Table of Contents

Robot Mission Replay Tools Market Introduction

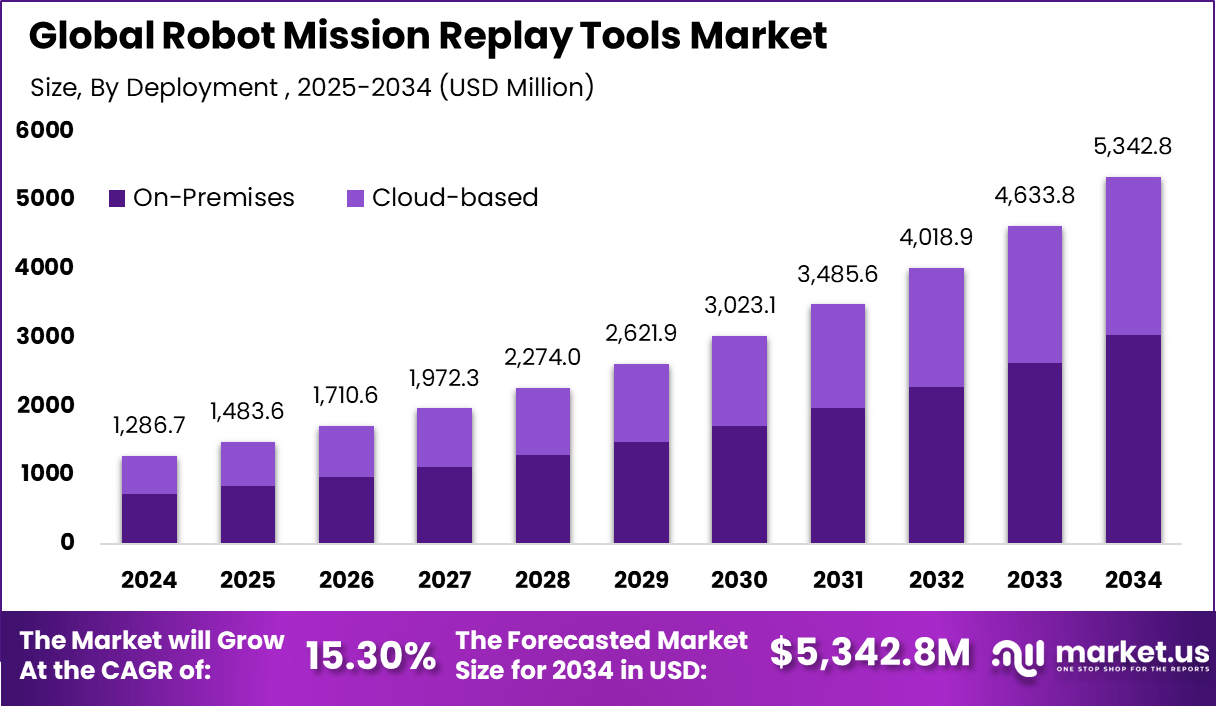

The global robot mission replay tools market generated USD 1,286.7 million in 2024 and is predicted to grow from USD 1,483.6 million in 2025 to about USD 5,342.8 million by 2034, recording a CAGR of 15.30% throughout the forecast span. Demand is rising because organizations are scaling robotic fleets and need faster ways to reproduce missions, validate performance, and reduce downtime after changes in layouts, software, or sensors. In 2024, North America held a dominant market position, capturing more than a 42.5% share and holding USD 546.84 Million revenue, supported by mature automation programs, higher R&D intensity, and wider deployment of warehouse and industrial robots.

How Growth is Impacting the Economy

Growth in robot mission replay tools is improving productivity by helping businesses deploy robots faster, stabilize operations, and reduce costly interruptions caused by software updates, environment changes, or navigation errors. As robot fleets grow, replay tools reduce troubleshooting time by enabling teams to reproduce missions, pinpoint failures, and validate fixes without repeated trial and error. This accelerates commissioning and supports higher equipment utilization, which strengthens output across manufacturing and logistics.

The market also supports skilled employment in robotics engineering, simulation, QA testing, and systems integration. In parallel, better mission validation strengthens supply continuity by lowering the risk of workflow disruption in fulfillment centers and factories. North America’s large 2024 revenue base indicates quicker reinvestment into automation toolchains that raise operational efficiency and improve competitiveness across robot-enabled industries.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=170551

Impact on Global Businesses

Rising costs and supply chain shifts: Businesses are under pressure to control robotics lifecycle costs, including downtime, integration effort, and recurring revalidation when sites change. Mission replay tools help reduce these costs by cutting retest time and improving reliability, which is critical as supply chains shift toward faster fulfillment and more distributed operations.

Sector specific impacts: Warehousing and logistics benefit through faster route updates, safer operations, and stable throughput. Manufacturing benefits through repeatable validation after line changes and software updates. Healthcare and labs benefit through traceability and standardized motion workflows. Defense and inspection use cases benefit through mission consistency and faster post mission analysis. Retail micro fulfillment benefits through quick tuning of robot workflows in tight spaces.

Strategies for Businesses

Standardize mission capture and replay workflows across sites to reduce variability and speed up troubleshooting. Integrate replay tools into deployment pipelines so every software or map change triggers structured validation before production release. Build a mission library that covers normal operations and edge cases, including congestion, sensor dropouts, and localization challenges. Pair replay with performance metrics such as task completion time, error rates, and safety event triggers to quantify improvements. Train operations teams to use replay outputs for faster root cause isolation and structured escalation. Align replay schedules with peak and off peak operations so validation supports uptime targets while maintaining continuous improvement.

Key Takeaways

- The market generated USD 1,286.7 million in 2024 and is projected to reach about USD 5,342.8 million by 2034.

- Growth is expected at a CAGR of 15.30% across the forecast span, with USD 1,483.6 million in 2025.

- North America led in 2024 with more than a 42.5% share and USD 546.84 Million revenue.

- Demand is rising as robotic fleets scale and organizations require faster validation after changes.

- Replay based testing improves uptime, commissioning speed, and operational repeatability.

➤ Unlock growth! Get your sample now! @ https://market.us/report/robot-mission-replay-tools-market/free-sample/

Analyst Viewpoint

In the present market, robot mission replay tools are becoming a core part of robotics operations because fleets are growing and environments are changing more frequently. North America’s 2024 dominance reflects mature automation adoption and stronger investment in toolchains that improve reliability. Looking ahead, the outlook remains positive as companies seek faster deployment cycles, safer operations, and repeatable validation across multi site fleets. Growth to about USD 5,342.8 million by 2034 suggests sustained demand for tools that convert mission data into actionable insights, shorten debugging time, and reduce operational risk. Providers that combine replay precision with analytics and easy integration into robotics stacks are expected to gain momentum.

Use Case and Growth Factors

| Use case | What mission replay tools enable | Growth factors |

|---|---|---|

| Warehouse AMR operations | Reproduce navigation issues and validate map updates | Faster fulfillment needs and site reconfiguration frequency |

| Manufacturing mobile robots | Validate route safety after line or layout changes | Smart factory expansion and uptime targets |

| Cobots and industrial robots | Replay motion sequences to confirm repeatability | Need for consistent quality and cycle time stability |

| Healthcare and lab robots | Standardize workflows and trace mission history | Compliance expectations and traceability needs |

| Field inspection robots | Review missions and validate software changes | Growth in remote inspection and reliability requirements |

| Robotics R&D and testing | Speed debugging and regression testing | Shift to continuous updates and software defined robotics |

Regional Analysis

North America dominated in 2024, capturing more than a 42.5% share and holding USD 546.84 Million revenue, supported by broad warehouse automation, higher robotics software investment, and stronger adoption of validation tooling. Europe is expected to expand as industrial automation programs mature and manufacturers prioritize repeatable verification after system changes.

Asia Pacific is projected to grow rapidly as large scale manufacturing and logistics automation increases demand for efficient testing and commissioning. The Middle East and Africa is anticipated to see selective growth tied to logistics hubs, infrastructure projects, and advanced industrial sites. Latin America is expected to progress as e commerce logistics and industrial modernization gradually expand robotic deployments.

➤ Explore Huge Library Here –

- Robotics Training Services Market

- Travel Rewards Credit Card Market

- Self-Reconfigurable Robots Market

- Bank Statement Aggregation Market

Business Opportunities

This market presents opportunities in enterprise grade replay platforms, analytics add ons, and integration services that connect replay outputs to fleet management, simulation, and QA pipelines. Buyers need tools that can reduce downtime and shorten time to deploy new missions across multiple sites.

There is growing opportunity in packaged replay libraries for specific environments such as warehouses, factories, and hospitals, enabling faster onboarding and standardized validation. Managed services also offer upside, including mission data management, regression test automation, and performance reporting. Providers that deliver easy interoperability, scalable data handling, and clear operational ROI are expected to secure recurring engagements as fleets expand.

Key Segmentation

The market can be segmented by deployment type into on premise and cloud enabled models, depending on data governance and connectivity needs. By robot type, it is segmented into autonomous mobile robots, industrial robots, collaborative robots, and inspection robots, each requiring different mission data fidelity.

By application, segmentation typically includes warehousing and logistics, manufacturing, healthcare and labs, defense and security, and infrastructure inspection. By function, it is segmented into mission capture, replay and simulation, regression testing, debugging and root cause analysis, and performance benchmarking. By end user, it is segmented across enterprises operating fleets, robotics developers, and systems integrators supporting multi site deployments.

Key Player Analysis

Participants compete on replay accuracy, ease of integration, scalability of mission data handling, and the ability to support multi robot fleets across sites. Differentiation is driven by how well tools reproduce real world sensor and navigation conditions and how quickly teams can isolate failures. Strong offerings provide mission libraries, automated regression testing, and analytics dashboards that translate replay results into engineering tasks.

Competitive advantage also depends on compatibility with diverse robot stacks, including fleet orchestration layers and simulation environments. Providers that simplify adoption, reduce validation time, and deliver measurable improvements in uptime and deployment speed are expected to strengthen their market position.

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Siemens AG

- Universal Robots

- Omron Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation

- Staubli International AG

- Denso Corporation

- Epson Robots

- Kawasaki Robotics

- Comau S.p.A.

- Schneider Electric SE.

- Honeywell International Inc.

- Bosch Rexroth AG

- Others

Recent Developments

- Increased adoption of replay-based regression testing to support frequent software updates.

- Higher focus on analytics dashboards that convert mission replays into performance metrics.

- Growing integration with fleet management systems for automated validation workflows.

- Wider use of standardized mission libraries to speed multi site deployments.

- Rising emphasis on reproducibility for safety validation in mixed human robot environments.

Conclusion

Robot mission replay tools are expanding as organizations scale fleets and require faster, safer validation after changes. With USD 1,286.7 million in 2024 and growth to about USD 5,342.8 million by 2034 at a 15.30% CAGR, adoption is expected to remain strong. North America’s 2024 lead reflects early investment in reliable robotics operations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)