Table of Contents

- Robotic Fashion Inductor Market Size

- Market Overview

- Key Market Takeaways

- Performance Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Table

- Demand analysis

- Investment and Business Benefits

- Regional Analysis

- Regional Driver Comparison

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Report Scope

Robotic Fashion Inductor Market Size

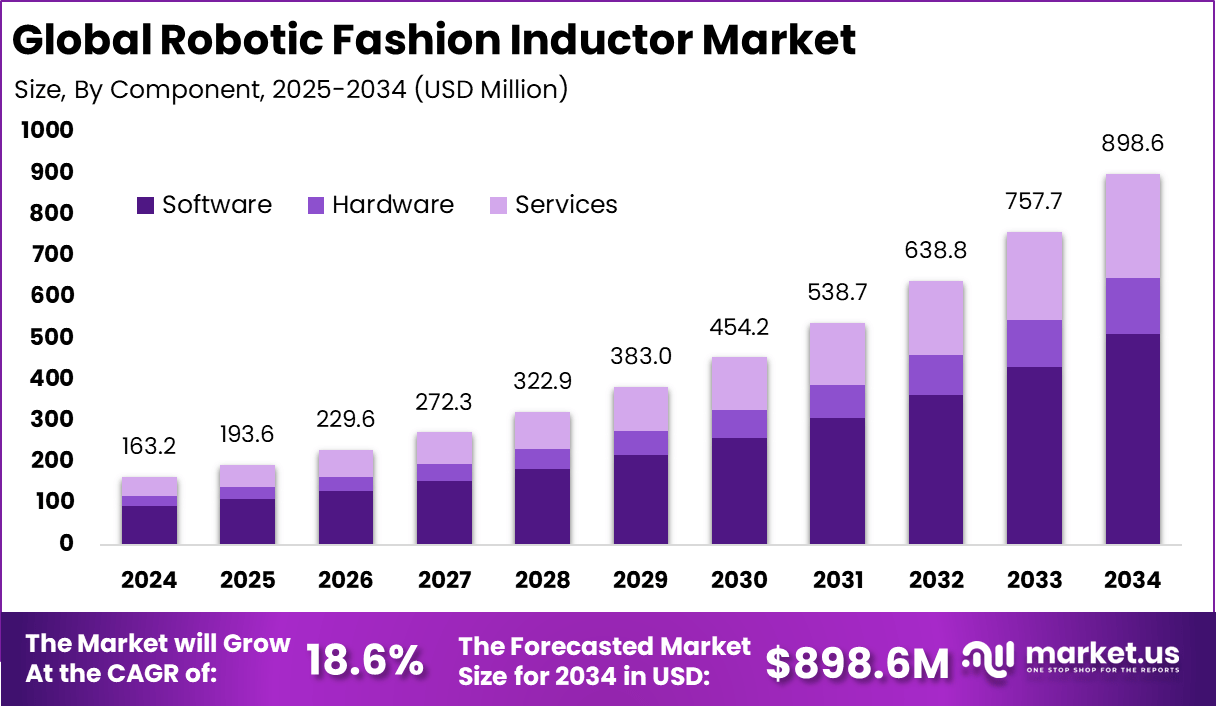

The global Robotic Fashion Inductor market generated USD 163.2 million in 2024 and is expected to grow steadily over the forecast period. Market revenue is projected to increase from USD 193.6 million in 2025 to approximately USD 898.6 million by 2034, registering a CAGR of 18.6% throughout the forecast span. This growth is driven by increasing automation in the fashion industry, particularly in design, manufacturing, and retail operations, improving efficiency and reducing costs.

Market Overview

Robotic Fashion Inductor Market refers to the emerging segment of warehouse and logistics automation focused on robotic systems designed to automatically induct, sort, and feed fashion items such as apparel and accessories into conveyor or sortation systems. These systems make use of artificial intelligence, machine vision, and robotic arms to handle deformable and irregularly shaped items that are common in fashion logistics.

The solutions are purpose-built to address the specific challenges of fashion supply chains, where polybagged clothing and accessory items require careful handling to avoid damage and maintain throughput. This category of robotics has developed as part of broader trends in AI-enabled warehouse automation to support faster, more reliable processing of high-mix SKU assortments. Top driving factors for the Robotic Fashion Inductor Market include the rapid growth of e-commerce in fashion, rising expectations for faster delivery, and the need to handle diverse product formats efficiently.

Online fashion retail generates fluctuating but high parcel volumes, and manual induction struggles to maintain consistent throughput and accuracy under such demands. Persistent labour shortages in warehouse operations and rising wage costs further elevate the importance of automated systems that can operate continuously without fatigue. These drivers collectively justify investment in robots tailored to the unique handling requirements of apparel and accessories.

Key Market Takeaways

- Software components led the market with a 56.9% share, central to automation platforms and control systems that manage precision-driven fashion manufacturing workflows.

- Smart tag and RFID inlay manufacturing accounted for 36.41%, driven by the growing demand for item-level tracking, inventory visibility, and smart apparel integration.

- Smart apparel manufacturers represented the largest end-user adoption with 48.1%, reflecting high uptake of robotic inductors in connected and wearable fashion production.

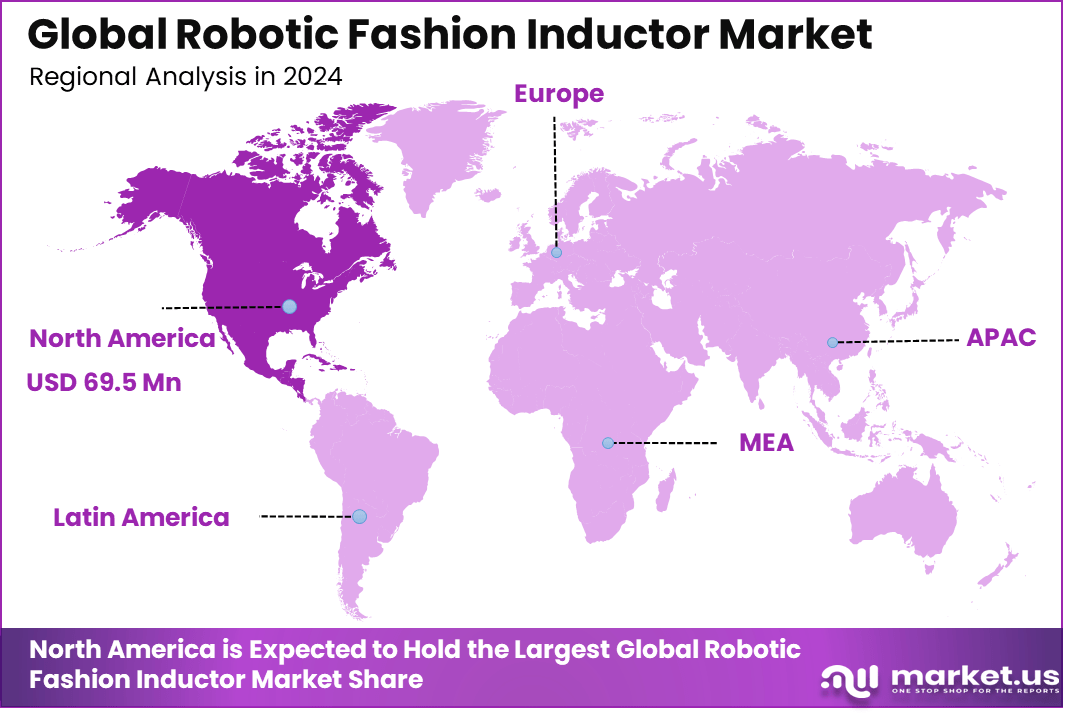

- North America held a leading 42.6% market share, supported by advanced manufacturing capabilities and early adoption of fashion automation technologies.

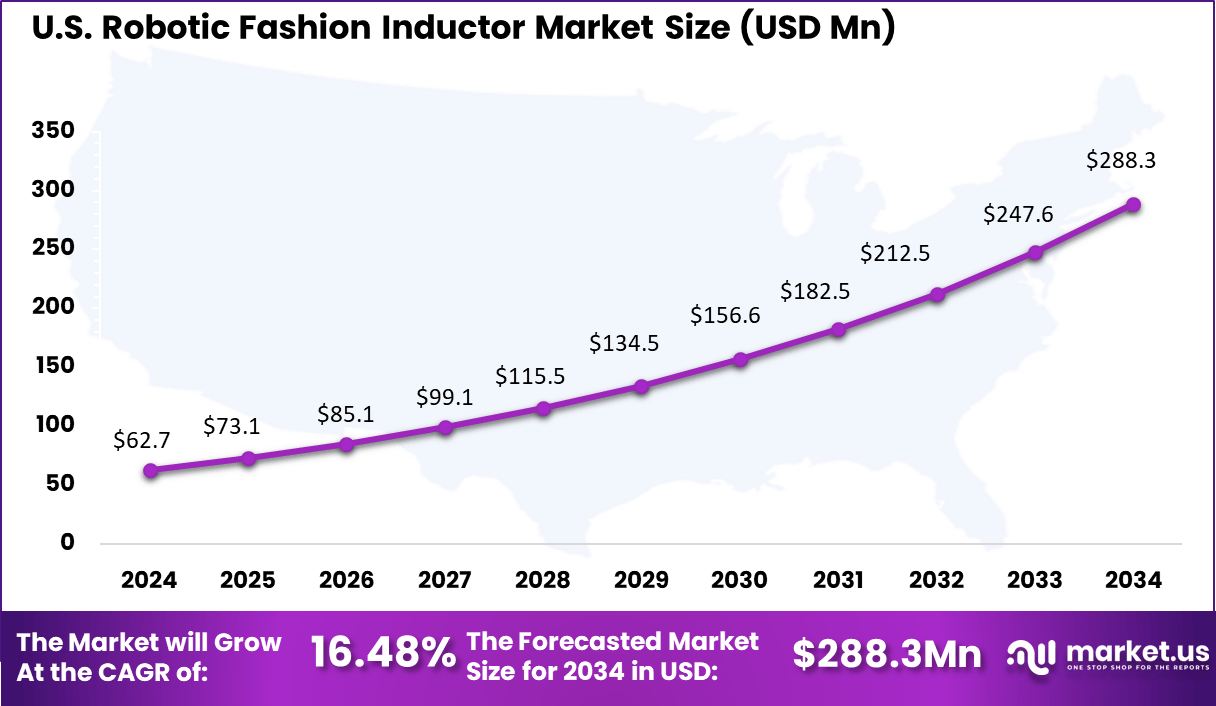

- The U.S. market reached USD 62.72 million in 2024, expanding at a robust 16.48% CAGR due to investments in smart textiles and RFID-enabled apparel.

- The global market generated USD 163.2 million in 2024 and is projected to grow from USD 193.6 million in 2025 to USD 898.6 million by 2034.

- A strong 18.6% CAGR highlights rapid market expansion driven by automation needs, rising smart apparel demand, and digital transformation in the fashion supply chain.

Performance Statistics

- High picking speed: Capable of processing up to 1,300 picks per hour, supporting fast-moving fashion and apparel logistics operations.

- Very high accuracy: Delivers over 99.5% picking accuracy, even with soft, flexible, and deformable items such as polybags and fabric pouches.

- Fully autonomous operation: Designed to operate continuously without human supervision, helping to lower cost per pick and increase overall throughput.

- Advanced AI vision: Uses AI-driven vision with pre-trained models to identify stable grasp points in cluttered, unstructured environments like bins and conveyors.

- Built for fashion logistics: Optimized specifically for apparel and accessories, where product variability and handling complexity are high.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Growth of online fashion retail | Need for efficient sorting and dispatch in e-commerce | ~7.4% | North America, Europe | Short Term |

| Increasing demand for automation in warehousing | Enhanced operational efficiency and speed | ~6.1% | Global | Short Term |

| Focus on reducing operational costs | Automation as a solution to high labor expenses | ~5.4% | Global | Mid Term |

| Advancements in AI and robotics | Real-time image recognition and sorting | ~4.9% | Global | Mid Term |

| Sustainability initiatives | Reduction in human labor and improved logistics efficiency | ~3.2% | Europe, North America | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| High cost of robotic systems | Expensive initial investment for small retailers | ~5.0% | Emerging Markets | Short to Mid Term |

| Integration complexity | Challenges in aligning new robotics systems with legacy processes | ~4.3% | Global | Mid Term |

| Data privacy and security concerns | Use of AI-driven systems to handle customer data | ~3.7% | Europe, North America | Short Term |

| Reliability issues | System failures or inaccuracies in sorting | ~3.0% | Global | Mid Term |

| Slow adoption among small fashion retailers | Budget limitations for investing in automation | ~2.4% | Global | Long Term |

Restraint Impact Table

| Restraint Factor | Restraint Description | Impact on Market Expansion (%) | Most Affected Regions | Duration of Impact |

|---|---|---|---|---|

| High initial capital expenditure | Costs of hardware and software for automation systems | ~6.2% | Emerging Markets | Short to Mid Term |

| Limited technical expertise | Lack of workforce skilled in robotic technology | ~5.1% | Global | Mid Term |

| Complex integration with existing systems | Difficulty in merging with legacy inventory systems | ~4.3% | Global | Mid Term |

| Consumer acceptance of automation | Resistance to robotic automation in physical stores | ~3.5% | Global | Long Term |

| Data security regulations | Concerns over customer data in AI systems | ~3.0% | Europe, North America | Long Term |

Demand analysis

Demand analysis reveals that the market is strongest among large fashion logistics operators, third-party fulfilment centres, and major distribution hubs that handle high volumes of mixed fashion items. These operators face intense pressure to maintain rapid fulfilment cycles while minimising errors that can lead to returns or customer dissatisfaction. Robotic fashion inductors contribute to smoother processing by ensuring consistent induction of items into sorting systems, which supports reliable downstream operations. The result is improved warehouse efficiency and better alignment with customer service commitments in fast-paced supply chains.

Key technologies influencing the market include AI-driven vision systems, robotic arm control software, advanced grippers capable of handling soft and deformable goods, and integrated sorter control interfaces. Vision systems enable robots to discern item shape, orientation, and optimal grasp points even in cluttered or random item piles. Integrated motion planning and control systems ensure collision-free operation and high speed of performance, which is critical for maintaining throughput in high-volume environments. These technologies work in concert to enhance the value proposition of robotic fashion inductors and improve overall warehouse automation performance.

The primary reasons for adopting robotic fashion inductors centre on throughput improvement, labour cost reduction, and increased process reliability. Automated induction can achieve high pick rates with accuracy exceeding manual efforts, which stabilises the start of sortation workflows and reduces bottlenecks. By reducing reliance on manual workers for repetitive and physically demanding tasks, organisations also improve workplace safety and reduce turnover. The ability to handle returns and unpredictable item mixes further supports operational flexibility in fashion logistics.

Investment and Business Benefits

Investment opportunities in this market exist in the development of enhanced AI models, more adaptable robot hardware, and systems that integrate seamlessly with broader warehouse execution and management platforms. As operators look to modernise facilities without extensive infrastructure changes, modular robotic solutions that can retrofit existing lines offer attractive prospects. There is also scope for services that support installation, customisation, training, and long-term maintenance as part of holistic automation offerings. Continued innovation in vision, gripping, and control technologies will likely unlock further value.

Business benefits associated with robotic fashion inductor deployment include improved operational efficiency, reduced dependency on manual labour, and better predictability of logistic workflows. Automated induction enables consistent processing speeds that shorten handling times and improve the reliability of downstream sorting and shipping operations. Precision and consistency also reduce errors that can lead to delays or damage, enhancing overall supply chain performance and customer satisfaction. Over time, these benefits support competitive positioning in markets where fulfilment speed and accuracy are key differentiators.

Regional Analysis

In 2024, North America held a dominant position in the global market, capturing more than 42.6% of total revenue. The region generated around USD 69.5 million, supported by strong adoption of robotics and AI in fashion design and production processes. North America’s advanced technological infrastructure and the presence of leading fashion retailers further strengthened its leadership in the market. As a result, North America continues to drive innovation and growth in the robotic fashion induction sector.

The United States reached USD 62.72 Million with a CAGR of 16.48%, reflecting steady growth in smart tag and RFID-related solutions. Rising focus on automation, digital apparel, and supply chain transparency continues to support market expansion.

Regional Driver Comparison

| Region | Primary Growth Driver | Regional Share (%) | Regional Value (USD Mn) | Adoption Maturity |

|---|---|---|---|---|

| North America | Dominance of e-commerce and retail automation | 42.6% | USD 69.5 Mn | Advanced |

| Europe | Focus on operational efficiency and sustainability | 31.2% | USD 50.9 Mn | Advanced |

| Asia Pacific | Rapid growth of e-commerce and retail sectors | 16.5% | USD 27.0 Mn | Developing to Advanced |

| Latin America | Rise in digital retail and logistics automation | 5.0% | USD 8.2 Mn | Developing |

| Middle East and Africa | Early adoption in retail automation | 4.7% | USD 7.7 Mn | Early |

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Retailers and e-commerce companies | Very High | ~48.7% | Enhanced customer experience and operational efficiency | Long-term investment in automation |

| Robotics technology providers | High | ~26.4% | Platform development and market penetration | R&D focused |

| Logistics companies | High | ~15.2% | Optimizing parcel sorting and distribution | Strategic partnerships |

| Government bodies | Moderate | ~6.0% | Supporting digital retail infrastructure | Policy and funding |

| Venture capitalists | Low | ~3.7% | Investment in emerging robotic technologies | Early-stage funding |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| AI and machine learning | Parcel sorting and decision-making | ~7.5% | Growing |

| Computer vision | Real-time object recognition and sorting | ~6.3% | Mature |

| Robotics hardware | Automated picking and placement systems | ~5.9% | Mature |

| Cloud computing | Scalable infrastructure for managing logistics data | ~4.7% | Mature |

| Edge computing | Real-time processing at the device level | ~3.8% | Developing |

Key Market Segments

By Component

- Software

- Hardware

- Services

By Application

- Smart Tag & RFID Inlay Manufacturing

- Precision Embroidery & Circuit Printing

- Automated Garment Assembly with Integrated Electronics

- Others

By End-User

- Smart Apparel Manufacturers

- Luxury & High-Tech Fashion Houses

- Technical Sportswear Brands

- Others

Top Key Players in the Market

- ABB, Ltd.

- SoftWear Automation, Inc.

- Sewbo, Inc.

- ZSK Stick- und Prüftechnik GmbH

- Brother Industries, Ltd.

- Tamicare Ltd.

- Kornit Digital, Ltd.

- Sensory Robotics

- Gerber Technology

- Assyst GmbH

- Prisca Vils AG

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 163.2 Mn |

| Forecast Revenue (2034) | USD 898.6 Mn |

| CAGR(2025-2034) | 18.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Component (Hardware, Software, Services), By Application (Smart Tag & RFID Inlay Manufacturing, Precision Embroidery & Circuit Printing, Automated Garment Assembly with Integrated Electronics, Others), By End-User (Smart Apparel Manufacturers, Luxury & High-Tech Fashion Houses, Technical Sportswear Brands, Others) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)