Table of Contents

Introduction

According to Farm Management Software Statistics, Farm Management Software streamlines farming tasks with features like crop planning, inventory control, financial monitoring, equipment upkeep, labor organization, data assessment, crop monitoring, and reporting.

It empowers farmers to oversee field operations, monitor resource usage, track costs, manage machinery, plan activities, analyze data patterns, and create summaries. Through integration and mobile access, farmers can link with various farming tools and stay informed wherever they are.

Ultimately, farm management software boosts efficiency, eco-friendliness, and profitability in contemporary farming methods.

Editor’s Choice

- The global farm management software market revenue reached USD 2.95 billion in 2023.

- By 2032, the total market revenue surged to USD 8.94 billion, with precision farming dominating at USD 4.04 billion, followed by livestock monitoring at USD 2.54 billion, fish farming at USD 1.34 billion, and smart greenhouse farming at USD 1.02 billion.

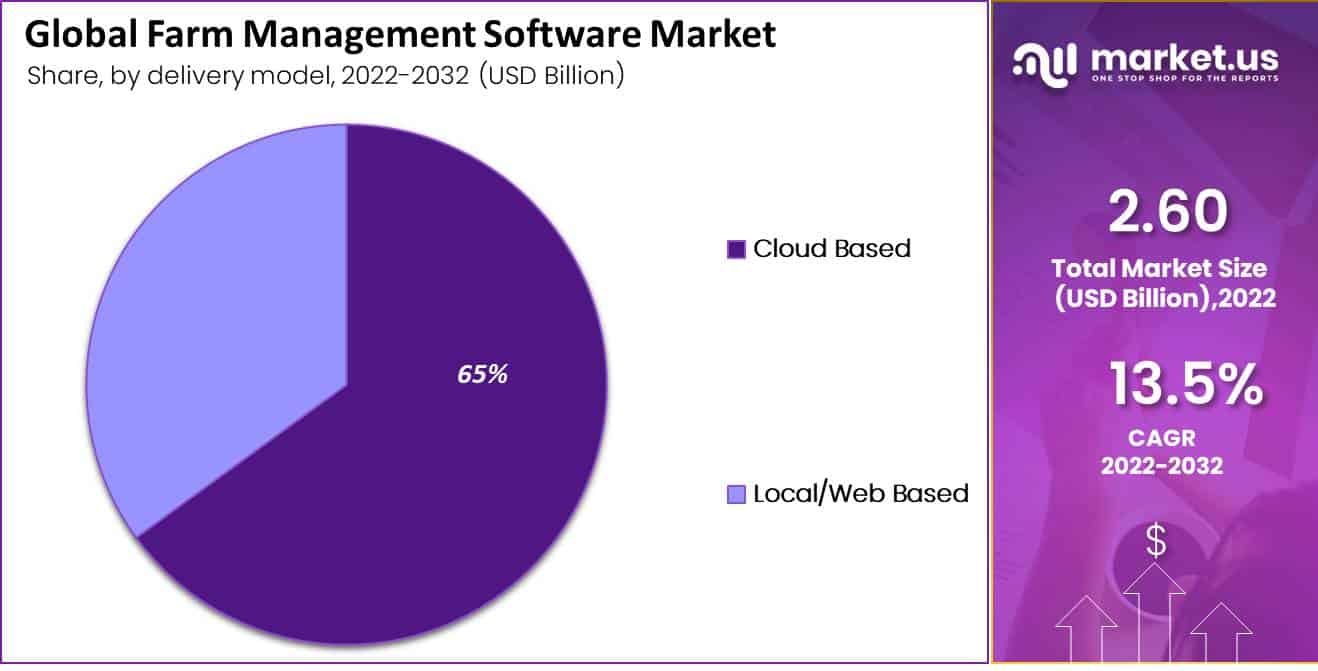

- The delivery model market share analysis reveals that cloud-based solutions command a significant portion, holding 65% of the market, while local/web-based options comprise the remaining 35%.

- North America leads the farm management software and data analytics market with a revenue of $498.95 million, reflecting the region’s advanced agricultural practices and technological adoption.

- Farm management software is the top use case globally, with a 39% adoption rate.

- 63% of respondents reported using farm software in some capacity, indicating a significant adoption of technology within the agricultural sector.

- Farmers’ primary concern currently revolves around rising input prices, with 67% citing it among their top three profitability concerns for the next two years.

Global Farm Management Software Market Overview

Global Farm Management Software Market Size

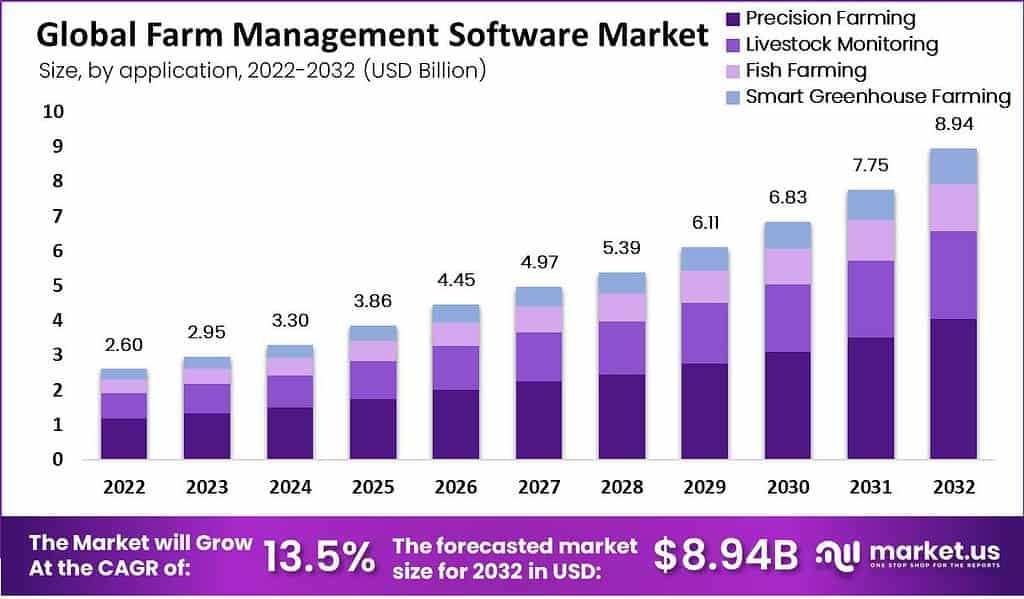

- The global farm management software market has demonstrated steady growth in revenue over the past decade at a CAGR of 13.5%.

- Starting at USD 2.60 billion in 2022, the market saw incremental increases, reaching USD 2.95 billion in 2023 and further expanding to USD 3.30 billion in 2024.

- As the adoption of farm management software continues to rise, revenue is expected to surge to USD 6.11 billion in 2029 and USD 6.83 billion in 2030.

- The market is poised for substantial growth, with revenues projected to exceed USD 7.75 billion in 2031 and USD 8.94 billion in 2032.

Farm Management Software Market Size – By Application

- The global farm management software market, segmented by application, showcases robust growth across various sectors.

- In 2022, the total market revenue stood at USD 2.60 billion, with precision farming contributing USD 1.18 billion, livestock monitoring at USD 0.74 billion, fish farming at USD 0.39 billion, and smart greenhouse farming at USD 0.30 billion.

- By 2032, the total market revenue surged to USD 8.94 billion, with precision farming dominating at USD 4.04 billion, followed by livestock monitoring at USD 2.54 billion, fish farming at USD 1.34 billion, and smart greenhouse farming at USD 1.02 billion.

Global Farm Management Software Market Share – By Delivery Model

- The delivery model market share analysis reveals that cloud-based solutions command a significant portion, holding 65% of the market, while local/web-based options comprise the remaining 35%.

- Cloud-based platforms allow users to access farm management software from anywhere with an internet connection, facilitating real-time data management and decision-making.

- Conversely, although still relevant, local/web-based solutions may appeal to users who prioritize data control or operate in areas with limited internet access.

Farm Management Software and Data Analytics Market Revenue in Different Regions

- North America leads the farm management software and data analytics market with a revenue of $498.95 million, reflecting the region’s advanced agricultural practices and technological adoption.

- Europe follows with $193.49 million, while the Asia Pacific region demonstrates significant potential with a $179.2 million revenue driven by emerging economies and increasing agricultural digitalization.

- South America contributes $80.46 million to the market, indicating a growing interest in farm management software and data analytics within the region.

- China and the United Kingdom represent notable figures, with revenues of $40.55 million and $38.6 million, respectively, highlighting their contributions to the global market.

- The Middle East and Africa region show a revenue of $31.71 million, signaling a nascent but growing market for farm management software and data analytics.

Adoption of Agtech Across Different Regions

- According to a recent survey on global agtech adoption, the utilization of various technologies varies across different regions.

- Farm management software is the top use case globally, with a 39% adoption rate.

- A combination of farm management software and remote sensing is prevalent in Europe, with a 62% adoption rate.

- Similarly, farm management software stands out as the most popular use case in North America, with a 61% adoption rate.

- South America demonstrates a preference for remote sensing technologies, with a 50% adoption rate.

- Conversely, farm automation and robotics emerge as the most favored use-case in Asia, albeit with a relatively lower adoption rate of 9%.

Precision Agriculture Hardware Adoption

- Precision agriculture hardware adoption rates vary across different regions globally.

- In North America and Europe, adoption stands at 18% and 21%, respectively, indicating a moderate level of uptake.

- South America shows a higher adoption rate at 27%, suggesting a greater acceptance and implementation of precision agriculture technologies in the region.

- Conversely, Asia lags with only 4% adoption, indicating a lower adoption level than other regions.

Current and Future Precision Agriculture Hardware Adoption

- According to the survey data, a significant percentage of respondents globally are adopting or planning to adopt precision agriculture hardware over the next two years.

- Yield monitoring and mapping have the highest adoption or planned adoption rate at 69%, followed closely by variable rate fertilizer application and sprayer section controllers, both at 67%.

- North America leads in adoption rates across all categories, with exceptionally high percentages for yield monitoring and mapping (76%) and variable rate fertilizer application (76%).

- South America follows closely with even higher adoption rates, notably for sprayer section controllers (77%) and yield monitoring and mapping (79%).

- In contrast, Europe exhibits lower adoption rates, with only 40% planning to adopt yield monitoring and mapping and variable rate fertilizer application and 53% for sprayer section controllers.

- Asia also shows moderate adoption intentions, with 42% planning to adopt yield monitoring, mapping, and variable rate fertilizer application and 44% for sprayer section controllers.

Farm Software Usage by Farmers

- According to the survey results, many farmers utilize various types of software to aid their operations.

- The data reveals that 63% of respondents reported using farm software in some capacity, indicating a significant adoption of technology within the agricultural sector.

- Furthermore, 42% of farmers indicated using industry-specific software tailored to their particular agricultural niche, suggesting a targeted approach to software adoption.

- Additionally, 37% reported using resource management software, emphasizing the importance placed on efficient utilization of resources within farming operations.

- Financial management software is particularly prevalent among farmers, with 84% utilizing such tools to manage their finances effectively.

- Interestingly, 18% of respondents reported using all three types of software, highlighting a subset of farmers who have embraced a comprehensive approach to digital tools in their farming practices.

Well-known Farm Management Software Providers

eFishery

- eFishery provides shrimp and fish farmers with an Internet of Things (IoT) solution and data platform to enhance productivity and efficiency.

- Additionally, the company gathers data on various parameters such as feeding, production, and water quality to offer predictive insights to farmers.

- Using eFishery’s feeders, aquaculture farmers have achieved notable results, including a reduction in cultivation cycle duration from 120 days to 90 days and a significant decrease in feed input by 21%.

- As of November 2019, approximately 3,000 eFishery feeders were in operation, serving 1,300 fish farmers.

AquaConnect

- AquaConnect offers shrimp farmers water quality monitoring, advisory assistance, and market access through its mobile application and on-the-ground agents.

- Their app, ‘FarmMojo,’ enables farmers to input data on water quality, feed usage, and shrimp health, which AquaConnect then analyzes to offer timely recommendations.

- As of November 2019, AquaConnect had automate feeding 800 farm ponds, benefiting 3,000 farmers across three Indian states.

- The company is extending its services to Indonesia, aiming to broaden its operational reach.

CropIn

- Founded in 2010, CropIn offers Software-as-a-Service agricultural solutions to optimize per-acre productivity and guarantee farm traceability.

- Employing a business-to-business approach, the company collects farm-specific data and provides data-led advisory assistance through its mobile application, SmartFarm.

- CropIn leverages sophisticated technologies such as big data analytics, artificial intelligence, remote sensing, and machine learning to deliver its advisory services.

- By November 2019, CropIn had positively influenced over 2.1 million farmers and digitized 5.6 million acres of agricultural land spanning 47 countries worldwide.

Barriers to the Adoption of Farm Management Software

- A more precise focus on return on investment (ROI) is essential to encourage greater adoption. According to 30% of farmers surveyed, an unclear ROI is a significant barrier to adoption. Based on their feedback, the minimum expected ROI for adoption is 3:1.

- Usage-based pricing models, such as cost per acre or module per acre, are widely prevalent, ranging from as low as $1 to as high as $60 per acre. Although these models appeal to agtech companies, even products with lower pricing per acre have faced challenges in scaling up.

- Apart from cost and ROI, farmers are apprehensive about data access, with 20% globally citing it as a top barrier to adopting farm-management software.

- North American farmers exhibit the highest concerns about data sharing (25%), while Asian farmers are the least concerned (18%).

- Farmers’ primary concern currently revolves around rising input prices, with 67% citing it among their top three profitability concerns for the next two years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)