Table of Contents

- Legal Case Management Software Market Size

- Market Overview

- Top Market Takeaways

- Technology Adoption and Trends

- User Demographics and Adoption Patterns

- Top Driving Factors

- Demand Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- AI-Led Growth Outlook

- Strategic Snapshot

- Value Chain Overview

- Key Market Segments

- Report Scope

Legal Case Management Software Market Size

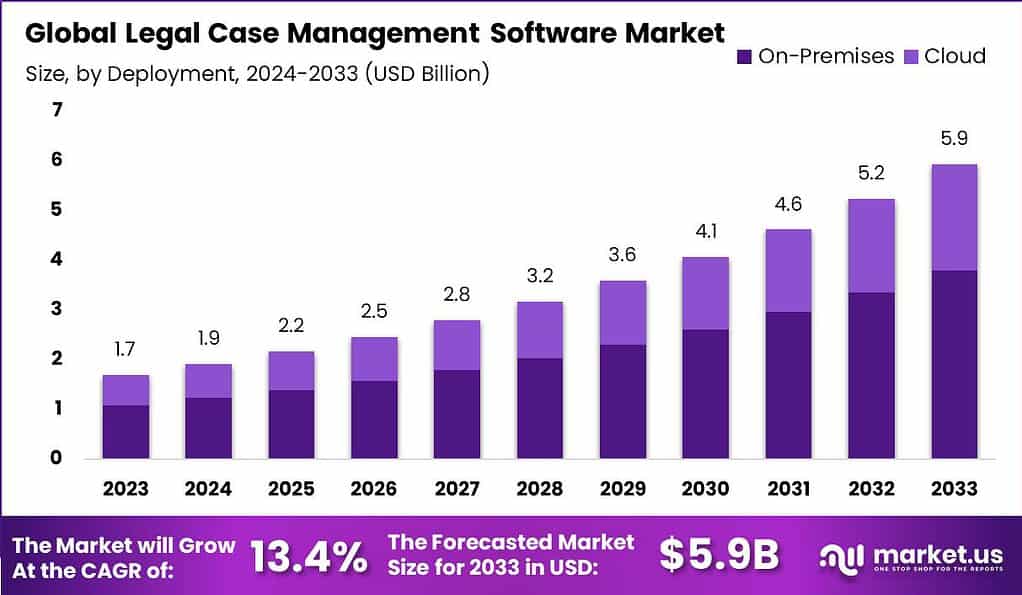

The global legal case management software market is estimated to be valued at USD 1.9 billion in 2024 and is projected to reach approximately USD 5.9 billion by 2033, registering a steady CAGR of 13.4% during the forecast period from 2023 to 2033. Growth is driven by rising demand for digital case tracking, document management, and workflow automation across law firms, corporate legal departments, and courts.

Increasing caseload complexity, regulatory compliance requirements, and the shift toward cloud based legal solutions are further supporting adoption. These platforms help improve operational efficiency, reduce manual errors, and enable secure collaboration, making them essential tools in modern legal operations.

Market Overview

The legal case management software market encompasses software solutions designed to support law firms and legal departments in handling cases, documents, scheduling, and client interactions. This market is characterized by increasing digital transformation within legal practices, driven by the need to improve operational efficiency and reduce manual workloads. Adoption is observed across small practices and large corporate legal teams seeking standardized workflows and better data access. The software supports secure information handling and streamlined case handling processes.

The market is shaped by demand for integrated systems that combine case tracking, document management, time logging, billing, and reporting. Service providers in this space deliver cloud-based, on-premise, and hybrid deployment options to match different organizational requirements. Functionality such as automated notifications, secure client portals, and analytics tools is increasingly valued. The legal sector’s need for compliance and audit readiness further underlines the software’s importance in modern practice.

Top Market Takeaways

- The legal case management software market is expanding steadily, supported by a strong growth pace of 13.4%, reflecting rising technology adoption across legal workflows.

- Cloud based deployment leads with a 64% share, as legal firms prioritize scalable access, remote availability, and operational cost control.

- Large enterprises dominate end user adoption with over 68% share, driven by the need to manage complex, high volume legal cases efficiently.

- Law firms and attorneys represent the primary application area, holding more than 57% share due to continuous demand for structured case tracking and deadline management.

- Digital transformation across the legal sector remains a key adoption driver, reinforced by stricter compliance needs, data security priorities, and hybrid work practices.

- Market progress is restrained by resistance to change among legal professionals, concerns over implementation costs, system integration complexity, and staff training requirements.

- Growth opportunities are emerging through global expansion, advanced automation, workflow intelligence, and tailored solutions for specialized legal practices.

Technology Adoption and Trends

- Cloud-based solutions dominate adoption with over 60% share in 2023, driven by demand for remote access, operational flexibility, and collaboration across legal teams.

- AI integration is a key trend, with 42% of legal software platforms incorporating tools such as document review and predictive analytics to automate routine tasks and improve accuracy.

- Strong integration with billing, calendaring, and document management systems has become a core requirement, enabling smoother and more efficient legal workflows.

User Demographics and Adoption Patterns

- Law firms and individual attorneys represent the largest user segment, accounting for more than 57% of market adoption in 2023.

- Large enterprises currently lead with over 68% share, supported by higher budgets and complex legal operations.

- At the same time, small firms form a substantial portion of the user base, with around 72% of users on some platforms coming from smaller practices.

- High upfront implementation costs continue to act as a barrier for small and mid-sized firms, slowing wider adoption despite clear efficiency benefits.

Top Driving Factors

A primary driver of the legal case management software market is the pressure to increase productivity while controlling costs. Legal professionals are required to handle large volumes of cases and administrative tasks, making manual processes inefficient and error prone. Software solutions help allocate resources more effectively and reduce time spent on repetitive work. Consequently, firms can focus more on legal strategy and client service.

Another factor driving adoption is the shift toward remote and hybrid work environments. Legal practitioners require access to case information from multiple locations and devices. Cloud-based solutions provide this accessibility while maintaining data security and integrity. This flexibility supports collaboration among lawyers, paralegals, and support staff regardless of physical location.

Demand Analysis

Demand for legal case management software is rising steadily as firms recognize the value of integrated digital tools. Small and mid-sized practices increasingly invest in software to level operational capabilities with larger competitors. In-house legal departments within corporations also seek solutions to manage compliance, contracts, and internal litigation effectively. This demand is especially strong in sectors with complex regulatory environments where accurate documentation and tracking are essential.

Users value features that reduce administrative burden and deliver clear oversight of active cases. Analytics and reporting functions help firms understand performance metrics and resource utilization. As firms prioritize client satisfaction, demand grows for systems that enhance responsiveness and transparency. Overall, demand correlates with increasing digitization of legal operations and expectations for service quality.

Increasing Adoption Technologies

Technological components such as cloud computing, mobile access, and secure data encryption are increasingly adopted within legal case management software. Cloud infrastructure allows firms to scale storage and computing capacity without significant upfront investment in hardware. Mobile interfaces enable lawyers to access case files, documents, and calendars while outside the office. These technologies support flexibility and continuity of service.

Secure data encryption and compliance tools are also gaining traction due to stringent data protection requirements. Legal practices deal with sensitive client information, making security a priority in software selection. Integration capabilities with email systems, document repositories, and accounting tools further enhance operational cohesion. Adoption of these technologies reflects broader trends in enterprise software aimed at enhancing functionality and risk management.

Firms adopt legal case management software to streamline case workflows and reduce manual tasks. Automation of routine activities, such as document generation and deadline tracking, minimizes human error and frees staff to focus on substantive legal work. This leads to improved efficiency and better use of human resources. Consistency in case handling also improves firm reputation and client trust.

Another key reason for adoption is enhanced client communication and service delivery. Software platforms often include client portals or shared dashboards that provide updates and document access. This transparency fosters stronger client relationships and can improve client retention. Additionally, firms benefit from centralized data storage, which simplifies audit processes and supports compliance with legal standards.

Investment Opportunities

Investment opportunities in the legal case management software market exist in development of niche solutions tailored to specific practice areas. Specialization for areas such as family law, intellectual property, or corporate litigation can address unique workflow requirements. Vendors that offer customizable modules may capture interest from firms seeking targeted functionality. Emerging providers with intuitive user interfaces also attract investment interest as firms seek ease of adoption.

Another opportunity lies in expanding cloud-based service offerings and subscription models. Firms increasingly prefer operational expense structures over large upfront capital expenditures for software infrastructure. Scalable platforms with flexible pricing can appeal to a broader range of clients, including solo practitioners and small firms. Continued investment in secure, compliant cloud environments can support market growth and provider differentiation.

AI-Led Growth Outlook

Artificial intelligence capabilities are expected to influence the legal case management software market by enabling advanced analytics and predictive insights. Tools that assist in legal research, document classification, and risk analysis can reduce time spent on labor-intensive tasks. AI functions integrated within case management systems may help prioritize work, identify patterns, and suggest next steps. This supports more strategic decision making within legal teams.

The outlook for AI adoption is shaped by improvements in natural language processing and machine learning tailored to legal text. Automated extraction of key information from documents can improve accuracy and speed. AI-enhanced reporting tools can provide deeper insights into case trends and performance metrics. As these technologies mature, they are likely to become standard components of advanced case management solutions.

Strategic Snapshot

Strategic positioning in the legal case management software market is guided by portfolio breadth, customer support quality, and integration capabilities. Providers with comprehensive feature sets that cover scheduling, billing, document management, and analytics are often preferred. Quality of implementation services and ongoing technical support also shapes customer satisfaction and retention. Integration with third-party systems such as accounting or document storage further enhances strategic value.

Market strategies include focusing on ease of use, security certifications, and tailored industry compliance. Firms require solutions that align with regulatory standards and protect client confidentiality. Vendors that demonstrate robust security practices and transparent update policies build credibility. Strategic differentiation may also come from localized features that meet specific jurisdictional requirements.

Value Chain Overview

The value chain for legal case management software begins with software development, including requirements gathering, design, and coding. Developers focus on feature sets that address legal workflows and compliance criteria. Testing and quality assurance follow, ensuring that the software performs reliably and securely across use cases. Product refinement based on user feedback is integral to maintaining relevance.

Distribution channels include direct sales, online marketplaces, and partnerships with legal technology resellers. Implementation services provide configuration, data migration, and training for client organizations. Ongoing support and maintenance ensure that systems remain secure and up to date. Ancillary services, such as consulting and customization, further extend the value delivered to end users.

Key Market Segments

Deployment

- On-Premises

- Cloud

End-User

- Small and Medium Enterprise

- Large Enterprise

Application

- Law Firms & Attorneys

- Courts

- Other Users

Top Key Players

- Clio

- Odyssey

- Smokeball

- Firm Central

- PracticePanther

- MyCase

- ProLaw

- Zola Suite

- Filevine

- LexisNexis

- Rocket Matter

- TrialWorks

- Other Key Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 1.7 Bn |

| Forecast Revenue (2033) | US$ 5.9 Bn |

| CAGR (2024-2033) | 13.4% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Deployment (On-Premises, Cloud), By End-User (Small and Medium Enterprise, Large Enterprise), By Application (Law Firms & Attorneys, Courts, Other Users) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)