Table of Contents

Intellectual Property Insurance Market Size

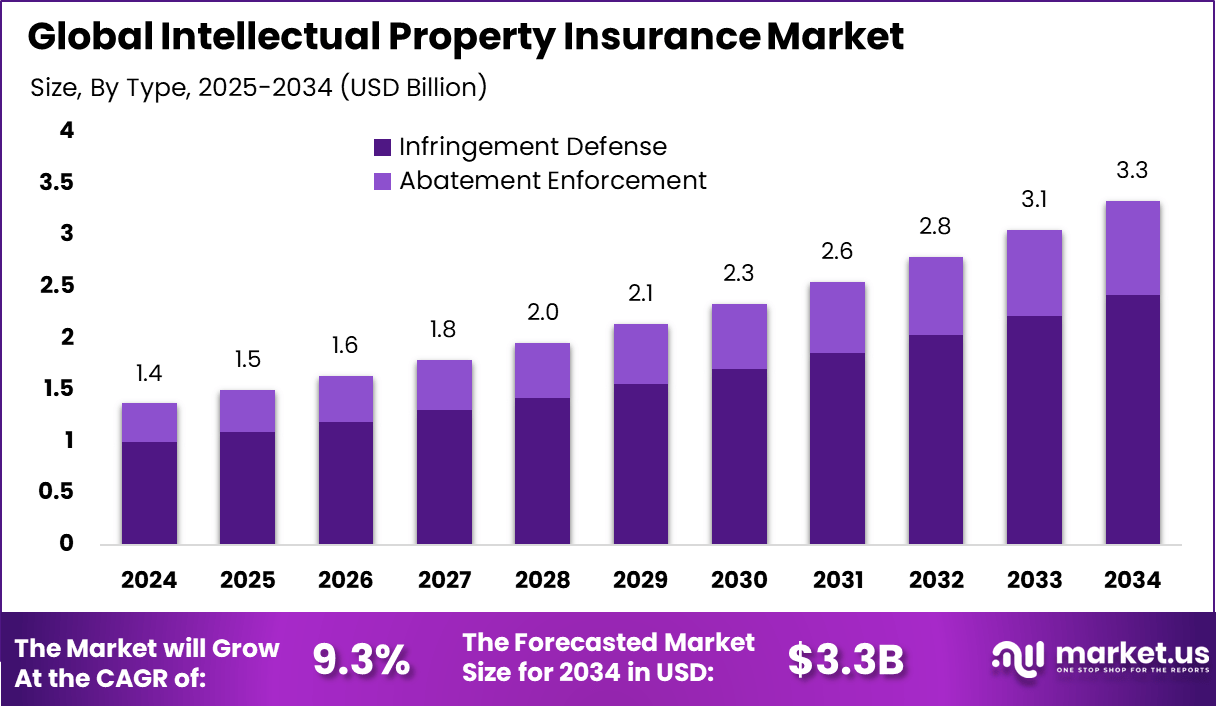

The global Intellectual Property Insurance market generated USD 1.4 billion in 2024 and is expected to expand steadily over the coming years. Revenue is projected to increase from USD 1.5 billion in 2025 to approximately USD 3.3 billion by 2034, reflecting a CAGR of 9.3% during the forecast period. This growth is supported by rising awareness of intellectual property risks and increasing legal costs related to infringement disputes. Businesses across technology, manufacturing, and creative sectors are placing greater emphasis on protecting intangible assets.

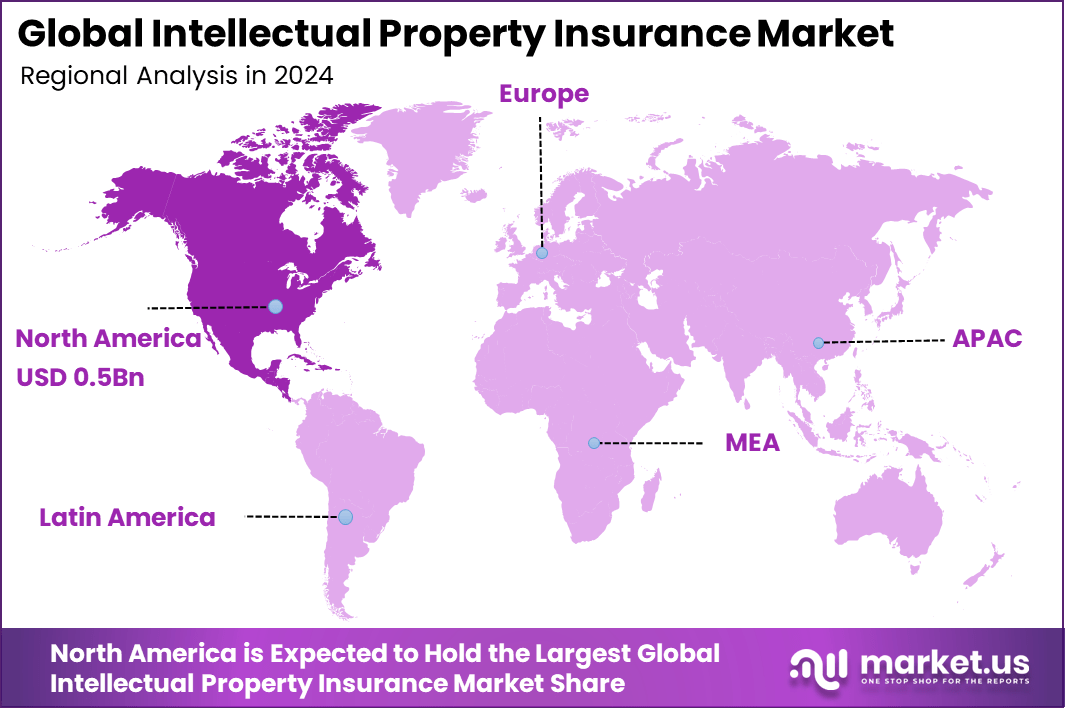

In 2024, North America held a dominant position in the global market, accounting for more than 38.9% of total revenue. The region generated around USD 0.5 billion, supported by a strong innovation ecosystem and high patent filing activity. Mature legal frameworks and greater adoption of risk mitigation tools further strengthened regional leadership. As a result, North America continued to influence market growth and insurance product development.

The intellectual property insurance market refers to financial products designed to protect organizations and individuals against losses arising from intellectual property related risks. These risks include infringement claims, defense costs, and loss of revenue due to unauthorized use of patents, trademarks, and copyrights. Coverage can extend to litigation expenses, settlement costs, and legal fees associated with protecting or enforcing IP rights. The market supports entities across sectors where innovation and creative assets contribute significantly to competitive advantage.

Growth in this market has been influenced by rising global investments in research, innovation, and brand development. As businesses expand their portfolios of intangible assets, exposure to disputes and enforcement challenges increases. Legal costs associated with IP litigation have become a critical concern for technology, pharmaceutical, media, and consumer goods companies. Adoption of insurance solutions that transfer financial risk has been prioritized to maintain operational stability.

Top Market Takeaways

- Infringement defense led the market with 72.8%, supported by rising demand for legal protection against patent, trademark, and related IP disputes.

- Media and entertainment accounted for 31.6%, reflecting higher exposure to copyright challenges, brand licensing issues, and content ownership claims.

- North America held 38.9% of the global market, underpinned by strong IP enforcement systems and broad awareness of intellectual property rights.

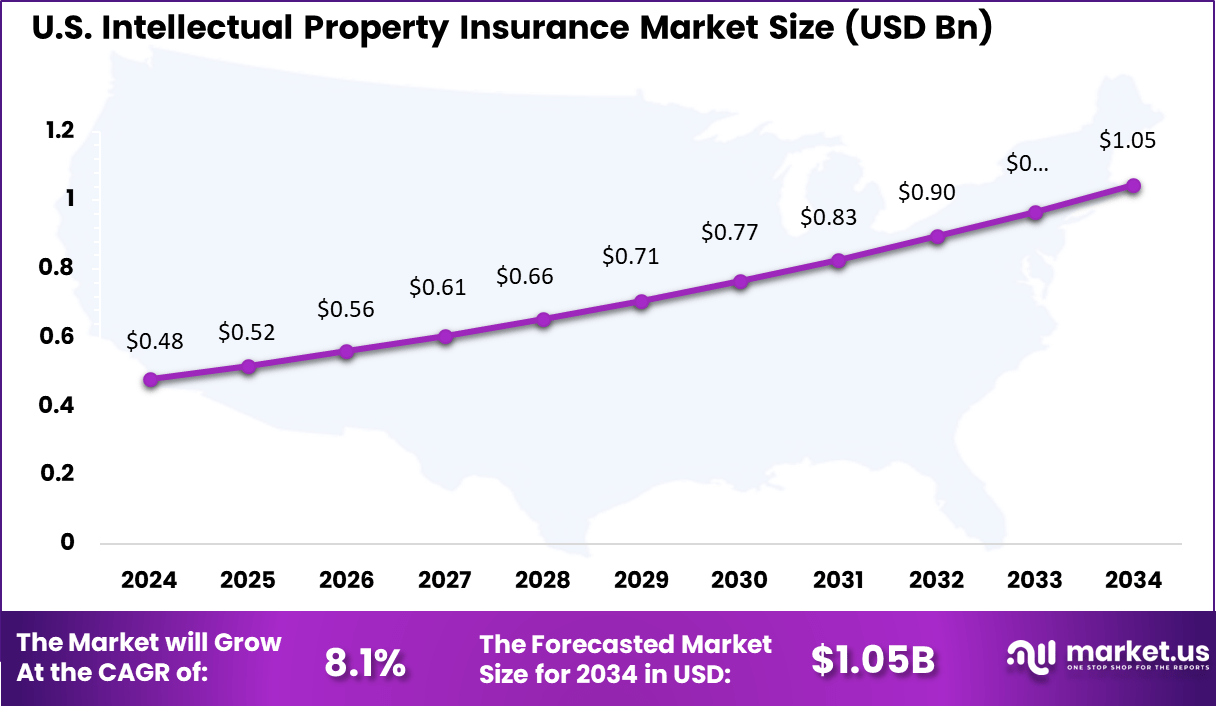

- The US market reached USD 0.48 billion in 2024 and is growing at an 8.1% CAGR, driven by increasing litigation risk and the rising value of creative and technology-based assets.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growth in patent filings | Increasing number of patents and trademarks requiring protection | ~2.4% | North America, Asia Pacific | Short to Mid Term |

| Rising IP litigation costs | High legal expenses driving demand for risk transfer | ~1.9% | North America, Europe | Short Term |

| SME innovation growth | Higher IP creation among startups and SMEs | ~1.6% | Global | Mid Term |

| Cross border commercialization | Global expansion increasing infringement exposure | ~1.4% | Global | Mid Term |

| Awareness of IP risk | Growing recognition of IP as a core business asset | ~1.0% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Underwriting complexity | Difficulty in valuing IP assets accurately | ~2.1% | Global | Mid Term |

| Claim severity volatility | Unpredictable litigation outcomes | ~1.7% | North America, Europe | Short Term |

| Limited historical data | Insufficient loss data for pricing models | ~1.4% | Global | Mid Term |

| Policy coverage disputes | Ambiguity in coverage interpretation | ~1.0% | Global | Short Term |

| Reinsurance constraints | Limited reinsurance capacity for IP risks | ~0.8% | Global | Long Term |

Top Driving Factors

One driving factor for the intellectual property insurance market is the proliferation of IP related disputes in competitive industries. As patent filings and trademark registrations grow, the likelihood of contention between rights holders rises. Companies seek financial protection against potentially large costs arising from litigation and enforcement actions. This dynamic has heightened interest in insurance solutions that mitigate uncertainty and financial exposure.

Another factor fuelling market growth is the increasing cost of legal services and judicial processes. Legal defenses in IP cases can be lengthy and costly, often stretching organizational budgets. Insurance coverage that absorbs a portion of these costs enhances financial planning and reduces unexpected cash outlays. As awareness of these financial pressures increases, demand for IP insurance products has been reinforced.

Demand Analysis

Demand for intellectual property insurance has been shaped by corporate strategies that emphasize innovation and global expansion. Organizations entering new markets face varying legal regimes and enforcement challenges that heighten risk exposure. Insurance solutions are viewed as mechanisms to support cross border operations while maintaining risk tolerance within acceptable limits. Growth in international trade and digital distribution has further amplified these considerations.

Demand is also influenced by sectoral differences in IP reliance. Industries such as technology, biotechnology, and creative media depend heavily on protected assets for revenue generation. This reliance increases sensitivity to infringement events and enforcement risks. As a result, entities in these sectors often prioritize insurance products to safeguard core intellectual assets and maintain competitive positioning.

Increasing Adoption Technologies

Data analytics and artificial intelligence technologies have been integrated into risk assessment frameworks for intellectual property insurance. These tools enhance the ability of underwriters to evaluate patent portfolios, prior art landscapes, and litigation histories. Improved risk models support more accurate pricing and tailored coverage options based on quantifiable risk indicators. Adoption of these technologies increases confidence among insurers and insureds in aligning protection with actual exposures.

Digital platforms and automated claims processing systems have also contributed to market adoption. Cloud based infrastructures enable secure document management, real time updates on claims status, and streamlined communication between stakeholders. These technologies reduce administrative burdens and improve user experiences. Enhanced efficiency in policy servicing and claim resolution supports broader acceptance of insurance solutions.

One reason for adopting intellectual property insurance is the protection of financial resources against unpredictable litigation costs. Without coverage, organizations may be exposed to significant legal expenses that affect liquidity and operational investments. Insurance products transfer a portion of this risk, providing financial certainty. This mechanism supports strategic planning and resilient financial management.

Another reason for adoption is the facilitation of business partnerships and transactions. Investors, licensors, and collaborators often require assurances that IP related risks are managed effectively. Insurance coverage can serve as a signal of risk mitigation discipline and financial preparedness. This can enhance credibility in negotiations and enable smoother contractual relationships.

Investment and Business Benefits

Investment opportunities in the intellectual property insurance market exist in developing customized products for emerging industries such as software as a service and digital platforms. These sectors present unique risk profiles that may not be fully addressed by traditional insurance offerings. Solutions tailored to digital IP and algorithm based assets can attract interest from technology centric enterprises. Focused investments in product innovation can differentiate providers and capture unmet demand.

Another opportunity lies in expanding distribution channels through strategic alliances with legal firms and patent brokers. Collaboration with entities that advise on IP strategy can create integrated services that blend risk management with legal expertise. This can streamline customer journeys and improve product relevance. Partnerships that enhance visibility and trust can help penetrate underinsured segments.

Adoption of intellectual property insurance provides organizations with greater financial stability in the face of enforcement and defense costs. By transferring risk, businesses can avoid abrupt budget reallocations during disputes. This supports continuity in research, development, and commercialization activities. Sustained investment in innovation is facilitated by predictable financial safeguards.

These insurance solutions also contribute to risk management maturity within organizations. Integration of coverage into enterprise risk frameworks encourages proactive identification of exposures and strategic alignment. This holistic approach enhances decision making and long term planning. Firms equipped with comprehensive risk strategies can achieve stronger resilience and operational confidence.

Regulatory Environment

The regulatory environment for the intellectual property insurance market is influenced by national and international laws governing intellectual property rights. Policy frameworks determine how patents, trademarks, and copyrights are registered, adjudicated, and enforced. Insurance solutions must align with these legal structures to ensure that covered events are valid under local statutes. Compliance with regulatory standards supports the enforceability of policies across jurisdictions.

Consumer protection regulations also affect how insurance products are designed, marketed, and administered. Disclosure requirements, fair trade practices, and transparency standards must be upheld to protect policyholders. Insurers are required to comply with financial solvency and reporting obligations to maintain licensure. Adherence to these regulatory frameworks fosters trust, reduces systemic risk, and supports orderly market development.

US Market Size

The United States alone contributes around USD 0.48 billion, expanding at a steady 8.1% CAGR.

In 2024, North America accounts for 38.9% of the global market, reflecting an advanced understanding of intellectual property rights and a high volume of innovation-driven businesses.

Key Market Segments

By Type

- Infringement Defense

- Abatement Enforcement

By Industry Vertical

- Media and Entertainment

- Technology and Software

- Pharmaceuticals and Life Sciences

- Consumer Electronics

- Manufacturing

- Retail and Consumer Goods

- Others

Top Key Players in the Market

- AXA XL

- Tokio Marine HCC

- Lloyd’s of London

- CFC Underwriting

- The Hanover Insurance Group

- Chubb Limited

- Munich Re

- Swiss Re

- Allianz Global Corporate & Specialty

- Tokio Marine Kiln

- Aon plc

- Lockton Companies

- Sompo Holdings

- Ping An Insurance

- Mitsui Sumitomo Insurance

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.4 Bn |

| Forecast Revenue (2034) | USD 3.3 Bn |

| CAGR(2025-2034) | 9.3% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)