Table of Contents

Introduction

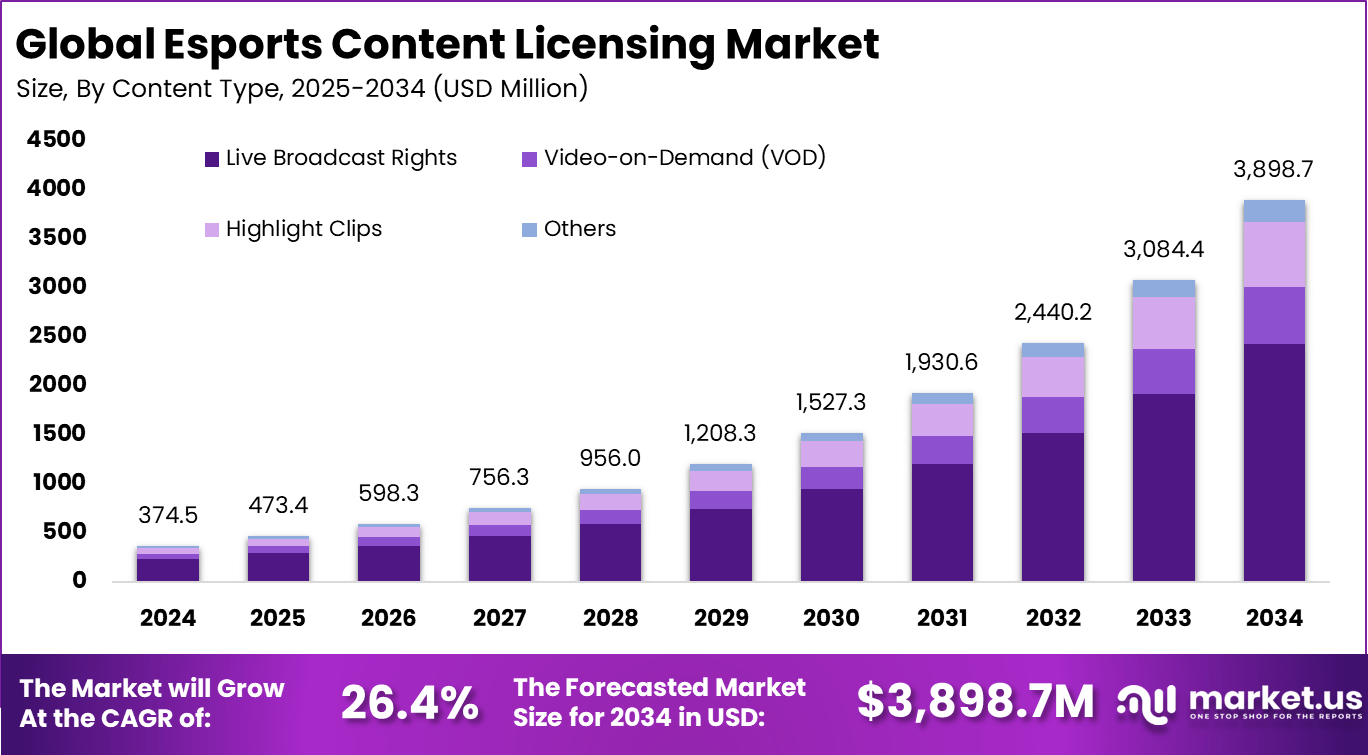

The Global Esports Content Licensing Market is projected to reach USD 3,898.7 million by 2034, rising sharply from USD 374.5 million in 2024 at a CAGR of 26.4%. North America led the market in 2024 with a 42.5% share valued at USD 159.1 million. Growth is driven by rising esports viewership, expansion of streaming platforms, increasing demand for exclusive broadcasting rights, and growing monetization opportunities through event highlights, tournament coverage, and branded content partnerships. The booming digital entertainment ecosystem further accelerates licensing investments.

How Growth is Impacting the Economy

The rapid expansion of esports content licensing is positively influencing global economic activity by stimulating digital media investments, expanding streaming infrastructure, and enhancing advertising revenue streams. As esports tournaments attract millions of viewers, broadcasters, OTT platforms, and sponsors spend heavily on exclusive content rights, driving economic growth in media, gaming, and entertainment. Licensing deals boost revenue for game publishers, production studios, and tournament organizers while creating new income models for players and esports teams.

Increased employment is generated across content production, event management, marketing, broadcasting, analytics, and digital rights management. Countries investing in esports ecosystems benefit from tourism linked to international tournaments, higher digital engagement, and youth employment opportunities. The economic multiplier effect extends across hardware manufacturing, internet services, and gaming software sectors, making esports content licensing a strategic contributor to the global digital economy.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/esports-content-licensing-market/free-sample/

Impact on Global Businesses

Rising costs for broadcast rights, exclusive licensing agreements, and high-quality production elevate operational expenses for media networks and streaming platforms. Supply chains shift toward digital content distributors, cloud-based delivery platforms, and analytics providers. Game publishers experience increased revenue and brand exposure, while sponsors gain new advertising opportunities. Event organizers benefit from global audience reach but must invest in advanced distribution technology. Sectors such as sports entertainment, gaming hardware, telecom, and digital marketing experience significant demand growth due to esports licensing expansion.

Strategies for Businesses

Businesses should invest in multi-platform content distribution to maximize audience reach and revenue. Forming long-term licensing partnerships with publishers, esports leagues, and streaming services ensures competitive advantage. Companies should leverage data analytics to optimize viewer engagement and personalize content offerings. Enhancing production quality, adopting cloud-based delivery, and expanding into emerging markets strengthens market positioning. Diversifying monetization models—subscriptions, PPV events, branded integrations—further improves profitability.

Key Takeaways

• Market growing at a high CAGR of 26.4% through 2034.

• North America dominates with over 42% market share.

• Esports viewership and streaming platform expansion drive growth.

• Exclusive licensing deals boost revenues for publishers and broadcasters.

• High-quality production and multi-platform distribution are essential.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=167508

Analyst Viewpoint

The esports content licensing market is experiencing exceptional momentum driven by soaring global viewership and digital transformation. Currently, major platforms compete for exclusive rights as esports becomes a mainstream entertainment category. The future outlook remains very positive as AI-powered personalization, multi-language broadcasting, and immersive viewing formats expand audience engagement. With continued investment from publishers, streaming platforms, and advertisers, esports content licensing will evolve into one of the most profitable segments of the digital entertainment ecosystem globally.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Exclusive tournament broadcasting | Growing global esports audience |

| Highlight clips for social media | Rising demand for short-form viral content |

| OTT streaming partnerships | Expansion of digital platforms and smart TV adoption |

| Brand sponsorship integrations | Increased advertiser interest in young demographics |

| Multi-language commentary rights | Need for global audience localization |

Regional Analysis

North America leads due to strong esports infrastructure, high sponsorship spending, and dominance of major leagues and streaming platforms. Europe shows consistent growth fueled by regional tournaments, publisher investments, and rising broadband penetration. Asia-Pacific is emerging as the fastest-growing region due to massive gaming populations, government support, and widespread mobile esports adoption. Latin America is expanding through regional streaming partnerships and improving digital infrastructure, while the Middle East shows rising interest driven by national esports initiatives.

➤ Want more market wisdom? Browse reports –

- ESG-Linked Insurance Market

- Voice Picking Solution Market

- Data Conversion Services Market

- Home Security Consulting Market

Business Opportunities

Significant opportunities lie in exclusive broadcasting licenses, regional content rights, multilingual commentary packages, and highlight distribution partnerships. Growth is strong in OTT streaming collaborations, AI-driven content recommendation systems, and branded esports entertainment series. Companies offering licensing management, rights protection, and monetization analytics can capture substantial value. Expansion into emerging markets creates new avenues for localized content production and revenue diversification.

Key Segmentation

The market includes licensing types such as broadcasting rights, streaming rights, digital clip rights, and branded content licenses. Distribution channels span OTT platforms, social media networks, linear TV broadcasters, gaming platforms, and event organizers. End users include streaming services, esports leagues, publishers, sponsors, and media agencies. Applications range from tournament broadcasting and exclusive highlights to branded integrations and community engagement content.

Key Player Analysis

Leading market participants focus on securing long-term licensing partnerships with major game publishers and esports leagues. Their strategies include expanding multi-region broadcasting rights, enhancing production quality, and developing advanced analytics to optimize viewer engagement. Many invest in personalized content formats, multi-language commentary, and immersive viewing technologies to improve user retention. Companies strengthen competitive positioning by forming alliances with digital platforms and advertisers to unlock diverse revenue streams.

- Riot Games

- Valve Corporation

- Activision Blizzard

- Epic Games

- Electronic Arts

- Amazon.com, Inc.

- The Walt Disney

- Warner Bros. Discovery

- BLAST

- ESL FACEIT Group

- Esports Engine

- Pandora TV

- Caffeine

- Huya

- Others

Recent Developments

• January 2024 – New global streaming partnership formed for top-tier esports tournaments.

• March 2024 – Expansion of multi-language commentary rights for Asian and European markets.

• July 2024 – OTT platforms launched premium esports subscription bundles.

• September 2024 – Major esports league signed long-term exclusive broadcast deal.

• December 2024 – AI-driven personalized highlight reels introduced for viewers.

Conclusion

The esports content licensing market is rapidly expanding as global viewership surges and digital platforms escalate competition for exclusive rights. With strong growth expected through 2034, licensing will remain a core revenue engine for the global esports ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)