Table of Contents

Introduction

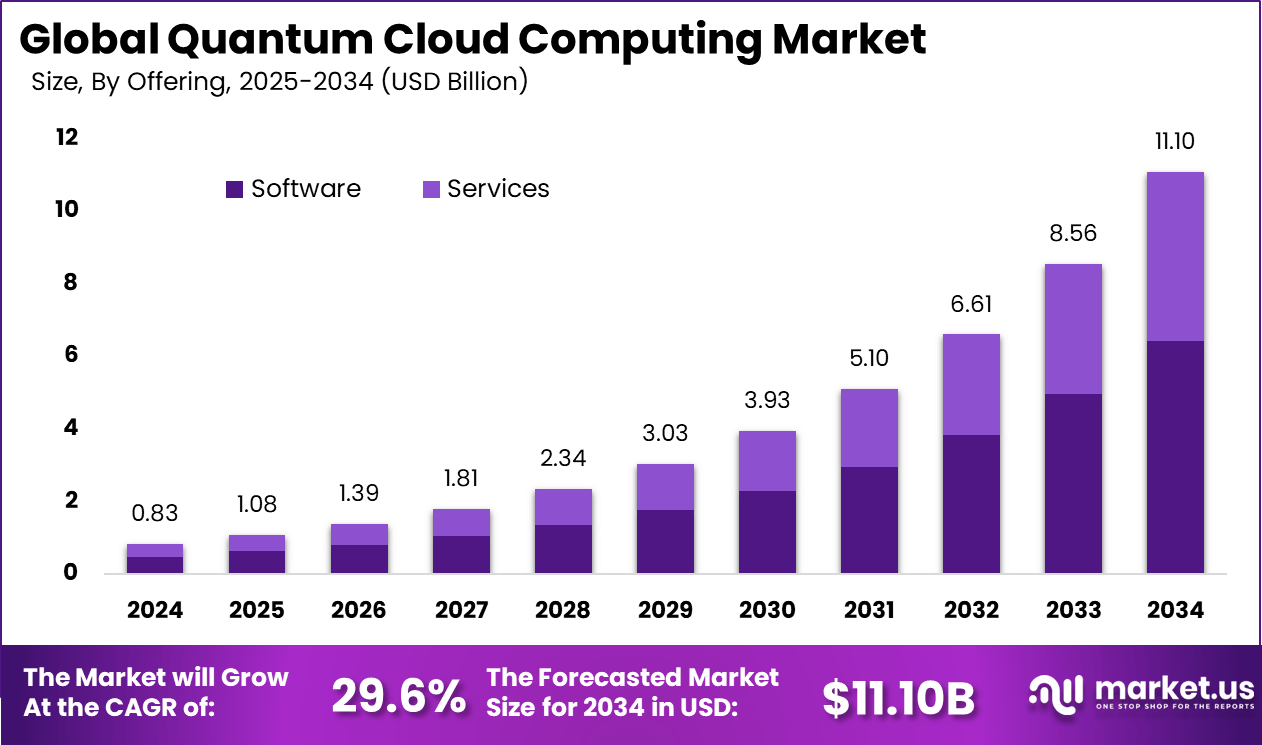

The global quantum cloud computing market size is expected to be worth around USD 11.10 billion by 2034, from USD 0.83 billion in 2024, growing at a CAGR of 29.6% during the forecast period. This significant expansion underscores the rapid shift toward cloud-based quantum services and reflects increasing enterprise demand for advanced computational capabilities.

The vast growth trajectory highlights how quantum cloud computing is moving from niche research applications into mainstream enterprise adoption. With North America holding a dominant share of over 42% in 2024 (USD 0.34 billion), the geography is leading the transformation even as global uptake accelerates.

How Growth is Impacting the Economy

The extraordinary growth of quantum cloud computing is expected to deliver a profound economic impact by enabling new productivity leaps and innovation cycles. By 2035, the quantum computing sector alone is projected to add more than USD 1 trillion to the global economy through gains in optimisation, simulation, and algorithmic capabilities.

With advanced industries like finance, healthcare and materials science adopting quantum-enabled services, companies are projected to reduce time-to-insight, speed product development and unlock cost efficiencies. This ripple effect is anticipated to spur job creation in high-tech talent, expand R&D investment, and catalyse ancillary industries such as quantum software and cloud infrastructure. The rise of quantum cloud models also means smaller organisations can access tools formerly limited to large labs, broadening the economic base of innovation.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/quantum-cloud-computing-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As quantum cloud computing becomes more mainstream, businesses face rising investment costs in quantum-capable infrastructure and talent to integrate services. Supply chain dynamics are shifting because hardware for quantum systems (such as specialised cooling setups, superconducting qubits, cryogenics) often requires rare materials and global supply networks, creating new dependency risks. Companies adopting quantum-cloud platforms must re-evaluate supply chain resilience and consider factors such as component scarcity and vendor lock-in.

Sector-Specific Impacts

In the financial services sector, quantum cloud solutions enable advanced risk modelling and portfolio optimisation, enabling competitive advantage in trading and asset management. Healthcare and pharmaceuticals, quantum-cloud-based simulation accelerates drug discovery and molecular modelling, compressing research timelines. In logistics and automotive, quantum cloud drives optimisation of routing, scheduling and battery design, reconfiguring supply networks. Across manufacturing and materials sciences, quantum cloud supports new material discovery and process simulation, altering product development cycles.

Strategies for Businesses

Businesses should prioritise building quantum cloud readiness by developing partnerships with quantum-as-a-service providers and training teams in quantum algorithms and hybrid quantum-classical computing. They should adopt a phased approach—beginning with pilot projects focusing on high-value optimisation challenges, then scaling to broader applications.

Firms should diversify supplier risk by engaging multiple quantum hardware/cloud providers and monitoring component supply chains for rare materials. They should integrate quantum cloud insights into digital transformation roadmaps and ensure governance frameworks recognise quantum risk (for cryptography, data security). Lastly, companies should monitor standardisation and regulatory developments in quantum computing to stay ahead of compliance- and interoperability-related disruptions.

Key Takeaways

- The quantum cloud computing market is projected to reach USD 11.10 billion by 2034, expanding at a ~29.6% CAGR.

- North America currently dominates with over 42% market share in 2024.

- The economic impact of quantum technologies could exceed USD 1 trillion by 2035.

- Businesses face rising investment and supply-chain complexity as quantum moves into enterprise use.

- Sector-level disruption is strongest in finance, healthcare, logistics, and materials science.

- Strategy should emphasise pilot adoption, talent up-skilling, supplier diversification, and governance readiness.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161437

Analyst Viewpoint

The present landscape for quantum cloud computing exhibits strong growth fundamentals driven by enterprise demand and technological advancement. With the market accelerating, the future outlook remains positive: as quantum hardware barriers diminish and cloud-based access becomes more affordable, adoption is expected to broaden significantly across industries.

Competitive advantage will accrue to early movers and those establishing ecosystem partnerships. Over the next decade, quantum cloud services are anticipated to become a core element of enterprise computing infrastructure rather than niche experimentation. The long-term positive view is underpinned by the transformative potential of quantum algorithms, hybrid-cloud models, and global investment momentum.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Drug discovery simulation | Increasing need for faster molecular modelling; cloud access lowering hardware barriers |

| Financial portfolio optimisation | Rising complexity in risk modelling; quantum cloud enabling faster scenario analysis |

| Supply-chain routing and scheduling | Logistics complexity rise; quantum cloud enabling optimisation across large variable sets |

| Material science and manufacturing simulation | Demand for novel materials and reduced development cycles; quantum-cloud backed simulation power |

| Cryptography and security enhancement | Growing cyber-threats; need for quantum-safe algorithms and cloud-based quantum services |

Regional Analysis

North America continues to hold the largest share of the quantum cloud computing market, accounting for over 42% in 2024, driven by robust cloud infrastructure, venture capital investment and strong technology provider presence. Europe and Asia Pacific are expected to register higher growth rates over the forecast period, as national programmes accelerate quantum research, cloud adoption expands and global competitiveness intensifies. Asia Pacific in particular is poised for rapid uptake due to increasing digitalisation, government initiatives and emerging quantum-software ecosystems. The diversification of quantum cloud centres globally suggests a gradually more balanced regional footprint in the mid-term.

➤ More data, more decisions! see what’s next –

- Parallel Computing Market

- Zero-emission Aircraft Market

- Data Monetization Platform Market

- Recurring Payments Market

Business Opportunities

The expanding quantum cloud computing market presents multiple business opportunities: service providers can launch quantum-as-a-service offerings tailored to industry verticals such as healthcare, finance and logistics. Software firms can develop quantum-algorithm libraries, emulators and hybrid quantum-classical platforms.

Infrastructure companies can build quantum-ready cloud data-centres and cooling/cryogenics supply chains. Consulting firms can advise enterprises on quantum strategy, readiness and integration. Emerging markets offer opportunities for localised quantum-cloud hubs and training platforms. For enterprises themselves, early adoption of quantum cloud can deliver competitive differentiation through speed, insight and scalability of complex computations.

Key Segmentation

Segmentation in the quantum cloud computing market covers product type, deployment model, application and end-user. Product type distinctions include hardware, software and services. Deployment models span public cloud, private cloud and hybrid cloud. Applications extend to optimisation, machine learning/AI, cryptography, simulation and logistics.

End-users include healthcare & pharmaceuticals, BFSI, IT & telecom, aerospace & defence, energy & utilities. Each segment is influenced by enabling technologies, industry-specific needs and cloud-based access trends, creating a layered market structure that supports both horizontal and vertical growth.

Key Player Analysis

Major players in the quantum cloud computing sector are advancing portfolio breadth, forging partnerships and investing in R&D to strengthen their position. They are expanding cloud-based quantum access, integrating hardware and software stacks, and pursuing geographic expansion to capture global demand.

Collaboration with academic institutes and industry consortia enables these companies to drive algorithm development and enterprise adoption. Their strategies include the acquisition of niche firms, investment in talent, and the establishment of quantum-cloud trial hubs. Competitive differentiation is increasingly tied to ecosystem strength, cloud service scalability, and industry-specific quantum applications.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc. (AWS)

- Baidu. Inc

- Huawei Technologies Co., Ltd.

- Quantum Computing Inc

- Terra Quantum

- Spinq

- QpiCloud

- CERN

- Others

Recent Developments

- A published analysis projects that quantum computing could add more than USD 1 trillion to the global economy between 2025 and 2035.

- Quantum cloud market drivers include the increasing demand for advanced computational capabilities and rising adoption of cloud-based quantum infrastructure.

- Government programmes in Europe and Asia Pacific are accelerating quantum cloud infrastructure funding and ecosystem development.

- Quantum computing cloud service reports identify quantum-as-a-service as one of the fastest growing models.

- Growth drivers also include the need for high-speed computation in industries such as pharmaceuticals, logistics and AI-enabled services.

Conclusion

The quantum cloud computing market is on a strong growth trajectory, offering transformational potential across industries. Businesses that act now to build capability, partner strategically and leverage quantum-cloud platforms are better positioned to gain sustainable competitive advantage.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)