Table of Contents

Payments Market size

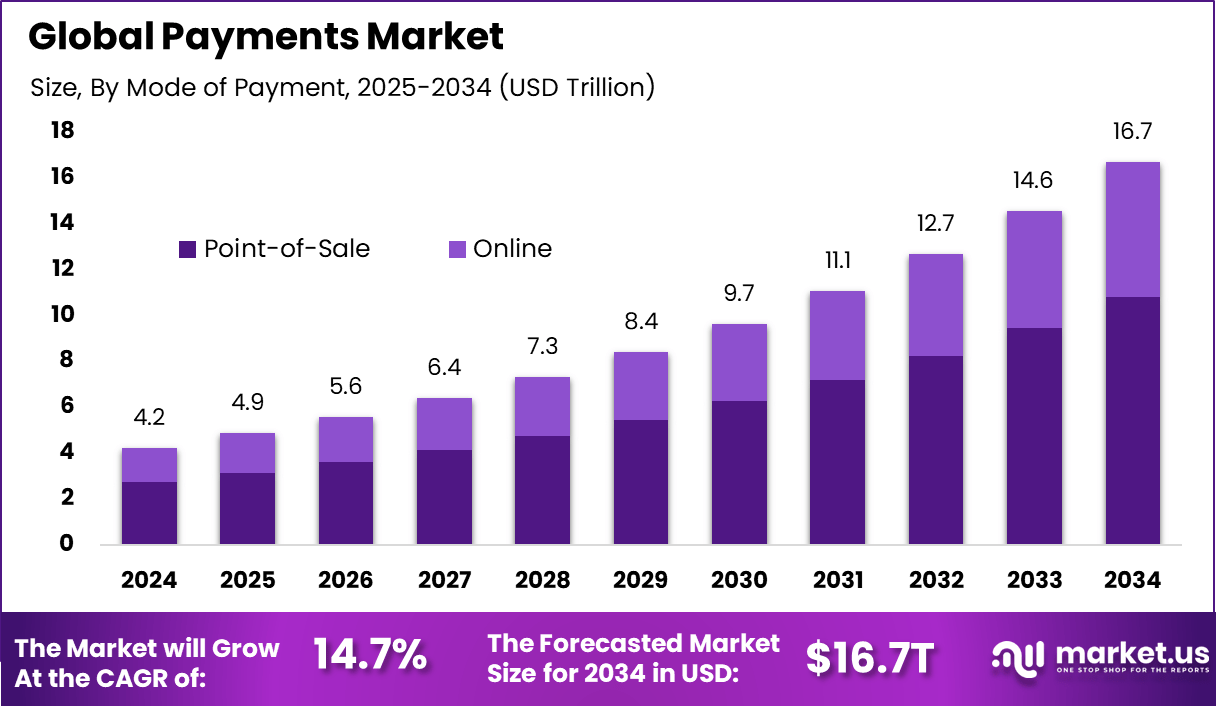

The global payments market was valued at USD 4.2 trillion in 2024 and is projected to reach approximately USD 16.7 trillion by 2034, expanding at a CAGR of 14.7% during the forecast period from 2025 to 2034. In 2024, North America led the market with more than 36.4% share, generating around USD 1.5 trillion in revenue.

The payments market covers systems and platforms that enable money to be transferred between individuals, businesses, and institutions. It includes cashless transactions such as card payments, digital wallets, bank transfers, and real-time payment methods. The market plays a central role in both consumer spending and business operations. Its importance continues to rise as economies move toward digital transactions.

The market operates across retail, e-commerce, banking, government, and cross-border trade. Payment providers focus on speed, security, and convenience to meet user expectations. Regulatory oversight is strong due to the financial and data-sensitive nature of transactions. As a result, the payments market remains both highly competitive and tightly regulated.

Payments Market Overview

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.2 Bn |

| Forecast Revenue (2034) | USD 16.7 Bn |

| CAGR(2025-2034) | 14.7% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Global digital payments have expanded rapidly over the past decade, reflecting a clear shift toward cashless transactions worldwide. Digital payment volumes reached USD 18.7 trillion in 2024, rising sharply from USD 1.7 trillion in 2014, as economies digitized and consumers increasingly adopted contactless, wallet-based, and online payment methods. Digital channels now account for 66% of global e-commerce transaction value and 38% of in-store payments, confirming a long-term structural move away from cash. This momentum is expected to continue as payment experiences become faster, more secure, and more integrated into daily commerce.

Digital wallets and account-to-account payments are at the center of this transition. Wallets are expected to support 61% of e-commerce transactions and 46% of point-of-sale payments by 2027, driven by smartphone penetration and growing consumer trust in digital platforms. Overall digital payment transaction value stood at USD 11.55 trillion in 2024 and is forecast to reach USD 16.62 trillion by 2028, supported by contactless usage, mobile-first behavior, and expanding cross-border trade.

Demand Analysis

Demand for payment solutions is rising across both consumer and enterprise segments. Consumers expect seamless payment experiences across online and offline channels. Businesses demand systems that integrate easily with accounting, inventory, and customer platforms. This has increased demand for flexible and interoperable payment technologies.

In emerging markets, demand is driven by financial inclusion initiatives and mobile payment adoption. Small businesses are adopting digital payments to reach wider customer bases. Cross-border commerce is also increasing transaction demand. Overall demand is becoming more diversified and continuous.

Increasing Adoption of Technologies

The payments market is seeing growing adoption of technologies such as contactless payments, tokenization, and real-time settlement systems. These technologies improve transaction speed and reduce fraud risks. Mobile-based payment solutions are becoming widely accepted in retail and service sectors. This shift supports a smoother user experience.

Cloud-based payment processing is also gaining adoption. It allows providers to scale operations efficiently and reduce infrastructure costs. Application programming interfaces support easier integration with third-party platforms. Together, these technologies are modernizing payment ecosystems. One key reason for adoption is the need for faster transaction processing. Businesses benefit from quicker settlements and reduced payment delays.

Consumers value instant confirmations and ease of use. These factors make digital payment systems more attractive than traditional methods. Another reason is improved security and transparency. Modern payment systems offer encryption, authentication, and real-time monitoring. This helps reduce fraud and build trust among users. Regulatory compliance requirements further encourage adoption of secure payment platforms.

Investment Opportunities

Investment opportunities exist across payment infrastructure, software platforms, and value-added services. Payment gateways, fraud prevention tools, and real-time processing systems attract steady investment. Financial institutions are upgrading legacy systems to remain competitive. These upgrades require long-term capital commitment.

Opportunities are also growing in embedded payments and cross-border solutions. Businesses seek payment systems that integrate directly into applications and platforms. International trade increases demand for efficient currency conversion and settlement tools. These areas continue to attract strategic investment.

Emerging Trends

In the payments market, one significant trend is the rise of digital and contactless payment solutions that enable consumers and businesses to complete transactions using mobile wallets, QR codes, and wearable devices. These methods reduce reliance on cash and physical cards while enhancing the speed and convenience of payments across retail, transport, and service environments. The increasing adoption of contactless interfaces reflects shifting user preferences toward frictionless checkout experiences.

Another emerging trend is the integration of payments with broader digital platforms and ecosystems such as e-commerce marketplaces, social commerce channels, and subscription services. Payments are being embedded directly into user journeys, allowing consumers to complete purchases without leaving native applications. This embedding of payment capabilities supports seamless interactions and deeper commercial engagement across digital touchpoints.

Growth Factors

A key growth factor in the payments market is the expansion of global digital commerce activity. As e-commerce and mobile commerce continue to grow, the volume of electronic transactions rises correspondingly. Consumer preference for online buying, accelerated by convenience and choice, drives demand for reliable, secure, and varied payment options that can support cross-border flows and multi-currency usage.

Another important growth factor is the expansion of payment infrastructure and interoperability frameworks. Improvements in real time payment rails, interbank settlement systems, and open banking standards support faster and more accessible payment flows. These infrastructure enhancements enable new entrants, encourage competition, and expand payment options for consumers and merchants alike.

Driver

A primary driver of the payments market is the consumer demand for convenience and speed. Users increasingly expect payment experiences that are fast, intuitive, and integrated into everyday activities such as online shopping, bill payments, and peer-to-peer transfers. Providers that deliver streamlined experiences with minimal friction are better positioned to capture higher transaction volumes and improve customer loyalty.

Another driver is the focus on financial inclusion and expanded access to digital financial services. Digital payments help bring unbanked and underbanked populations into formal financial systems by offering accessible alternatives to traditional banking. Mobile money solutions and simplified digital onboarding contribute to broader participation in digital finance.

Restraint

A notable restraint in the payments market is the complexity of regulatory compliance across regions. Payment service providers must navigate diverse legal frameworks that govern licensing, anti-money laundering controls, data protection, and consumer rights. Balancing compliance requirements with competitive service offerings increases operational burden and can slow market entry or expansion in certain jurisdictions.

Another restraint relates to fraud and security concerns. As digital payments proliferate, so do attempts to exploit vulnerabilities such as credential theft, account takeover, and payment fraud. Providers must invest in robust security measures, identity verification protocols, and fraud detection systems, which can raise costs and complexity in service delivery.

Opportunity

An opportunity in the payments market lies in the development of integrated value-added services, such as real time loyalty rewards, personalised offers, and financial management tools. Platforms that combine payments with contextual services can increase engagement and differentiate offerings in competitive environments. These enhanced experiences can drive both transaction frequency and customer retention.

Another opportunity exists in expanding cross-border payment solutions that reduce cost, improve transparency, and shorten settlement times. As global commerce grows, providers that enable efficient international payments, simplified currency conversion, and competitive pricing can capture new customer segments and deepen participation in global flows.

Challenge

A central challenge is the balance between innovation and security. While new payment technologies must deliver convenience and seamless experiences, they must also safeguard against threats that compromise consumer data and transactional integrity. Developing solutions that are both user friendly and highly secure requires continuous investment and vigilance.

Another challenge is the management of interoperability across diverse platforms and standards. Ensuring that payment solutions work smoothly across different devices, networks, currencies, and regulatory domains demands careful design, testing, and coordination. Fragmentation in technology and regulation can slow the adoption of unified payment experiences.

Key Market Segments

By Mode of Payment

- Point-of-Sale

- Card (Debit, Credit, Pre-paid)

- Digital Wallets (Apple Pay, Google Pay, Interac Flash)

- Cash

- Other POS (Gift-cards, QR, Wearables)

- Online

- Card (Card-Not-Present)

- Digital Wallet & Account-to-Account (Interac e-Transfer, PayPal)

- Other Online (COD, BNPL, Bank Transfer)

By Interaction Channel

- Point-of-Sale

- E-commerce/M-commerce

By Transaction Type

- Person-to-Person (P2P)

- Consumer-to-Business (C2B)

- Business-to-Business (B2B)

- Remittances & Cross-border

By End-user Industry

- Retail

- Entertainment & Digital Content

- Healthcare

- Hospitality & Travel

- Government & Utilities

- Other End-user Industries

Top Key Players in the Market

- Visa Inc.

- Mastercard Incorporated

- China UnionPay Co., Ltd.

- Ant Group Co., Ltd. (Alipay)

- PayPal Holdings, Inc.

- Apple Inc. (Apple Pay)

- Google LLC (Google Pay)

- Amazon.com, Inc. (Amazon Pay)

- American Express Company

- Adyen N.V.

- Stripe, Inc.

- Block, Inc. (Square & Afterpay)

- Worldline SA

- Fidelity National Information Services, Inc. (FIS)

- Fiserv, Inc.

- Global Payments Inc.

- Klarna Bank AB

- Razorpay Software Pvt. Ltd.

- PayU Payments Pvt. Ltd.

- Revolut Ltd.

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)