Table of Contents

Flux for Semiconductor Market Size

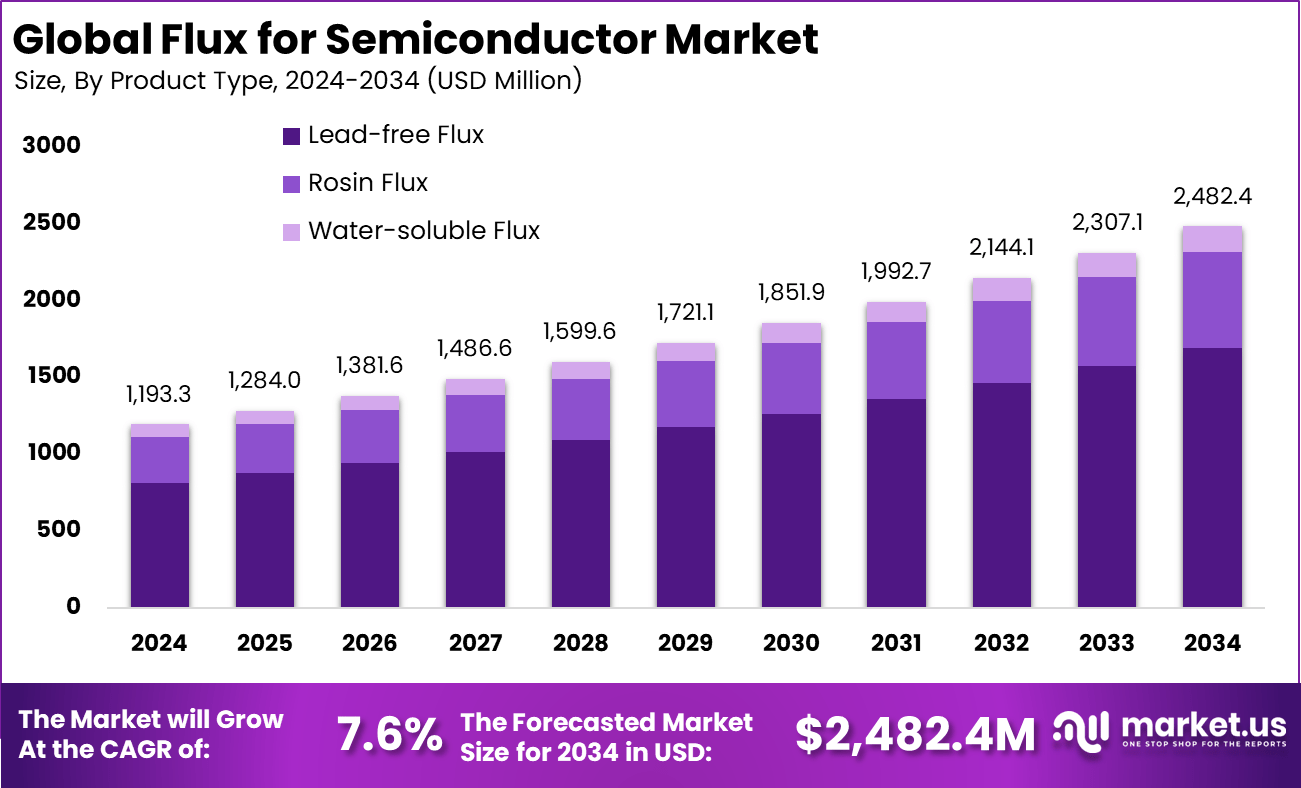

According to Market.us, The global flux for semiconductor market was valued at USD 1,193.3 million in 2024 and is projected to reach approximately USD 2,482.4 million by 2034, expanding at a CAGR of 7.6% during the forecast period from 2025 to 2034. Asia Pacific dominated the market with more than 78.6% share, generating around USD 937.93 million in revenue, supported by strong semiconductor manufacturing activity and large scale electronics production across the region.

The flux for semiconductor market focuses on chemical formulations used during soldering, wafer packaging, bumping, and assembly processes. Flux removes oxide layers from metal surfaces, improves wetting, and supports strong and clean solder joints. It is widely used in applications such as chip packaging, wafer-level bonding, flip-chip assembly, and printed circuit interconnects. As semiconductor devices become smaller and more complex, demand for highly controlled flux materials continues to rise.

Growth in this market is supported by advanced manufacturing environments where process cleanliness and precision are critical. Semiconductor plants require flux that leaves minimal residue, supports fine-pitch structures, and maintains stable performance under high temperatures. As companies shift to smaller nodes and dense packaging formats, flux formulations become more specialized, driving the need for high-purity and application-specific products.

Quick Market Facts

- The lead free flux segment led adoption with a 68.2% share, reflecting strong regulatory pressure toward safer and environmentally compliant semiconductor materials.

- Surface mount technology accounted for 56.5%, highlighting its essential role in high volume and compact electronic assembly processes.

- Consumer electronics represented 45.7% of total usage, supported by sustained demand for smartphones, wearables, and connected home devices.

- Lead free technology captured 72.3%, confirming a broad industry shift away from hazardous soldering and joining materials.

- Offline distribution dominated with 94.5%, indicating that procurement remains concentrated within established supplier and distributor networks.

- China continues to play a central role in regional demand, supported by its large scale electronics manufacturing and assembly capabilities.

- Asia Pacific held over 78.6% of global activity, driven by concentrated semiconductor fabrication, packaging, and electronics production ecosystems across the region.

Emerging Trends

In the flux for semiconductor market, a distinct trend is the increasing adoption of high-performance and environmentally compliant flux formulations that support advanced packaging and fine pitch soldering processes. Flux materials are being developed to improve surface wetting, reduce residue, and adapt to miniaturized components used in modern semiconductor devices. These enhancements help ensure defect-free interconnections and higher yields during assembly.

Another emerging trend is the integration of automated dispensing and precision flux application technologies within semiconductor manufacturing lines. As wafer fab and assembly operations become more automated, flux delivery systems are being tailored to integrate with robotics and inline inspection systems to ensure consistent material deposition and reduced process variability. This supports higher throughput and reliability for complex semiconductor assemblies.

Growth Factors

One principal growth factor for the flux for semiconductor market is the expanding complexity and sensitivity of semiconductor devices, which increases dependence on specialized flux materials that can reliably remove oxides, enhance solder wetting, and strengthen electrical connections at micro and nano scales. As packaging technologies evolve, the role of flux in enabling precision soldering becomes more critical.

Another important factor supporting growth is the broader expansion of electronics manufacturing and semiconductor production globally. Rising deployment of consumer electronics, automotive systems, industrial electronics, and telecommunications infrastructure requires robust flux solutions to support assembly processes. This sustained demand for semiconductor components fuels the need for corresponding flux materials in production workflows.

Driver

A core driver of the flux for semiconductor market is the ongoing push toward high-reliability and high-density packaging technologies in semiconductor fabrication. Advanced nodes and packaging architectures such as flip-chip, ball grid arrays, and fine pitch bonding require flux materials that can operate effectively under stringent process conditions and ensure defect-free joints.

Another driver is the continuous innovation in flux chemistries aimed at reducing environmental impact and improving compliance with regulations governing volatile organic compounds and hazardous substances. As environmental standards tighten, manufacturers are transitioning toward low-residue, halogen-free, and no-clean flux formulations, which stimulate development activities in the sector.

Restraint

A significant restraint in this market arises from the stringent regulatory and environmental compliance requirements associated with flux materials. Flux formulations often include chemicals that must meet regulatory controls to limit hazardous emissions and environmental impact. Navigating diverse regulatory landscapes can increase formulation complexity and compliance costs.

Another restraint is the technical challenge of developing flux solutions that balance performance, residue levels, and compatibility with evolving semiconductor materials and assembly processes. Advanced packaging techniques can demand highly specialized flux properties, which complicates material development and can slow adoption of new formulations.

Opportunity

A key opportunity in the flux for semiconductor market lies in advancing flux formulations tailored for emerging semiconductor packaging technologies, including heterogeneous integration and 3D stacking. Materials that can meet the precise demands of these advanced processes will be positioned to capture adoption as chip architectures grow more complex.

Another opportunity exists in the development of flux materials and delivery systems designed for fully automated and smart manufacturing lines. Integration with real time monitoring, closed loop control, and adaptive dispensing systems can increase process yield and reduce manufacturing variability, making flux solutions more valuable in precision fabrication environments.

Key Market Segments

By Product Type

- Lead-free Flux

- Rosin Flux

- Water-soluble Flux

By Application

- Soldering

- Surface Mount Technology

- Repair

By End-User

- Consumer Electronics

- Automotive

- Telecommunications

- Others

By Technology

- Lead-free Technology

- Conventional Technology

By Distribution Channel

- Online Sales

- Offline Sales

Top Key Players in the Market

- Intel Corporation

- Samsung Electronics

- TSMC (Taiwan Semiconductor Manufacturing Company)

- Qualcomm Inc.

- NVIDIA Corporation

- Texas Instruments

- Micron Technology

- Broadcom Inc.

- SK Hynix

- AMD (Advanced Micro Devices)

- Infineon Technologies

- Analog Devices

- GlobalFoundries

- Renesas Electronics Corporation

- STMicroelectronics

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1,193.3 Mn |

| Forecast Revenue (2034) | USD 2,482.4 Mn |

| CAGR(2025-2034) | 7.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)