Table of Contents

Introduction

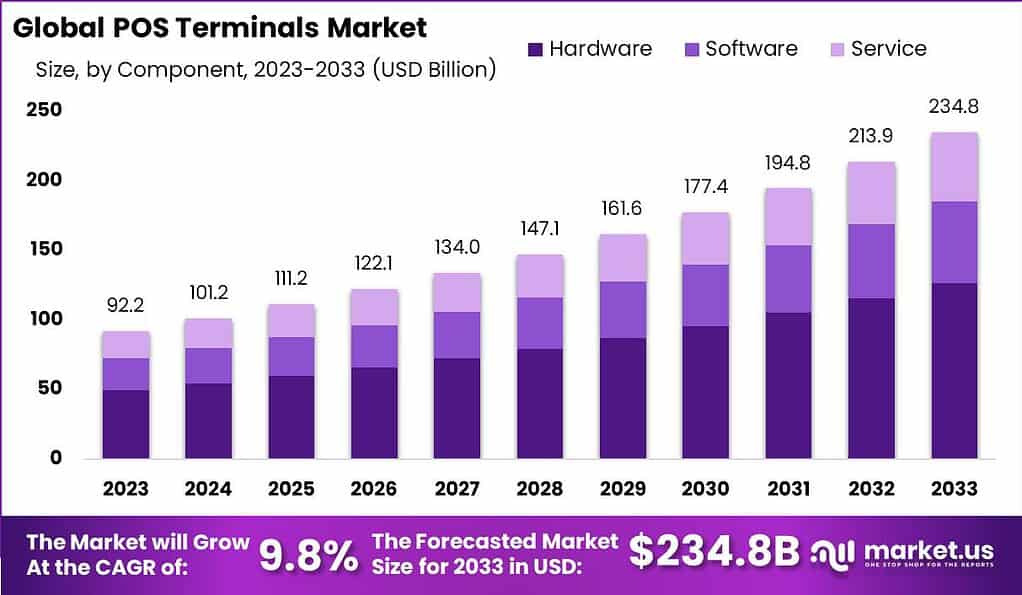

According to Market.us, The Global POS Terminals Market is poised for significant growth, projected to expand from USD 92.2 Billion in 2023 to approximately USD 234.8 Billion by 2033, with a Compound Annual Growth Rate (CAGR) of 9.8% over the forecast period from 2024 to 2033.

Point of Sale (POS) terminals are electronic devices used in retail and hospitality industries to process card payments. These devices can manage multiple operations such as sales management, inventory management, and customer management. Modern POS terminals are highly integrated and often feature capabilities for additional functionalities such as employee management, CRM, and marketing. With technological advancements, POS terminals have evolved from traditional checkout terminals to comprehensive management systems that can be operated from mobile devices and cloud-based platforms.

The demand for POS terminals has been driven by the increasing need for more efficient transactional operations across various business sectors. Key factors contributing to the growth of the POS terminals market include the rise in cashless transactions globally, advancements in wireless communication technology, and a growing emphasis on customer experience and management. Enhanced security features and the integration of value-added services have also played a crucial role in the adoption of modern POS terminals.

The market for POS terminals presents significant opportunities, especially in the development and deployment of mobile and wireless POS solutions in emerging markets. As businesses seek to enhance operational efficiency and customer interaction, the demand for POS systems capable of supporting digital payments and loyalty programs is expected to rise.

Additionally, the integration of AI and machine learning for better inventory and sales analytics offers further growth prospects. The trend towards omni-channel retailing and the adoption of eco-friendly, paperless transactions are also expected to open new avenues for market expansion.

Key Takeaways

- The global POS Terminals market is anticipated to exhibit substantial growth, with projections estimating the market size to escalate to USD 234.8 Billion by 2033, from USD 92.2 Billion in 2023. This represents a robust compound annual growth rate (CAGR) of 9.8% over the forecast period from 2024 to 2033.

- In the segmental analysis for 2023, the Hardware component of POS terminals secured a commanding lead, holding more than 54% of the market share. This dominance underscores the significant investment in physical POS infrastructure across various industries.

- The market for Fixed POS Terminals also demonstrated considerable strength, capturing over 62% of the global POS terminals market. This suggests a continued reliance on traditional, stationary POS systems in numerous commercial settings.

- Cloud-Based POS solutions have increasingly been adopted, evidenced by their commanding more than 50% market share in 2023. This shift is indicative of the market’s movement towards more scalable, flexible, and remotely accessible systems.

- Regarding operating platforms, the Windows/Linux systems maintained a significant presence in the POS Terminals market, comprising over 48% of the market share. This indicates a strong preference for these operating systems due to their robustness and wide acceptance in commercial environments.

- The Retail sector remained a prominent user of POS terminals, holding more than 40% of the market share in 2023. This sector’s dominance highlights the critical role of POS systems in facilitating transactions and enhancing customer service in retail environments.

- Geographically, the Asia-Pacific (APAC) region led the global market, capturing more than 38% of the market share, with revenues surpassing USD 35 billion in 2023. The region’s dominance is driven by rapid economic development, increasing retail and hospitality sectors, and growing adoption of advanced technologies in countries such as China, India, and Japan.

POS Terminals Statistics

- The Global Restaurant Point of Sale Terminal Market is projected to reach a value of approximately USD 51.3 billion by 2033, up from USD 22.7 billion in 2023, marking a Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period from 2024 to 2033.

- The Global mPOS Terminal Market is anticipated to grow significantly, reaching an estimated USD 106.8 billion by 2033, from USD 38.3 billion in 2023. This represents a CAGR of 10.8% during the forecast period from 2024 to 2033.

- The Global Retail POS Market is expected to expand to USD 73.3 billion by 2033, from USD 27.0 billion in 2023, with a growth rate of 10.5% CAGR throughout the period from 2024 to 2033.

- Finally, the Global Wireless POS Terminals Market is forecasted to reach USD 29.8 billion by 2033, rising from USD 10.5 billion in 2023, with a CAGR of 11.0% during the forecast period from 2024 to 2033.

- Approximately 90% of restaurants utilize POS data to inform their discounting, loyalty programs, and marketing strategies. This data also aids in menu optimization and enhancing digital engagement.

- A survey indicated that 43% of restaurant operators plan to research and implement new POS systems in 2024, focusing on platforms with advanced features such as mobility and cloud integration.

- The use of handheld POS terminals in restaurants has surged, with 61% of operators using them in 2022, a significant increase from just under 30% in 2017.

- Cloud-based POS systems are becoming increasingly popular, projected to surpass $30 billion by 2031, with a CAGR of nearly 25% from a value of $3.9 billion in 2022.

- As per Worldmetrics survey, the adoption of EMV-compliant POS terminals has increased by 590% in the past five years. The average acceptance rate of Apple Pay at POS terminals in the US is 65%.

- 86% of small business owners believe mobile POS technology improves their customer service. Manual entry errors at POS terminals account for over 70% of transaction mistakes in retail.

Emerging Trends

- AI and Machine Learning Integration: POS systems are increasingly incorporating AI and machine learning to enhance customer experiences, optimize inventory management, and improve decision-making processes. These technologies help in analyzing customer behaviors to tailor product suggestions and promotions effectively.

- Mobile and Cloud-Based Solutions: The shift towards mobile and cloud-based POS systems is prominent, offering businesses flexibility to conduct transactions remotely and manage operations from anywhere, which is crucial for scalability and adaptability in various business environments.

- Enhanced Security Measures: With the rise in digital transactions, robust security features like end-to-end encryption, tokenization, and multi-factor authentication are becoming standard to protect sensitive customer data against breaches and frauds.

- Contactless Payments and Digital Wallets: The trend towards contactless transactions continues to grow, driven by the need for quicker and safer payment methods. This includes support for NFC, QR codes, and various digital wallets, aligning with consumer expectations for convenience and safety.

- Advanced Data Analytics: POS systems are being equipped with advanced analytics to provide real-time insights into sales, inventory, and customer preferences, helping businesses make informed decisions and tailor their strategies to better meet market demands.

Top Use Cases for POS Terminals

- Retail Enhancements: In retail, POS systems streamline operations by integrating sales channels, managing inventory, and offering personalized customer experiences through data-driven insights.

- Hospitality Management: For hospitality, mobile POS solutions facilitate seamless service delivery in restaurants and hotels, managing orders and payments efficiently and improving guest experiences

- Healthcare Applications: In healthcare settings, POS systems help manage billing and patient data securely, providing robust solutions that cater to sensitive environments.

- Service Industry Adaptability: POS systems in service sectors like salons and gyms offer tailored solutions for booking, billing, and customer management, enhancing operational efficiency and client satisfaction.

- E-commerce Integration: For e-commerce, cloud-based POS systems ensure that inventory and pricing are consistent across online and offline platforms, providing a unified customer shopping experience.

Major Challenges

- Data Security Concerns: As POS systems process sensitive payment information, data security remains a crucial challenge. The integration of advanced technology in POS systems, although beneficial, increases the vulnerability to cyber-attacks, requiring robust security protocols.

- Infrastructure Reliability: The effectiveness of POS terminals heavily relies on the underlying infrastructure. In many regions, especially in developing countries, the lack of reliable and advanced technological infrastructure can hinder the performance and reliability of POS systems.

- Integration Complexities: Modern POS systems, which are designed to integrate with various other technologies and systems, face challenges in seamless integration. This can result in operational disruptions and increased costs for businesses that struggle with the technical aspects of integration.

- High Initial Costs: Deploying modern POS systems involves significant initial investment, which can be a barrier for small to medium-sized enterprises (SMEs). These costs encompass hardware, software, and the necessary services for installation and maintenance.

- Regulatory Compliance: With the increasing focus on consumer data protection, POS systems must comply with stringent regulatory standards globally. This requires continuous updates and maintenance to ensure compliance with laws such as GDPR in Europe and similar regulations in other regions.

Top Opportunities

- Mobile POS Systems (mPOS): The rise of mPOS systems offers flexibility and mobility, allowing businesses to conduct transactions anywhere. This is particularly advantageous for service-oriented businesses and those operating in multiple locations.

- Contactless Payments: Increased consumer preference for contactless payments, driven by the need for convenience and hygiene, especially post-COVID-19, presents significant growth opportunities. POS systems that support NFC and other contactless technologies are becoming increasingly popular.

- Integrated Systems: There’s a growing demand for POS systems that integrate with other business management tools such as inventory and customer relationship management. These integrated systems offer comprehensive solutions that improve efficiency and provide valuable insights.

- Adoption in Emerging Markets: Rapid urbanization and economic development in emerging markets are driving the adoption of POS systems. As these markets continue to embrace digital payments, the demand for POS technology is expected to grow, offering a considerable expansion opportunity for providers.

- Technological Advancements: Innovations in AI, machine learning, and data analytics are transforming the POS market. These technologies help businesses enhance customer experiences and streamline operations, providing a competitive edge in the market.

Recent Developments

Acrelec

In March 2023, Acrelec introduced a new self-service kiosk integrated with advanced POS capabilities for quick-service restaurants. This solution aims to enhance customer experience and streamline operations.

AURES Group

In May 2023, AURES Group launched the “YUNO II” POS terminal, featuring improved processing power and a sleek design suitable for retail and hospitality sectors.

HM Electronics (HME)

HME announced in June 2023 the acquisition of a POS software company to expand its product offerings for the restaurant industry, aiming to provide integrated solutions for drive-thru and in-store operations.

Hewlett Packard Development LP (HP)

In April 2023, HP unveiled the “HP Engage Go” mobile POS system, designed to offer flexibility and mobility for retail and hospitality businesses.

NCR Corporation

In August 2023, NCR Corporation announced plans to split into two separate companies, focusing on digital commerce (including POS systems) and ATM operations, to better serve their respective markets.

Oracle

Oracle released updates to its Oracle MICROS Simphony POS system in February 2023, enhancing cloud-based functionalities to improve restaurant management and customer engagement.

Presto Group

In July 2023, Presto introduced an AI-powered voice ordering system compatible with existing POS terminals to increase efficiency in drive-thru restaurants.

Qu (Qu Inc.)

Qu announced in May 2023 the release of its next-generation unified POS platform designed to simplify restaurant operations and enhance guest experiences.

Quail Digital

In March 2023, Quail Digital launched a new wireless headset system integrated with POS terminals to improve staff communication in retail environments.

Revel Systems

In January 2023, Revel Systems updated its iPad-based POS platform, adding new features for online ordering and enhanced inventory management.

Toast Inc.

Toast Inc. introduced “Toast Mobile Order & Pay” in June 2023, allowing guests to order and pay from their mobile devices, integrating seamlessly with Toast POS systems.

Toshiba Corporation

In September 2023, Toshiba Global Commerce Solutions announced the “ELERA Commerce Platform,” offering scalable POS solutions with cloud-native architecture for retailers.

Conclusion

In conclusion, the POS terminals market is set to expand as businesses across various sectors continue to embrace advanced transactional technologies to enhance operational efficiency and customer satisfaction. The shift towards cashless payments and the integration of sophisticated functionalities like AI analytics and mobile connectivity in POS systems are key factors propelling this growth. Furthermore, the burgeoning opportunities in emerging markets and the push for omnichannel and eco-friendly solutions are likely to further drive the adoption of innovative POS terminals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)