Table of Contents

Robotic Plastering Systems Market Size

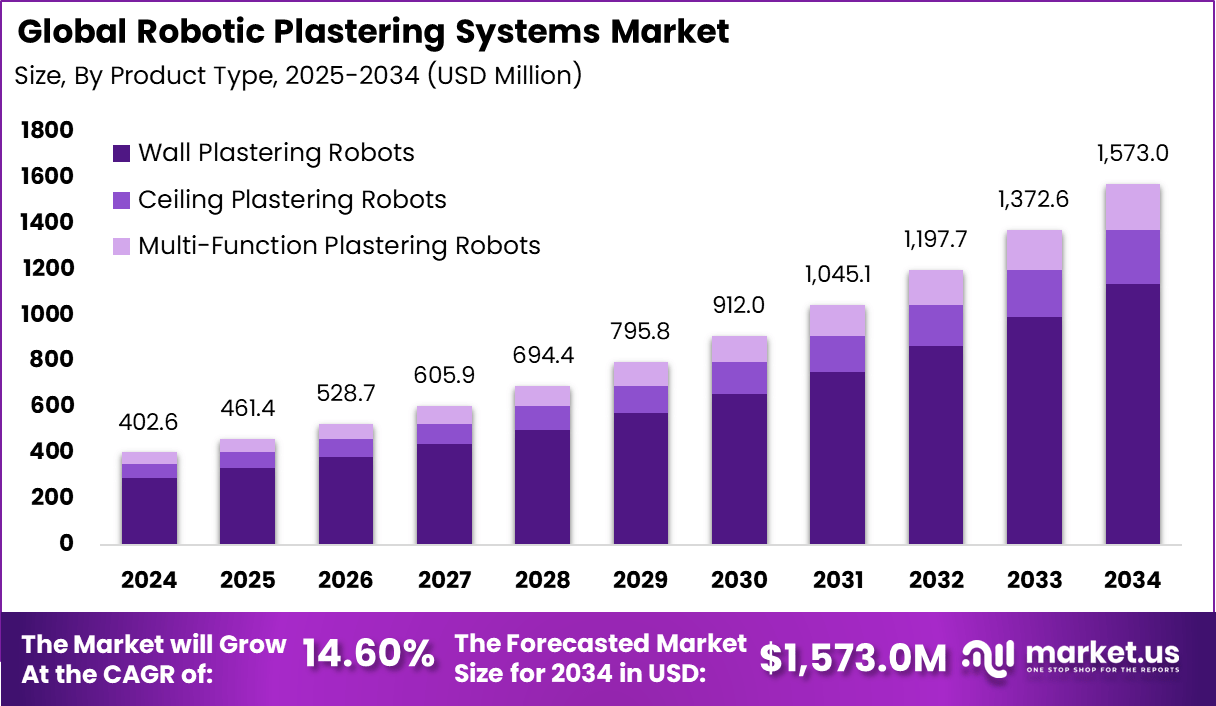

The global Robotic Plastering Systems market generated USD 402.6 million in 2024 and is expected to grow significantly over the forecast period. Market revenue is projected to increase from USD 461.4 million in 2025 to approximately USD 1,573 million by 2034, registering a CAGR of 14.60% throughout the forecast span. This growth is driven by increasing adoption of automation in construction processes, reducing labor costs, and improving plastering precision and efficiency.

Robotic Plastering Systems Market refers to the segment of construction automation that includes machines and tools designed to apply plaster, render, and surface finishes with mechanical precision instead of manual labour. These systems typically integrate robotics, sensors, motion control, and application mechanisms to handle wall and ceiling plastering tasks in construction environments. The primary purpose of these systems is to improve the quality and consistency of plaster finishes while reducing dependency on manual skills. This shift from traditional manual plastering to mechanised systems reflects broader digital innovation trends in construction workflows.

Top driving factors for the Robotic Plastering Systems Market include persistent construction labour shortages, rising labour costs, and the urgent need for enhanced productivity and safety on sites. Construction markets globally continue to experience gaps in skilled trades, prompting stakeholders to consider technology solutions that can carry routine tasks reliably. In addition, contractors are under constant pressure to complete projects with high quality and minimal rework, which automated plastering systems can support through precise and uniform application. As a result, interest in robotics for finishing trades has grown significantly across multiple geographies.

Another influential driver is the adoption of digital construction practices and the integration of advanced control technologies. Robotics with improved sensors and control software are better able to operate in complex building environments, adapting to surface contours and varying work conditions. These technological enhancements reduce idle time and waste of plaster material, which can improve overall resource utilisation on site. When combined with trends such as prefabrication and modular construction, robotic plastering becomes more attractive as an efficiency-enhancing tool.

Demand analysis shows that the market is propelled both by major contractors operating on large residential and commercial projects and by specialised firms aiming to innovate construction workflows. Residential construction, where repetitive wall finishing tasks are common, represents a significant application area for plastering robots. Contractors seeking to maintain schedule predictability and reduce onsite labour requirements are among the early adopters of these systems. Broader construction digitisation and emphasis on safety further support demand for automated plastering solutions.

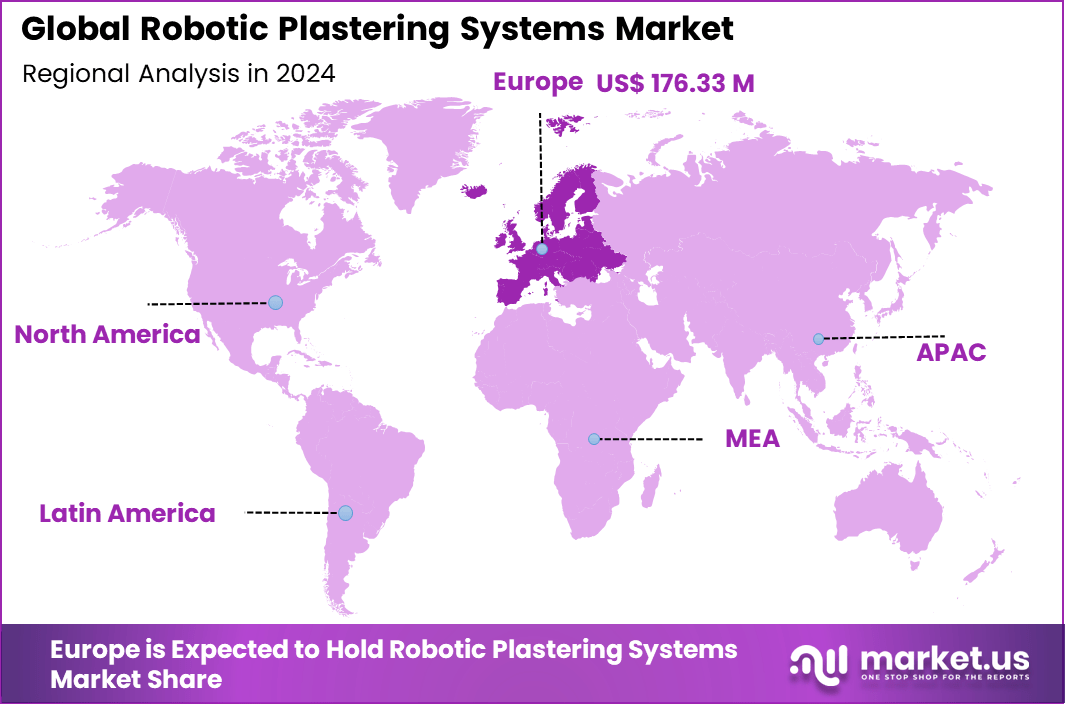

In 2024, Europe held a dominant position in the global market, capturing more than 43.8% of total revenue. The region generated around USD 176.33 million, supported by strong demand for innovative construction technologies and a focus on improving building automation and quality control. Europe’s early adoption of robotic systems in construction further strengthened its leadership in the market. As a result, Europe continues to drive the growth and evolution of robotic plastering technologies.

Driver Analysis

The robotic plastering systems market is being driven by the growing demand for automation in the construction industry to improve productivity, quality, and safety. Traditional plastering work is labour intensive, time consuming, and dependent on skilled craftsmen whose availability is increasingly constrained.

Robotic plastering systems automate the application of plaster and finishing materials on walls and ceilings, enabling consistent layer thickness, smoother surface quality, and reduced rework. These capabilities help construction firms accelerate project timelines, optimise workforce allocation, and reduce labour costs, which has become increasingly important amid rising construction activity and workforce shortages.

Restraint Analysis

A significant restraint in the robotic plastering systems market relates to high upfront investment and implementation complexity. Robotic plastering units require advanced mechanical platforms, control software, specialised nozzles, and integration with building plans, which can represent a substantial capital expenditure compared with traditional manual methods.

Smaller contractors and local builders may find these costs difficult to justify, particularly on smaller projects where the scale of automation benefits is limited. Operational readiness also depends on trained technicians to program, maintain, and troubleshoot robots, which can further increase initial adoption barriers.

Opportunity Analysis

Emerging opportunities in the robotic plastering systems market are linked to the expanding adoption of digital construction practices, modular building methods, and integrated robotics on job sites. As Building Information Modelling (BIM), prefabrication, and industrialised construction approaches become more prevalent, robotic plastering can be coordinated with digital workflows to achieve faster, more predictable outcomes.

There is also potential for hybrid solutions that combine robotic systems with human oversight to balance automation efficiency with flexibility in complex architectural designs. Service‑oriented deployment models, such as robot‑as‑a‑service, can attract smaller builders by reducing initial capital commitments and spreading costs over time.

Challenge Analysis

A central challenge confronting this market involves ensuring consistent performance and adaptability in varied on‑site conditions. Construction environments are inherently unstructured, with variations in surface geometry, material properties, and environmental factors such as temperature and humidity.

Robotic plastering systems must be robustly engineered to handle these real‑world variabilities without compromising finish quality. Achieving reliable calibration, alignment with building plans, and integration with other on‑site workflows demands close coordination between contractors, equipment vendors, and project managers. Ensuring safety compliance and coexistence with human workers on job sites also requires effective risk management and operational protocols.

Emerging Trends

Emerging trends in the robotic plastering systems landscape include the development of mobile and autonomous platforms that navigate complex interior layouts with minimal external guidance. Advances in sensor technologies, machine vision, and real‑time feedback loops are enabling robots to adjust application parameters dynamically, improving finish uniformity and reducing waste.

There is also growth in collaborative robotics that work alongside human operators to combine human judgement with machine precision, particularly in irregular or decorative plastering tasks. Integration with digital design tools and project management software is enhancing coordination and reducing the friction between design intent and on‑site execution.

Growth Factors

Growth in the robotic plastering systems market is supported by increasing construction activity, rising labour costs, and the emphasis on productivity improvements across commercial and residential building sectors. Urbanisation, infrastructure development, and housing demand are driving adoption of automation to meet project schedules and quality expectations.

Technological advancements in robotics, control systems, and materials science are making robotic plastering solutions more capable, reliable, and cost‑competitive over time. As contractors and construction firms seek to modernise workflows and reduce reliance on manual labour, robotic plastering systems are becoming attractive tools to enhance efficiency and deliver consistent, high‑quality finishes.

Key Market Segments

By Product Type

- Wall Plastering Robots

- Ceiling Plastering Robots

- Multi-Function Plastering Robots

By Application

- Residential Construction

- Commercial Construction

- Industrial Construction

By Automation Level

- Fully Automated

- Semi-Automated

By End-User

- Contractors & Construction Companies

- Real Estate Developers

- Government & Public Infrastructure Projects

- Others

Top Key Players in the Market

- Fastbrick Robotics Ltd

- Advanced Construction Robotics

- Okibo Ltd.

- Construction Robotics LLC

- Kewazo GmbH

- SAM (Semi-Automated Mason)

- Robotics Plus Ltd.

- Brokk AB

- FBR Limited

- Ekso Bionics Holdings Inc.

- Conjet AB

- Cazza Construction Robotics

- Apis Cor

- Hadrian X

- Shimizu Corporation

- ABB Ltd.

- Yaskawa Electric Corporation

- Fujita Corporation

- Komatsu Ltd.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 402.6 Mn |

| Forecast Revenue (2034) | USD 1,573 Mn |

| CAGR(2025-2034) | 14.60% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Product Type (Wall Plastering Robots, Ceiling Plastering Robots, Multi-Function Plastering Robots), By Application (Residential Construction, Commercial Construction), By Automation Level (Fully Automated, Semi-Automated), By End-User (Contractors & Construction Companies, Real Estate Developers, Others) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)