Table of Contents

Introduction

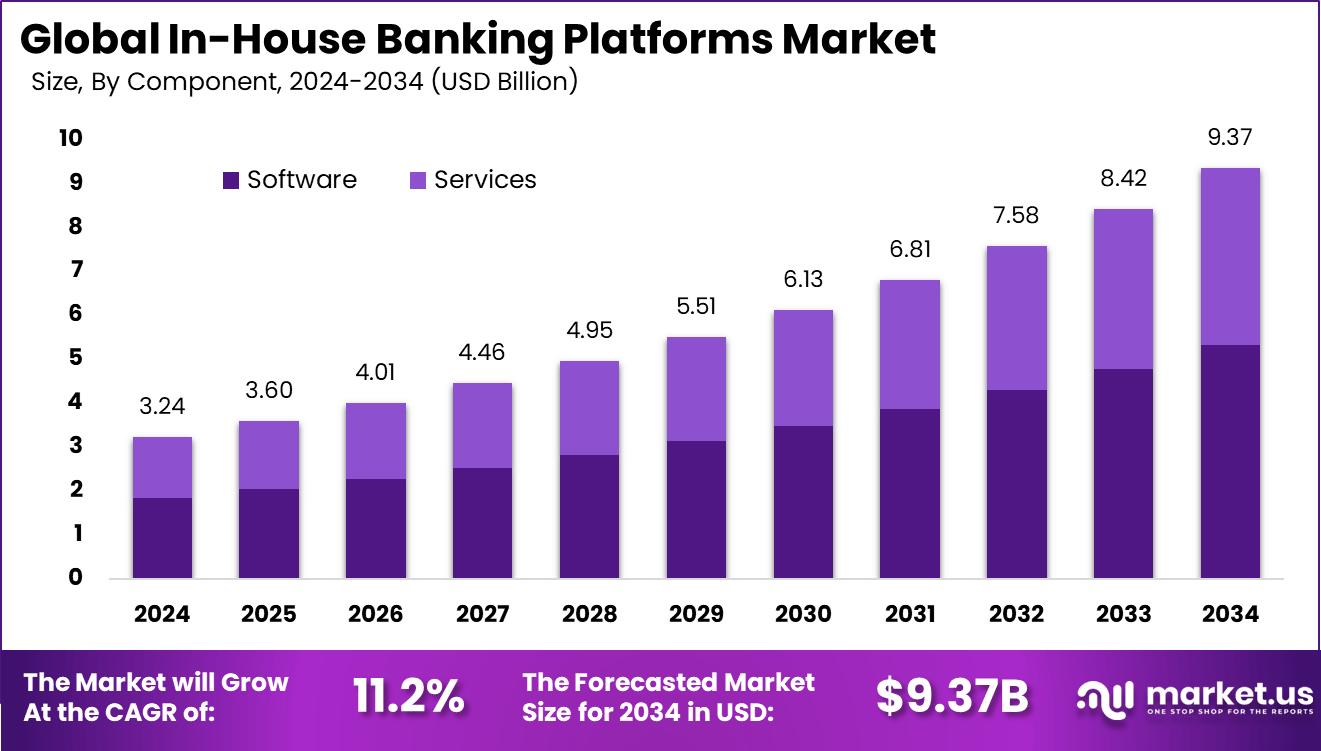

The Global In-House Banking Platforms Market is projected to reach USD 9.37 billion by 2034, growing from USD 3.24 billion in 2024, at a CAGR of 11.2%. This growth reflects the growing demand for automated, streamlined banking solutions within corporations.

The rise in financial complexity, cost-efficiency requirements, and digital transformation in financial management are key drivers of market expansion. As companies increasingly seek secure, scalable platforms to manage their financial operations, the in-house banking platforms market is poised for significant growth in the coming decade.

How Growth is Impacting the Economy

The robust growth in the in-house banking platforms market is having a significant impact on the global economy. The expansion of this market allows businesses to adopt more efficient, cost-effective financial management systems. By optimizing internal banking processes, companies are reducing operational costs and improving financial controls.

This leads to increased profitability, creating a ripple effect across industries. The adoption of these platforms is also fostering innovation within financial technology, resulting in new job creation and the development of related sectors. Economies benefit from increased productivity as businesses modernize their financial processes, thereby strengthening overall financial stability and sustainability.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/in-house-banking-platforms-market/free-sample/

Impact on Global Businesses

The rise in the adoption of in-house banking platforms has had a profound impact on global businesses. With rising costs in financial operations, these platforms offer businesses the ability to streamline financial functions, reduce reliance on external banks, and mitigate rising transaction fees.

The shift to in-house banking platforms also influences supply chains by enhancing liquidity management and increasing the speed of financial transactions, which is vital in today’s fast-paced business environment. Sectors such as manufacturing, retail, and technology benefit the most from these platforms due to their ability to handle complex financial processes and support large-scale operations.

Strategies for Businesses

Businesses are focusing on adopting in-house banking platforms as part of their digital transformation strategies. To leverage this growth, organizations are prioritizing seamless integration, user-friendly interfaces, and enhanced security features.

Additionally, investing in customized solutions that cater to specific financial needs, such as treasury management, is becoming crucial. Partnerships with technology providers that specialize in in-house banking platforms are also essential for businesses seeking to stay ahead in an increasingly competitive marketplace. Ensuring scalability and flexibility to adapt to future market demands will be key to staying relevant in the evolving financial landscape.

Key Takeaways

- The market is expected to reach USD 9.37 billion by 2034, growing at a CAGR of 11.2%.

- North America leads with over 40.3% market share, valued at USD 1.30 billion.

- In-house banking platforms offer cost efficiency and process automation.

- Growth is driven by financial complexity, digital transformation, and demand for scalability.

- Businesses adopting these platforms gain increased profitability and operational efficiency.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=168912

Analyst Viewpoint

The in-house banking platforms market is currently experiencing strong growth, driven by the need for businesses to enhance financial efficiency and control. In the future, as organizations continue to embrace digital transformation, the demand for these platforms will only rise, offering vast opportunities for both established and emerging players in the market. The future of in-house banking platforms is expected to be positively impacted by advancements in AI, blockchain, and data analytics, ensuring a more secure and efficient financial ecosystem for businesses worldwide.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Treasury Management | Streamlining cash flow and liquidity management |

| Financial Risk Management | Enhanced financial security and risk mitigation |

| Payment Processing | Faster and more efficient transaction handling |

| Intercompany Financial Operations | Improved control over internal financial processes |

Regional Analysis

North America holds a dominant position in the in-house banking platforms market, accounting for more than 40.3% of the market share. This region is expected to maintain its lead due to the high adoption of advanced financial technologies and the strong presence of key industry players. Europe follows closely, with steady growth driven by increasing financial complexity and the need for efficient banking operations. The Asia Pacific region, however, is expected to exhibit the fastest growth, as businesses in emerging economies adopt these platforms to modernize their financial management systems.

➤ Want more market wisdom? Browse reports –

- Confined Space Monitoring Market

- Field Data Collection App Market

- Autonomous Security Tower Market

- Edge Application Security Market

Business Opportunities

The growing demand for in-house banking platforms presents numerous business opportunities. Companies specializing in fintech solutions are well-positioned to capitalize on this trend by offering customizable platforms tailored to various industry needs. Additionally, as companies expand globally, there will be a greater need for scalable platforms capable of handling multi-currency and multi-jurisdictional financial operations. This opens up opportunities for businesses to provide integrated services that combine financial management with innovative technologies, such as artificial intelligence and blockchain, to further enhance efficiency.

Key Segmentation

The in-house banking platforms market is segmented into several key categories:

- By Solution: Treasury management, payment processing, financial risk management

- By Deployment: On-premise, cloud-based

- By End-User: Large enterprises, SMEs

- By Industry: Manufacturing, retail, banking, others

These segments are driving market growth as organizations across industries seek to improve their financial management through tailored platforms.

Key Player Analysis

Leading players in the in-house banking platforms market are focusing on enhancing platform features, such as real-time financial analytics, AI-driven decision-making, and seamless integrations with existing enterprise resource planning systems. Many companies are investing in research and development to improve platform scalability and security. Furthermore, strategic partnerships and acquisitions are helping these players expand their customer base and offer more innovative solutions. By focusing on customer needs and adopting new technologies, these players are setting the stage for future market dominance.

- SAP SE

- Kyriba

- FIS (Fidelity National Information Services)

- Finastra

- TreasuryXpress (a Bottomline Technologies company)

- ION Treasury

- Oracle Corporation

- Serrala

- Bellin (Coupa Treasury)

- Reval (ION Group)

- TIS (Treasury Intelligence Solutions)

- Broadridge Financial Solutions

- Openlink (ION Group)

- Murex

- FIS Global

- Infosys Finacle

- Sopra Banking Software

- Fiserv Incorporation

- Others

Recent Developments

- January 2025: A leading financial technology provider announced the integration of AI-powered risk management features into its in-house banking platform.

- February 2025: A major financial services company expanded its in-house banking solution to include blockchain for faster cross-border payments.

- March 2025: A new partnership between a fintech startup and an established enterprise software company will enhance cloud-based in-house banking platforms.

- April 2025: A software company launched an upgraded version of its in-house banking platform, focusing on multi-currency support.

- May 2025: A major in-house banking platform provider introduced a new feature that automates tax reporting and compliance.

Conclusion

The in-house banking platforms market is experiencing strong growth, driven by increasing demand for streamlined financial operations. With technological advancements and the adoption of scalable solutions, businesses are poised to benefit from greater financial efficiency in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)