Table of Contents

- Introduction

- Editor’s Choice

- Global Gaming Industry Size and Growth

- Gaming Monetization Statistics By Key Models

- Gaming Monetization Statistics by Subscription Model

- Gaming Monetization Statistics by Advertising and Ad-Supported Gaming

- Mobile Gaming Revenue Trends – Gaming Monetization Statistics

- Gaming Monetization Statistics by Profitable Mobile Games

- Gaming Monetization Statistics – In-App Purchase Items

- PC and Console Gaming Monetization Statistics

- Data Privacy Concerns Among Mobile Gamers

- Recent Development

- Conclusion

- FAQs

Introduction

Gaming Monetization Statistics: The gaming sector has undergone a considerable transformation, moving away from its conventional model of selling games as independent units.

Instead, it has embraced a diverse ecosystem where various strategies are utilized to produce revenue. Gaming monetization pertains to the practices and tactics employed by game developers and publishers to derive earnings from their creations.

This multifaceted methodology holds immense importance in maintaining the industry’s expansion, facilitating game development, and furnishing players with captivating interactions. The dynamic gaming monetization landscape is characterized by its ability to adapt to changing market dynamics, emerging player preferences, and technological advancements.

This adaptability will remain essential in sustaining the industry’s growth while ensuring that players continue to receive captivating gaming experiences.

Editor’s Choice

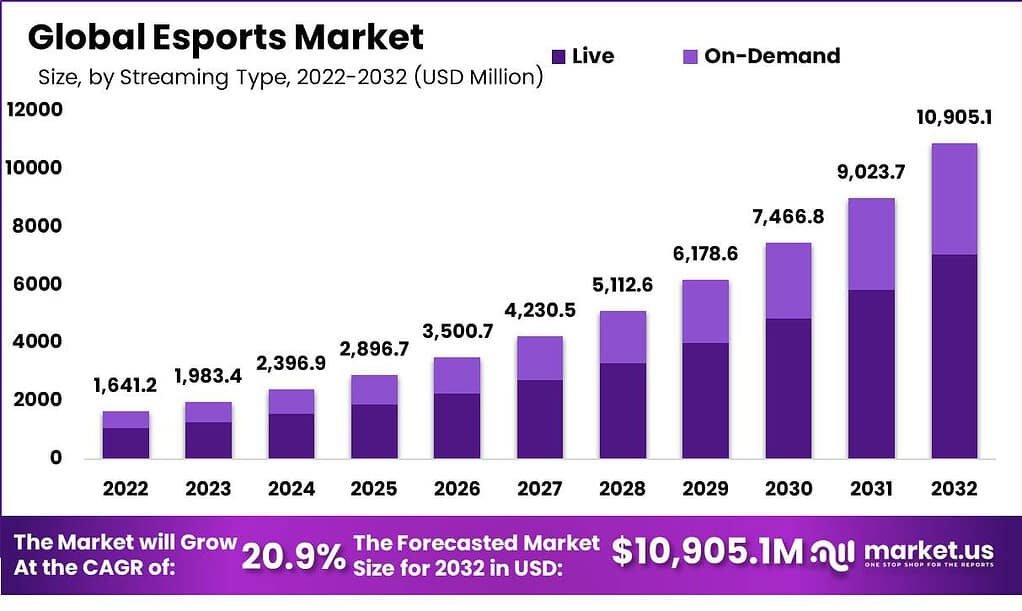

- The Global Esports Market size is expected to be worth around USD 10,905.1 Million by 2033, from USD 1,983.4 Million in 2023, growing at a CAGR of 20.9% during the forecast period from 2024 to 2033.

- Anticipated figures indicate that the Games market is on track to attain a total revenue of approximately US$225.30 billion in 2022.

- The free content category constitutes a significant portion of up to 90% of the entire game’s content.

- Anticipated data suggests that the Gaming market is poised to encompass a user base of approximately 4.3 billion individuals by 2027.

- The degree of user penetration, at 48.9% in 2023, will elevate to 54.5% by 2027.

- Furthermore, the projected average revenue per user (ARPU) is expected to reach a value of US$93.31.

- The Mobile Games market is poised to achieve a revenue milestone of approximately US$173.60 billion in 2023.

- The projected outlook for the In-game Advertising market anticipates revenue reaching approximately US$94.53 billion in 2023.

- The most recent 2022 report regarding the console and PC gaming domain discloses a decline of 2.2% in revenue over the preceding year.

Global Gaming Industry Size and Growth

- Anticipated figures indicate that the Games market is on track to attain a total revenue of approximately US$225.30 billion in 2022.

- Forecasts envision a consistent growth trajectory characterized by an annual expansion rate (CAGR 2022-2027) of 8.35%, culminating in an estimated market size of US$352.10 billion by 2027.

- Regarding specific revenue streams within this market, projections highlight that In-app Purchase (IAP) revenue is poised to reach US$145.30 billion in 2022, while revenue stemming from paid app acquisitions is set to amount to US$1.25 billion in the same year.

- Notably, advertising revenue within the Games market is expected to ascend to US$78.84 billion in 2022.

- Concurrently, the Games market is projected to witness a substantial volume of downloads, with the figure anticipated to reach 118.70 billion in 2022.

- The average annual revenue per download is estimated at US$1.90.

- A comprehensive international comparison underscores China‘s prominence as the leading revenue generator, with an estimated US$71.30 billion anticipated in 2022.

(Source: Statista)

Gaming Monetization Statistics By Key Models

Free-to-Play (F2P) Model

- Upon downloading a game, users are confronted with two distinct content categories. The initial category encompasses free content, constituting a significant portion of up to 90% of the entire game’s content. In contrast, the second category involves paid content, accessible to users through real currency microtransactions.

- For six years, from 2018 to 2023, the revenue generated by the free-to-play (F2P) PC games market has exhibited a gradual yet consistent upward trajectory.

- Commencing at $21.6 billion in 2018, the revenue figures demonstrated marginal fluctuations, with subsequent years reflecting revenues of $21.5 billion in 2019 and a subsequent uptick to $22.7 billion in 2020.

- The market’s resilience persisted, witnessing a steady rise to $23.1 billion in 2021, followed by a progression to $23.7 billion in 2022.

- This trend is expected to continue in 2023, with projected revenue reaching $24.52 billion. These progressive revenue increments underscore the enduring appeal and sustained growth within the F2P PC games market during this six-year timeframe.

(Source: Edvice.pro, Statista)

Gaming Monetization Statistics by Subscription Model

- As indicated by the survey findings, approximately 35% of global gamers currently hold active gaming subscriptions; however, this distribution is not uniform.

- In the United States, merely 20% of gamers were actively paying for subscription services, while in markets like India and Indonesia, the prevalence of subscribers was more than double.

- The survey’s analysis revealed the potential for expansion in gaming subscriptions, not only among gamers who have not yet subscribed but also among those already availing of such services.

- Among respondents who were already subscribers, a notable 80% expressed interest in subscribing to multiple services (9%) or were inclined towards multiple subscriptions (71%).

- Regarding the factors influencing their decision to subscribe, the surveyed subscribers agreed that the quality of the games offered was the paramount consideration.

- Subsequently, price, the number of games, and diversity emerged as the subsequent reasons, with varying prioritization contingent upon the respondents’ weekly gaming hours.

- In contrast, when questioning non-subscribers about their rationales, cost emerged as the primary factor, with a desire to possess games rather than opting for access-based rentals ranking as another significant concern.

(Source: “The Global Gaming Study: The Future of Subscriptions” by Simon-Kucher & Partners)

Gaming Monetization Statistics by Advertising and Ad-Supported Gaming

- The projected outlook for the In-game Advertising market anticipates revenue reaching approximately US$94.53 billion in 2023.

- Forecasts further indicate an anticipated annual growth rate (CAGR 2023-2027) of 11.38%, culminating in a projected market size of US$145.50 billion by 2027.

- Within the In-game Advertising domain, the projected user count is expected to amount to zero by 2027, with user penetration forecasted at zero in 2023 and expected to remain at zero by 2027.

- A comprehensive international comparison underscores China’s prominence as the leading revenue generator, with an estimated revenue of US$40,200.00 million in 2023.

- Additionally, the In-game Advertising market is projected to have an average revenue per user (ARPU) of approximately US$8.67 in 2023.

- In 2022, advertising revenue derived from video games amounted to $70 billion in the United States.

- Projections indicate a substantial surge to reach $137 billion by 2027.

- This trajectory signifies a noteworthy compound annual growth rate (CAGR) surpassing 14% over the specified timeframe.

- Over the past five years, the proportion of mobile gamers who prefer ad-supported mobile games has notably increased, rising from 21% in 2017 to 50% in 2022. Remarkably, this percentage surpasses those inclined towards pay-to-play games or games predominantly reliant on in-app purchases.

More Insights

- Regarding parental behavior, approximately 48% reported occasional purchases, while 40% refrained from making any purchases.

- Among Gen X gamers, 45% engaged in occasional purchases, while an equivalent percentage refrained from purchases.

- Millennials mirrored these statistics, with 44% making occasional purchases and the same percentage abstaining.

- Notably, swift in-app purchases were made by parents, with 27% indicating a mere few days of deliberation. In contrast, approximately 26% of respondents were willing to wait months before making such purchases.

- Further insights revealed that 60% of gamers discovered new mobile games through advertisements featured in other mobile games.

- Despite in-app purchases not being particularly frequent, around 50% of respondents preferred ad-supported games, showcasing a significant increase from the 21% of mobile gamers favoring this model in 2017.

- Video ads retained their prominence, garnering support from 53% of respondents.

- In parallel, support for survey ads (17%) and playable ads (16%) exhibited an ascent from their previous levels of 8% and 9%, respectively, in 2017.

- Additionally, the study disclosed that video ads incorporating an element of humor tend to captivate more attention. The demand for humor within video ads increased, with 57% of respondents indicating their willingness to engage with amusing videos, marking a substantial rise from the 44% reported in 2017. Apart from humor, the significance of storytelling and product demonstrations also increased.

(Source: Statista, Tapjoy gaming survey)

Mobile Gaming Revenue Trends – Gaming Monetization Statistics

- Projected figures indicate that the Mobile Games market is poised to achieve a revenue milestone of approximately US$173.60 billion in 2023.

- Forecasts underscore a consistent growth trajectory, exemplified by an annual expansion rate (CAGR 2023-2027) of 6.42%, culminating in a projected market capacity of US$222.70 billion by 2027.

- The projected user count in the Mobile Games market is anticipated to reach 2.3 billion users by 2027.

- The metric of user penetration, marking 25.1% in 2023, is projected to escalate to 29.2% by 2027.

- In an international context, the United States is anticipated to lead in revenue generation, with an estimated revenue of US$46,470.00 million in 2023.

- Moreover, the average revenue per user (ARPU) within the Mobile Games market will be US$90.16 in 2023.

(Source: Statista)

Gaming Monetization Statistics by Profitable Mobile Games

- While mobile games may still fall short in scope and development expenses compared to console and PC releases, they exhibit remarkable prowess in revenue generation. As of 2018, mobile gaming outpaced its counterparts in the PC and console domains. Notably, China, the United States, and Japan emerged as the primary contenders in consumer expenditure on mobile games, contributing to more than half of the total spending.

- China leads in spending volume, whereas Japan boasts the distinction of spending the highest amount per capita globally.

- Remarkably successful mobile games like “Honor of Kings” and “Genshin Impact” hail from these nations, underscoring their significant influence on the industry.

- This prowess culminated in mobile gaming’s commanding share, accounting for 51 percent of the total revenue in 2021.

- In 2023, the mobile gaming landscape is set to witness substantial revenue contributions from various prominent titles. Leading the ranks is “Honor of Kings,” generating an impressive revenue of $864.32 million, followed closely by “PUBG MOBILE” with $636.7 million.

- The ever-popular “Candy Crush Saga” continues to captivate players and rake in significant earnings, amounting to $592.75 million.

- Additionally, “Genshin Impact” secures a notable position with revenue of $572.62 million, while the immersive world of “Roblox” garners attention and accumulates $497.92 million in revenue.

- The engaging gameplay of “Coin Master” results in a revenue of $447.37 million, while “Royal Match” and “Gardenscapes” each contribute substantially with revenues of $417.26 million and $361.68 million, respectively.

- Not to be overlooked, “Honkai: Star Rail” captures players’ interest and achieves a revenue of $323.57 million.

- Finally, the enduring appeal of “Pokemon GO” maintains its presence, achieving a revenue of $318.15 million. These remarkable figures collectively underscore the diverse and lucrative nature of the mobile gaming sector.

(Source: Business of Apps, Statista)

Gaming Monetization Statistics – In-App Purchase Items

- When evaluating the top-grossing iOS games spanning 2014 to 2018, a prevalent trend emerges wherein applications featuring consumable elements dominate the rankings.

- Noteworthy examples such as Clash of Clans, Game of War, and Fortnite heavily rely on virtual currency as a foundational aspect of gameplay. The fundamental strategy revolves around establishing a framework wherein the possession of currency becomes pivotal for making progress.

- An illustrative case is observed in Clash of Clans, where users require Gems to develop their villages and actively engage in clan wars. Although Gems can be earned through regular gameplay, the option of in-app purchases (IAPs) expedites the process. Among these, the $4.99 “Pile of Gems” stands out as a frequently chosen in-app purchase, contributing to the app’s popularity.

- Conversely, apps like Candy Crush Saga leverage consumable power-ups to propel user advancement. The application presents an array of sought-after in-app purchases that enhance the chances of achieving higher scores or restoring health during challenging levels.

Other Sources

- Significantly, even seemingly straightforward apps embrace this approach; for instance, the “Power-up + 5 Moves” priced at $0.99 ranks among the most favored in-app purchases they offer.

- Several apps introduce premium bundles that offer substantial quantities at a discounted rate, enticing loyal users to invest. This is exemplified by Game of War – Fire Age, where the most sought-after in-app purchase amounts to a $99.00 package encompassing 28K Gold units.

- Among the leading Android games currently available at discounted rates on Google Play, examples include “Lost Journey,” priced at a reduced Rs. 5 / $0.01 from its original $0.99, and “Deus Ex GO – Puzzle Challenge,” now available for Rs. 10 / $0.99, down from $4.99.

- Other prominent titles, such as “Hitman Sniper,” “Need for Speed Most Wanted,” and “LIMBO,” have all undergone price reductions to Rs. 10 / $0.99 from their previous values of $4.99.

- Moreover, gaming enthusiasts can now access titles like “Geometry Dash” for Rs. 40 / $0.75, marked down from $1.99, and “Trivia Crack (Ad free)” for Rs. 50 / $0.75, down from $2.99.

(Source: Wappier, FoneArena)

PC and Console Gaming Monetization Statistics

PC and Console Game Sales Revenue

- The most recent 2022 report regarding the console and PC gaming domain discloses a decline of 2.2% in revenue over the preceding year.

- This reduction is attributed to the industry’s transition to a more stabilized state after the robust expansion driven by the pandemic during 2020 and 2021.

- The report emphasizes that 2022 saw the participation of 1.1 billion PC players and 611 million console players.

- The decline of 2.2% primarily stemmed from a 4.2% contraction in the console gaming market, even though the PC games market exhibited a modest 1.8% growth.

- Remarkably, a noteworthy decrease of 20% in the average playtime per player between 2021 and 2022.

- Concurrently, the segment of players engaging in approximately 1000 hours of gameplay each week experienced a substantial decline of 37%.

- The report also draws attention to a significant shift in the demographic composition, signifying that the PC and console markets have achieved greater inclusivity, with female and non-binary gamers contributing to 40% of the customer base.

(Source: Newzoo)

Expansion Packs and Downloadable Content (DLC) Revenue

- In 2022, downloadable content (DLC) sales constituted 13% of PC and 7% of console revenue in the United States.

- The introduction of DLC resulted in an 11% increase in overall monthly active users (MAU) for both PC and console games. Among various game genres, certain categories reaped more significant advantages from DLC offerings.

- Strategy games registered the highest growth in MAU following DLC releases, closely followed by role-playing and simulation titles.

- Additionally, an intriguing observation is that, on average, approximately 30% of monthly active users for the game “Dead Cells” were new players during the months DLC was released.

- In the period spanning from April 2020 to April 2023, downloadable content (DLC) exerted a substantial impact on the growth of monthly active users (MAU) for specific genres.

- Strategy titles experienced a remarkable increase of slightly over 30% while role-playing games observed growth exceeding 20%. Notably, these genres were characterized by frequent release schedules for DLC, augmenting the overall elevation in MAU. Additional prominent genres benefiting from DLC-driven MAU growth included simulation, platformer, and adventure games.

- Particularly, adventure DLC managed to attract an average of 11% more MAUs.

- Examining the case of the roguelike-Metroidvania game by Motion Twin, their trio of paid DLCs – “Fatal Falls,” “Queen of the Sea,” and “Return to Castlevania” – contributed to an impressive average MAU upswing of +156% between early 2021 and the present.

- During the same period, non-DLC content updates attracted an average of +47% more MAUs.

- However, a noteworthy observation emerges regarding “Dead Cells”; an average of 87% of the existing players did not return to the game to engage with the DLC content.

- Surprisingly, nearly one-third of the monthly active users participating in the DLC content were newcomers to the title.

(Source: Newzoo)

Data Privacy Concerns Among Mobile Gamers

- Data privacy emerges as a substantial concern for modern consumers in the contemporary landscape. Smartphone users are increasingly keen on understanding the entities monitoring their mobile behaviors and preferences and how this data is utilized.

- The recent actions of Google discontinuing support for third-party cookies and Apple introducing significant changes to IDFA have introduced fresh complexities for publishers in their data collection strategies.

- That being acknowledged, the study revealed a notable dynamic: 43% of respondents were willing to allow app tracking, while 39% stated a consistent aversion to opting into data tracking on iOS.

- Around 18% remained uncertain regarding their stance. The pivotal factor influencing individuals to opt into tracking was a sense of trust in the developer or publisher. This underscores the pivotal role that brand trust plays in motivating mobile gamers to share their data.

(Source: Tapjoy gaming survey)

Recent Development

Acquisitions:

- Tencent’s Stake in Epic Games: Tencent owns a 40% stake in Epic Games, significantly influencing the monetization strategies employed by games developed on the Unreal Engine. This investment ensures that Tencent receives a portion of the revenue generated from games using this popular game development platform.

New Product Launches:

- Unity’s New Monetization Tools: Unity launched advanced monetization tools aimed at enhancing revenue streams for game developers. These tools integrate AI to optimize in-app purchases (IAP) and ad placements, ensuring a balance between user experience and monetization.

- Twitch’s New Features for Streamers: Twitch introduced new monetization features for streamers, including improved ad management tools and enhanced subscription options. These features are designed to provide streamers with more flexible and effective ways to generate revenue from their content.

Funding:

- Massive Funding for Mobile Game Startups: Several mobile game startups received substantial funding to develop innovative games and monetization strategies. For example, in 2023, multiple startups secured millions in venture capital to enhance their gaming platforms and integrate advanced monetization techniques like AI-driven ad placements and dynamic in-app purchases.

Market Growth:

- Growth in Mobile Gaming Revenue: The growth is driven by increased smartphone penetration and the rising popularity of mobile games across various demographics.

- Increase in User Spending: The global gaming industry generated approximately $182.9 billion in 2022, with mobile gaming accounting for over 50% of this revenue. Despite a slight decline in the previous year, the market is expected to recover and grow due to innovative monetization strategies and new game releases.

Innovation in Monetization Strategies:

- Hybrid Monetization Models: There is a significant shift towards hybrid monetization models that combine various revenue strategies, such as in-app purchases, subscriptions, and ads. This approach aims to maximize revenue by catering to different player preferences and engagement levels.

- AI-Driven Monetization: AI is increasingly being used to optimize monetization strategies in gaming. By analyzing player behavior, AI helps predict the best times to show ads or offer in-app purchases, enhancing both user experience and revenue generation.

Strategic Partnerships:

- Collaborations for Enhanced Player Experience: Companies like Microsoft and Sony are forming strategic partnerships to integrate advanced monetization tools into their gaming platforms.

- These collaborations aim to provide seamless monetization options while improving the overall player experience through better content and services.

Conclusion

Gaming Monetization Statistics – The gaming monetization landscape has transformed from traditional sales models to a multifaceted ecosystem embracing in-app purchases, advertising, and subscriptions.

Market projections reveal the industry’s resilience, with mobile gaming excelling through free-to-play approaches and downloadable content.

Changing player demographics, acceptance of in-game ads, and brand trust have redefined user engagement.

As the landscape evolves, adaptability remains crucial for sustaining growth, aligning strategies with player preferences, and maintaining a delicate balance between monetization and player satisfaction in the ever-evolving gaming industry.

FAQs

Gaming monetization refers to the methods and strategies employed by game developers and publishers to generate revenue from their products. These strategies include in-app purchases, advertising, subscriptions, and other innovative models.

The gaming industry has experienced significant revenue growth, with projections indicating a steady increase in total revenue. From 2022 to 2027, the market is expected to witness an annual growth rate (CAGR) of 8.35%, resulting in a projected volume of US$352.10 billion by 2027.

In-app purchases contribute substantially to gaming revenue. In the Games market, IAP revenue is projected to reach US$145.30 billion in 2022, showcasing its significance as players opt for microtransactions to enhance their gaming experiences.

Player behavior towards gaming subscriptions has evolved, with around 35% of global gamers having active subscriptions. Preferences for ad-supported games have risen, indicating a shift towards subscription-based models.

Data privacy concerns are relevant as players become more conscious of their data. Trust in developers and publishers influences players’ willingness to share personal data, with around 43% of respondents being open to app tracking.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)