Table of Contents

- Programmatic DOOH Platform Market Size

- Market Overview

- Top Market Takeaways

- Programmatic DOOH Platform Insights

- Top Driving Factors

- Demand Analysis

- Increasing Adoption Technologies

- Key Reasons for Adopting These Solutions

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Regional Analysis

- Key Market Segments

- Report Scope

Programmatic DOOH Platform Market Size

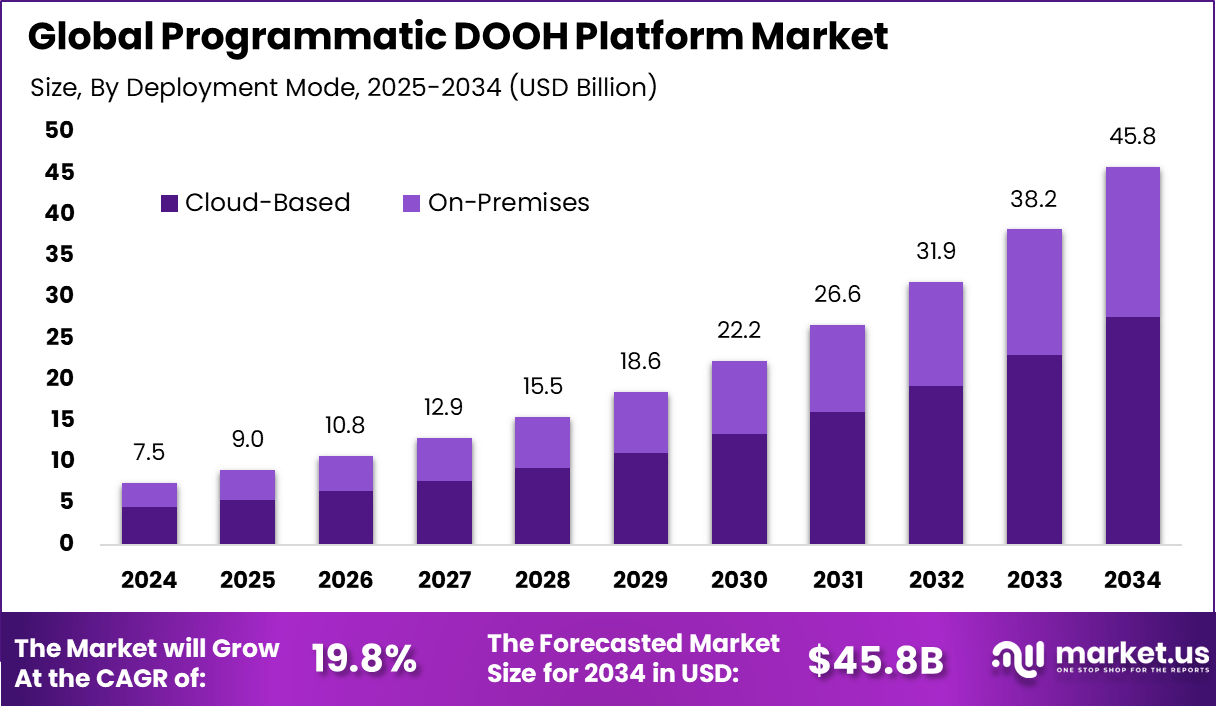

The global Programmatic DOOH Platform market generated USD 7.5 billion in 2024 and is expected to expand at a strong pace over the forecast period. Market revenue is projected to rise from USD 9.0 billion in 2025 to approximately USD 45.8 billion by 2034, reflecting a CAGR of 19.8% throughout the forecast span. This growth is supported by increasing adoption of automated advertising platforms and data driven outdoor media strategies. Advancements in real time bidding and audience targeting are further strengthening market expansion.

Programmatic DOOH advertising is expected to record steady spending growth in the near term. According to StackAdapt, programmatic DOOH ad spending is projected to rise by 22.6% in 2025 and reach USD 1.22 billion by 2026. This growth reflects increasing interest among advertisers in data driven outdoor campaigns. However, a survey indicates that 59% of marketers still depend on direct deals for OOH buying, suggesting that adoption is progressing gradually despite strong market interest.

Regional trends highlight continued leadership from major advertising markets. The United States is projected to remain a key contributor, with DOOH ad spending expected to reach USD 4.40 billion in 2025. In China, DOOH spending is forecast to reach USD 4.84 billion in 2025 and grow at a CAGR of 6.57% to approximately USD 6.65 billion by 2030. This expansion is supported by rapid urbanization and sustained investment in digital display infrastructure.

Market Overview

The programmatic digital out of home platform market refers to software platforms that enable automated buying, selling, and delivery of digital out of home advertising inventory. These platforms use data driven algorithms to place ads on digital screens such as billboards, transit displays, malls, airports, and retail locations in real time. Programmatic DOOH platforms connect advertisers, media owners, and demand side systems through centralized marketplaces. The market supports dynamic, location aware, and time sensitive advertising execution.

Market development has been driven by the digitization of out of home media and the shift toward automated advertising transactions. Advertisers increasingly seek the same flexibility and efficiency in physical world advertising that exists in digital channels. Programmatic platforms enable scalable campaign management and real time optimization across large screen networks. As cities and public spaces adopt digital signage, platform based DOOH delivery continues to expand.

Top Market Takeaways

- Software solutions led adoption with a 64.7% share, reflecting strong reliance on automated ad buying, real time bidding, and campaign optimization capabilities within programmatic DOOH ecosystems.

- Billboards remained the most influential format, capturing 45.5% share, as they continue to deliver broad visibility and consistent performance for large scale outdoor campaigns.

- The retail sector accounted for 38.5% share, supported by growing use of location based promotions, hyperlocal messaging, and strategies focused on converting physical store traffic.

- Cloud based deployment represented 60.2% share, indicating preference for scalable platforms that enable centralized campaign control, real time ad delivery, and performance analytics.

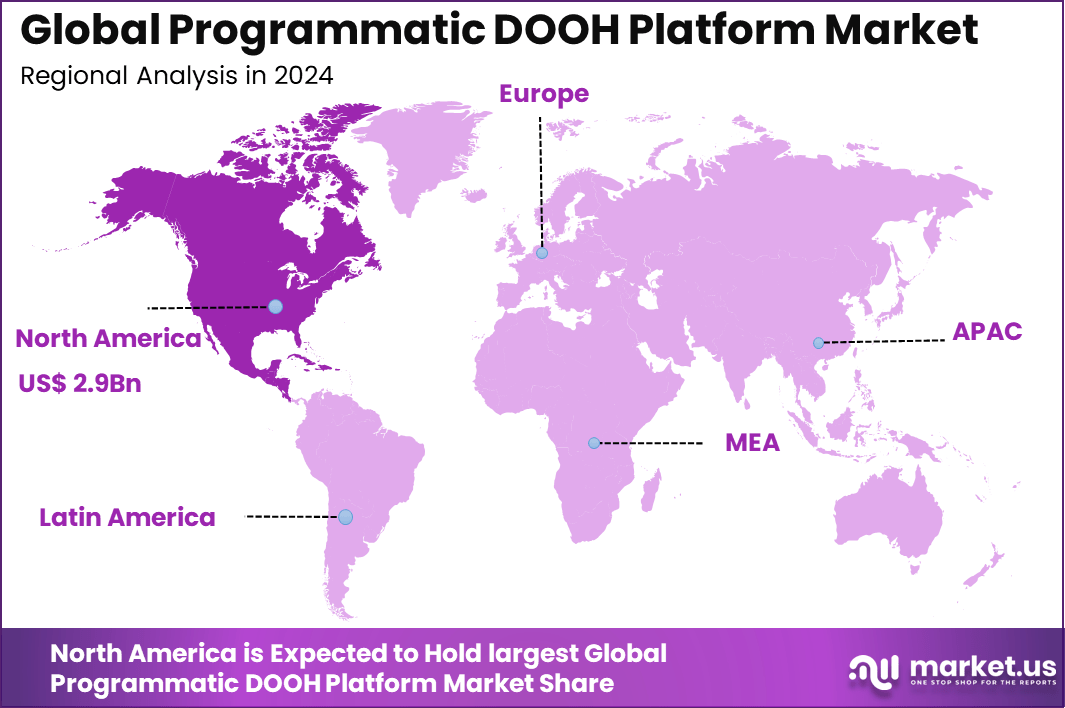

- North America held 39.3% share, driven by high penetration of digital signage, mature advertising technology infrastructure, and strong brand demand for automated outdoor media.

- The U.S. market reached USD 2.51 billion, expanding at a 15.2% growth pace, supported by rapid adoption of automated outdoor advertising across urban centers and commercial locations.

Programmatic DOOH Platform Insights

- Media professionals anticipated a 28% increase in programmatic DOOH investment over the next 18 months, reflecting strong confidence in automated outdoor advertising effectiveness.

- Programmatic DOOH adoption was expected to rise from 27% to 35% within 18 months, indicating fast progression toward market maturity.

- For the first time, 50% of DOOH campaigns in the past year were purchased partly or fully through programmatic channels, signaling a structural shift in buying behavior.

- When programmatic DOOH is managed by digital teams, 81% of budgets were reallocated from other digital channels, while 79% shifted from traditional media, showing convergence of media planning strategies.

- Use of dynamic creative optimisation was projected to increase, as its positive impact on campaign relevance and performance became more widely recognized.

- Sustainability considerations gained importance, with about 60% of marketers factoring environmental impact into programmatic DOOH investment decisions.

Top Driving Factors

One major driving factor of the programmatic DOOH platform market is the demand for data driven and flexible advertising execution. Brands want the ability to adjust creatives based on location, time of day, weather, or audience context. Programmatic platforms make this possible by automating ad placement decisions using predefined rules and data inputs. This flexibility increases campaign relevance and effectiveness.

Another key driver is the convergence of digital advertising practices with physical media. Marketers are extending omnichannel strategies beyond online environments into real world touchpoints. Programmatic DOOH platforms enable seamless integration with broader digital campaigns. This alignment supports unified measurement and planning across channels.

Demand Analysis

Demand for programmatic DOOH platforms is influenced by growing advertiser interest in high impact and brand safe environments. DOOH screens offer premium visibility in controlled public spaces where ad fraud and viewability issues are minimal. Programmatic platforms make this inventory easier to access and scale. As brand awareness campaigns grow, demand for automated DOOH buying increases. Demand is also shaped by media owner adoption of digital screens. Operators seek platforms that maximize inventory utilization and pricing efficiency. Programmatic systems allow real time demand matching and yield optimization. This supply side participation reinforces market growth.

Increasing Adoption Technologies

Cloud based advertising infrastructure has accelerated adoption of programmatic DOOH platforms. Cloud platforms support real time bidding, campaign orchestration, and scalable data processing across distributed screen networks. This architecture enables rapid deployment and global reach. Cloud adoption improves reliability and operational efficiency.

Data analytics and artificial intelligence technologies are also influencing adoption. These tools enable audience modeling, performance forecasting, and dynamic creative optimization. AI driven decision engines help select the most relevant ads for each display opportunity. Advanced analytics strengthen campaign effectiveness and platform value.

Accoridng to internetnewstimes.com, artificial intelligence is projected to be worth more than USD 3.6 trillion by 2034, underlining its long-term economic impact across industries. Investment intensity is also rising, as 10% of AI-using businesses now spend over USD 500,000 per year on AI technologies, signaling that AI is no longer experimental but a core strategic priority for many organizations.

Key Reasons for Adopting These Solutions

One key reason advertisers adopt programmatic DOOH platforms is improved campaign agility and control. Automated buying allows rapid adjustments without manual negotiations or delays. Campaigns can be activated or paused instantly based on performance or external factors. This responsiveness supports modern marketing requirements.

Another reason is enhanced targeting and contextual relevance. Programmatic platforms enable location based, time based, and situational targeting within physical environments. This precision improves message impact and reduces wasted impressions. Advertisers value the ability to align messages with real world context.

Investment Opportunities

Investment opportunities in the programmatic DOOH platform market exist in platforms that integrate audience measurement and attribution capabilities. Solutions that connect exposure data with mobile or retail outcomes can deliver stronger advertiser value. Investors may focus on platforms that bridge offline and online performance insights. Measurement innovation remains a key growth area.

Another opportunity lies in platform interoperability and global scalability. Solutions that support multiple demand sources, media owners, and regional regulations can capture broader market share. Expansion into smart city and retail media networks offers additional upside. Scalable and compliant platforms are positioned for long term growth.

Business Benefits

Adoption of programmatic DOOH platforms improves efficiency in media buying and selling. Automation reduces manual processes and shortens campaign setup times. Media owners benefit from optimized inventory utilization and pricing transparency. These efficiencies improve profitability across the ecosystem.

Programmatic platforms also support consistent brand messaging across channels. Integration with digital advertising systems enables coordinated creative execution. This consistency strengthens brand impact and recall. Businesses benefit from unified planning and execution capabilities.

Regulatory Environment

The regulatory environment for the programmatic DOOH platform market is influenced by advertising standards and data privacy regulations. While DOOH does not rely on personal identifiers, use of location and audience data must comply with privacy laws. Platforms are required to apply anonymization and consent based data practices. Compliance ensures responsible use of contextual data.

Advertising content regulations also affect platform operations. DOOH ads must adhere to local rules governing public messaging, safety, and decency. Platforms must enable compliance through content controls and approval workflows. Alignment with regulatory requirements supports sustainable adoption and public trust.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 39.3% of total revenue. The region generated around USD 2.9 billion, supported by high digital advertising spend and advanced advertising infrastructure. Strong presence of smart city projects and connected display networks strengthened regional leadership. As a result, North America continued to influence innovation and adoption trends in programmatic DOOH platforms.

Key Market Segments

By Component

- Software

- Services

By Application

- Billboards

- Transit

- Street Furniture

- Retail

- Others

By End-User

- Retail

- Automotive

- Entertainment

- BFSI

- Healthcare

- Others

By Deployment Mode

- Cloud-Based

- On-Premises

Top Key Players in the Market

- Vistar Media

- Broadsign

- Hivestack

- Clear Channel Outdoor

- JCDecaux

- Lamar Advertising Company

- Outfront Media

- Adomni

- Place Exchange

- Magnite

- The Trade Desk

- Verizon Media (Yahoo DSP)

- Firefly

- Quividi

- Ocean Outdoor

- Intersection

- Ströer SE & Co. KGaA

- Zeta Global

- Moving Walls

- Blip Billboards

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.5 Bn |

| Forecast Revenue (2034) | USD 45.8 Bn |

| CAGR(2025-2034) | 19.8% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)