Table of Contents

Market Overview

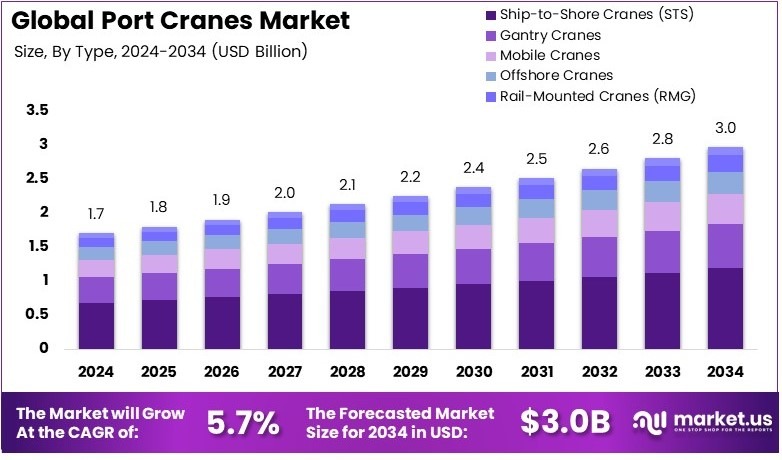

The Global Port Cranes Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period.

The Port Cranes Market is growing fast. Global trade and port expansions drive demand. Efficient cargo handling is critical for modern ports. SENNEBOGEN cranes lead in port logistics. They offer a working radius up to 40 m, improving coverage and speed. Single-girder gantry cranes handle up to 10 tonnes. Double-girder gantry cranes lift up to 60 tonnes.

Market opportunities are strong. Ports invest in smart and automated cranes. Automation reduces downtime and human error. About 90% of crane accidents occur due to human mistakes. Safety-focused upgrades are key.

Government funding supports growth. Regulations push for safer and greener cranes. Infrastructure budgets are rising worldwide. Policies encourage energy-efficient and advanced equipment. This boosts market entry for new players.

The Port Cranes Market offers high returns. Manufacturers and operators can expand quickly. Investors benefit from rising trade volumes. Modern ports seek reliable and powerful crane solutions. Automation, safety, and efficiency remain top priorities.

Key Takeaways

- The Port Cranes Market was USD 1.7B in 2024, reaching USD 3.0B by 2034 at 5.7% CAGR.

- Ship-to-Shore Cranes (STS) held 40.3% share in 2024, driven by global maritime trade.

- Port Loading and Unloading led with 47.2% in 2024 due to growing container traffic.

- Cranes above 500 Tons capacity dominated at 35.6%, handling heavy cargo efficiently.

- Electric Cranes reached 50.8% in 2024, boosting energy-efficient port operations.

- APAC led with 37.2%, valued at USD 0.63B, backed by port modernization and trade.

Market Drivers

- Global trade growth and containerization boost demand for advanced port cranes.

- Port modernization drives investment in high-capacity crane systems.

- Mega ships need cranes with higher lifting capacity and longer reach.

- Automation & smart tech improve crane precision, safety, and efficiency.

Challenges

- High investment costs can limit crane adoption for smaller ports.

- Maintenance & operations require skilled staff and high expenses.

- Space constraints make installing large cranes difficult in some harbors.

- Environmental regulations increase costs for eco-friendly compliance.

Segmentation Insights

Type Analysis:

Ship-to-Shore Cranes (STS) lead with 40.3% share. They handle containers directly from ships and are vital in major ports. Other cranes like Gantry, Mobile, Offshore, and Rail-Mounted have smaller shares.

Application Analysis:

Port Loading and Unloading dominates with 47.2% share. High-capacity, fast cranes meet growing container demand. Shipbuilding, aerospace, and construction use cranes but on a smaller scale.

Load Capacity Analysis:

Cranes above 500 tons hold 35.6% share for heavy loads like large ships and equipment. Smaller cranes under 50 tons or 50–200 tons serve smaller ports and mid-sized operations.

Power Source Analysis:

Electric cranes lead with 50.8% share for efficiency and low emissions. Diesel cranes are used where electricity is limited, and hybrid cranes offer flexibility with lower fuel use.

Regional Insights

Asia Pacific: 37.2% share, led by China, Japan, and India. Growth driven by industrialization, port upgrades, and major trade hubs.

North America: Strong U.S. ports like Los Angeles and New York push automation and cargo efficiency.

Europe: Netherlands and Germany invest in modern cranes to handle larger ships and boost efficiency.

Middle East & Africa: Dubai and Suez modernize ports for bigger container ships.

Latin America: Brazil and Mexico upgrade ports to support growing trade.

Recent Developments

- In January 2025, Hutchison Ports Thailand acquired advanced cranes for Laem Chabang Port, enhancing its cargo handling efficiency. This investment aims to strengthen the port’s operational capacity and support growing trade volumes.

- In February 2024, $20 billion in U.S. funding was allocated to boost port cranes and cybersecurity initiatives, ensuring safer and more automated port operations. The funding focuses on upgrading technology to meet global trade demands.

- In December 2024, the HIPG announced a major investment of $41 million in crane technology, with full operational deployment expected by January 2025. This move targets improved loading speeds and more efficient container management.

- In February 2025, DP World committed £60 million to expand the UK’s trading capacity, ordering four new quay cranes for its Southampton container terminal. The investment is intended to increase throughput and streamline port logistics.

Conclusion

The Global Port Cranes Market will reach USD 3.0B by 2034 at 5.7% CAGR. Growth is driven by global trade, port expansion, and automation. APAC leads, with strong investments in modern, energy-efficient cranes. High costs remain a challenge, but demand for safer, faster, and smart cranes creates major opportunities.