Table of Contents

Introduction

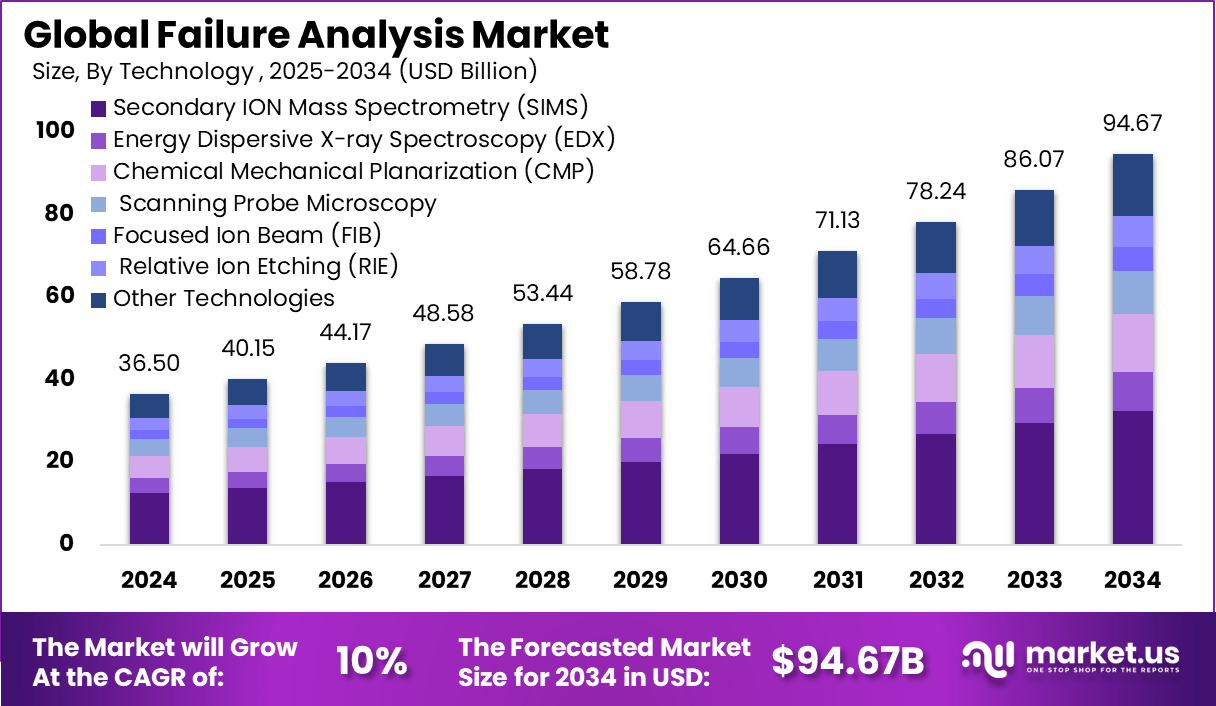

The Global Failure Analysis Market generated USD 36.50 billion in 2024 and is projected to expand from USD 40.15 billion in 2025 to nearly USD 94.67 billion by 2034, registering a 10% CAGR. Growth is driven by increasing complexity in semiconductor devices, rising product reliability demands, and expanding use of advanced imaging technologies. North America dominated the market with a 36.5% share and USD 2.17 billion revenue, supported by strong R&D infrastructure and expanding electronics manufacturing.

How Growth Is Impacting the Economy

The rapid expansion of the failure analysis market boosts economic development by improving manufacturing efficiency, reducing product defects, and strengthening innovation cycles across high-value industries. As companies adopt advanced analytical methods, operational losses from failures decline, leading to significant cost savings.

Growing demand for reliable electronic components stimulates investment in testing labs, semiconductor fabrication units, and material science research. This market drives job creation across engineering, microscopy, data analytics, and precision manufacturing sectors. Furthermore, improving product reliability enhances export competitiveness for electronics-producing nations. Failure analysis also supports national infrastructure resilience by preventing system breakdowns in aerospace, automotive, healthcare, and energy systems, contributing to long-term economic stability.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/failure-analysis-market/free-sample/

Impact on Global Businesses

Rising costs of advanced equipment, skilled labor shortages, and supply chain disruptions in precision components impact businesses, increasing procurement complexity. Industries such as semiconductor manufacturing, automotive electronics, aerospace engineering, and industrial machinery face stricter quality-control requirements, pushing firms to expand failure analysis capabilities. These tools help detect micro-defects, prevent recalls, decrease warranty expenses, and maintain brand trust. Shifts toward regional sourcing of lab equipment and analytical instruments reduce dependence on global supply chains.

Strategies for Businesses

Adopt automation-driven analysis platforms, invest in skilled forensic engineering teams, diversify suppliers of testing tools, collaborate with research institutes, deploy predictive diagnostics, and integrate cloud-based data analytics to streamline defect analysis and speed up root-cause identification.

Key Takeaways

- Strong expansion toward USD 94.67 billion by 2034.

- Semiconductor miniaturization increases demand for advanced analysis tools.

- North America leads due to strong R&D and electronics manufacturing.

- Businesses face rising equipment costs and shifting supply chains.

- Failure analysis lowers defect rates and strengthens product reliability.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=167610

Analyst Viewpoint

The failure analysis market is experiencing sustained momentum driven by the rapid evolution of semiconductor packaging, electric vehicle electronics, and high-performance computing systems. Companies increasingly rely on micro-level defect identification to ensure safety and functionality. In the coming years, broader adoption of AI-based analytics, automated microscopy, and nanotechnology-driven testing is expected to enhance market growth. Emerging consumer electronics and industrial automation trends continue to strengthen market opportunity, making long-term prospects highly positive.

Use Case and Growth Factors

| Use Case | Description | Growth Factor |

|---|---|---|

| Semiconductor Inspection | Identifying micro-defects in advanced chips | Shrinking transistor sizes |

| Automotive Electronics Testing | Ensuring reliability of EV components | Rising EV production |

| Aerospace Component Validation | Preventing failures in critical systems | Safety and regulatory demands |

| Medical Device Integrity | Detecting material flaws | Increasing healthcare device complexity |

| Industrial Machinery Diagnostics | Root-cause failure detection | Predictive maintenance adoption |

Regional Analysis

North America leads the market due to strong semiconductor R&D, government-backed innovation programs, and a mature electronics ecosystem. Europe shows steady growth supported by aerospace engineering, automotive safety standards, and material research. Asia Pacific is the fastest-growing region with major semiconductor production hubs, expanding EV manufacturing, and rapid industrialization. Latin America and the Middle East observe a gradual adoption as infrastructure and manufacturing capabilities improve.

➤ Want more market wisdom? Browse reports –

- Underwater Marine IoT & Wireless Market

- Work Zone Detection AI Market

- Drowning Detection AI Market

- Digital Trade Finance Market

Business Opportunities

Growing semiconductor miniaturization offers opportunities for advanced microscopy, nanoprobes, and 3D imaging tools. EV and battery manufacturers require sophisticated failure diagnostics to enhance safety and lifespan. Aerospace and medical device industries create demand for high-reliability testing workflows. AI-driven defect classification, cloud-based analysis platforms, and portable failure analysis instruments present strong prospects for emerging players.

Key Segmentation

The market includes failure analysis services, equipment, and software platforms used across semiconductors, automotive, aerospace, medical devices, and industrial machinery. Key segments include material analysis tools, electrical failure analysis, physical defect analysis, non-destructive testing, microscopy systems, and spectroscopy tools. Each segment supports specialized industry needs for precision diagnostics, product validation, and performance reliability improvement.

Key Player Analysis

Leading participants focus on enhancing precision imaging, strengthening multi-modal analytical capabilities, and improving automated defect detection. Companies invest in high-resolution TEM/SEM systems, spectroscopy innovations, and machine-learning algorithms that accelerate root-cause identification. Strategic collaborations with semiconductor fabs, aerospace integrators, and research labs enhance their technological leadership. A continuous emphasis on performance accuracy, throughput optimization, and integrated software ecosystems strengthens their competitive market position.

- Presto Engineering Inc.

- TUV SUD

- Rood Microtec GmbH

- Eurofins EAG Laboratories

- SGS SA

- CoreTest Technologies Inc.

- Materials Testing Inc.

- McDowell Owens Engineering Inc.

- Exponent Inc.

- TechInsights Inc.

- Hitachi High-Tech Analytical Science Ltd.

- Intertek Group plc

- NanoScope Services Ltd

- Applus+ Laboratories Inc.

- Advanced Nanolab Pte Ltd

- Toray Engineering Co., Ltd.

- Tescan Orsay Holding

- Leica Microsystems Inc.

- Keysight Technologies Inc.

- Crane Engineering Inc.

- Others

Recent Developments

• 2024: Launch of next-generation SEM platforms with enhanced nanoscale imaging resolution.

• 2024: Introduction of AI-assisted failure pattern recognition engines for semiconductor labs.

• 2025: Expansion of R&D centers focused on advanced materials and chip packaging analysis.

• 2025: New partnerships formed with EV manufacturers for battery failure diagnostics.

• 2025: Deployment of cloud-based data platforms for global defect analysis collaboration.

Conclusion

The Failure Analysis Market continues to grow as industries demand higher reliability and performance. Advancements in imaging, analytics, and semiconductor technologies will keep driving market expansion, ensuring strong opportunities and robust long-term growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)