Table of Contents

Luxury Furniture Insurance Market Size

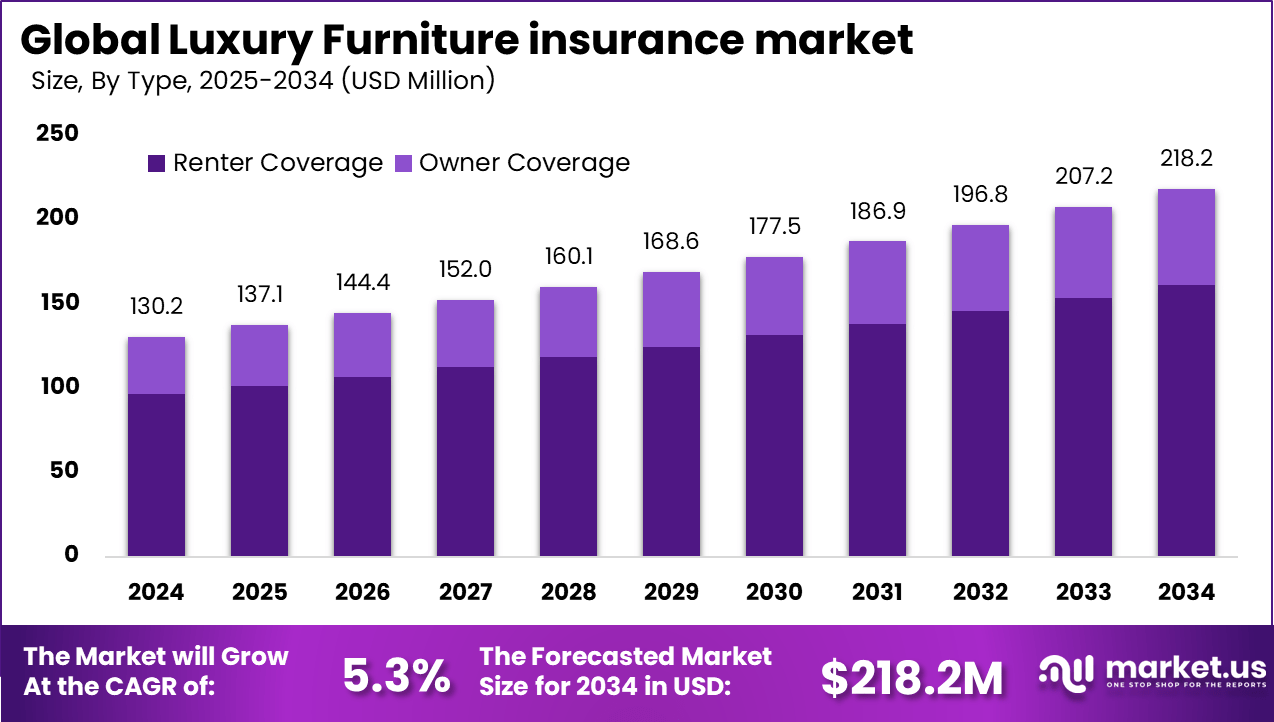

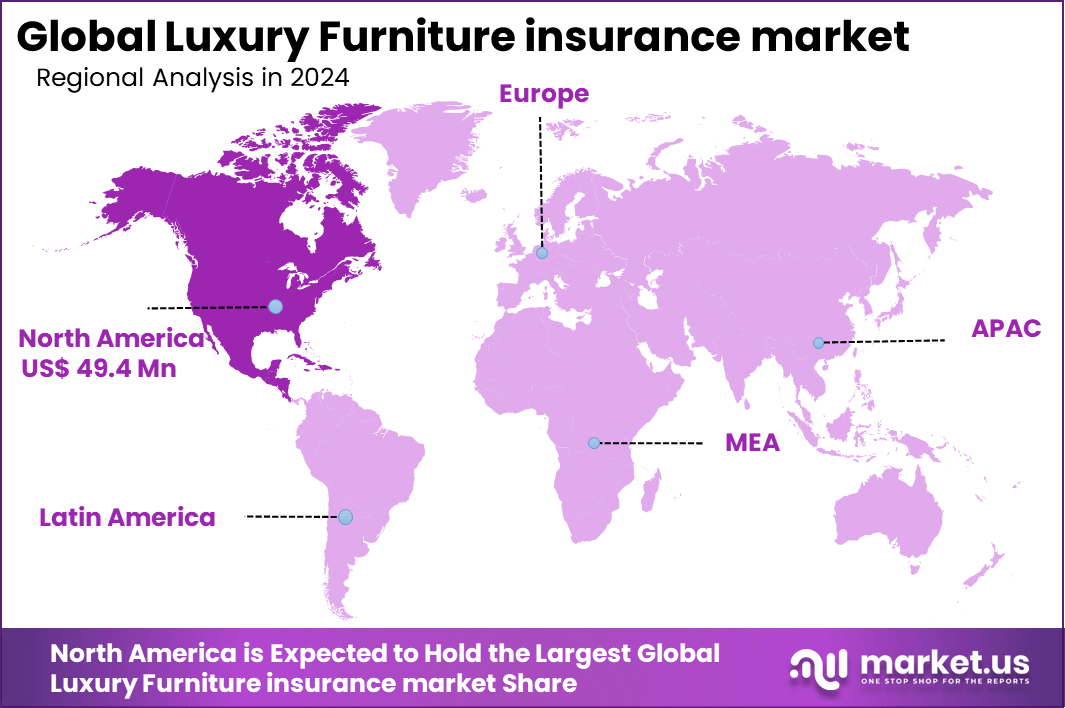

The global luxury furniture insurance market was valued at USD 130.2 million in 2024 and is projected to reach approximately USD 218.2 million by 2034, expanding at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant position with more than 38% market share, generating around USD 49.4 million in revenue, supported by high ownership of premium furniture and rising demand for specialized coverage.

The luxury furniture insurance market is characterized by coverage designed specifically for high value furnishings that are often used in premium residential and commercial settings. Demand in this space is driven by the increasing number of affluent households and luxury hospitality establishments seeking protection against loss, damage, theft, and natural events. Buyers in this segment tend to be risk aware and place a high value on preserving the financial and aesthetic worth of luxury furniture pieces. Insurers have responded by tailoring policies to include specialized appraisal requirements and coverage terms that reflect the unique value of these items.

Key Takeaway

- The renter coverage segment led in 2024 with a 73.9% share, as growth in luxury apartment rentals and higher ownership of premium furniture increased demand for tenant-focused protection.

- The business segment accounted for 64.5%, driven by hospitality and corporate users seeking coverage for high-value interior assets against damage and loss.

- Large enterprises captured 57.3%, reflecting preference for bundled, multi-property insurance programs designed to protect luxury furnishings across offices, hotels, and retail locations.

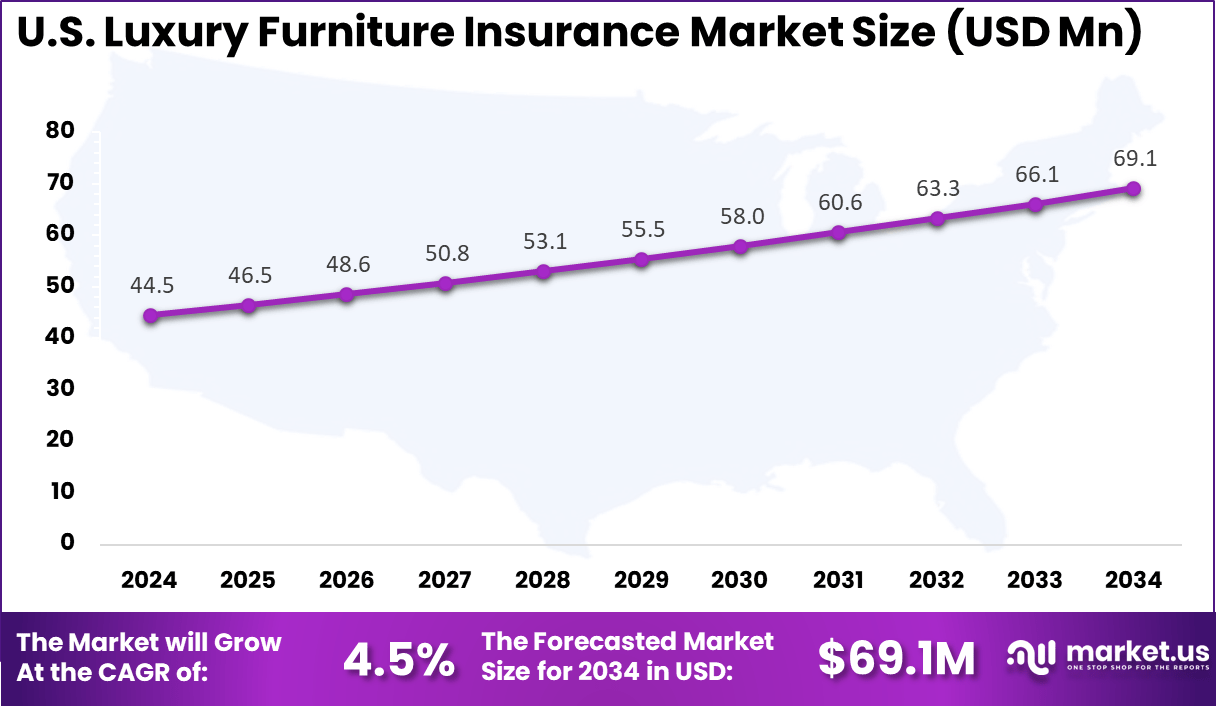

- The U.S. market was valued at USD 44.5 million in 2024 and is growing at a 4.5% CAGR, supported by higher spending on luxury interiors and rising uptake of niche insurance products.

- North America remained the leading region with over 38% share, backed by mature underwriting capabilities, strong insurer presence, and increasing awareness of asset protection among high-net-worth individuals and enterprises.

Investment Opportunities

Investment prospects within the luxury furniture insurance market are linked to the development of niche coverage products. Specialized policy offerings that address unique risks, such as art influenced furniture or imported handcrafted pieces, can attract premium clients. Providers that innovate in product design and risk stratification are likely to capture demand from discerning buyers who need tailored protection. Strategic partnerships with luxury furniture retailers and appraisers can also create pathways for market expansion.

Another area of investment lies in enhancing digital customer engagement platforms. Insurers that build robust digital ecosystems for policy management, valuation support, and claims services can differentiate their offerings. Investment in secure, intuitive interfaces that simplify complex insurance interactions can improve customer retention and satisfaction. With ongoing digital transformation, there remains significant opportunity for firms that can combine technological capability with deep underwriting expertise.

Business Benefits

For insurers, offering luxury furniture insurance can increase diversification of product portfolios. Specialty coverage often commands higher premiums and can improve revenue stability by addressing an underserved niche. Enhanced risk assessment tools also reduce uncertainty and support more accurate pricing of policies. These benefits contribute to stronger financial performance and competitive positioning in the specialty insurance market.

Customers benefit through assurance that their high value assets are protected against a range of risks that general property insurance may not cover. Tailored coverage terms and professional appraisal support provide peace of mind for owners of luxury furnishings. Additionally, streamlined digital processes reduce the complexity and time associated with policy management and claims. This combination of protection and convenience strengthens client satisfaction and reinforces the value proposition of luxury furniture insurance.

U.S. Market Size

The U.S. luxury furniture insurance market is valued at USD 44.5 million and is expanding at a projected CAGR of 4.5%, supported by rising disposable incomes and increasing awareness of the need to protect high value furniture assets. Both households and commercial buyers are placing greater emphasis on insurance coverage to safeguard premium furnishings.

In 2024, North America held a dominant position in the global luxury furniture insurance market with more than 38% share, generating approximately USD 49.4 million in revenue. This leadership is driven by strong purchasing power and sustained demand for premium residential and commercial interiors across the region.

Key Market Segments

By Type

- Owner Coverage

- Renter Coverage

By End Use

- Business

- Personal

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Others

Top Key Players in the Market

- Chubb

- AIG Private Client Group

- PURE Insurance

- Nationwide Private Client

- Hiscox

- AXA XL

- Berkley One

- Cincinnati Insurance Company

- AON Private Risk Management

- Marsh Private Client Services

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 130.2 Mn |

| Forecast Revenue (2034) | USD 218.2 Mn |

| CAGR(2025-2034) | 5.3% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)