Table of Contents

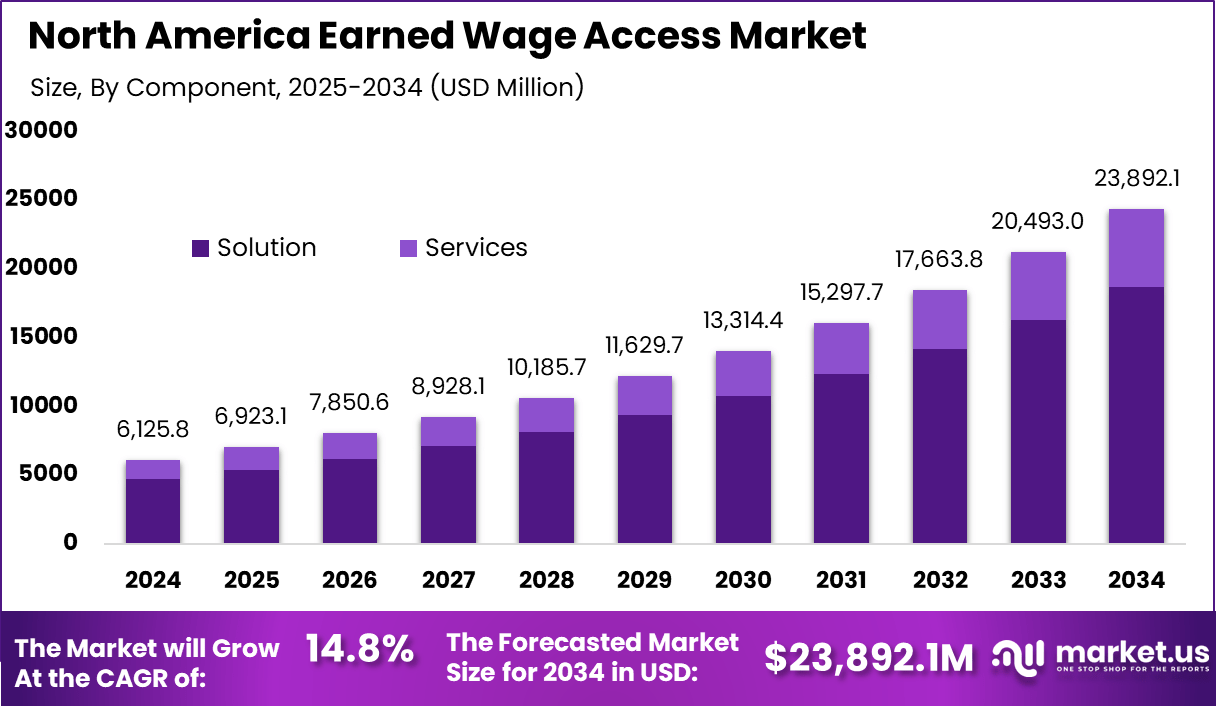

New York, NY – December, 2025: The North America earned wage access market generated USD 6,125.8 million in 2024 and is projected to grow from USD 6,923.1 million in 2025 to approximately USD 23,892.1 million by 2034, registering a CAGR of 14.8% over the forecast period.

Earned wage access adoption is driven by rising financial pressure on workers and growing demand for flexible pay options that allow early access to earned income. Expansion of the gig economy and hourly employment models is accelerating usage, with around 28% of workers earning between USD 50,000 and USD 100,000 still living paycheck to paycheck, highlighting the need for on demand wage solutions.

Market development in North America is driven by persistent financial stress among wage earners and growing employer focus on retention and workforce wellbeing. According to the Federal Reserve, over 35% of U.S. adults report difficulty covering unexpected expenses, which directly increases interest in early wage access tools. Employers are using EWA as a non-salary benefit to differentiate themselves in competitive labor markets, particularly in hourly-wage industries. At the same time, improvements in payroll APIs and mobile payment rails have reduced implementation complexity, supporting wider adoption.

Buy this report directly from here: [Discounts: Up To 60% OFF]: https://market.us/purchase-report/?report_id=164300

Top Market Takeaways

- Digital on-demand pay leads with 56.4%, driven by rising demand for flexible and real-time wage access.

- Solutions dominate with 76.8%, reflecting strong adoption of digital platforms for earned wage access and payroll automation.

- Large enterprises account for 82.4%, as scale employers use EWA to improve satisfaction and retention.

- Retail and e-commerce represent 29.4%, supported by high-turnover, hourly workforces seeking pay flexibility.

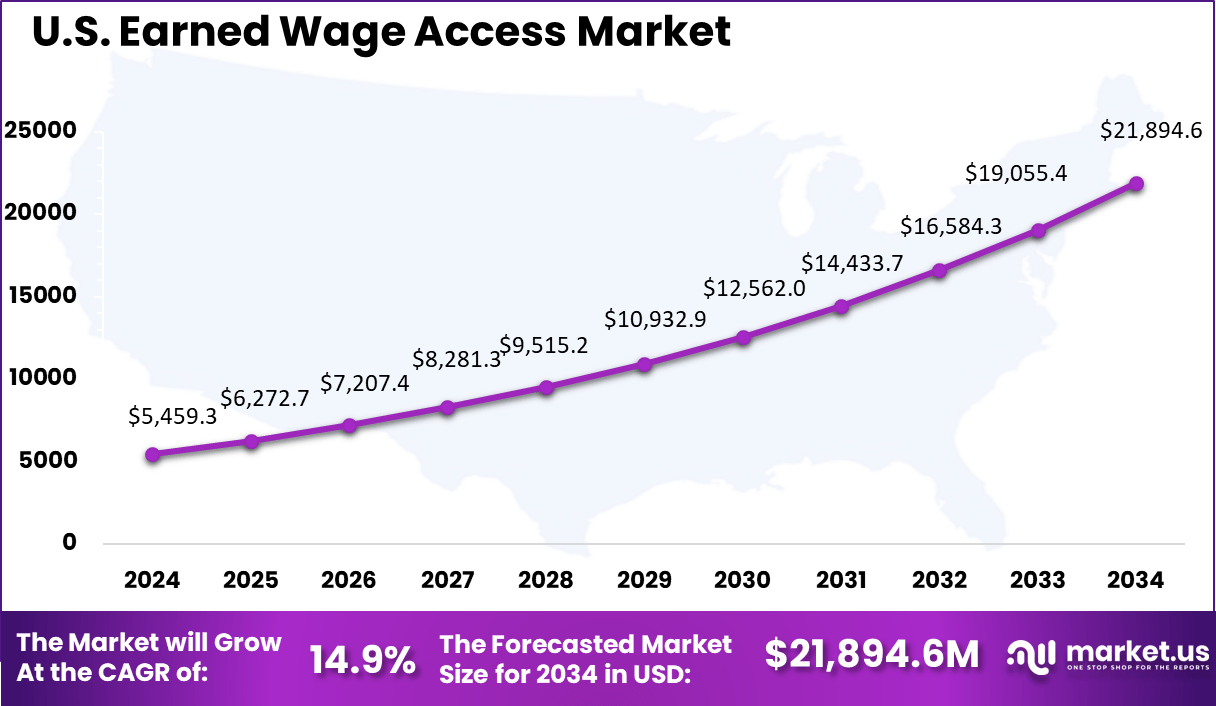

- The U.S. market reached USD 5,459.3 million and is growing at 14.9%, underscoring rapid expansion of employee-centric financial tools.

EWA Adoption and Demand

User and Demand Statistics

- More than 60% of U.S. workers live paycheck to paycheck, and 97% of full-time employees report some level of financial stress.

- EWA strongly appeals to younger workers, with 84% of Millennials and 87% of Gen Z willing to apply for jobs offering same-day pay.

- Around 60% of U.S. workers want daily access to earned wages instead of waiting for traditional pay cycles.

- Among EWA users, 77% report lower financial anxiety and 72% feel greater control over their finances.

Employer Adoption and Impact

- Only 10% of U.S. employers currently offer EWA, indicating significant untapped growth potential.

- Retail and e-commerce account for 21% of EWA adoption by industry, driven by large hourly workforces.

- Employers offering EWA report improved retention and productivity, as financial stability reduces absenteeism and disengagement.

Technology and Regulation

- Cloud-based platforms dominate with an 81% share, supported by scalability and seamless payroll integration.

- Regulatory scrutiny is increasing, as some EWA services show implicit APRs exceeding 300%, raising concerns around transparency and consumer protection.

By Model

Digital on-demand pay leads with 56.4%, reflecting growing employee preference for flexible and real time access to earned wages. This model allows workers to withdraw a portion of their salary before the scheduled payday, which helps manage short term expenses and improves financial stability. Demand for this model is rising as employers focus more on employee financial wellbeing. Digital on-demand pay is increasingly viewed as a value added benefit that supports workforce satisfaction and helps reduce financial stress across different employment categories.

Market Share By Model (%), 2020-2024

| Key Segments | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Digital On-Demand Pay | 56.4% | 56.4% | 56.4% | 56.4% | 56.4% |

| Proprietary HCM | 22.0% | 22.3% | 22.6% | 22.9% | 23.2% |

| Card Model | 15.4% | 15.2% | 15.0% | 14.8% | 14.6% |

| Direct-to-Consumer | 6.3% | 6.2% | 6.1% | 5.9% | 5.8% |

By Component

Solutions dominate the market with 76.8%, highlighting strong adoption of digital platforms that support earned wage access and payroll automation. These platforms connect directly with employer payroll systems to calculate earned income and enable controlled wage disbursement. The dominance of this segment is driven by the need for secure, scalable, and compliant systems. Employers prefer solution based platforms as they reduce manual payroll handling, improve accuracy, and support seamless integration with existing HR and finance systems.

Market Share By Component (%), 2020-2024

| Key Segments | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Solution | 76.1% | 76.3% | 76.4% | 76.6% | 76.8% |

| Cloud | 71.4% | 71.7% | 71.9% | 72.2% | 72.4% |

| On-Premise | 28.6% | 28.3% | 28.1% | 27.8% | 27.6% |

| Services | 23.9% | 23.7% | 23.6% | 23.4% | 23.2% |

By Enterprise Size

Large enterprises account for 82.4%, showing that earned wage access adoption is strongest among organizations with large workforces. These employers use on-demand pay systems to address workforce retention challenges and improve employee engagement. Large organizations also benefit from economies of scale when implementing digital wage access platforms. Offering flexible pay options helps them attract talent, lower turnover rates, and strengthen overall workforce stability across multiple locations.

Market Share By Enterprise Size (%), 2020-2024

| Key Segments | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Large Enterprises | 81.6% | 81.8% | 82.0% | 82.2% | 82.4% |

| SMEs | 18.4% | 18.2% | 18.0% | 17.8% | 17.6% |

By Industry Vertical

Retail and e-commerce represent 29.4%, supported by high employee turnover and irregular work schedules. Workers in these sectors often seek faster access to earnings to manage variable income and daily living costs. Employers in retail and e-commerce adopt earned wage access tools to improve employee retention and attendance. Flexible wage access helps enhance job satisfaction and provides a competitive advantage in labor intensive environments.

Market Share By Industry Vertical (%), 2020-2024

| Key Segments | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Retail & E-commerce | 29.8% | 29.7% | 29.6% | 29.5% | 29.4% |

| Hospitality & Construction | 22.9% | 22.7% | 22.5% | 22.3% | 22.1% |

| Healthcare | 15.1% | 15.5% | 15.9% | 16.3% | 16.7% |

| Transportation & Logistics | 11.5% | 11.5% | 11.6% | 11.6% | 11.6% |

| Manufacturing | 7.2% | 7.1% | 6.9% | 6.8% | 6.7% |

| BFSI | 5.6% | 5.5% | 5.3% | 5.2% | 5.1% |

United States

The United States reached USD 5,459.3 million and is expanding at a CAGR of 14.9%, indicating strong growth in employee focused financial solutions. Employers across industries are increasingly integrating earned wage access into their compensation frameworks. Growth in the US market is supported by rising awareness of financial wellness benefits and widespread digital payroll adoption. As employee expectations continue to evolve, earned wage access platforms are becoming a standard component of modern workforce management.

Market Share By Country (%), 2020-2024

| By Country | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| U.S. | 88.7% | 88.8% | 88.9% | 89.0% | 89.1% |

| Canada | 11.3% | 11.2% | 11.1% | 11.0% | 10.9% |

Emerging Trends

One emerging trend in the North America market is the expanding position of earned wage access as a sought-after employee benefit. Surveys show that a high proportion of workers now consider access to earned wages a key factor in employment choice, particularly among younger generations, who see financial flexibility as part of overall compensation. This shift is influencing employers to include EWA as part of broader benefits packages.

Another trend is stronger integration with payroll platforms and HR systems. Employers are moving from ad-hoc pay advances toward systems that automatically calculate earned income and deliver funds through direct deposit or payment cards with minimal manual intervention. This improvement reduces administrative overhead and improves reliability for workers.

Growth Factors

A major growth factor in North America is rising employee demand for financial flexibility. Many workers, especially hourly, gig, or lower-income employees, face cash flow gaps between pay periods and may incur fees from overdrafts or payday loans. Earned wage access offers an alternative that helps workers manage expenses without affecting credit scores. This demand has supported broader adoption by employers and platforms alike.

Another growth factor is employer interest in financial wellbeing as part of talent retention and recruitment. Data suggests that employers offering earned wage access see stronger engagement with benefits and may improve workforce stability, as employees use the benefit regularly and value the flexibility it provides. Surveys indicate that many companies view earned wage access as one of the most popular financial wellness benefits offered to staff.

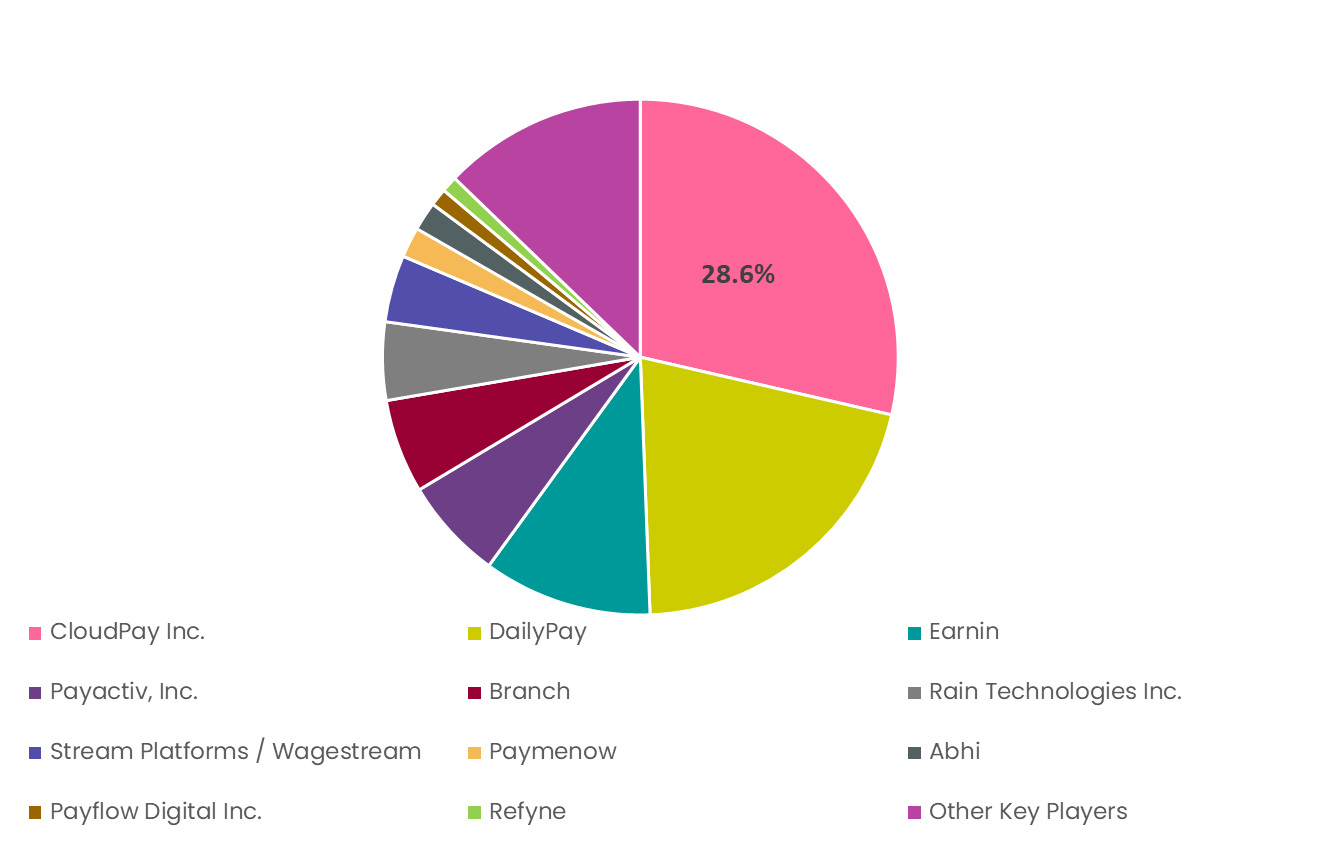

Top Key Players in the Market

- CloudPay Inc.

- DailyPay

- Earnin

- Payactiv Inc.

- Branch

- Rain Technologies Inc.

- Stream Platforms / Wagestream

- Paymenow

- Abhi

- Payflow Digital Inc.

- Refyne

- Other Key Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6,125.8 Mn |

| Forecast Revenue (2034) | USD 23,892.1 Mn |

| CAGR(2025-2034) | 14.8% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Key Market Segments

By Model

- Digital On-Demand Pay

- Proprietary HCM

- Card Model

- Direct-to-Consumer

By Component

- Solution

- Cloud

- On-Premise

- Services

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- Retail & E-commerce

- Hospitality & Construction

- Healthcare

- Transportation & Logistics

- Manufacturing

- BFSI

- Others

You may also be interested in

- AI Task Manager App Market

- iGaming Platform Market

- 3D Virtual Event Platforms Market

- Agentic AI Insurance Market

- AI in Nuclear Energy Market

- Circular Economy Trade Finance Market

- Earned Wage Access Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)