Table of Contents

Strategic Investment Perspective

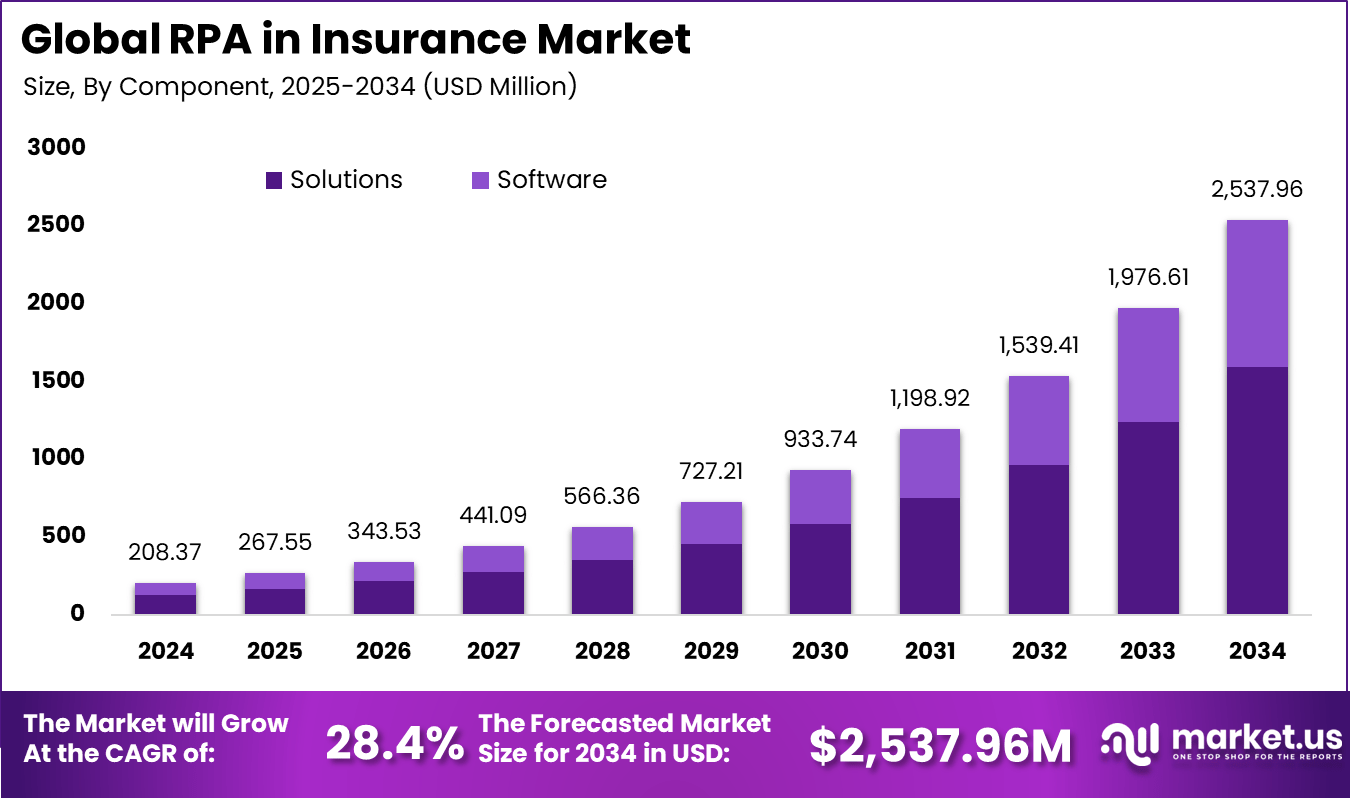

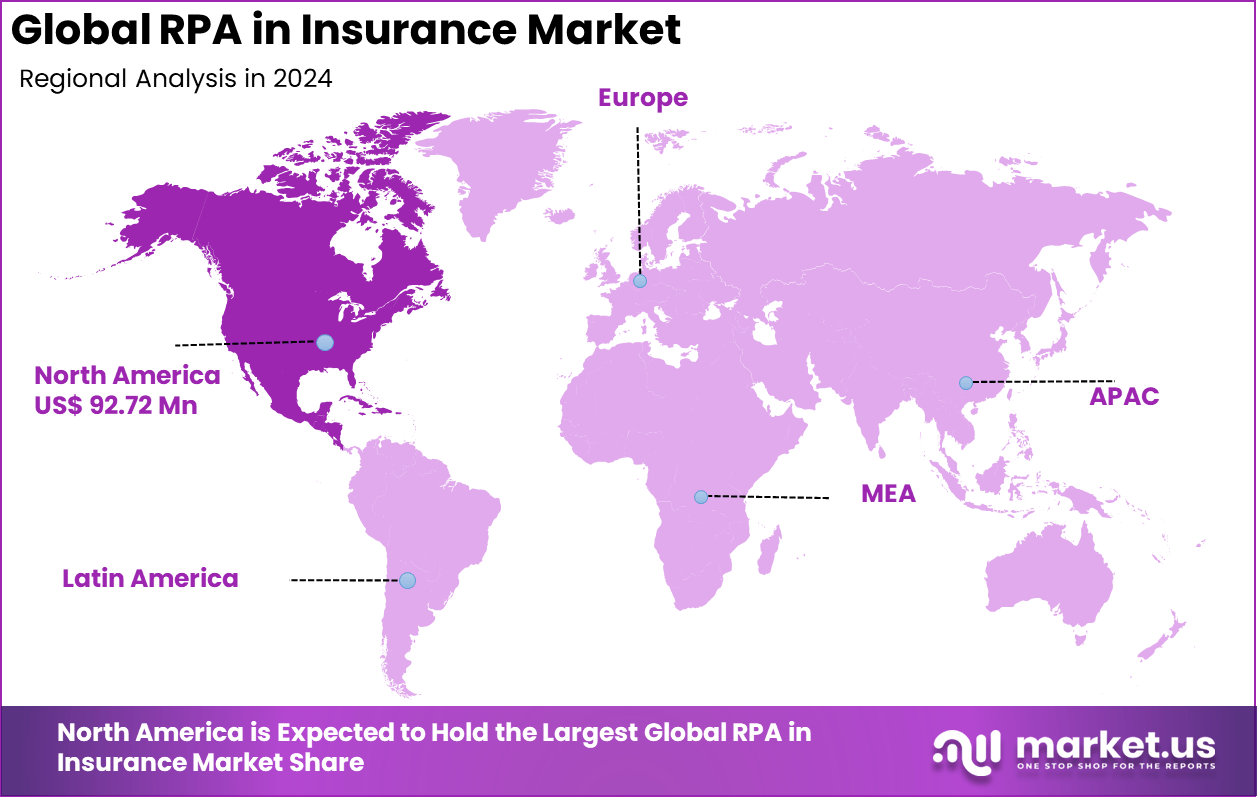

The Global RPA in Insurance Market offers a transformative investment opportunity, growing from USD 208.37 million in 2024 to nearly USD 2,537.96 million by 2034, expanding at a CAGR of 28.4%. North America’s dominant position in 2024, capturing more than 44.5% share and USD 92.72 million in revenue, underscores the region’s leadership in insurance automation and long-term growth potential for investors.

Robotic Process Automation (RPA) in the insurance market refers to the use of software bots to automate repetitive, rule-based tasks that have traditionally required human effort. In insurance operations, RPA handles functions such as data entry, claims processing, customer onboarding, and policy administration by mimicking human interactions with software systems. The technology allows insurers to streamline workflows, reduce manual errors, and improve processing speeds across multiple operational areas. As digital transformation becomes integral to the insurance industry, RPA’s role has expanded beyond simple task automation to become a core operational strategy.

In the insurance context, RPA supports business objectives by integrating with legacy systems without requiring major infrastructure changes. This compatibility has encouraged insurers to adopt RPA incrementally and scale automation solutions over time. The scope of tasks automated by RPA continues to broaden, covering claims, underwriting, compliance checks, and customer interactions. As a result, RPA is being viewed as a foundational technology that strengthens process efficiency and operational agility.

One of the primary drivers for RPA adoption in the insurance market is the need to improve operational efficiency amid increasing process complexity. Insurance workflows are data-intensive and involve significant documentation, such as forms, medical records, and customer information. Automating these routine activities reduces processing time and allows human staff to focus on higher-value tasks. This improvement in operational efficiency has made RPA a strategic priority for many insurers

Another key factor is the pressure to enhance customer experience by delivering faster and more reliable services. Policyholders increasingly expect quick responses to inquiries, swift claim settlements, and accurate policy servicing. RPA enables insurers to meet these expectations by reducing manual delays and improving consistency in transaction handling. In turn, improved service delivery strengthens customer satisfaction and loyalty.

Key Segment Highlights

- By component, solutions led the market with a 62.8% share, reflecting strong demand for software platforms that automate and manage insurance operations.

- By organization size, large enterprises dominated with 72.65%, supported by higher budgets and the ability to deploy advanced systems at scale.

- By application, claims processing held 25.91%, driven by the need to improve speed, accuracy, and cost efficiency in claims handling.

- By insurance type, property and casualty insurance accounted for 45.2%, as insurers focus on managing higher claim volumes and risk exposure.

- North America led regionally with a 44.5% share, supported by advanced insurance infrastructure and early adoption of digital solutions.

- The US market generated USD 84.57 million and is expanding at a 26.6% CAGR, reflecting strong momentum in technology adoption across insurance operations.

Key Performance Improvements

- Claims processing: Robotic Process Automation has significantly improved claims management by reducing processing time by 90%, from 72 hours to under 5 minutes, while achieving 99% accuracy for standard forms. This level of automation has enabled insurers to lower claims related operating costs by 40% to 70%.

- Cost and efficiency: RPA has delivered broader efficiency gains across insurance operations, with cost reductions of up to 30% in areas such as claims handling and policy administration. Automation also saves about 34% of employee time previously spent on manual data processing, allowing staff to focus on higher value work.

- Customer experience: Insurers using automated workflows have reported a 65% reduction in customer service costs. Routine customer interactions are highly suitable for automation, with RPA handling up to 92% of these tasks, leading to faster response times and improved service quality.

- Fraud detection: The combination of AI and RPA has strengthened fraud detection, identifying 53% more potential fraud indicators and generating average annual savings of around USD 4.2 million for mid sized insurers.

Increasing Adoption Technologies

Advances in RPA tools, including low-code and no-code platforms, are enhancing adoption in the insurance market. These platforms allow business users with limited coding expertise to create and manage automation workflows, lowering barriers to entry and encouraging broader use. This democratization of automation supports faster deployment and operational experimentation. As a result, insurers of varying sizes can leverage RPA without heavy dependence on technical development teams.

Integration with emerging technologies such as artificial intelligence, machine learning, and process analytics is also accelerating adoption. Intelligent automation solutions that combine RPA with cognitive capabilities can handle more complex tasks, such as interpreting unstructured data or performing preliminary decision support. This evolution extends the application of RPA beyond basic rule execution to more sophisticated process augmentations. These advancements are helping insurers to automate end-to-end workflows and unlock additional value from their technology investments.

Investment Opportunities

Investment opportunities in the RPA in insurance market are emerging from the need to modernize legacy systems and improve operational resilience. Insurance firms are allocating budgets toward digital transformation initiatives that include automation enhancements. Investments in RPA platforms, integration services, and talent development help firms scale automation and strengthen process standardization. These moves are expected to support long-term sustainable operations.

Additional opportunities lie in specialized automation solutions that address niche workflow challenges, such as fraud detection, regulatory reporting, and complex underwriting support. Insurers that invest in targeted RPA applications can differentiate their service capabilities and improve strategic decision-making processes. Opportunities also exist in establishing automation centers of excellence, which can centralize governance, training, and innovation for scalable automation deployment. These investments help insurers build internal capacity and foster continuous improvement.

Regional Analysis

In North America, RPA adoption in insurance is driven by advanced digital transformation initiatives and strong demand for operational efficiency. Insurers in this region are increasingly integrating automation into their core systems, supported by investments in cloud, analytics, and intelligent process design. These efforts reflect a mature market with broad interest in scaling digital capabilities. As a result, North America remains a leading region for RPA utilization in insurance workflows.

Europe follows with growing interest in RPA solutions as insurers face regulatory complexity and seek to optimize costs. European insurers are using automation to strengthen compliance processes and enrich customer service delivery. Meanwhile, the Asia Pacific region continues to expand adoption as more insurers in emerging markets invest in digitization to remain competitive. These regional dynamics highlight varied stages of RPA integration based on local market conditions and strategic priorities.

Use Case Analysis

One of the most prevalent use cases for RPA in insurance is claims processing automation. In traditional settings, claims involve multiple steps such as data extraction, validation, and settlement review, all of which are labour-intensive. RPA can streamline these steps by automatically pulling information from forms and systems and performing validation checks. This reduces the duration and cost of claims handling and improves service responsiveness.

Another key use case is underwriting support where RPA gathers and consolidates data from internal and external sources to improve risk assessments. By automating data collection and preliminary risk checks, underwriters can focus on complex evaluation tasks that require domain expertise. This not only speeds up the underwriting cycle but also leads to more accurate risk pricing. The ability to integrate RPA with analytics enhances the depth of insights available during underwriting decisions.

Risk Analysis

One risk in deploying RPA in insurance relates to organizational readiness and legacy system constraints. Insurance firms often operate on long-standing systems that may not be fully compatible with modern automation tools. Integrating RPA requires thoughtful planning to avoid disruption of critical processes. Without careful alignment, automation efforts can stall or create vulnerabilities in workflows.

Another risk stems from management of process exceptions and governance. RPA bots excel at handling rule-based tasks, but they can struggle with unexpected scenarios that require human judgment. If not governed with proper oversight frameworks, automated processes can amplify errors or bypass necessary checks. Effective governance structures and ongoing monitoring are essential to ensure automation supports business goals without unintended consequences.

Buyer Decision Criteria

Buyers evaluating RPA solutions in the insurance market typically prioritize compatibility with existing systems and the ability to automate core workflows such as claims, underwriting, and compliance reporting. Decision makers assess how well an RPA platform integrates with legacy applications and whether it supports future scalability. Operational fit and ease of deployment are also important considerations. These factors help ensure that automation initiatives produce tangible benefits.

Cost-effectiveness and long-term support capabilities influence buyer choices as well. Insurers consider total cost of ownership, including implementation, maintenance, and potential upgrades. Support services, training, and governance tools also contribute to decision making. Buyers seek solutions that balance upfront affordability with strong operational performance and vendor support.

Key Market Segments

By Component

- Software

- Services

- Consulting

- Implementation & Integration

- Managed Services

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Claims Processing

- Policy Administration

- Underwriting & Risk Assessment

- Insurance Underwriting

- Customer Onboarding

- Regulatory Compliance Reporting

- Finance and Accounting

- Others

By Insurance Type

- Life & Health Insurance

- Property & Casualty (P&C) Insurance

- Reinsurance

- Others

Top Key Players in the Market

- UiPath

- SS&C Blue Prism

- IBM Corporation

- Microsoft Power Automate

- NICE

- Microsoft

- Vuram

- Infosys Limited

- Opteamix

- Pegasystems, Inc.

- Fidel Technologies

- Aspire Systems

- Royal Cyber Inc.

- Dynpro

- Automation Anywhere, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 208.3 Million |

| Forecast Revenue (2034) | USD 2,537.9 Million |

| CAGR(2025-2034) | 28.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)