Table of Contents

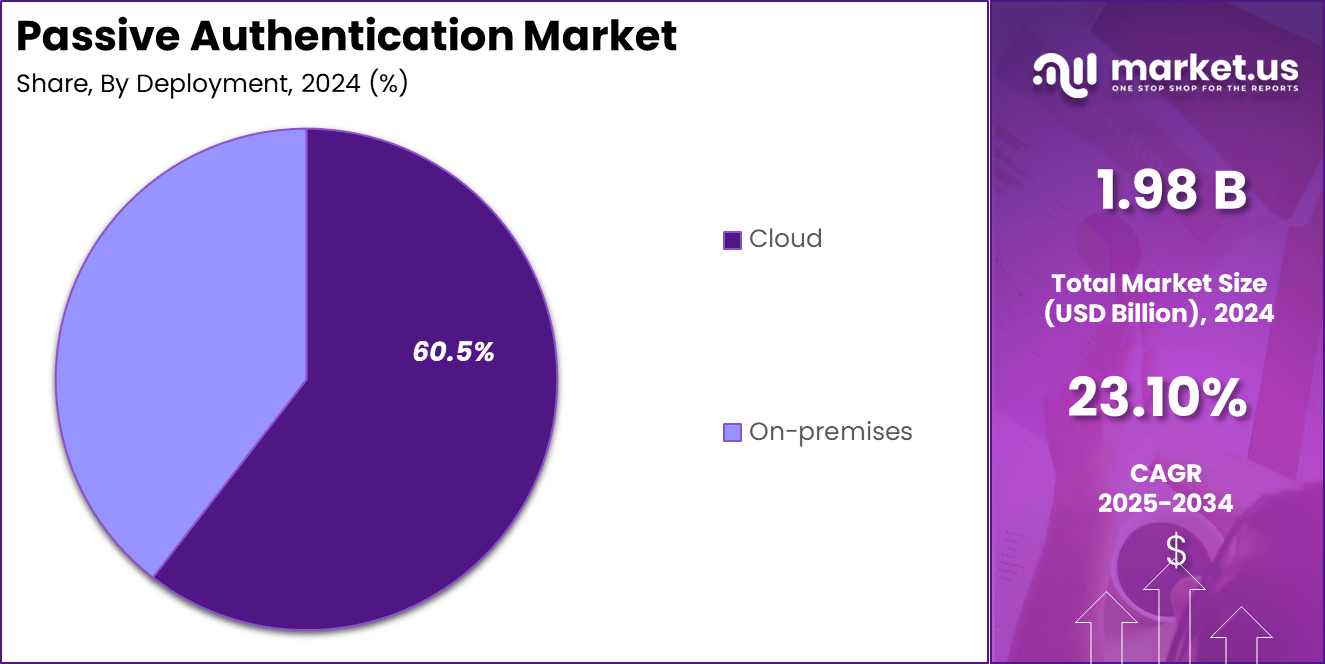

The global Passive Authentication Market was valued at USD 1.98 billion in 2024 and is anticipated to reach USD 15.82 billion by 2034, registering a CAGR of 23.10% during the forecast period. In North America, the market accounted for 40.2% of the global share with a value of USD 0.79 billion in 2024, while the US contributed USD 0.73 billion and is projected to expand at a CAGR of 21.5%. By offering, the solution segment led with 65.4%, followed by risk management and fraud detection under business function with 45.8%. The cloud deployment segment captured 60.5%, large enterprises dominated with 70.3%, and the BFSI industry vertical accounted for 31.7% of the total market share.

Passive authentication is gaining widespread traction as organizations increasingly prioritize seamless security frameworks that do not interrupt user experience. Unlike traditional authentication methods that rely on passwords or one-time verification codes, passive authentication leverages behavioral biometrics such as typing patterns, device usage, location data, and interaction habits to validate user identity continuously. This approach enables enterprises to maintain robust cybersecurity standards while minimizing user friction across digital platforms, making it especially relevant in sectors that demand high levels of trust and compliance.

(Get Your Research Sample from this link above)

The growing adoption of digital banking platforms, remote workforce environments, and cloud-based enterprise ecosystems has accelerated the demand for advanced authentication solutions. Enterprises are shifting toward intelligent identity verification systems that can operate in real time without requiring direct user input. Passive authentication solutions are increasingly integrated with AI-driven security tools to support fraud detection, risk monitoring, and compliance management processes. As cyber threats continue to evolve in sophistication, organizations are focusing on implementing adaptive security frameworks that can detect anomalies and unauthorized access attempts through behavioral analytics.

Key Takeaways

- The solution segment accounted for 65.4% of the market share by offering.

- Risk management and fraud detection captured 45.8% of the share by business function.

- Cloud deployment held 60.5% of the market share.

- Large enterprises accounted for 70.3% of the share by organization size.

- The BFSI industry vertical captured 31.7% of the total market share.

- North America accounted for 40.2% of the global market share.

Regional Analysis

North America continues to hold a dominant position in the passive authentication market due to the region’s advanced digital infrastructure and early adoption of enterprise security technologies. Organizations across the US are investing heavily in behavior-based authentication systems to safeguard digital transactions and mitigate identity-related cyber risks. The presence of stringent regulatory frameworks related to financial data protection and privacy compliance is encouraging enterprises to adopt passive authentication solutions for secure customer interactions.

In addition, the region’s mature fintech ecosystem and increasing reliance on mobile banking applications have created a favorable environment for the deployment of AI-enabled authentication technologies. Enterprises operating in sectors such as banking, healthcare, and telecommunications are integrating passive authentication tools into their digital platforms to enhance security without compromising user convenience. This trend is further supported by the rising volume of online transactions and remote access requirements across enterprise environments.

Market Segments

By Offerings

By offering, the solution segment dominates the market as enterprises increasingly implement advanced software platforms for identity verification and fraud prevention. Services, including professional and managed support, are also witnessing adoption as organizations seek assistance in deploying and maintaining authentication frameworks tailored to their operational needs.

- Solution

- Services

- Professional Services

- Managed Services

By Business Functions

By business function, risk management and fraud detection represent the leading segment due to the growing emphasis on identifying suspicious activities and unauthorized access attempts in real time. Compliance management is also gaining importance as enterprises align their cybersecurity practices with regulatory mandates and industry standards.

- Compliance Management

- Marketing Management

- Risk Management

- Others

(Get Your Research Sample from this link above)

By Deployments

By deployment, cloud-based solutions are widely preferred for their scalability and cost efficiency, allowing enterprises to integrate authentication tools across distributed systems. On-premises deployment remains relevant for organizations that require greater control over sensitive data and internal infrastructure

- On-premises

- Cloud

By Organization Sizes

By organization size, large enterprises dominate the market owing to higher investments in cybersecurity infrastructure and advanced identity management systems. Small and medium enterprises are gradually adopting passive authentication technologies as digital transformation initiatives expand across emerging economies.

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Verticals

By industry vertical, BFSI leads the market due to the need for secure digital banking experiences and compliance with financial regulations. Other sectors, such as healthcare, retail, government, and IT and telecommunications, are also adopting passive authentication to enhance data protection and customer trust.

- BFSI

- Government

- IT & Telecommunications

- Retail and consumer goods

- Healthcare

- Media and Entertainment

- Others

Emerging Trends

The integration of artificial intelligence and machine learning technologies into authentication platforms is emerging as a key trend across the market. Behavioral biometrics driven by AI models enable continuous identity verification by analyzing user interactions and detecting anomalies in real time.

Another notable trend is the adoption of multi-factor authentication frameworks that incorporate passive authentication as an additional security layer. Enterprises are combining traditional verification methods with behavioral analytics to strengthen access control mechanisms without affecting user experience.

Growth Factors

The rapid increase in digital payment platforms and online banking services is driving the demand for frictionless authentication solutions. Financial institutions are focusing on minimizing identity theft risks by implementing passive authentication systems that operate in the background.

Furthermore, the expansion of remote working environments and cloud-based enterprise applications has created new security challenges for organizations. Passive authentication technologies provide continuous monitoring capabilities that support secure access to enterprise networks and digital resources.

Top Keyplayers

- IBM Corporation

- Cisco Systems Inc.

- Thales Group (Gemalto)

- NEC Corporation

- OneSpan Inc.

- Verint Systems Inc.

- Aware Inc.

- Pindrop Security Inc.

- Transmit Security

- Nuance Communications Inc.

- BioCatch Ltd.

- ID RandD Inc.

- Fortress Identity

- BehavioSec AB

- Experian plc

- LexisNexis Risk Solutions

- TypingDNA Inc.

- Zighra Inc.

- Incognia

- Signicat AS

- Kount (Equifax)

- Others

Future Predictions

The passive authentication market is expected to witness sustained growth as enterprises continue to adopt AI-enabled security frameworks for identity management. Advancements in behavioral analytics and device recognition technologies are anticipated to enhance the accuracy and efficiency of authentication systems.

In the coming years, industries such as healthcare, government, and retail are projected to expand their adoption of passive authentication to safeguard sensitive information and ensure compliance with evolving data protection regulations. Continuous innovation in cybersecurity technologies is likely to support the development of adaptive authentication platforms.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.98 Billion |

| Forecast Revenue (2034) | USD 15.82 Billion |

| CAGR(2025-2034) | 23.10% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Conclusion

The passive authentication market is emerging as a critical component of modern cybersecurity strategies, enabling organizations to secure digital interactions without disrupting user experience. As enterprises accelerate digital transformation initiatives and adopt cloud-based infrastructures, the demand for intelligent identity verification solutions is expected to rise. The integration of behavioral analytics and AI-driven technologies into authentication frameworks is anticipated to play a significant role in enhancing enterprise security and supporting long term market growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)