Table of Contents

Introduction

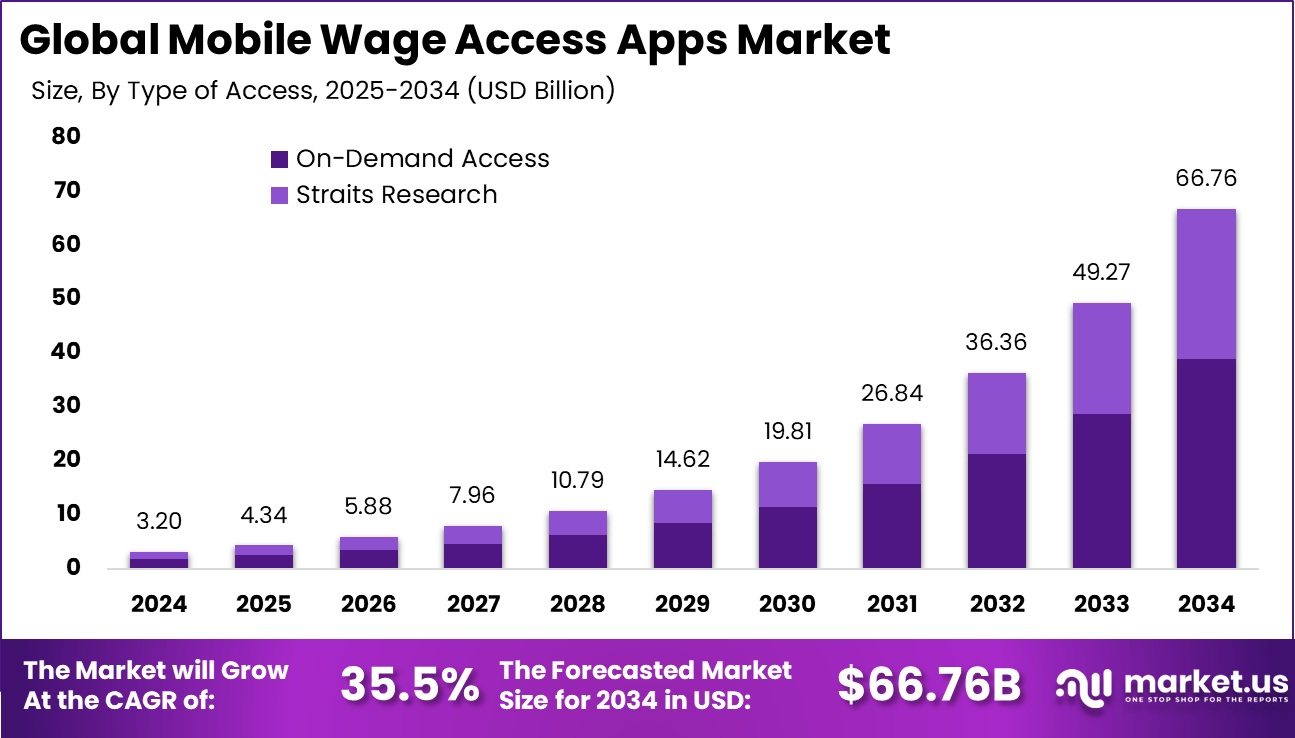

The Global Mobile Wage Access Apps Market reached USD 3.20 billion in 2024 and is expected to rise to USD 66.76 billion by 2034, expanding at a CAGR of 35.5%. North America dominated with a 33.6% share worth USD 1.07 billion. Growth is driven by increasing demand for on-demand pay solutions, greater smartphone penetration, rising financial stress among hourly workers, and employer adoption of earned wage access (EWA) tools that improve workplace satisfaction and retention.

How Growth is Impacting the Economy

The rapid expansion of mobile wage access apps is influencing global economic structures by providing workers with immediate access to earned income, reducing dependency on high-interest loans, and improving personal financial stability. This reduces financial stress, enhances productivity, and strengthens overall workforce engagement. The increasing use of on-demand pay also improves cash flow within low-income segments, stimulating local economic activity.

At a macro level, the technology accelerates digital payments adoption, strengthens fintech ecosystems, and encourages financial inclusion in emerging markets. As companies integrate wage access tools, operational efficiencies improve through reduced turnover and lower recruitment costs. Financial institutions benefit from new partnership models, while governments gain opportunities to regulate innovative wage systems to ensure compliance, transparency, and consumer protection, ultimately supporting a more resilient and equitable economic environment.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/mobile-wage-access-apps-market/free-sample/

Impact on Global Businesses

Businesses face rising implementation costs for digital payroll systems, API integrations, and employee onboarding. Supply chains shift as fintech providers partner with HR tech companies, payroll processors, and digital banking ecosystems. Sector-specific impacts include reduced churn in retail and hospitality, stronger employee retention in logistics and manufacturing, improved workforce stability in healthcare, and wider adoption of instant-pay programs in the gig economy.

Strategies for Businesses

Companies should evaluate earned wage access as an employee benefit, integrate wage access APIs with payroll software, and partner with reputable fintech providers. Building financial education programs strengthens workforce stability. Ensuring transparency in fee structures and data privacy enhances trust. Employers should also assess operational risks, conduct pilots before full-scale deployment, and adopt analytics to monitor employee usage patterns for improved workforce planning.

Key Takeaways

- Market projected to reach USD 66.76 billion by 2034

- CAGR of 35.5% driven by fintech expansion

- North America leads with 33.6% revenue share

- EWA adoption improves employee retention

- Financial inclusion and real-time digital payments are accelerating

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166336

Analyst Viewpoint

Current market momentum is fueled by employers seeking to improve retention, workers demanding financial flexibility, and fintech firms expanding embedded finance capabilities. Present adoption is strong across hourly and gig-based sectors, with mobile access emerging as a key financial stability tool. Future growth is expected to accelerate as regulators create clearer frameworks and digital banking infrastructure evolves. Advancements in real-time payments, API-driven payroll systems, and AI-powered financial planning tools will further strengthen the earned wage access landscape and widen global adoption.

Use Case and Growth Factors

Use Cases Table

| Use Case | Description |

|---|---|

| Employee Earned Wage Access | Workers withdraw part of earned wages before payday. |

| Gig Worker Instant Pay | On-demand payouts for rideshare, delivery, and freelance work. |

| Financial Wellness Tools | Apps offer budgeting, savings, and financial guidance. |

| Employer Payroll Integration | Businesses integrate EWA for workforce retention and satisfaction. |

Growth Factors Table

| Growth Factor | Description |

|---|---|

| Rising Financial Stress | Drives demand for early wage access. |

| Growth of Gig Economy | Expands need for instant payments. |

| Smartphone Penetration | Supports access to digital financial tools. |

| Fintech-Payroll Partnerships | Accelerate global adoption of EWA solutions. |

Regional Analysis

North America leads due to strong HR tech ecosystems, early fintech adoption, and large gig workforce participation. Europe follows with expanding regulatory frameworks supporting wage flexibility. Asia Pacific shows rapid growth driven by high smartphone adoption, large hourly worker populations, and rising digital payments usage. Latin America benefits from financial inclusion initiatives, while the Middle East and Africa see increasing adoption through mobile banking expansion and emerging labor market digitization trends.

➤ Want more market wisdom? Browse reports –

- Energy & Power Plant Insurance Market

- Barber Booking Apps Market

- AI Hiring Software Market

- Neural Processors Market

Business Opportunities

Emerging opportunities include embedded EWA solutions within payroll software, advanced financial wellness platforms, AI-driven risk scoring for wage withdrawals, and instant settlement systems powered by digital banking. Markets with high unbanked populations offer potential for mobile-only wage access systems. Partnerships among fintechs, gig platforms, retail employers, and neobanks create continuous revenue streams. Additional opportunities exist in extending wage access solutions toward SMEs, cross-border gig workers, and subscription-based financial support models.

Key Segmentation

The market is segmented by type, business model, end-user, deployment mode, and industry vertical. Types include employer-integrated earned wage access and direct-to-consumer wage access. Business models include fee-based, subscription-based, and employer-funded systems. End-users comprise gig workers, hourly employees, and salaried staff. Deployment modes include cloud, mobile apps, and web-based platforms. Key industries adopting EWA include retail, hospitality, logistics, healthcare, manufacturing, and gig-based services.

Key Player Analysis

Participants focus on developing secure, user-friendly mobile interfaces, strengthening API connectivity with payroll software, and expanding partnerships with employers and gig platforms. Their strategies include enhancing instant-pay infrastructure, integrating financial literacy tools, and improving compliance with regional wage regulations. Continuous innovation in AI-driven budgeting, personalized financial insights, and real-time payment rails supports user engagement. Companies also emphasize data security and transparent pricing to build trust and differentiate in a rapidly growing fintech environment.

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- Expansion of EWA integrations with major HR and payroll providers

- Launch of instant-pay platforms for gig workers across multiple countries

- Introduction of AI-driven financial wellness features within wage access apps

- Partnerships between neobanks and EWA platforms for seamless digital payouts

- Regulatory discussions advancing to define consumer protections for EWA services

Conclusion

The mobile wage access apps market is rapidly expanding due to rising financial flexibility demands, employer adoption, and fintech innovation. With strong global momentum and supportive digital infrastructure, the market is positioned for significant long-term growth and broader financial inclusion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)