Table of Contents

Introduction

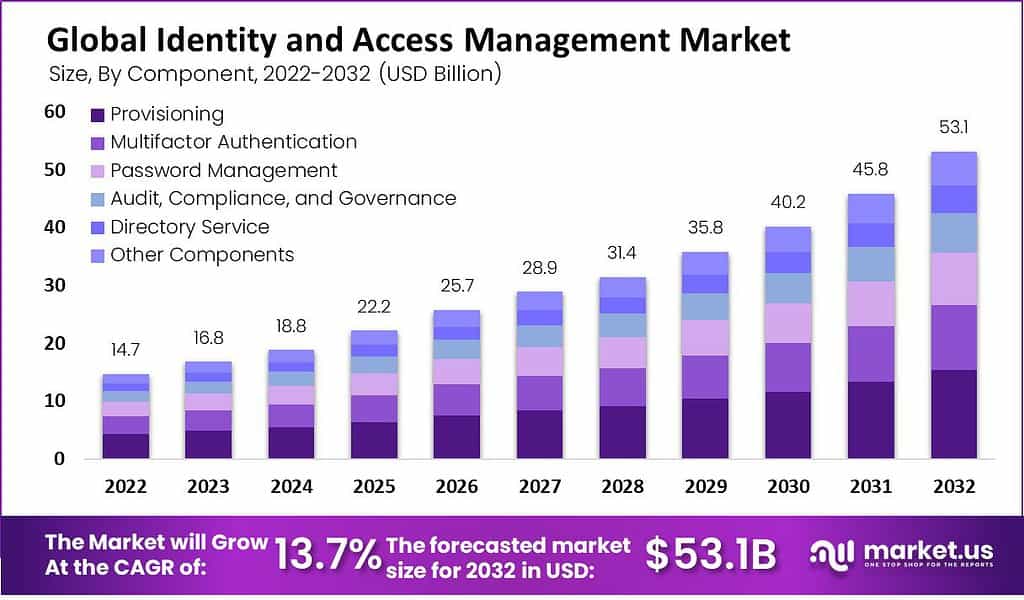

The Identity and Access Management (IAM) Market is projected to experience rapid expansion by 2032, reaching USD 51.4 billion with an impressive compound annual growth rate of 13.7% between 2023-2032.

Identity and Access Management (IAM) is a crucial framework and set of technologies that organizations use to manage digital identities and control access to resources within their networks. IAM solutions ensure that the right individuals have appropriate access privileges to systems, applications, and data, while also maintaining security and compliance standards.

The Identity and Access Management market has witnessed significant growth, driven by increasing awareness of security concerns, stringent regulatory compliance requirements, and the expanding adoption of cloud-based services. The evolution of complex IT infrastructures, such as hybrid cloud environments, and the increasing sophistication of cyber threats have further underscored the importance of robust IAM solutions. The market’s expansion can also be attributed to the growing demand for advanced authentication methods, single sign-on (SSO), multi-factor authentication (MFA), and the integration of artificial intelligence (AI) for enhanced security measures. As businesses continue to prioritize digital transformation, the adoption of IAM solutions is set to rise, reflecting the critical need to safeguard access to valuable digital assets and ensure regulatory compliance.

Facts and Latest Statistics

- Identity and Access Management Market size is expected to be worth around USD 53.1 Billion by 2032, from USD 16.8 Billion in 2023, growing at a CAGR of 13.7%.

- 60% of large enterprises are expected to adopt cloud-delivered Privileged Access Management (PAM) services by 2024, an increase from 30% in 2022, to reduce risks associated with privileged access.

- 70% of organizations are projected to implement a Zero Trust security model that depends heavily on robust IAM solutions for secure access control and user authentication.

- 60% of organizations plan to implement Enhanced Identity Proofing and Fraud Detection solutions to combat the risks linked to identity theft and account takeover attacks.

- 30% of enterprises will likely have adopted a Cloud Privilege Access Management (CPAM) solution by 2024 to address privileged access risks in cloud environments.

- The banking, financial services, and insurance (BFSI) sector is forecasted to be the largest adopter of IAM solutions in 2023, with a market share of approximately 26.0%. This adoption is spurred by strict regulatory demands and the necessity for secure access to confidential data.

- An 84% rate of identity-related breaches in the past year was reported by a 2022 survey from the Identity Defined Security Alliance.

- 37% of all breaches involve the exploitation of stolen login credentials.

- The primary advantages of passwordless technology include improved security (41%), enhanced user experience (24%), increased productivity (19%), and reduced IT department workload (17%).

- Only 28% of surveyed IT security practitioners indicate their organizations verify if remote workers securely access the network.

- 74% of all breaches involve a human element, through privilege misuse, stolen credentials, social engineering, or errors.

- 38% of security decision-makers identify development teams as the primary source of risk from unknown, unmanaged identities.

- The average cost of a data breach is 4.45 million US dollars, marking a 15% rise over the past three years.

- When investing in an IAM solution, organizations prioritize ease of integration (72%), end-user experience (62%), and product performance and effectiveness (61%).

- The market’s expansion is primarily driven by factors like cyberattacks and identity fraud, necessitating tightened security measures, as well as the growing adoption of cloud-based IAM solutions for remote access security.

- Continuous technological advancement poses a challenge for the IAM industry, with cybercriminals leveraging sophisticated techniques like AI and machine learning to infiltrate systems. Additionally, the high initial investment acts as a restraining factor for market growth.

- The provisioning segment leads in terms of revenue within the IAM market, while the multifactor authentication segment is expected to witness the fastest growth, offering enhanced security through multi-layered authentication processes.

- The on-premise deployment segment currently dominates the market, while the cloud-based deployment segment is expected to register significant growth owing to its cost-effectiveness and simplified management.

- The healthcare sector leads the IAM market due to the critical need for data security, followed by the BFSI sector, which is expected to be the fastest-growing segment, driven by the increasing adoption of digital banking and online payment services.

- Integration of advanced technologies such as blockchain and biometrics presents a promising growth opportunity for the IAM market, providing enhanced security and access management for organizations.

- North America currently holds the largest market share, attributed to the region’s heightened focus on data security and cybersecurity management. However, Asia Pacific is anticipated to witness the fastest growth, with organizations investing in IAM solutions to protect their databases from potential threats.

Emerging Trends

- Shift towards Zero Trust Architecture: Organizations are increasingly adopting Zero Trust security models, reflecting a fundamental change in approach to IT security. This model operates on the principle that no entity should be automatically trusted, regardless of whether it is inside or outside the network perimeter.

- Rise of Passwordless Technologies: There’s a growing trend towards the implementation of passwordless authentication methods. These methods, which include biometrics, hardware tokens, and smartphone apps, are gaining traction due to their ability to enhance security while also improving user experience and productivity.

- Increased Adoption of Cloud-based IAM Solutions: The shift towards cloud-delivered IAM and PAM solutions is becoming more pronounced. These solutions offer scalability, flexibility, and cost-effectiveness, making them attractive for enterprises looking to enhance their security posture in a cloud-centric world.

- Enhanced Identity Proofing and Fraud Detection: As digital transactions continue to rise, organizations are investing in advanced identity verification and fraud detection technologies. These solutions utilize AI and machine learning to analyze user behavior and detect anomalies, thereby preventing identity theft and account takeover attacks.

- Focus on Regulatory Compliance: With the BFSI sector leading in IAM adoption, it’s clear that stringent regulatory requirements are a significant driver for the deployment of IAM solutions. Organizations across industries are focusing on compliance with data protection and privacy laws to avoid hefty fines and reputational damage.

Recent Developments

- February 2023: Broadcom and CA Technologies – Broadcom completed its acquisition of CA Technologies, adding CA’s IAM portfolio to its offerings. This includes sophisticated products like Privileged Access Management and Governance.

- March 2023: Microsoft’s Azure Active Directory (AAD) Passwordless – Microsoft launched a passwordless login feature for Azure Active Directory. This innovative feature allows users to log in to various applications and services without needing a password, enhancing security and convenience.

- May 2023: IBM Cloud Identity Governance – IBM expanded its IAM solutions by releasing IBM Cloud Identity Governance. This new solution aids in managing access controls and user privileges across hybrid cloud environments, streamlining the governance of identities.

- July 2023: AWS Amazon Cognito Identity Broker – Amazon Web Services introduced Amazon Cognito Identity Broker. This service simplifies the process of user authentication and authorization for web and mobile applications, making it easier for developers to secure their apps.

Conclusion

The landscape of Identity and Access Management (IAM) is undergoing significant transformations, driven by technological advancements, evolving security threats, and changing regulatory environments. The adoption of cloud-based IAM solutions, the shift towards Zero Trust architecture, and the implementation of passwordless technologies are among the key trends shaping the future of IAM. Organizations are increasingly recognizing the importance of robust IAM strategies in safeguarding digital identities and ensuring secure access to resources. As the sector continues to evolve, staying abreast of emerging trends and developments will be critical for organizations looking to bolster their cybersecurity defenses and meet compliance requirements.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)