Table of Contents

Introduction

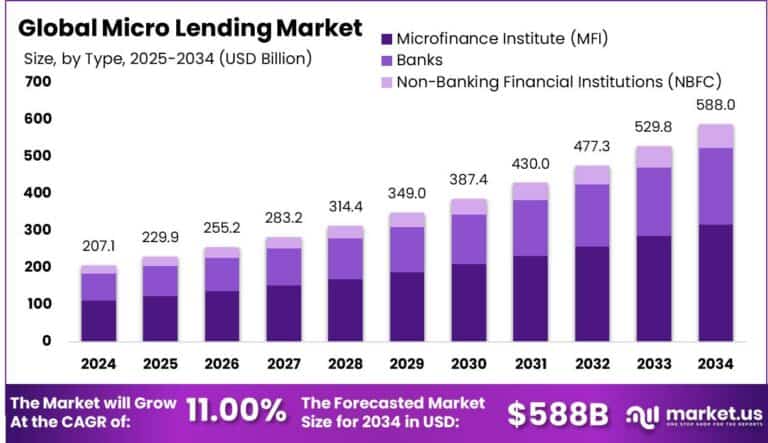

The global micro-lending market is projected to reach USD 588 billion by 2034, growing from USD 207.1 billion in 2024 at a CAGR of 11%. In 2024, Asia-Pacific dominated with a 45% market share, generating USD 93.1 billion in revenue. China contributed USD 30.5 billion with an 8.2% CAGR, driven by strong demand from small businesses and individual borrowers. The market growth is supported by increasing financial inclusion, digital lending platforms, and rising entrepreneurship, particularly in emerging economies.

How Tariffs Are Impacting the Economy

Tariffs on financial technology equipment and services indirectly affect the micro-lending ecosystem by raising costs for fintech infrastructure and hardware imports. Increased tariffs drive up operational expenses for digital lenders, translating into higher borrowing costs or limited access to affordable credit. This inflationary pressure can reduce consumer spending and slow economic growth.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/micro-lending-market/free-sample/

(Use corporate mail ID for quicker response)

Furthermore, supply chain disruptions hinder the deployment of lending technologies, delaying service expansion. Retaliatory trade policies increase market uncertainty, complicating cross-border lending and investment. Collectively, tariffs constrain fintech innovation and infrastructure development, slowing progress toward broader financial inclusion and economic empowerment.

Impact on Global Businesses

Micro-lending businesses face elevated technology costs due to tariffs on digital infrastructure and related hardware, squeezing profit margins. Supply chain adjustments to mitigate tariffs increase complexity and capital requirements. Fintech firms and traditional lenders experience slower technology rollouts, affecting scalability and customer acquisition. Market volatility from tariffs forces cautious expansion strategies. In emerging economies, increased costs limit credit access for underserved populations, restraining business growth. Firms must innovate in cost management, diversify supply chains, and accelerate digital adoption to sustain competitiveness in a tariff-impacted environment.

Strategies for Businesses

Businesses respond by diversifying suppliers and investing in local technology development to reduce tariff exposure. Cloud-based lending platforms minimize dependence on physical infrastructure. Leveraging predictive analytics enables proactive tariff risk management and inventory optimization. Strategic partnerships with regional tech providers enhance supply chain resilience. Emphasizing automation and process efficiency reduces operational costs. Engaging with policymakers and industry groups supports favorable trade policies. Overall, adaptability, innovation, and collaboration underpin sustainable growth amidst tariff challenges.

Key Takeaways

- Micro-lending market projected to grow at 11% CAGR through 2034

- Tariffs increase fintech infrastructure costs, affecting lending affordability

- Supply chain disruptions delay technology deployment and service expansion

- Businesses adopt supplier diversification and cloud solutions

- Predictive analytics aid in navigating tariff-related risks

➤ Get full access now @ https://market.us/purchase-report/?report_id=148833

Analyst Viewpoint

The micro-lending market shows strong growth, propelled by digital financial inclusion and rising entrepreneurship. Although tariffs create cost pressures and supply chain challenges, they accelerate fintech innovation and localization efforts. The market outlook remains positive as digital lending platforms evolve, expanding reach to underserved populations. Continued regional investments and supportive policies will drive sustainable growth, overcoming tariff-induced obstacles and fostering broader economic empowerment.

Regional Analysis

Asia-Pacific leads the micro-lending market with a 45% revenue share in 2024, driven by rapid digital adoption and supportive government initiatives. China, India, and Southeast Asia spearhead growth through expanding small business lending and individual credit access. North America and Europe show steady growth, supported by mature fintech ecosystems. Regional disparities arise from differing regulatory frameworks, technology penetration, and financial inclusion levels, shaping market dynamics.

➤ Discover More Trending Research

- B2B Electronic Commerce Market

- E-Commerce Payment Market

- Food E-Commerce Market

- Post Production Market

Business Opportunities

Expanding financial inclusion efforts create opportunities for micro-lenders to serve underserved populations with tailored credit products. Growth in mobile and digital banking enables scalable lending solutions. Emerging markets present significant untapped potential, driven by rising entrepreneurship and government support. Integration of AI and machine learning enhances credit risk assessment and operational efficiency. Partnerships with telecom and fintech firms facilitate innovative delivery channels. Additionally, green and social impact lending opens new market segments.

Key Segmentation

Loan Type

- Personal Microloans

- Business Microloans

Lending Platform

- Online/Digital

- Offline/Branch-based

End User

- Individuals

- Small and Medium Enterprises (SMEs)

Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Key Player Analysis

Leading companies focus on integrating AI-driven credit scoring and automated underwriting to improve loan approval speed and accuracy. Investment in scalable, cloud-based platforms enhances reach and reduces costs. Strategic partnerships with telecom operators and financial institutions expand customer bases. Market leaders emphasize compliance with regulatory standards and data security. Continuous innovation in user experience and product customization sustains competitive advantage, particularly in emerging markets.

Top Key Players in the Market

- Accion International

- Bluevine Inc.

- Fundera Inc.

- Funding Circle

- Kabbage Inc.

- American Express

- OnDeck

- Fundbox

- LendingClub Bank

- Zopa Bank Limited

- Others

Recent Developments

In 2025, several micro-lending firms launched AI-powered credit risk solutions, enhancing loan disbursement efficiency. Expansion into underserved rural markets increased through partnerships with mobile network operators. Regulatory advancements in Asia-Pacific facilitated smoother fintech operations.

Conclusion

The micro-lending market is poised for sustained growth driven by digital innovation and rising demand for inclusive credit. While tariffs pose challenges, strategic adaptations and technology investments will enable continued expansion. Market evolution will support economic empowerment globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)