Table of Contents

Introduction

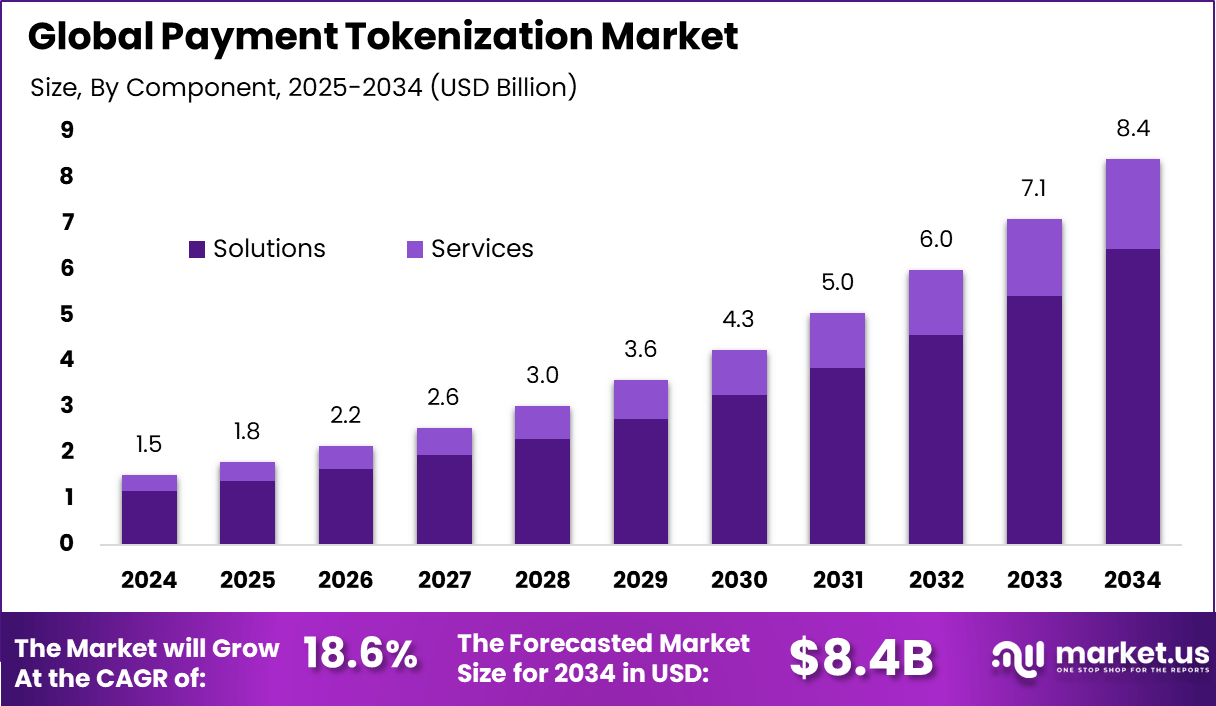

The Global Payment Tokenization Market is projected to grow from USD 1.5 billion in 2024 to approximately USD 8.4 billion by 2034, expanding at a CAGR of 18.6%. In 2024, North America held a dominant market position, capturing over USD 0.5 billion, driven by the region’s robust adoption of secure digital payment technologies.

Tokenization, which replaces sensitive payment card details with unique identifiers or tokens, plays a critical role in enhancing payment security. As cyber threats rise, the demand for tokenization solutions is expected to grow rapidly, particularly in sectors dealing with large-scale transactions.

How Growth is Impacting the Economy

The rapid growth of the payment tokenization market is significantly impacting the global economy by enhancing the security and efficiency of digital payments. As more consumers and businesses shift to online and mobile payment methods, the need for secure payment systems is growing. Tokenization reduces the risk of fraud and data breaches by ensuring that sensitive information, such as credit card numbers, is not stored on merchant servers.

This increase in transaction security is fostering consumer confidence in digital payments, leading to greater adoption across industries. The growth of the tokenization market is also driving job creation in cybersecurity, fintech, and regulatory compliance sectors. Moreover, it is contributing to the broader digital economy by supporting seamless and secure cross-border transactions. As digital payments become increasingly integral to everyday transactions, tokenization will play a vital role in maintaining the stability and trust in financial systems globally.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/payment-tokenization-market/free-sample/

Impact on Global Businesses

The increasing adoption of payment tokenization is transforming global businesses by providing a more secure and efficient way to process payments. As the cost of cybercrime rises, businesses are investing in tokenization solutions to mitigate risks related to payment fraud and data breaches. For sectors like retail, healthcare, and finance, tokenization enables smoother, more secure transactions, reducing the operational impact of cyber threats.

Additionally, tokenization allows businesses to comply with increasingly stringent data protection regulations, thus avoiding costly fines. Supply chain shifts are also impacted, as tokenization enables smoother financial transactions across borders, reducing friction in international trade. For sectors like e-commerce, the shift to tokenized payments is enhancing customer experience by offering faster and more secure checkout processes, driving customer satisfaction and business growth.

Strategies for Businesses

Businesses looking to leverage the growth in the payment tokenization market should focus on integrating tokenization technologies into their existing payment infrastructures. This includes adopting cloud-based tokenization solutions that can scale with business growth and provide secure, seamless payment experiences.

Partnering with payment processors and technology providers that specialize in tokenization can streamline the adoption process and ensure compliance with global security standards. Furthermore, businesses should invest in educating their workforce and customers on the benefits of tokenization, emphasizing its role in reducing fraud and ensuring data privacy. As the tokenization market grows, companies should also remain flexible, preparing to incorporate future technological advancements, such as blockchain and AI, which may further enhance payment security and efficiency.

Key Takeaways

- The payment tokenization market is projected to grow from USD 1.5 billion in 2024 to USD 8.4 billion by 2034, at a CAGR of 18.6%.

- North America holds a dominant share, accounting for over USD 0.5 billion in 2024.

- Tokenization enhances payment security, reducing fraud and data breaches.

- Growth driven by increasing demand for secure, scalable digital payment solutions.

- Key industries benefiting include retail, finance, healthcare, and e-commerce.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=169118

Analyst Viewpoint

The payment tokenization market is witnessing robust growth, driven by an increasing global demand for secure digital payments. Presently, tokenization is becoming a standard practice for businesses and consumers concerned about payment security. In the future, the market is expected to grow further, with advancements in artificial intelligence, machine learning, and blockchain likely to enhance the capabilities of tokenization platforms.

Tokenization will continue to evolve, becoming even more integrated into mobile and online payment systems, driving efficiency and security in financial transactions. This growth presents a positive outlook for both established and emerging businesses in the digital payment sector.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| E-commerce Payments | Increased demand for secure and seamless checkout |

| Mobile Wallet Integration | Rising adoption of mobile payments and wallets |

| Cross-Border Transactions | Need for secure international financial transactions |

| Financial Institutions | Compliance with evolving data protection regulations |

| Healthcare Payments | Protection of sensitive patient information |

Regional Analysis

North America holds a dominant market share in payment tokenization, with over USD 0.5 billion in revenue in 2024, attributed to its advanced digital payment infrastructure and high adoption rate of secure payment technologies. Europe is experiencing steady growth in tokenization, driven by strict data protection regulations and an expanding digital economy.

The Asia Pacific region is expected to exhibit the fastest growth, with increasing digital payments adoption and rising concerns over payment fraud in emerging markets. Global businesses in these regions are investing in tokenization to ensure secure transactions and comply with data privacy laws.

➤ Want more market wisdom? Browse reports –

- Solid State LiDAR Sensor Market

- Metaverse Dating Market

- Business Interruption Insurance Market

- AI Pet Camera Market

Business Opportunities

The growing demand for secure digital payment solutions presents significant business opportunities in the payment tokenization market. Companies that specialize in payment processing, cybersecurity, and data management are well-positioned to capitalize on this trend by offering tokenization services to businesses across industries.

E-commerce companies, financial institutions, and healthcare providers will drive the bulk of the demand for tokenization solutions, as they seek to protect sensitive customer data and comply with industry regulations. Additionally, as mobile payment systems and digital wallets continue to gain traction, businesses have an opportunity to develop integrated tokenization solutions to enhance the security and efficiency of these platforms.

Key Segmentation

The payment tokenization market is segmented into several key categories:

- By Application: E-commerce, mobile wallets, cross-border transactions, financial institutions, healthcare

- By Deployment: Cloud-based, on-premise

- By End-User: Retail, financial services, healthcare, government, others

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

These segments drive the market by providing tailored security solutions to various industries, promoting the widespread adoption of tokenization across different payment environments.

Key Player Analysis

Leading players in the payment tokenization market focus on providing end-to-end security solutions that comply with global regulations such as GDPR and PCI DSS. These companies are investing heavily in technology upgrades to support mobile and digital wallet integrations.

Additionally, partnerships between fintech firms and traditional banks are expanding the market reach of tokenization services. Players are also focusing on creating scalable tokenization platforms that can be easily integrated into existing payment systems, ensuring businesses of all sizes can benefit from the enhanced security tokenization offers.

- Visa, Inc.

- Mastercard, Inc.

- American Express Company

- Fiserv Incorporation

- Fidelity National Information Services, Inc. (FIS)

- PayPal Holdings, Inc.

- Thales Group

- Broadcom, Inc. (Symantec)

- Micro Focus International plc

- TokenEx, Inc.

- Lookout, Inc.

- Futurex, LP

- HelpSystems, LLC

- Marqeta, Inc.

- Bluefin Payment Systems, LLC

- Others

Recent Developments

- January 2025: A major financial institution launched a new tokenization service for mobile payments, enhancing transaction security.

- February 2025: A leading fintech company introduced AI-powered tokenization technology to improve fraud detection in digital transactions.

- March 2025: A partnership between a cloud-based payment processor and a healthcare provider introduced tokenization for patient billing systems.

- April 2025: A European bank implemented blockchain-based tokenization for cross-border transactions, reducing costs and increasing security.

- May 2025: A global payment gateway expanded its tokenization services to cover multiple payment methods, including crypto payments.

Conclusion

The payment tokenization market is experiencing strong growth, driven by increasing concerns over payment security and rising adoption of digital payment solutions. As tokenization technologies evolve, businesses across industries will continue to benefit from enhanced security and regulatory compliance, driving market expansion and creating new opportunities for innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)