Table of Contents

- Report Overview

- Market Key Insights

- Operational and Business Impact Insights

- Top Driving Factors

- Regional Analysis

- Drivers Impact Analysis

- Risk Impact Analysis

- Opportunity Analysis

- Challenge Analysis

- Market Narrative

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Key Market Segments

- Report Scope

Report Overview

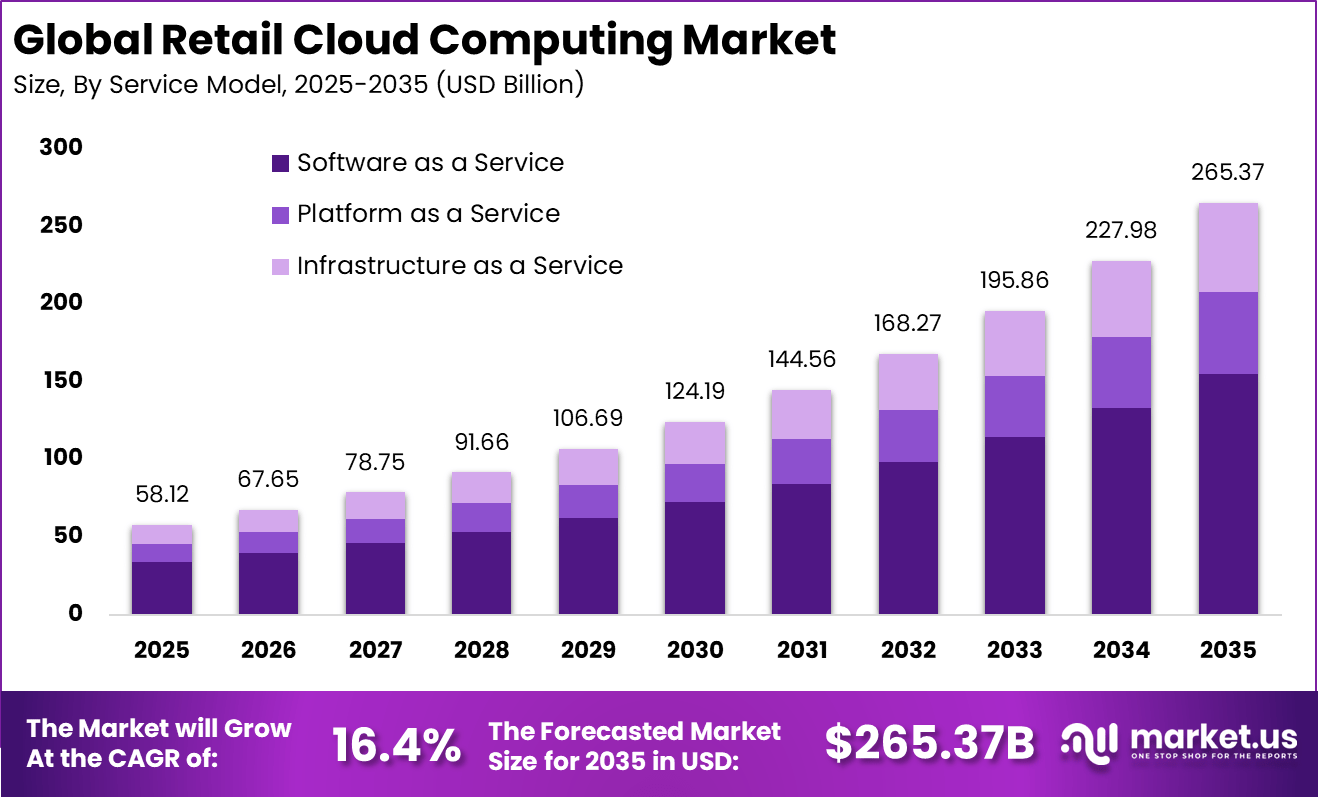

The global Retail Cloud Computing market was valued at USD 58.12 billion in 2025 and is expected to expand strongly over the forecast period. The market is projected to reach approximately USD 265.37 billion by 2034, growing at a CAGR of 16.4% from 2025 to 2035. This growth is driven by increasing adoption of cloud based retail platforms, real time inventory management, and data driven customer engagement solutions. Retailers are leveraging cloud infrastructure to improve scalability, operational efficiency, and omnichannel experiences.

The retail cloud computing market refers to the use of cloud-based infrastructure, platforms, and software solutions to support retail operations and digital commerce activities. These solutions help retailers manage data storage, point-of-sale systems, inventory, customer engagement platforms, and analytics through centralized cloud environments. Cloud computing enables retailers to operate across physical and digital channels with greater flexibility. Adoption spans large retail chains, online retailers, and small retail businesses.

Market Key Insights

- In 2025, Software as a Service led the market with a 68% share, showing clear retailer preference for scalable, subscription based platforms that lower IT complexity and accelerate deployment.

- The public cloud deployment model captured a 60% share in 2025, supported by flexibility, rapid scalability, and reduced upfront infrastructure investment.

- Large enterprises accounted for 65% of total adoption, reflecting higher digital maturity and stronger capacity to invest in advanced cloud ecosystems across multiple regions and retail formats.

- Omnichannel retail and customer experience applications held a dominant 65% share, confirming that seamless integration of online and offline channels remained the primary objective of cloud investment.

- Supermarkets and hypermarkets also captured 65% share, driven by high transaction volumes, complex supply chains, and the need for real time inventory visibility.

- The United States remained a key adoption market in 2025, supported by early technology uptake and strong enterprise cloud readiness.

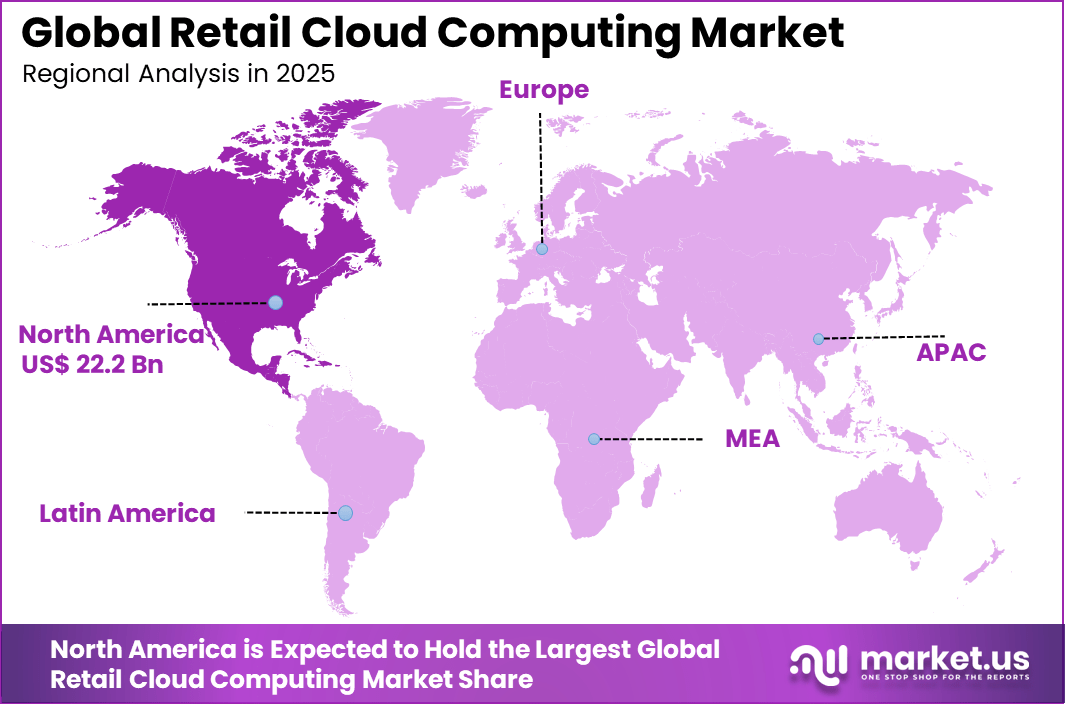

- North America maintained regional leadership with more than a 38.21% share, reflecting deep cloud penetration and advanced retail digital infrastructure.

Operational and Business Impact Insights

- Sales performance improved significantly, as retailers adopting cloud platforms reported sales gains of up to 95%. This growth was enabled by unified sales channels and real time access to customer and inventory data.

- Cost efficiency strengthened, with average operational costs declining by 30% to 40% following cloud adoption. Savings were achieved through infrastructure optimization, lower maintenance effort, and improved resource utilization.

- Customer experience emerged as a core driver, as 73% of shoppers used multiple channels during their purchase journey. As a result, nearly 80% of retailers prioritized cloud enabled omnichannel integration.

- AI adoption expanded across retail operations, with about 71% of retailers using cloud based AI and machine learning for supply chain planning. At the same time, 86% applied these tools to automate retail operations, improving speed, accuracy, and decision support.

Top Driving Factors

One major driving factor of the retail cloud computing market is the growth of omnichannel retail strategies. Retailers aim to deliver a unified shopping experience across physical stores, mobile apps, and online platforms. Cloud computing supports real-time data synchronization across channels. This capability improves inventory accuracy, order fulfillment, and customer experience.

Another key driver is the need for operational scalability and cost efficiency. Retail demand fluctuates due to seasonal sales, promotions, and changing consumer behavior. Cloud infrastructure allows retailers to scale computing resources up or down as needed. This flexibility reduces capital expenditure and supports efficient cost management.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 38.21% of total revenue. The region generated around USD 22.2 billion, supported by advanced digital retail ecosystems and high cloud adoption among large retailers. Strong investment in analytics, AI driven personalization, and e commerce infrastructure strengthened regional leadership. As a result, North America continues to influence technology adoption trends in the retail cloud computing market.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Omnichannel retail expansion | Integration of online and offline retail operations | ~4.2% | North America, Europe | Short to Mid Term |

| Demand for real time analytics | Data driven pricing and inventory decisions | ~3.6% | Global | Short Term |

| Growth of e commerce platforms | Need for scalable and flexible infrastructure | ~3.1% | Global | Mid Term |

| Cost optimization focus | Shift from capital expenditure to operational models | ~2.8% | Global | Mid Term |

| AI driven customer engagement | Personalized shopping experiences | ~2.7% | North America, Asia Pacific | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Data security concerns | Exposure of customer and payment data | ~3.4% | Global | Short Term |

| Regulatory compliance | Data protection and consumer privacy rules | ~2.6% | Europe, North America | Mid Term |

| Cloud service outages | Operational disruption during peak sales | ~2.1% | Global | Short Term |

| Vendor dependency | Reliance on limited cloud providers | ~1.7% | Global | Long Term |

| Integration complexity | Legacy system compatibility issues | ~1.3% | Global | Mid Term |

Opportunity Analysis

Emerging opportunities in the retail cloud computing market are closely linked to advancements in data analytics and mobile-first retail strategies. Cloud platforms facilitate large-scale data consolidation and analysis, enabling retailers to extract meaningful insights into consumer preferences, purchase behaviors, and demand patterns. These insights can support personalized marketing, dynamic pricing strategies, and inventory optimization.

The widespread adoption of smartphones and mobile shopping has further amplified the value of cloud infrastructure, as retailers can deliver seamless experiences across digital channels and physical stores. By leveraging cloud-enabled analytics and mobile integration, retailers can gain competitive advantage through enhanced customer engagement and operational efficiencies in supply chain coordination.

Challenge Analysis

A central challenge facing the retail cloud computing market relates to ensuring consistent performance and reliability during periods of peak demand and high transaction volumes. Retail environments are characterized by seasonal spikes, promotional events, and flash sales that generate surges in online traffic and data processing requirements.

Cloud architectures must be designed to maintain high availability, minimize latency, and sustain transaction throughput without service degradation. Failure to maintain reliable performance during these critical periods can lead to poor user experiences, lost sales, and reputational damage. Addressing this challenge necessitates robust infrastructure planning, resilient system design, and continuous monitoring to align cloud resources with fluctuating retail demand profiles.

Market Narrative

The retail cloud computing ecosystem has evolved into a strategic enabler of digital transformation for retailers seeking to optimize customer experiences and operational processes. Cloud technologies support real-time data access, enabling unified visibility across inventory, sales, and customer interactions. This visibility fosters greater agility in demand forecasting, supply chain adjustments, and personalized service delivery. By reducing dependence on on-premise servers, cloud solutions help retailers lower infrastructure costs and accelerate deployment cycles for new applications and services.

Cloud platforms also facilitate the integration of emerging capabilities such as advanced analytics and AI-driven customer insights, empowering retailers to refine marketing strategies and improve demand responsiveness. As retail strategies continue to emphasize omnichannel engagement, cloud computing remains a foundational element in bridging digital and physical retail operations. However, alignment with legacy systems and assurance of performance reliability continue to require careful management and investment, shaping how organizations approach cloud adoption and long-term infrastructure planning.

Investment Opportunities

Investment opportunities in the retail cloud computing market exist in cloud-native retail management platforms. Solutions that integrate inventory, sales, customer data, and analytics into unified systems attract strong interest. These platforms support both physical and online retail operations. Investors focus on scalable and interoperable solutions.

Another opportunity lies in cloud-based personalization and customer engagement tools. Retailers seek platforms that support targeted promotions and loyalty programs. Cloud solutions that analyze customer behavior in real time offer competitive advantages. These tools support revenue growth and customer retention.

Business Benefits

Adoption of retail cloud computing improves operational efficiency by centralizing systems and data. Retailers reduce manual processes and improve coordination across locations. Automated workflows support faster decision making. These efficiencies lower operating costs.

Cloud solutions also enhance customer experience by enabling consistent service across channels. Real-time inventory visibility reduces order errors and delivery delays. Personalized engagement improves customer satisfaction. Strong customer experience supports long-term brand loyalty.

Regulatory Environment

The regulatory environment for retail cloud computing includes data protection and consumer privacy laws. Retailers handle sensitive customer information such as payment data and personal details. Compliance with data privacy regulations is mandatory. Secure data handling and access control are critical.

Retail cloud systems must also align with financial transaction and cybersecurity regulations. Payment processing systems require strict security standards. Cloud providers and retailers share responsibility for compliance. Regulatory alignment reduces legal risk and supports secure retail operations.

Key Market Segments

By Service Model

- Software as a Service

- Point-of-Sale Systems

- Inventory Management

- Customer Relationship Management

- E-commerce Platforms

- Workforce Management

- Others

- Platform as a Service

- Development & Deployment Platforms

- Analytics & Big Data Platforms

- Integration Platforms

- Others

- Infrastructure as a Service

- Compute

- Storage

- Networking

- Others

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Omnichannel Retail & Customer Experience

- Supply Chain Management & Merchandising

- Store Operations & Workforce Management

- Analytics & Business Intelligence

- Security & Compliance

- Others

By End-User Retail

- Supermarkets & Hypermarkets

- Specialty Stores & Apparel

- Fashion & Apparel

- Consumer Electronics

- Home & Furniture

- Others

- Department Stores & Discount Stores

- E-commerce Pure-play

- Others

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Adobe Inc.

- Cisco Systems, Inc.

- HCL Technologies Limited

- Fujitsu Limited

- Infor, Inc.

- Epicor Software Corporation

- LS Retail ehf

- Aptos, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 58.1 Bn |

| Forecast Revenue (2035) | USD 265.3 Bn |

| CAGR(2026-2035) | 16.4% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)