Table of Contents

Introduction

The global payment devices market is expanding rapidly, driven by rising digital adoption and evolving consumer expectations. Businesses across sectors are modernizing transaction infrastructures, integrating advanced tools that enhance speed, security, and convenience for both merchants and customers.

Additionally, increasing reliance on contactless and mobile-first payments accelerates the shift toward next-generation POS terminals, kiosks, and biometric solutions. Companies are leveraging cloud capabilities to streamline device management, optimize operations, and improve cost efficiency at scale.

Moreover, supportive government initiatives promoting cashless economies continue to accelerate adoption. These programs encourage interoperability, regulatory compliance, and secure hardware deployment across banking, retail, mobility, and healthcare sectors worldwide.

Consequently, opportunities for innovation in biometric authentication, IoT-enabled devices, fraud prevention, and omnichannel payment ecosystems are rising. Organizations adopting modern, secure device solutions are positioned to deliver seamless experiences and meet evolving digital commerce needs.

Key Takeaways

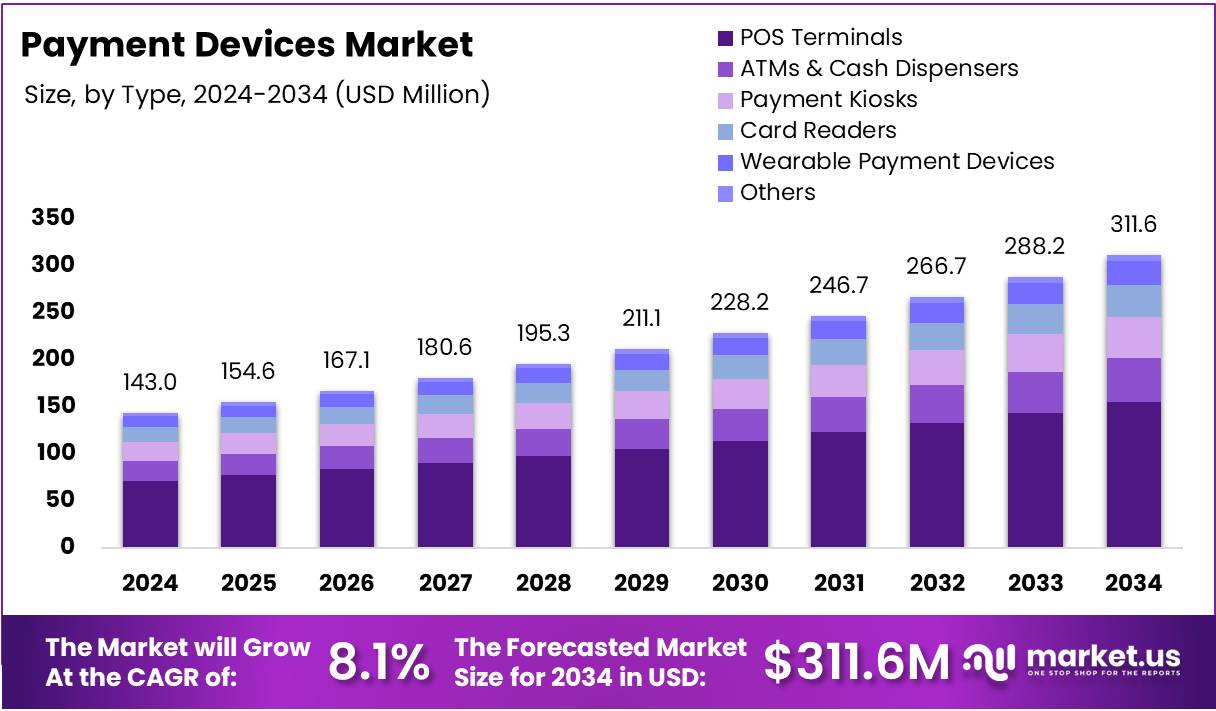

- Global Payment Devices Market is projected to reach USD 311.6 Million by 2034 from USD 143.0 Million in 2024, growing at a CAGR of 8.1%.

- By Type, POS Terminals dominated with a 49.80% share in 2024.

- By Technology, Contactless/NFC led the market with a 54.20% share in 2024.

- By Deployment Mode, On-premise accounted for 67.30% of the market in 2024.

- North America dominated with a 41.3% share, valued at USD 59.0 Million in 2024.

Market Segmentation Overview

By Type

POS Terminals maintained dominance due to widespread retail modernization and increasing adoption of digital checkout tools. Furthermore, omnichannel commerce expansion strengthened the integration of smart terminals that support faster, secure, and user-friendly payments across high-traffic environments.

Meanwhile, ATMs & cash dispensers continued to evolve as financial inclusion programs expanded. Although cash usage declined, emerging markets upgraded ATM fleets for enhanced security, remote monitoring, and improved withdrawal experiences, ensuring sustained relevance of these devices.

Payment kiosks experienced growing traction as self-service preferences increased in retail, transport, and QSR sectors. These kiosks reduced operational burdens, enhanced customer flow, and delivered multi-payment acceptance options that improved convenience and efficiency.

Card readers remained essential for SMBs due to portable design and affordability. Rising adoption of mobile POS systems and digital wallets ensured consistent demand, especially among small retailers, delivery services, and pop-up businesses.

Wearable payment devices expanded with the surge in smartwatches and fitness bands. These devices enabled tap-to-pay functionality, appealing strongly to younger consumers and health-tech users seeking fast, frictionless payment experiences.

By Technology

Contactless/NFC systems dominated as hygiene concerns and demand for fast checkouts accelerated tap-to-pay uptake. NFC-enabled smartphones and wearables enhanced convenience, driving widespread adoption across global retail and mobility networks.

Contact-based technologies remained relevant among sectors requiring secure PIN-based validation. Their reliability, compatibility with legacy systems, and minimal upgrade requirements ensured ongoing deployment across traditional banking and retail operations.

Hybrid and multimode devices grew in adoption as merchants pursued flexible acceptance options. By combining EMV, NFC, and QR capabilities, these systems enabled seamless transactions across diverse customer preferences and regional payment standards.

Biometric-enabled payment devices advanced due to heightened fraud risks and rising trust in biometric authentication. Fingerprint and facial recognition systems improved security and delivered frictionless customer authentication.

By Deployment Mode

On-premise models continued to dominate due to strict compliance requirements and the need for full control over sensitive transaction data. Highly regulated industries maintained investments in secure, internally managed infrastructures.

Cloud-based deployment expanded as businesses embraced scalable, subscription-driven solutions. Cloud platforms enabled remote updates, operational cost reduction, and improved flexibility, making them ideal for SMEs and digital-first enterprises.

Drivers

Rising consumer preference for cashless transactions is driving rapid adoption of modern payment devices. Digital payments offer superior speed, convenience, and security, pushing retailers and service providers to upgrade to contactless-ready and omnichannel-compatible systems.

Digital transformation in banking and finance is accelerating market growth. Banks are upgrading infrastructures with biometric devices, mobile POS units, and cloud-managed systems to deliver secure, real-time, and user-friendly transaction experiences.

Use Cases

Retail automation and self-service expansion are increasing the deployment of smart kiosks and POS solutions. These devices reduce wait times, streamline ordering, and improve labor productivity, especially in high-volume retail and QSR environments.

Mobility and transportation payments benefit from NFC terminals and wearable-enabled systems that support faster ticketing and seamless transit experiences. Contactless fare collection enhances passenger flow and operational efficiency.

Major Challenges

Security vulnerabilities in legacy systems continue to restrain market expansion. Outdated infrastructures struggle to withstand modern cyberthreats, leading to increased fraud risks and costly system maintenance.

Complex regulatory environments add compliance burdens for device manufacturers. Regional variations in standards, certifications, and data protection laws slow product rollouts and increase development costs.

Business Opportunities

Biometric and AI-driven authentication solutions offer strong opportunities. Demand for fraud prevention, real-time monitoring, and secure identity verification will fuel investment in intelligent, next-generation devices.

IoT-enabled multifunctional payment terminals present significant potential. Integrated platforms that combine payments, analytics, inventory management, and remote monitoring will appeal to SMEs and large enterprises seeking efficiency gains.

Regional Analysis

North America leads due to advanced digital ecosystems and high contactless payment adoption. Continuous upgrades in security frameworks and strong fintech presence reinforce its dominant market position.

Asia Pacific is growing rapidly with rising smartphone penetration, financial inclusion programs, and expanding e-commerce activity. Government-driven digital payment initiatives further accelerate regional device deployment.

Recent Developments

- In October 2025, RBI launched IoT-based UPI payments, enabling connected devices to conduct secure automated transactions.

- In October 2025, FiatPe released the Next 3-in-1 PoS device with integrated card reader, QR-based payments, and soundbox features.

- In January 2024, Ingenico introduced the iSC-M802 terminal with enhanced processing and connectivity for improved retail payment experiences.

Conclusion

The global payment devices market is poised for sustained growth as digital commerce accelerates and consumers demand secure, frictionless payment experiences. Innovations in biometrics, cloud management, IoT integration, and contactless technologies will continue shaping the market’s evolution. Organizations that invest in modern, interoperable, and customer-centric device ecosystems will be well positioned to capture emerging opportunities and lead the next wave of payment transformation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)