Table of Contents

Robot Fleet Analytics Market Size

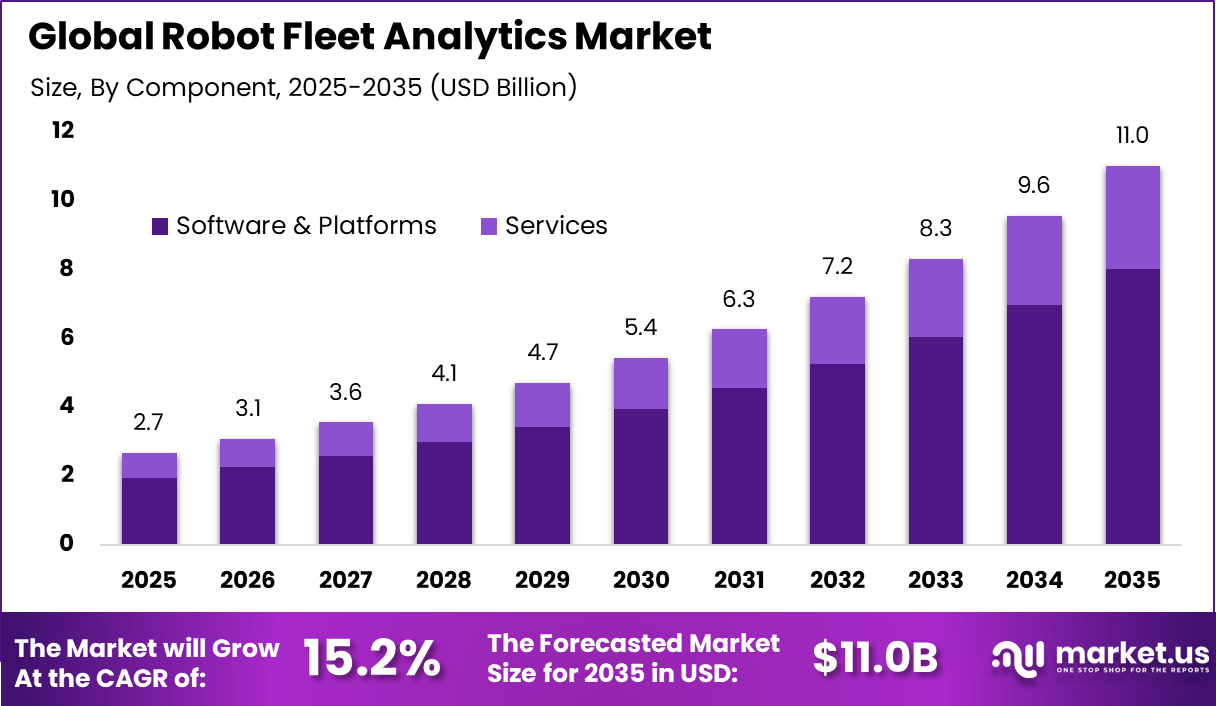

The global Robot Fleet Analytics market was valued at USD 2.7 billion in 2025 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 11 billion by 2035, expanding at a CAGR of 15.2% from 2026 to 2035. This growth is driven by rising deployment of autonomous robots across logistics, manufacturing, healthcare, and public infrastructure, along with increasing demand for real time performance monitoring and predictive maintenance.

The Robot Fleet Analytics Market focuses on software platforms and analytical systems that monitor, manage, and optimize large groups of robots operating simultaneously. These robots are deployed across warehouses, factories, hospitals, logistics hubs, and outdoor environments. Fleet analytics collects data related to robot location, task execution, utilization rates, battery health, and downtime. This information is transformed into actionable insights that improve coordination and performance at scale.

As organizations move from pilot robotics projects to full scale deployments, managing individual robots manually becomes impractical. Fleet level visibility is required to ensure consistency, reliability, and efficiency. Robot fleet analytics acts as the intelligence layer that connects robotic hardware with operational decision making. This role has elevated analytics from a support tool to a core operational system.

Top Market Takeaways

- By component, software and platforms accounted for 72.8% of the Robot Fleet Analytics Market, supported by the need for centralized monitoring and performance tracking.

- By deployment mode, cloud based solutions held a 70.4% share, reflecting preference for scalable infrastructure and real time data visibility.

- By robot type, industrial robots represented 41.6% of total usage, driven by automation across manufacturing facilities.

- By end user industry, logistics and e commerce captured 32.1% of the market, supported by warehouse automation and faster order fulfillment requirements.

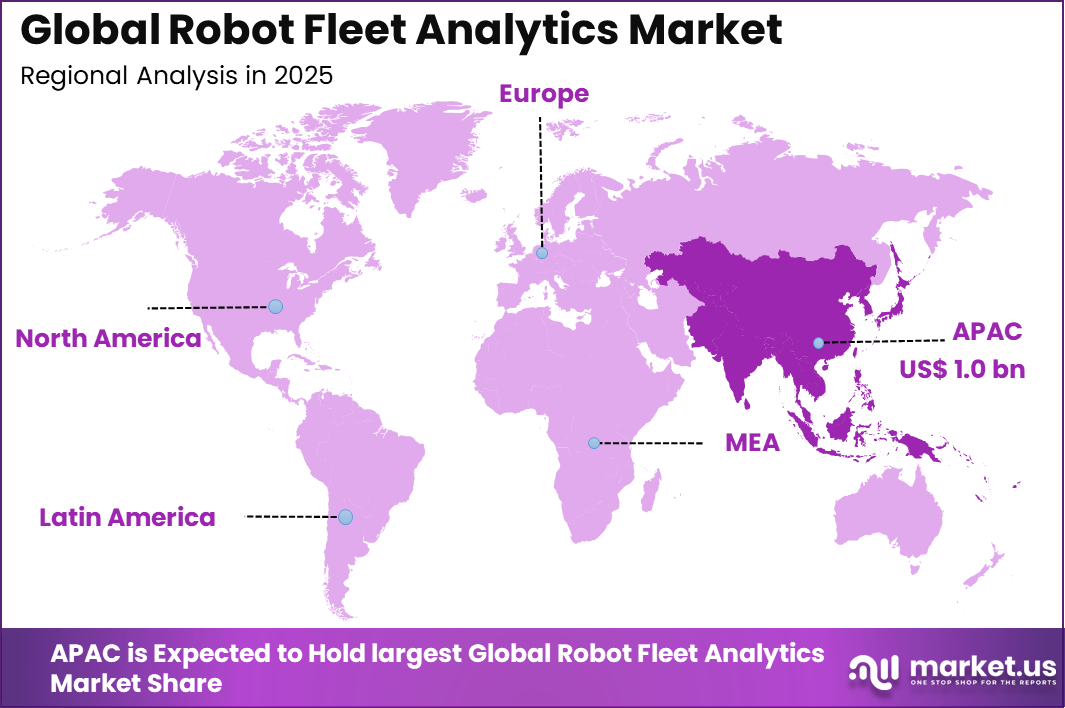

- Regionally, Asia Pacific led with a 40.2% share, reflecting strong adoption of industrial robotics.

- China reached a market value of USD 0.29 billion and recorded a CAGR of 12.3%, supported by large scale deployment of robots across key industries.

Regional Analysis

Asia Pacific held a dominant position in the global market, accounting for more than 40.2% of total revenue. The region generated around USD 1.0 billion, supported by large scale automation initiatives, strong industrial robotics adoption, and expanding smart factory programs. Rapid growth in e commerce logistics and warehouse automation further strengthened regional leadership. As a result, Asia Pacific continues to shape adoption and innovation trends in robot fleet analytics.

Driver Analysis

A primary driver of the robot fleet analytics market is the widespread adoption of robotics across sectors such as logistics, fulfillment, and manufacturing. Organisations are deploying multiple robots to automate repetitive tasks, reduce labour constraints, and improve throughput. Coordinating these fleets requires visibility into real-time performance, battery health, routing efficiency, and utilisation patterns. Fleet analytics provides this insight, supporting continuous performance improvement and operational efficiency.

Another important driver is the need to reduce downtime and maintenance costs. Analytics tools help identify patterns related to component wear, system bottlenecks, and task inefficiencies. Predictive insights allow maintenance activities to be scheduled proactively rather than reactively, improving uptime and reducing the total cost of ownership. This capability strengthens confidence in large scale automation investments.

Restraint Analysis

A key restraint in the robot fleet analytics market is integration complexity across diverse robot platforms. Many organisations operate fleets composed of robots from different manufacturers with varying software interfaces and communication protocols. Aggregating data into a unified analytics layer requires custom integrations and continuous coordination. This complexity can increase deployment effort and slow adoption.

Another restraint relates to data volume and infrastructure requirements. Robot fleets generate large quantities of operational data in real time. Processing, storing, and analysing this data demands robust computing infrastructure and network capacity. Smaller organisations with limited technical resources may face challenges in supporting advanced analytics workflows.

Opportunity Analysis

An important opportunity in the robot fleet analytics market lies in optimisation of task allocation and routing. Analytics can be used not only to monitor performance but also to dynamically adjust task assignments, path planning, and workload balancing across multiple robots. These optimisation capabilities improve throughput, reduce idle time, and enhance energy efficiency. Organisations seeking higher productivity from automation see strong value in these insights.

Another opportunity is expansion into service and healthcare robotics. Hospitals, hotels, and public facilities are adopting fleets of service robots for tasks such as delivery, cleaning, and assistance. These environments require high reliability and compliance with operational standards. Fleet analytics supports oversight, performance reporting, and predictive maintenance, creating new demand outside traditional industrial settings.

Challenge Analysis

A major challenge for the robot fleet analytics market is ensuring reliable real time data connectivity. Fleet analytics depends on continuous data streams from robots operating across expansive facilities or dispersed locations. Network interruptions or latency can affect visibility and decision making. Ensuring resilient and secure connectivity is essential for effective fleet management.

Another challenge is translating technical metrics into actionable business insights. Raw robot telemetry and operational data may be meaningful to engineers but require contextualisation for operational leaders. Analytics platforms must present insights in intuitive dashboards and reports that align with business goals. Bridging the gap between data and decision making remains an ongoing challenge.

Emerging Trends Analysis

An emerging trend in the robot fleet analytics market is increased use of artificial intelligence for autonomous optimisation. Machine learning models analyse historical and real time data to predict congestion, recommend task reassignment, and optimise fleet behaviour over time. This approach shifts analytics from reactive monitoring to proactive decision support. Intelligent automation is becoming a defining feature.

Another trend is integration with broader enterprise systems such as warehouse management, manufacturing execution, and facility management platforms. Linking robot analytics with broader operational data improves coordination and planning. End-to-end visibility across automated and human driven processes enables comprehensive performance management.

Growth Factors Analysis

One of the key growth factors for the robot fleet analytics market is the expansion of warehouse and logistics automation. e-commerce growth and labour shortages are driving broad adoption of robotics in fulfilment centres. Managing these fleets efficiently requires analytics-driven oversight. This structural demand supports sustained market growth.

Another growth factor is rising emphasis on performance accountability for automation investments. Organisations now expect measurable productivity gains and reduced operational risk from robot deployments. Fleet analytics provides the metrics and insights to demonstrate return on investment. As automation budgets increase, demand for analytics grows in parallel.

Customer Impact: Trends and Disruptors

Customers investing in robot fleet analytics are experiencing improved operational visibility and faster decision making. Real time dashboards and alerts reduce downtime by identifying issues early. Predictive maintenance supported by analytics minimises unexpected failures and improves fleet availability. Customers are also using analytics to balance workload and optimise resource allocation, which enhances overall productivity.

Key disruptors include growing adoption of edge computing and increased emphasis on autonomous optimisation. Edge enabled analytics reduces latency and supports data processing closer to the robot source, improving responsiveness. The shift toward self‐managed optimisation means analytics platforms are evolving from reporting tools into intelligent decision engines, changing customer expectations about what analytics should deliver.

Key Market Segments

By Component

- Software & Platforms

- Core Analytics Engines

- Task & Path Optimization Software

- Dashboard & Visualization Tools

- Predictive Maintenance Modules

- Others

- Services

- Implementation & Integration

- Consulting

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Robot Type

- Industrial Robots

- Collaborative Robots

- Autonomous Mobile Robots

- Service Robots

By End-User Industry

- Automotive

- Electronics & Semiconductor

- Logistics & E-commerce Fulfillment

- Food & Beverage

- Metals & Machinery

- Healthcare & Pharmaceuticals

- Others

Top Key Players in the Market

- Amazon Robotics

- ABB Ltd.

- Boston Dynamics

- Clearpath Robotics

- KUKA AG

- Omron Corporation

- Siemens AG

- Rockwell Automation

- Honeywell International Inc.

- Locus Robotics

- GreyOrange

- Geekplus Technology

- Mobile Industrial Robots (MiR)

- Seegrid Corporation

- BlueBotics

- Vecna Robotics

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 2.7 Bn |

| Forecast Revenue (2035) | USD 11.0 Bn |

| CAGR(2026-2035) | 15.2% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2026-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)