Table of Contents

Report Overview

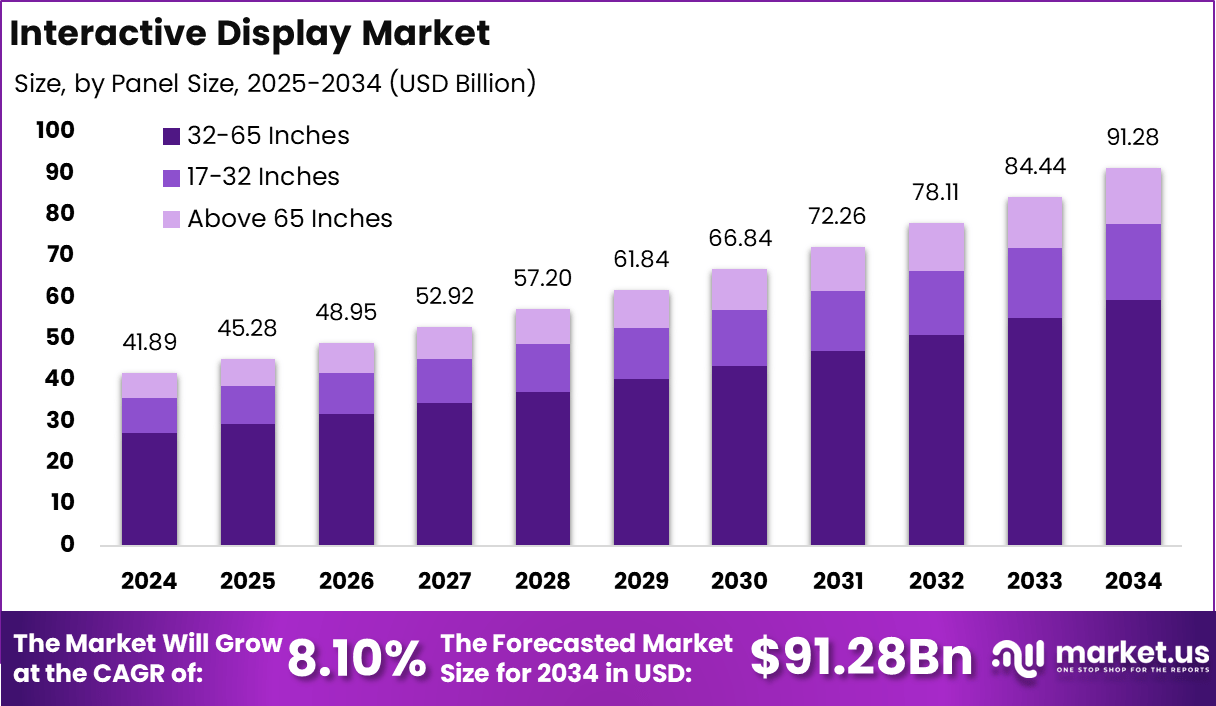

The global Interactive Display market was valued at USD 45.2 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 91.28 billion by 2034, expanding at a CAGR of 8.1% from 2025 to 2034. This growth is driven by rising adoption of interactive screens across education, corporate environments, retail, and public spaces. Increasing demand for touch based collaboration and digital engagement tools is further supporting market expansion.

The interactive display market refers to digital screens that allow users to interact through touch, gestures, or stylus input. These displays are used in classrooms, corporate meeting rooms, retail environments, healthcare facilities, and public information spaces. Interactive displays support collaboration, presentations, learning, and customer engagement. They combine display technology with software to enable real-time interaction. Adoption improves communication effectiveness and user participation.

North America held a dominant position in the global market, accounting for more than 37.7% of total revenue. The region generated around USD 15.7 billion, supported by strong investment in digital infrastructure and widespread use of interactive technologies. Early adoption across classrooms, offices, and commercial venues strengthened regional leadership. As a result, North America continues to influence innovation and adoption trends in the interactive display market.

One major driving factor of the interactive display market is the growing demand for collaborative work and learning environments. Organizations and institutions prioritize interactive tools that improve participation. Interactive displays support brainstorming, annotation, and shared content viewing. Engagement improves productivity and learning outcomes. Collaboration needs strongly drive adoption.

Another key driver is the increasing use of digital tools in education. Schools and training centers adopt interactive displays to enhance teaching methods. Visual and hands-on learning improves understanding. Interactive content keeps learners engaged. Education digitization supports market growth.

Key Insights Summary

- The global interactive display market was valued at USD 41.89 billion in 2024 and is projected to reach USD 91.28 billion by 2034, growing at a CAGR of 8.1%.

- North America accounted for 37.7% share in 2024, valued at USD 15.79 billion, driven by strong adoption in education and corporate sectors.

- The U.S. market generated USD 35.8 billion in 2024 and is expected to reach USD 66.57 billion by 2034, expanding at a 6.4% CAGR.

- Interactive whiteboards led by product type with a 35.6% share, supported by widespread classroom and training use.

- Displays sized 32–65 inches dominated panel size with a 65.2% share, favored for education and enterprise environments.

- Flat panels captured 98.2% share, driven by slim design, energy efficiency, and high display quality.

- LED technology led with a 70.3% share, due to brightness, durability, and lower power consumption.

- The education sector remained the largest vertical with a 30.5% share, reflecting strong use in digital classrooms and e-learning.

Driver Analysis

The interactive display market is being driven by the growing demand for dynamic visual communication tools that enhance engagement, collaboration, and information access across education, corporate, retail, and entertainment environments. Interactive displays combine touch sensitivity, digital annotation, multimedia playback, and connectivity to support real-time interaction between users and content.

As remote and hybrid collaboration becomes more prevalent, organisations are prioritising solutions that bridge physical and virtual engagement without compromising clarity or responsiveness. These platforms enable interactive lessons, collaborative brainstorming, immersive presentations, and wayfinding solutions, supporting both operational productivity and audience involvement.

Restraint Analysis

A significant restraint in the interactive display market relates to the initial investment and associated infrastructure requirements. High-resolution, multi-touch displays often require supporting hardware, network bandwidth, mounting systems, and technical integration with existing audiovisual ecosystems. For smaller institutions or cost-sensitive buyers, these upfront costs can present budgetary barriers when compared with traditional displays or low-cost projection systems. Additionally, ensuring seamless integration with legacy software platforms and training staff to utilise interactive features effectively may require additional time and resources that some organisations cannot readily allocate.

Opportunity Analysis

Emerging opportunities in the interactive display market are linked to the convergence of advanced technologies such as artificial intelligence, gesture recognition, and cloud connectivity. AI-enabled features can support predictive content suggestions, automatic calibration, voice-assisted controls, and real-time analytics that inform user behaviour and engagement patterns.

There is also opportunity in industry-specific solutions that address tailored workflows, such as design studios utilising multi-touch creative canvases, healthcare environments requiring patient education interfaces, and retail spaces deploying interactive wayfinding or product exploration. Connectivity with collaboration platforms and cloud-based content management further extends value by enabling remote content updates and cross-location synchronisation.

Challenge Analysis

A central challenge confronting this market relates to balancing advanced feature sets with usability and interoperability. As interactive displays incorporate richer functionality, ensuring intuitive user experiences becomes essential to drive adoption and minimise training overhead. Compatibility with diverse operating systems, conferencing platforms, and device types requires robust standards support and ongoing software updates. Addressing performance latency, touch accuracy, and display calibration across varied lighting and environmental conditions also demands rigorous quality control and field support to maintain reliability.

Emerging Trends

Emerging trends in the interactive display landscape include the integration of collaboration-centric ecosystems that unify interactive whiteboarding, video conferencing, and document sharing within a single interface. Another trend is the rise of modular display architectures that allow organisations to scale visual real estate and add specialised sensors or interactive layers as needed.

Augmented reality overlays and immersive content capabilities are beginning to appear, enabling contextual learning and enhanced visualization for technical training, simulations, and product demonstrations. There is also growing interest in environmentally conscious designs that reduce power consumption and improve lifecycle sustainability.

Growth Factors

Growth in the interactive display market is supported by persistent demand for engaging, flexible, and connected communication tools across sectors experiencing digital transformation. Education continues to adopt interactive displays as core teaching aids that support collaborative learning, digital curriculum integration, and hybrid classroom models. In corporate settings, interactive displays are increasingly used for strategy sessions, cross-functional collaboration, and executive presentations.

Retail and hospitality sectors leverage interactive screens for wayfinding, product browsing, and customer interaction, reinforcing their role in enhancing brand experience. As technology evolves and prices become more accessible, interactive displays are emerging as foundational components of modern engagement and productivity ecosystems.

Key Market Segments

By Product

- Interactive Kiosks

- Interactive Whiteboards

- Interactive Tables

- Interactive Video Walls

- Interactive Monitors

By Panel Size

- 17-32 Inches

- 32-65 Inches

- Above 65 Inches

By Panel Type

- Flat

- Flexible

- Transparent

By Technology

- LCD

- LED

- OLED

- Others

By Vertical

- Retail & Hospitality

- BFSI

- Industrial

- Healthcare

- Corporate & Government

- Transportation

- Education

- Sports & Entertainment

- Others

Top Key Players in the Market

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Panasonic Corporation

- Leyard Optoelectronic Co., Ltd.

- Sharp NEC Display Solutions, Ltd.

- ViewSonic Corporation

- Planar Systems, Inc.

- SMART Technologies ULC

- Promethean World Ltd.

- Newline Interactive, Inc.

- Elo Touch Solutions, Inc.

- BenQ Corporation

- Delta Electronics, Inc. (Vivitek)

- Christie Digital Systems USA, Inc.

- AU Optronics Corp.

- Advantech Co., Ltd.

- Boxlight Corporation

- Horizon Display, Inc.

- Baanto International Ltd.

- Intuiface (IntuiLab SAS)

- CLEVERTOUCH (Boxlight)

- Kiosk Information Systems

- GestureTek Systems, Inc.

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)