Table of Contents

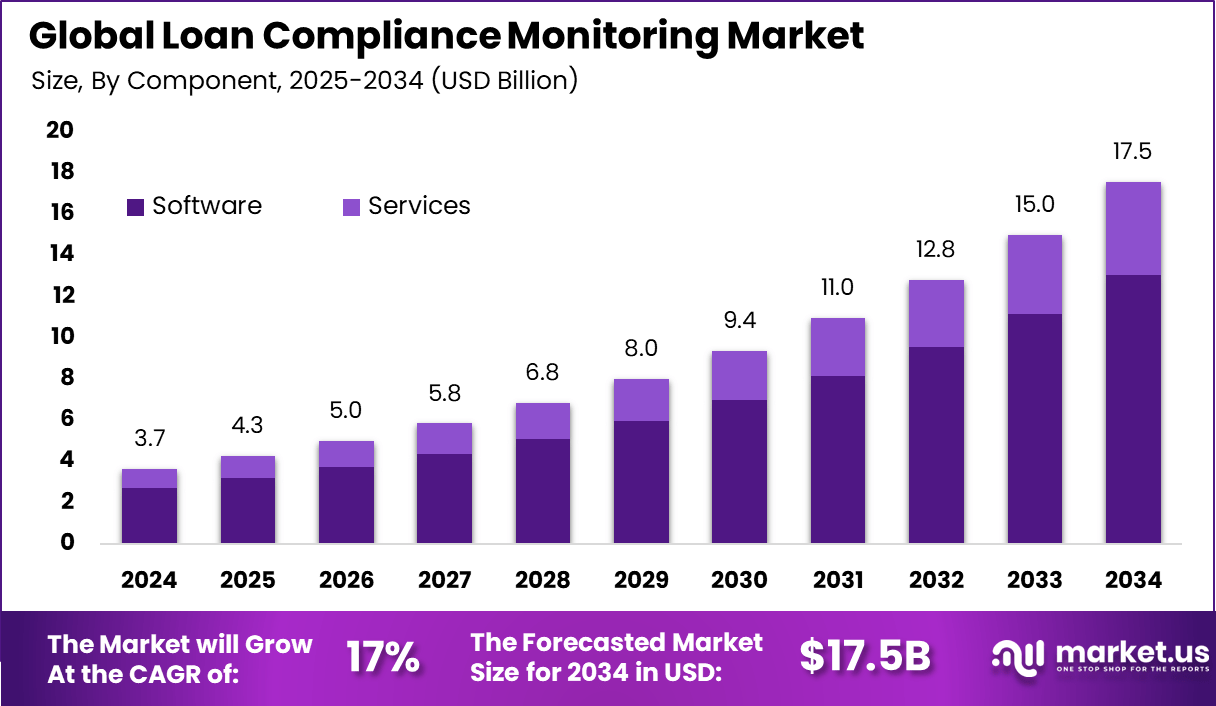

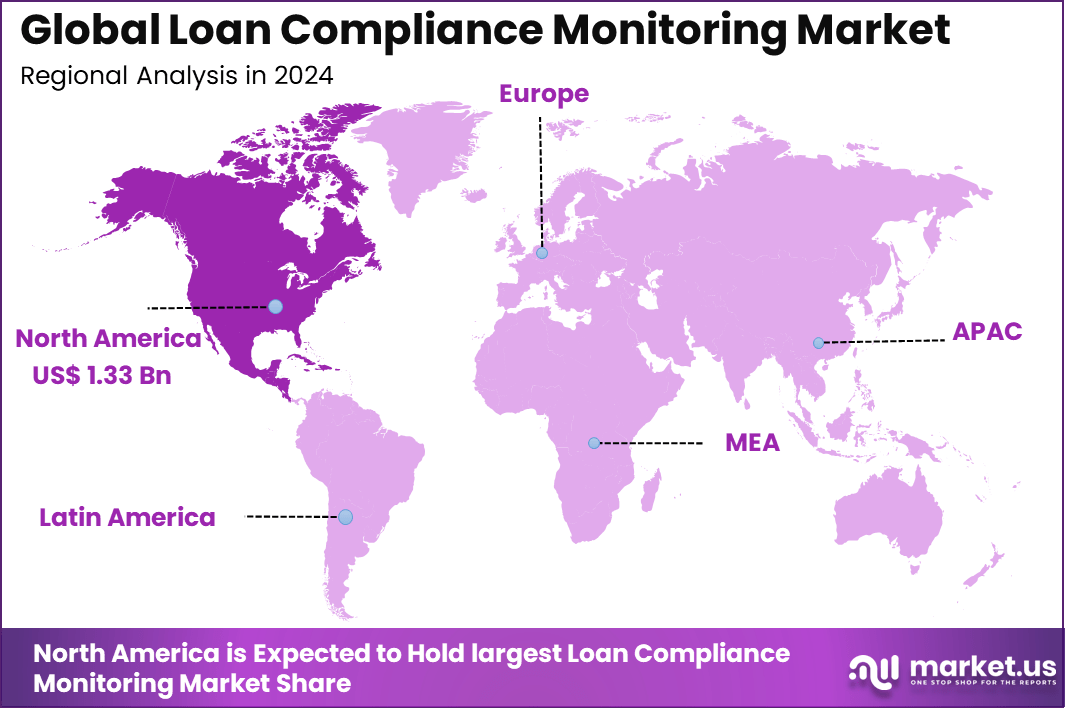

New York, NY – December 12, 2025: According to Market.us, The global loan compliance monitoring market was valued at USD 3.7 billion in 2024 and is projected to increase from USD 4.3 billion in 2025 to nearly USD 17.5 billion by 2034, reflecting a CAGR of 17% over the forecast period. North America led the market in 2024 with over 36.5% share, generating approximately USD 1.33 billion in revenue.

Growth in the Loan Compliance Monitoring market is anchored in the increasing complexity of regulatory frameworks that govern lending activities worldwide. Financial regulators enforce detailed reporting, borrower protection standards, documentation rules, and risk controls that financial institutions must satisfy. Manual monitoring becomes impractical as loan books expand and regulatory updates increase, prompting adoption of automated systems to ensure consistency and reduce human error. The rapid rise of digital lending platforms further intensifies the need for real-time compliance tools that can track diverse loan portfolios, adhere to regulatory updates, and generate accurate compliance documentation.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.7 Bn |

| Forecast Revenue (2034) | USD 17.5 Bn |

| CAGR(2025-2034) | 17% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Buy this report directly from here [Year end sale live GET MAX* OFF till 31-Dec-2025]: https://market.us/purchase-report/?report_id=169430

Demand for loan compliance monitoring solutions is driven by banks, credit unions, mortgage lenders, non-bank financial institutions, and emerging fintech lenders seeking to balance operational efficiency with compliance obligations. Banks represent a significant share of market demand due to heightened regulatory scrutiny, large and varied loan portfolios, and the need for real-time compliance insights across product lines. Fintech and digital lenders are also adopting these solutions as they scale and face similar regulatory expectations across jurisdictions. The emphasis on consistency in reporting and risk alerting mechanisms supports sustained demand as institutions aim to avoid regulatory penalties and maintain trust with customers and stakeholders.

Top Market Takeaways

- By component, software holds a dominant 74.4% share, supported by rising demand for advanced analytics, automated monitoring, and real time tracking across lending workflows. Financial institutions rely on software platforms to detect compliance gaps quickly and maintain continuous oversight of lending activities.

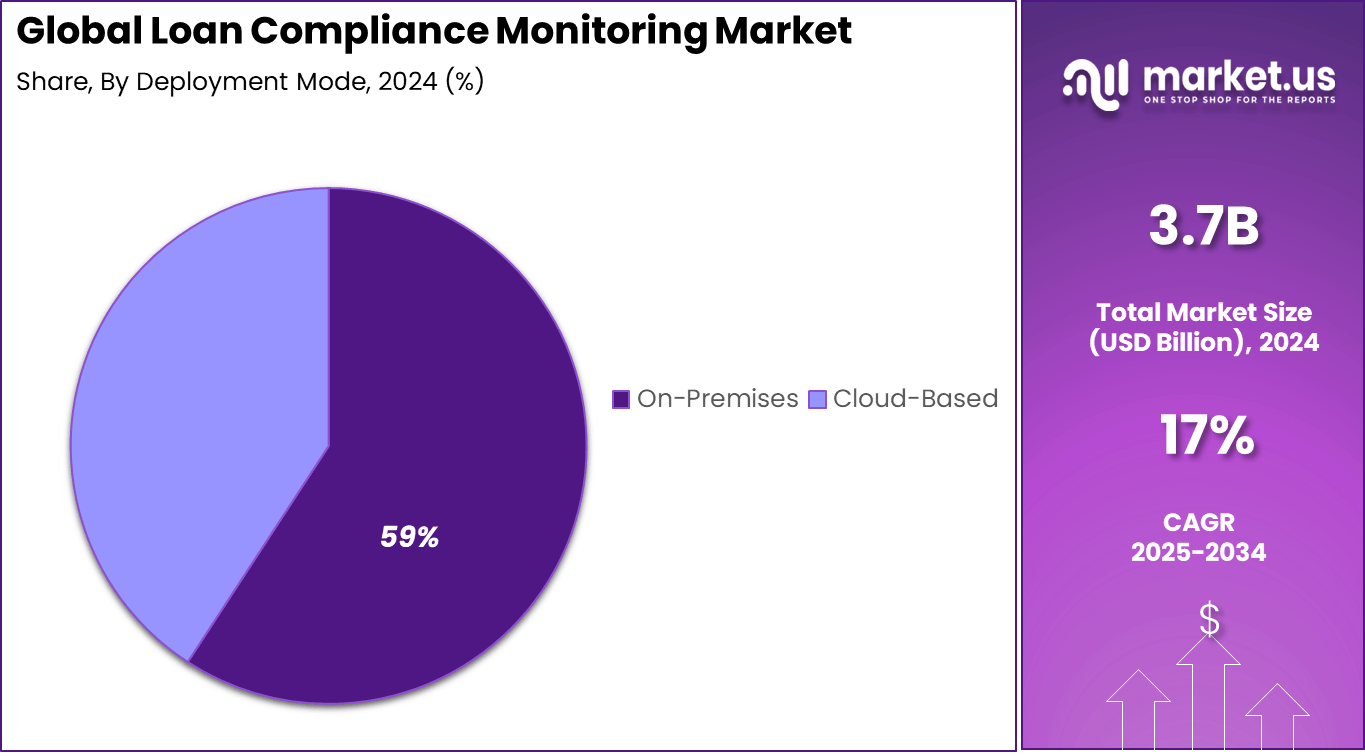

- By deployment mode, on premises solutions account for 59.2%, preferred by large financial institutions that prioritize high security and strict control over sensitive compliance data. The use of on site systems helps banks manage internal policies and maintain data governance standards.

- By organization size, large enterprises represent 71.2%, reflecting their exposure to complex regulatory environments. These organizations depend on robust compliance tools to manage risk, ensure policy alignment, and maintain accurate reporting across diverse lending portfolios.

- By end user, banks lead with 38.5% as they manage high lending volumes and operate under strict regulatory requirements. Their role in credit approval, monitoring, and reporting increases the need for continuous compliance oversight.

- By application, regulatory compliance drives 36.3% of use cases. Institutions focus on meeting legal expectations, preventing penalties, and improving transparency in loan processing and documentation.

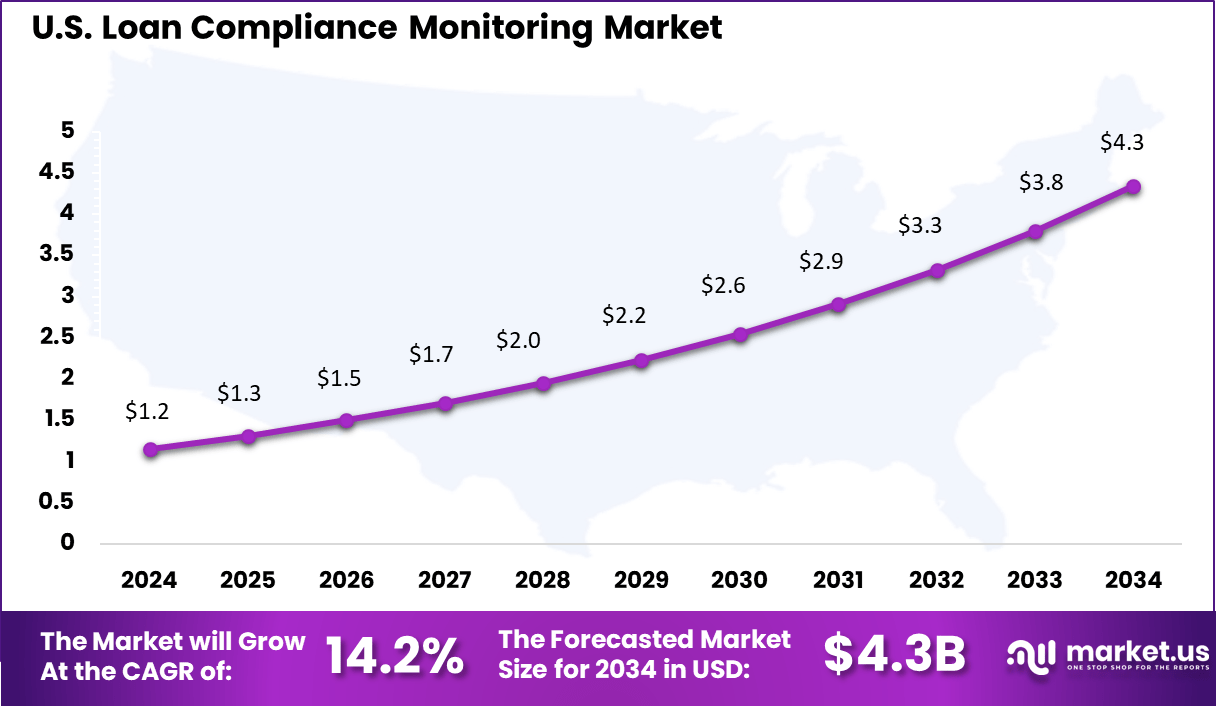

- By region, North America holds 36.5%, supported by strong adoption of compliance technologies and stricter supervision in the financial sector. The United States reached USD 1.15 billion with a CAGR of 14.2%, highlighting steady investment in advanced compliance monitoring tools.

Emerging Trends

Emerging trends in this market are largely driven by digitization and technological innovation. Cloud-based compliance monitoring platforms are being adopted more widely because they provide scalable, accessible, and real-time insight into compliance status across diverse loan portfolios. Advances in artificial intelligence and machine learning are enabling predictive analytics that can identify potential breaches before they occur, reducing operational risk and improving the quality of oversight. Integration of big data analytics with compliance systems is enhancing the ability of lenders to detect anomalies and document regulatory adherence continuously.

Investment Opportunities and Business Benefits

Opportunities exist in digital and non-bank lending, where smaller players need affordable tools to handle high volumes without large compliance teams. Advanced data analysis features that spot unusual activity or repayment issues attract investors, as they enhance portfolio oversight and reduce gaps. Tailored solutions for small and medium enterprises entering new markets also show promise amid open banking shifts.

Businesses gain operational efficiency by cutting manual reviews, which lowers costs and boosts productivity across teams. Real-time insights into portfolio health minimize defaults and support better decision-making on borrower support. Secure audit trails and automated reporting build trust with regulators and improve overall customer experiences through consistent, fair processes.

By Component

Software holds a dominant 74.4% share, showing its central role in modern loan compliance monitoring. Financial institutions depend on software tools to automate rule checks, identify irregularities, and ensure that lending workflows align with regulatory requirements. The ability to process large volumes of loan data in real time strengthens the value of software platforms.

Growth in this segment is supported by rising use of analytics, machine learning, and automated auditing functions. These features help reduce manual errors and improve efficiency across compliance teams. As regulations become more complex, software adoption is expected to expand further within banks and lending organizations.

By Deployment Mode

On premises solutions account for 59.2%, reflecting strong preference among large financial institutions for full control over operational and compliance data. These organizations rely on internal infrastructure to protect sensitive information and reduce exposure to external risks. This segment benefits from institutions with strict internal governance requirements. The ability to manage systems locally and comply with internal IT policies continues to support the use of on site deployment across banks and regulated lenders.

By Organization Size

Large enterprises represent 71.2% of the market, showing the importance of advanced compliance systems in high volume lending operations. These organizations operate across multiple regions and face complex regulatory expectations that require strong oversight. Demand is driven by the need to manage diverse lending portfolios and maintain accurate reporting. Large institutions must adapt quickly to regulatory updates, which further increases reliance on automated compliance monitoring tools.

By End User

Banks lead with 38.5%, confirming their central position in the loan compliance monitoring landscape. Their involvement in credit assessment, risk evaluation, and loan disbursement creates continuous demand for accurate and reliable compliance systems. The segment grows as banks modernize lending operations and adapt to stricter supervision from regulatory authorities. Automated platforms help banks reduce compliance gaps, improve documentation quality, and support faster loan processing.

By Application

Regulatory compliance drives 36.3% of use cases, reflecting the strong focus on meeting legal requirements and avoiding penalties. Institutions depend on monitoring tools to track lending behavior, ensure transparency, and maintain alignment with local and international standards. This segment gains momentum as lenders adopt digital processes that require consistent oversight. Automated compliance tools support clean data flows, reduce operational risk, and improve audit readiness across lending operations.

By Region

North America holds 36.5%, supported by strong adoption of digital compliance solutions and tighter regulatory frameworks. The region benefits from advanced financial infrastructure and high investment in risk management systems.

The United States reached USD 1.15 billion with a CAGR of 14.2%, showing steady modernization of compliance processes within lending institutions. Ongoing focus on transparency, improved data accuracy, and automated reporting continues to strengthen market demand.

Top Key Players in the Market

- Wolters Kluwer Financial Services

- Fiserv, Inc.

- SAS Institute Inc.

- Oracle Corporation

- FIS Global

- Temenos AG

- nCino, Inc.

- Smarsh Inc.

- S&P Global Market Intelligence

- Ellie Mae (now part of ICE Mortgage Technology)

- Black Knight, Inc.

- Moody’s Analytics

- Compliance Systems, Inc.

- Abrigo

- Jack Henry & Associates, Inc.

- MetricStream

- Riskonnect, Inc.

- Ascent RegTech

- Actico GmbH

- LogicManager, Inc.

- Others

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- Banks

- Credit Unions

- Non-Banking Financial Institutions

- Mortgage Lenders

- Others

By Application

- Regulatory Compliance

- Risk Management

- Audit Management

- Reporting and Analytics

- Others

You may also want to read

- Bank Fee Recovery Services Market

- Banking Data Lake Platform Market

- Bank Connectivity Platform Market

- Space Asset Securitization Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)