Table of Contents

Mobile Wallet Tokenization Market Size

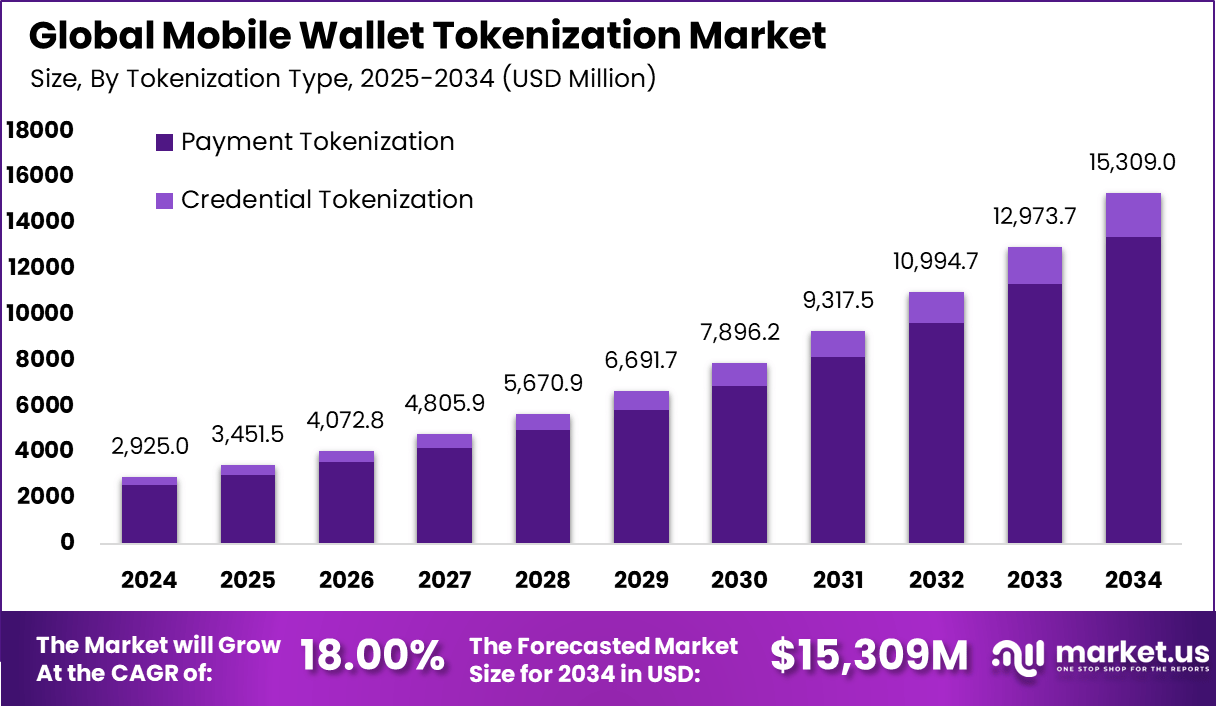

The global Mobile Wallet Tokenization market generated USD 2,925.0 million in 2024 and is expected to show strong growth over the forecast period. Revenue is projected to increase from USD 3,451.5 million in 2025 to approximately USD 15,309.0 million by 2034, registering a CAGR of 18%. This expansion is driven by rising adoption of digital payments and increasing focus on transaction security. Growing use of smartphones and contactless payment solutions is further supporting market development.

Key Statistics

- Payment tokenization dominated by tokenization type with an 87.6% share, as sensitive card data continued to be replaced with secure tokens to protect transactions across mobile wallets and digital payment platforms.

- Cloud-based deployment led with a 75.4% share, supported by scalability, centralized control, and cost efficiency, making it suitable for high volume and real time transaction processing.

- In app and e commerce payments accounted for a leading 53.8% share, driven by growth in mobile commerce, smoother checkout flows, and rising demand for secure digital payments.

- The BFSI segment held a dominant 61.5% share, as banks and financial institutions relied on tokenization to secure card on file data, reduce fraud exposure, and meet regulatory compliance needs.

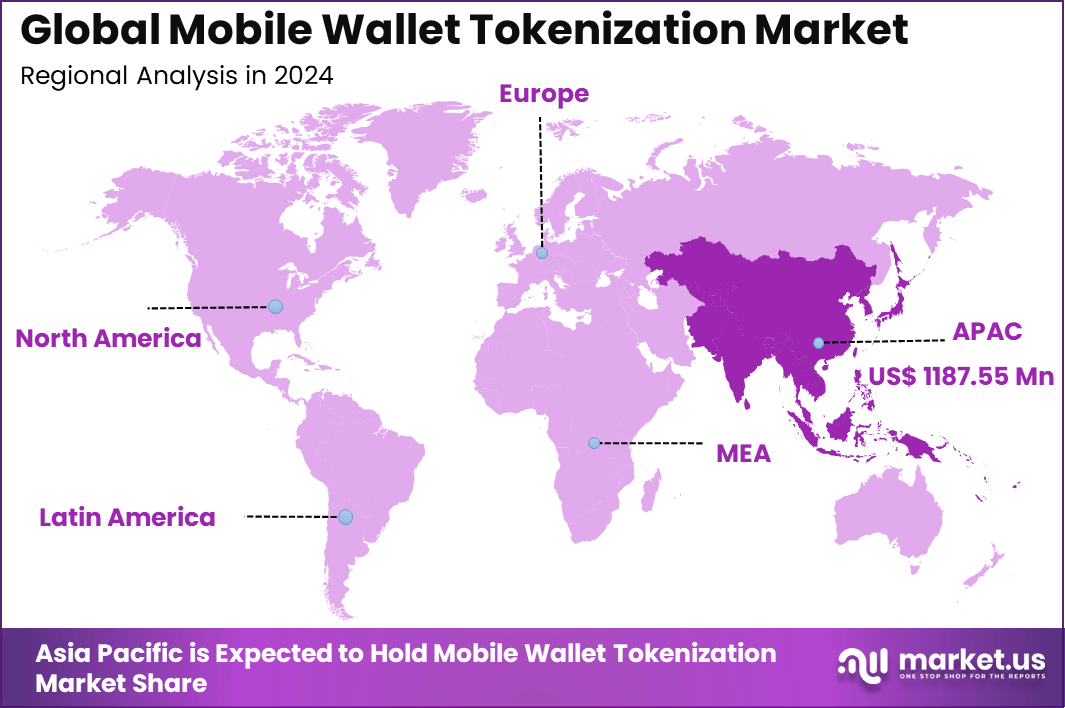

- Asia Pacific emerged as the leading region with around 40.6% share, supported by strong mobile wallet usage and rapid digital payment adoption.

- The China market reached approximately USD 359.8 million in 2025, reflecting high transaction volumes and widespread mobile payment usage.

- Market expansion continued at a 15.7% growth pace, supported by regulatory backing, rising mobile wallet penetration, and increasing digital payment activity across the region.

Supporting Usage and Security Indicators

- About 93% of leading mobile wallets adopted tokenization to safeguard sensitive user information and reduce exposure to payment data risks.

- Revenue from tokenization provisioning and management exceeded USD 53 billion in 2025, rising sharply from USD 18 billion in 2020, indicating strong monetization of security services.

- Tokenization enabled secure support for contactless payments and persistent tokens used in remote digital transactions.

- Businesses using tokenization reported a 34% reduction in payment fraud incidents, highlighting its effectiveness in risk mitigation.

- Mobile wallet providers leveraging tokenization recorded a 48% decline in data breaches over the past two years.

- Apple Pay and Google Pay together accounted for nearly 60% of all mobile tokenized payment activity, reflecting strong consumer trust in established platforms.

- NFC technology remained the dominant mobile wallet standard, supported by broad device compatibility and widespread merchant acceptance.

- Security remained a top user concern, as 72% of mobile wallet users ranked data protection as their highest priority, favoring tokenization combined with biometric authentication.

Market Overview

The mobile wallet tokenization market refers to technologies and services that replace sensitive payment credentials, such as card numbers, with unique digital tokens within mobile wallets. These tokens are used to process transactions without exposing actual financial data, reducing fraud risk and enhancing payment security. Tokenization operates across contactless payments, in app purchases, and online transactions initiated through smartphones. The market supports banks, payment networks, merchants, and consumers seeking secure digital payment experiences.

Market development has been supported by rapid growth in mobile payments and digital commerce. As smartphones become central to financial activity, protecting payment data has become a priority. Tokenization enables secure transactions while maintaining convenience and speed. With rising cyber threats, token based payment security has become a foundational component of mobile wallet ecosystems.

Top Driving Factors

One major driving factor of the mobile wallet tokenization market is the increasing focus on payment security and fraud prevention. Traditional payment methods expose sensitive card details during transactions, increasing vulnerability to data breaches. Tokenization minimizes this risk by ensuring real credentials are never shared. This security advantage has driven adoption among financial institutions and payment providers.

Another key driver is the expansion of contactless and mobile payments. Consumers increasingly prefer tap to pay and app based transactions for convenience and speed. Tokenization enables these payment methods to function securely across devices and channels. As contactless usage grows, demand for tokenization infrastructure continues to rise.

Demand Analysis

Demand for mobile wallet tokenization is influenced by the growth of digital wallets across retail, transportation, and online services. Merchants and service providers require secure payment mechanisms that integrate seamlessly with mobile platforms. Tokenization supports this requirement by simplifying compliance and reducing fraud liability. This has increased demand from both large enterprises and small merchants.

Demand is also shaped by regulatory pressure around payment data protection. Financial institutions must comply with strict security standards when handling customer data. Tokenization helps meet these requirements by limiting exposure of sensitive information. As compliance expectations tighten, adoption of token based security solutions increases.

Increasing Adoption Technologies

Advancements in near field communication technology have supported tokenization adoption in mobile wallets. NFC enables secure contactless communication between devices and payment terminals. Tokenization works alongside NFC to ensure transaction data remains protected. This combination supports smooth and secure in store payment experiences.

Cloud based payment infrastructure is also accelerating adoption. Token management platforms hosted in secure cloud environments allow scalable issuance, storage, and lifecycle management of tokens. These platforms enable real time transaction processing and monitoring. Cloud integration improves flexibility and supports rapid expansion of mobile wallet services.

Key Reasons for Adopting These Solutions

One key reason organizations adopt mobile wallet tokenization is enhanced consumer trust. Secure payment experiences reduce fear of fraud and data misuse. This trust encourages wider adoption of mobile wallets and digital payments. Financial institutions view tokenization as essential for customer confidence.

Another reason is operational efficiency and risk reduction. Tokenization reduces the scope of sensitive data handled by merchants and service providers. This lowers compliance burden and potential costs associated with data breaches. Improved risk management supports sustainable digital payment operations.

Investment Opportunities

Investment opportunities in the mobile wallet tokenization market exist in platforms that support multi device and cross border payments. Solutions that enable seamless token use across smartphones, wearables, and online platforms offer strong growth potential. Expansion into emerging markets with rising mobile payment adoption presents additional opportunity. Investors may focus on scalability and interoperability capabilities.

Another opportunity lies in advanced token lifecycle management and analytics solutions. Platforms that provide real time monitoring, fraud detection, and performance insights add value to payment ecosystems. Integration with broader digital identity and authentication systems can further strengthen offerings. These capabilities align with evolving payment security needs.

Business Benefits

Adoption of mobile wallet tokenization improves security posture while maintaining transaction speed and user convenience. Reduced fraud incidents and lower chargeback rates contribute to cost savings. Businesses benefit from safer payment acceptance and improved customer experience. These advantages support higher transaction volumes and loyalty.

Tokenization also supports innovation in digital payment services. Secure token frameworks enable new use cases such as in app purchases, subscription billing, and connected device payments. This flexibility allows businesses to expand payment options without increasing risk. Long term benefits include stronger competitiveness and digital readiness.

Regional Analysis

In 2024, Asia Pacific held a dominant position in the global market, accounting for more than 38.7% of total revenue. The region generated around USD 1,187.55 million, supported by high mobile payment adoption and rapid digitalization of financial services. Strong growth in e commerce and widespread use of mobile wallets strengthened regional leadership. As a result, Asia Pacific continued to play a key role in advancing mobile wallet tokenization adoption worldwide.

Regulatory Environment

The regulatory environment for the mobile wallet tokenization market is shaped by payment security and data protection standards. Regulations require safeguarding of consumer financial data during storage and transmission. Tokenization supports compliance by minimizing exposure of sensitive information. Adherence to these standards is critical for market participation.

Payment industry regulations and regional financial laws also influence tokenization implementation. Providers must align with standards related to authentication, transaction monitoring, and consumer protection. Ongoing regulatory oversight encourages continuous improvement in token security practices. Compliance supports trust, stability, and long term growth of mobile wallet tokenization solutions.

Key Market Segments

By Tokenization Type

- Payment Tokenization

- Credential Tokenization

By Deployment

- Cloud-based

- On-Premises

By Application

- In-Store Payments

- In-App & E-Commerce Payments

- Peer-to-Peer Transfers

By End-User

- BFSI

- Retail & E-Commerce

- Hospitality & Travel

- Healthcare

- Others

Top Key Players in the Market

- Apple Inc.

- Google LLC

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- American Express Company

- Alibaba Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Amazon.com Inc.

- Square Inc. (Block, Inc.)

- FIS (Fidelity National Information Services, Inc.)

- Fiserv, Inc.

- NXP Semiconductors N.V.

- Thales Group

- Gemalto (now part of Thales Group)

- IDEMIA

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2,925.0 Mn |

| Forecast Revenue (2034) | USD 15,309.0 Mn |

| CAGR(2025-2034) | 18% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)