eSports betting software market is growing consumer demand for interactive and real time entertainment. eSports events provide continuous streams of outcomes and performance metrics, creating opportunities for dynamic betting experiences. Bettors are drawn to in play wagering, statistical insights, and live odds adjustments. Software that supports real time betting enhances engagement and retention.

Another key driver is youthful demographics that align eSports fandom with digital betting behaviors. Younger audiences, comfortable with online platforms and gaming environments, are more likely to explore interactive wagering options. This demographic shift influences operators to develop technology that resonates with digital native users. The result is heightened investment in user experience and interface design tailored to engaged bettors.

Demand Analysis

Demand for eSports betting software is shaped by the expansion of organized competitive gaming and formalized leagues. As eSports events gain structure, sponsorship, broadcasting, and global participation, betting ecosystems form around predictable competition schedules. Technology providers must adapt to diverse game formats, varying odds models, and tournament patterns. This complexity fuels demand for robust wagering platforms.

Demand is also supported by cross market integration with online gaming and fantasy sports. Bettors who participate in multiple forms of digital entertainment find value in platforms that blend gaming statistics with wagering opportunities. Operators leverage aggregated data and user profiles to tailor experiences and support personalized betting flows. This integration strengthens the case for comprehensive eSports betting solutions.

Increasing Adoption Technologies

Artificial intelligence and machine learning technologies are increasingly embedded in eSports betting software for dynamic odds setting and risk management. These technologies analyze historical match data, player statistics, and real time performance to refine probability models. AI enabled systems support automated risk mitigation and forecast shifts in betting behavior. This capability improves profitability and operational stability.

Cloud computing and scalable infrastructure are also supporting adoption by enabling high volume transaction processing and rapid content delivery. Cloud based delivery ensures platform responsiveness during peak event periods and supports global accessibility. Operators benefit from elastic scaling that aligns with seasonal demand surges. These technologies reduce latency and improve uptime for distributed user bases.

Key Reasons

One key reason operators adopt eSports betting software is to unlock new revenue streams within digital entertainment ecosystems. Betting on eSports expands the addressable market beyond traditional sports, capturing a younger, engaged audience. Technology platforms enable diversified monetization of user participation. This strategic extension supports long term growth.

Another reason is improved customer experience and retention. Modern software provides intuitive interfaces, personalized recommendations, and flexible wager types that resonate with diverse user preferences. Seamless mobile support and real time interactions increase user satisfaction. Enhanced experience drives repeat engagement and higher lifetime value.

Investment Opportunities

Investment opportunities in the eSports betting software market exist in development of customizable, modular platforms that cater to regional licensing and local preferences. Markets vary in regulation, currency use, and cultural expectations. Platforms that support flexible deployment models and compliance modules offer differentiation. Investors may find growth potential in technology that adapts to global markets.

Another opportunity lies in analytics and engagement features such as predictive insights and gamification elements. Tools that combine social features, leaderboards, and interactive challenges deepen user engagement. Investment in data analytics that supports personalized content and promotional incentives can increase stickiness. These advanced features support competitive positioning and revenue diversification.

Business Benefits

Adoption of eSports betting software enables operators to enter a rapidly expanding segment of digital wagering. Technology platforms provide scalable infrastructure that supports broad user acquisition and retention strategies. Revenue diversification reduces dependence on traditional sports betting cycles. Operators can monetize peak engagement periods and emerging events.

Software driven risk management and automated compliance also improve operational efficiency. Integrated systems reduce manual oversight and support real time decision making. Automated fraud detection and user verification enhance platform integrity. These benefits help operators maintain sustainable and compliant wagering ecosystems.

Regulatory Environment

The regulatory environment for the eSports betting software market is shaped by national and regional gambling laws that govern wagering activities. Operators must secure appropriate licenses and adhere to age verification, responsible gambling, and anti money laundering requirements. Compliance with these frameworks is essential to lawful service delivery and market access.

eSports specific betting regulations are evolving as jurisdictions consider how competitive gaming fits within existing gaming statutes. Regulatory authorities also address data protection and financial transaction security within betting platforms. Ensuring alignment with local and international standards supports trust, reduces legal risk, and enables scalable global operations.

Emerging Trends

In the eSports betting software market, one trend is the growth of integrated live betting capabilities that allow users to place wagers during ongoing matches. Software platforms are being designed to update odds in real time as game events unfold, giving bettors engaging opportunities that mirror the fast pace of competitive gaming.

Another trend is the integration of social and interactive features within betting platforms. Some software solutions now support features such as chat, group challenges, and user-generated content that encourage community participation. These interactive elements help platforms maintain engagement and provide experiences that go beyond simple wager placement.

Growth Factors

A key growth factor in the eSports betting software market is the rapid rise in viewership of competitive gaming events. Large audiences tune in for major tournaments and league play, creating a user base interested in wagering on outcomes. Software that supports popular titles and provides clear match data attracts bettors who want to engage with events they already follow closely.

Another factor supporting growth is the expansion of legal and regulated betting frameworks in more regions. As governments and regulators clarify rules for online wagering and skill-based betting, operators can offer compliant platforms that protect users and encourage trust. Clear regulations help software providers develop features that meet both user expectations and legal requirements.

Driver

A primary driver of the eSports betting software market is the demand for specialised odds engines and risk management designed for game-centric wagering. Unlike traditional sports, eSports outcomes are influenced by game mechanics, player networks, and in-game events. Software that models these dynamics accurately helps operators set competitive odds and manage exposure effectively.

Another driver is the need for seamless payment integration and user onboarding. Bettors expect streamlined experiences with multiple payment options, quick account creation, and secure verification. Platforms that support integrated wallets, digital payments, and fast verification processes improve user adoption and retention.

Restraint

A notable restraint in this market is concern about responsible gambling and youth access. eSports audiences often include younger demographics, and operators must ensure that betting platforms enforce age restrictions, promote responsible behaviour, and comply with protective standards. These concerns require careful design and enforcement mechanisms.

Another restraint relates to technical complexity in supporting high performance and scalability. eSports events can generate sudden spikes in platform usage as popular matches begin. Software must handle these peak loads without service degradation to provide consistent user experience.

Opportunity

An important opportunity exists in expanding analytic and insight features for bettors. Platforms that provide detailed player statistics, historical performance, and trend visualisations can help users make more informed decisions. These educational tools can differentiate software offerings and improve user engagement.

Another opportunity lies in developing tools for cross-platform integration with streaming services. Connecting betting interfaces to live streams or match coverage can create fluid experiences where users watch and bet without switching applications. This integration can enhance engagement and extend session time.

Challenge

A main challenge for the eSports betting software market is ensuring integrity and fairness in outcomes. Unlike traditional sports, digital game environments may be vulnerable to hacking, match-fixing, or exploitation of bugs. Betting platforms need robust monitoring to detect irregular patterns and protect both operators and users.

Another challenge involves navigating varying regulatory environments across regions. Betting laws differ widely, and platforms must adapt to local rules related to licensing, taxation, and consumer protection. Ensuring compliance without compromising platform features or user experience requires ongoing legal and technical effort.

Key Market Segments

By Component

- Software

- Services

By Device Type

- Desktop

- Mobile

By End-User

- Individual Bettors

- Commercial Operators

By Game Type

- First-Person Shooter

- Multiplayer Online Battle Arena

- Real-Time Strategy

- Sports Games

- Others

Top Key Players in the Market

- Bet365

- Betway

- Pinnacle

- Unikrn

- Rivalry

- GG.BET

- Buff.bet

- Loot.bet

- Betfair

- William Hill

- 888sport

- Betsson

- Parimatch

- Betfred

- BetVictor

- Sky Bet

- LeoVegas

- Mr Green

- 10Bet

- Intertops

- Other Major Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.7 Bn |

| Forecast Revenue (2034) | USD 17.4 Bn |

| CAGR(2025-2034) | 20.60% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)