Table of Contents

Open RAN Market Size

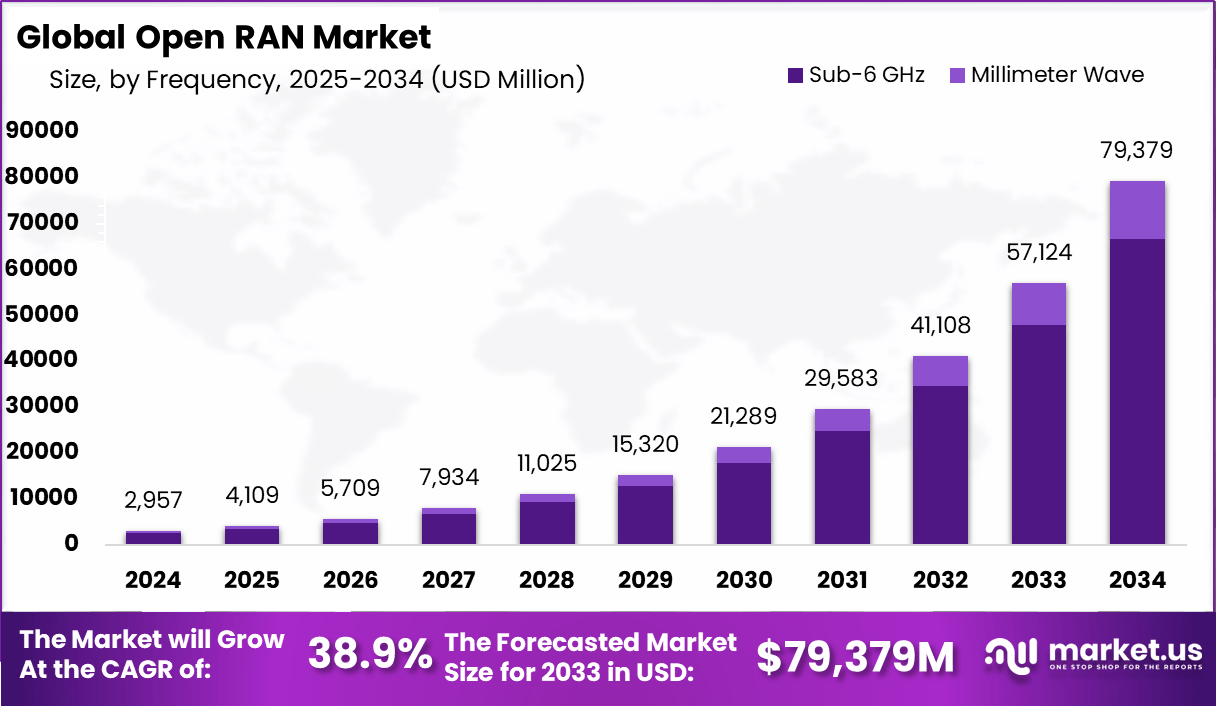

The global Open RAN market was valued at USD 2,957 million in 2024 and is projected to reach approximately USD 79,379 million by 2034, expanding at a CAGR of 38.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant position with 34.6% market share, generating around USD 1,024.3 million in revenue, supported by strong investments in 5G infrastructure and network modernization initiatives.

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2,957 Million |

| Forecast Revenue (2034) | USD 79,379 Million |

| CAGR (2025-2034) | 38.9% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Open RAN Market Overview

The Open RAN market refers to open and interoperable radio access network architectures used in mobile telecommunications. Open RAN separates hardware and software components, allowing different vendors to work together within the same network. This approach contrasts with traditional, closed RAN systems that rely on single-vendor solutions.

The market supports greater flexibility and innovation in network deployment. Open RAN is adopted by telecom operators seeking cost efficiency and vendor diversity. It enables operators to deploy networks using standardized interfaces. This reduces dependency on proprietary systems. As mobile networks expand, Open RAN is gaining strategic importance.

One major driving factor is the need to reduce network deployment and operating costs. Traditional RAN systems require high capital investment and vendor lock-in. Open RAN allows operators to choose cost-effective components. This improves long-term cost control. Another driving factor is the demand for network flexibility. Operators need to upgrade and scale networks quickly. Open RAN supports modular upgrades without full system replacement. This aligns with evolving 4G and 5G requirements.

Key Takeaways

- The global Open RAN market is set for rapid expansion, rising from USD 2,957 million in 2024 to USD 79,379 million by 2034, supported by a strong 38.9% CAGR over the forecast period.

- Hardware led the components segment in 2023 with a 51.8% share, reflecting sustained investment in physical network infrastructure required for Open RAN deployments.

- 4G networks remained dominant in 2023, accounting for 59.25%, as they continue to serve as the foundation for many Open RAN rollouts alongside gradual 5G integration.

- Radio units held a leading 42.35% share among Open RAN units, highlighting their critical role in managing radio signals and enabling network performance.

- Sub-6 GHz frequencies dominated with an 84.2% share in 2023, favored for their balance of wide coverage and reliable performance.

- North America led the global market with a 34.64% share, generating USD 1,024.3 million in 2024, supported by advanced telecom infrastructure and early Open RAN adoption.

Component Analysis

Hardware Component

The hardware component held the largest share in the Open RAN market throughout the period. Its share was 52.67% in 2019, slightly declining to 52.50% in 2020 and 52.32% in 2021, reflecting steady but competitive adoption conditions. This gradual shift continued with 52.14% in 2022, 51.94% in 2023, and 51.80% in 2024, indicating a controlled reduction rather than a sharp drop.

This trend suggests that hardware remained essential for Open RAN deployments, especially for radio units and baseband infrastructure. However, the slow decline from 52.67% to 51.80% over six years indicates increasing balance with other components. The market structure shows that hardware dominance persisted even as network architectures evolved.

Open RAN Market Share, By Component Analysis, 2019-2024 (%)

| Component | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Hardware | 52.67% | 52.50% | 52.32% | 52.14% | 51.94% | 51.80% |

| Software | 32.97% | 33.00% | 33.04% | 33.07% | 33.07% | 33.16% |

| Services | 14.36% | 14.50% | 14.64% | 14.78% | 14.99% | 15.03% |

Network Type Analysis

4G Networks Analysis

4G networks held the dominant position in the Open RAN market throughout the period. The segment represented 58.57% in 2019, increasing to 58.78% in 2020 and maintaining 58.72% in 2021, showing stable demand. The share expanded further to 58.90% in 2022, 59.11% in 2023, and reached 59.25% in 2024.

This growth from 58.57% to 59.25% reflects the continued reliance on 4G infrastructure for wide area coverage and capacity needs. Many operators adopted Open RAN within existing 4G networks to reduce costs and improve flexibility. The data confirms that 4G remained the backbone for Open RAN deployments during this timeframe.

Open RAN Market Share, By Network Type Analysis, 2019-2024 (%)

| Network Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| 2G/3G Networks | 14.41% | 14.23% | 14.04% | 13.85% | 13.66% | 13.45% |

| 4G Networks | 58.57% | 58.78% | 58.72% | 58.90% | 59.11% | 59.25% |

| 5G Networks | 27.01% | 26.98% | 27.24% | 27.26% | 27.23% | 27.31% |

Unit Analysis

Radio Unit Analysis

The radio unit segment held the largest share in the Open RAN market during the review period. Its share stood at 43.46% in 2019, declining slightly to 43.24% in 2020 and 43.01% in 2021, showing gradual structural adjustments. This trend continued with 42.78% in 2022, 42.48% in 2023, and 42.35% in 2024.

The decline from 43.46% to 42.35% indicates that radio units remained essential but faced increasing optimization across network architectures. Deployment efficiency and tighter hardware integration influenced this shift. Despite the reduction, radio units continued to play a core role in Open RAN rollouts.

Open RAN Market Share, By Unit Analysis, 2019-2024 (%)

| Unit | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Radio Unit | 43.46% | 43.24% | 43.01% | 42.78% | 42.48% | 42.35% |

| Centralized Unit | 34.45% | 34.47% | 34.49% | 34.52% | 34.51% | 34.59% |

| Distributed Unit | 22.09% | 22.29% | 22.50% | 22.70% | 23.01% | 23.06% |

Frequency Analysis

Sub-6 GHz Frequency Analysis

Sub-6 GHz frequencies dominated the Open RAN market over the entire timeline. The segment held 84.81% in 2019, slightly declining to 84.68% in 2020 and 84.54% in 2021, indicating stable demand. This gradual movement continued with 84.40% in 2022, 84.29% in 2023, and 84.12% in 2024.

The change from 84.81% to 84.12% shows that Sub-6 GHz remained the primary frequency band for Open RAN deployments. Broad coverage needs and existing infrastructure supported this dominance. The data confirms long term reliance on this frequency range.

Open RAN Market Share, By Frequency Analysis, 2019-2024 (%)

| Frequency | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| Sub-6 GHz | 84.81% | 84.68% | 84.54% | 84.40% | 84.29% | 84.12% |

| Millimeter Wave | 15.19% | 15.32% | 15.46% | 15.60% | 15.71% | 15.88% |

Emerging Trends

In the Open RAN market, a major trend is the shift toward disaggregated radio access network architectures that separate hardware from software functions. Traditional monolithic RAN systems are being replaced with modular components compliant with open interfaces. This modularity enhances flexibility and supports multi-vendor environments where network operators can mix and match components without vendor lock-in.

Another emerging trend is the integration of automation and intelligence into Open RAN operations. Operators are deploying advanced orchestration tools, real-time analytics, and machine learning algorithms to optimise resource allocation, interference management, and network performance dynamically. These intelligent capabilities help improve efficiency and responsiveness across heterogeneous network deployments.

Growth Factors

A key growth factor in the Open RAN market is the increased demand for cost-efficient and scalable mobile network infrastructures. As data traffic continues to grow and service providers roll out 5G coverage, Open RAN solutions provide an alternative that can reduce capital and operational expenses by enabling greater reuse of hardware and software across sites and vendors.

Another important factor supporting growth is the push from global standards bodies and industry alliances to promote interoperability. Standardised open interfaces encourage competitive ecosystems, increase supplier diversity, and support innovation. This collaborative momentum helps accelerate adoption by reducing integration complexity and enhancing confidence in multi-vendor deployments.

Driver

A principal driver of the Open RAN market is the need for network agility and vendor flexibility. Service providers seek platforms that allow rapid deployment of new services and features without being constrained by proprietary systems. Open RAN’s modular approach enables quicker adaptation to evolving service demands and technology upgrades.

Another driver is the focus on reducing total cost of network ownership. By enabling disaggregated components and software driven network features, Open RAN supports economies of scale and more efficient resource utilisation. These economic considerations motivate operators to explore open architectures as part of broader network modernisation initiatives.

Restraint

A notable restraint in this market is the complexity of integrating multi-vendor hardware and software components. While open interfaces promote interoperability in principle, achieving seamless coordination among products from different suppliers requires rigorous testing, validation, and integration expertise. This technical complexity can slow deployment and increase operational risk.

Another restraint relates to performance consistency and quality assurance. Operators must ensure that Open RAN deployments can match the reliability, throughput, and latency expectations of traditional RAN systems. Verifying performance across diverse network environments remains a challenge that operators and solution providers must address collaboratively.

Opportunity

A strong opportunity exists in the expansion of Open RAN into small cell and private network segments. Enterprises, campuses, and industrial facilities are deploying localized networks to support specific connectivity needs. Open RAN’s flexible and scalable architecture is well-suited to these use cases, enabling tailored solutions with lower cost and rapid deployment cycles.

Another opportunity lies in software innovation and value-added applications. As Open RAN evolves, there is potential to layer advanced features such as AI-driven optimisation, cloud-native network functions, and adaptive spectrum utilisation. These enhancements can extend the value proposition of Open RAN beyond basic connectivity to support differentiated services.

Challenge

One of the main challenges for the Open RAN market is building a robust ecosystem of interoperable suppliers and integration partners. Success depends not only on open standards but also on industry-wide commitment to certification, quality control, and joint testing frameworks. Developing this ecosystem at scale is essential to reduce deployment risk and increase operator confidence.

Another challenge involves ensuring seamless migration from legacy RAN systems. Many operators have extensive investments in traditional infrastructure, and transitioning to Open RAN architectures requires careful planning to avoid service disruption. Interoperability with existing network elements and phased migration strategies are critical but complex aspects of this transformation.

Top Key Players in the Market

- Rakuten Group, Inc.

- Samsung Electronics Co., Ltd.

- Nokia Corporation Finland

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limited Japan

- Mavenir

- Parallel Wireless

- Radisys

- NEC Corporation

- 1VIAVI Solutions Inc.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Network Type

- 2G/3G Networks

- 4G Networks

- 5G Networks

By Unit

- Radio Unit

- Centralized Unit

- Distributed Unit

By Frequency

- Sub-6 GHz

- Millimeter Wave (mmWave)

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)