Table of Contents

Shopify Merchant Insurance Market Size

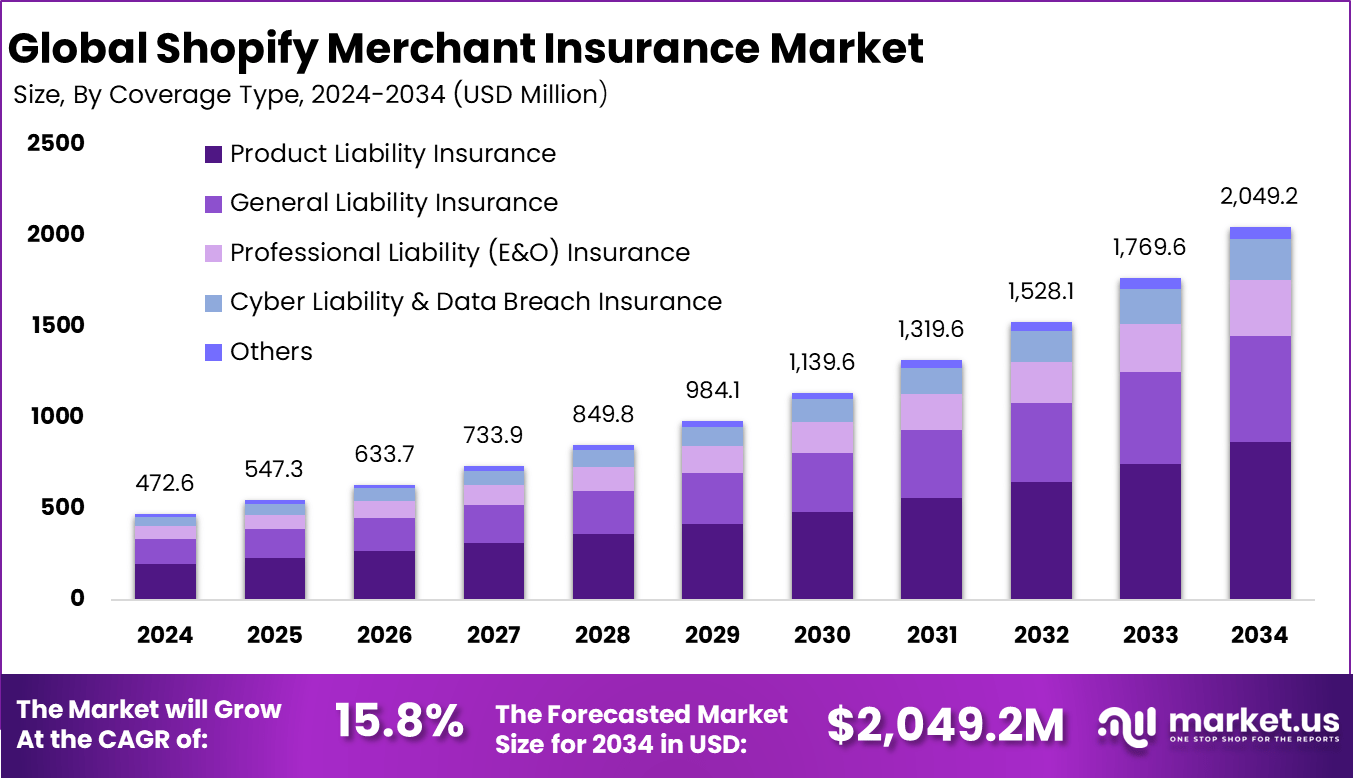

The global Shopify Merchant Insurance market was valued at USD 472.6 million in 2024 and is expected to grow steadily over the forecast period. The market is projected to reach approximately USD 2,049.2 million by 2034, expanding at a CAGR of 15.8% from 2025 to 2034. This growth is driven by the rising number of online merchants and increasing awareness of business risk protection. Growing demand for tailored insurance solutions for e commerce operations is further supporting market expansion.

The Shopify merchant insurance market refers to insurance products designed to protect online sellers operating on the Shopify platform. These insurance solutions typically cover risks such as product liability, general liability, property damage, and business interruption. Shopify merchants range from small independent sellers to large direct-to-consumer brands, all of which face exposure to operational and legal risks. Insurance coverage helps merchants manage uncertainty while continuing daily operations. As e-commerce activity increases, insurance becomes a necessary part of business protection.

Market Key Takeaways

- In 2024, product liability insurance led coverage adoption with a 42.3% share. This leadership reflected rising exposure to customer claims, product returns, and cross border sales risks among online merchants.

- Small merchants represented the largest insured group with a 58.7% share, indicating strong demand for affordable, simplified, and easy to access insurance solutions among early stage and growing ecommerce businesses.

- The apparel and fashion segment captured a 34.9% share, supported by high order volumes, frequent returns, and elevated liability exposure related to sizing, materials, and product compliance.

- Annual policies accounted for 71.5% of adoption, showing clear preference for predictable coverage terms, cost stability, and uninterrupted protection throughout the operating year.

- The embedded and app based distribution model held a 47.8% share, highlighting the shift toward seamless, in platform insurance purchasing integrated directly into merchant workflows.

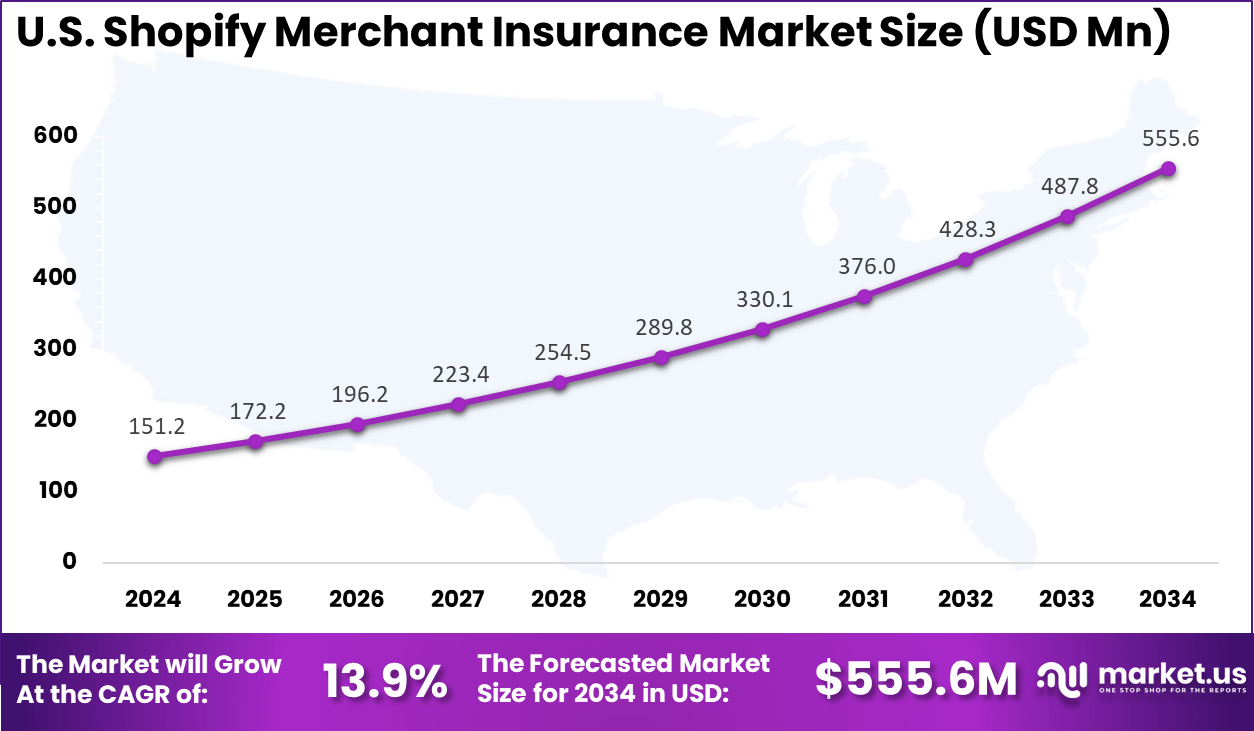

- The United States remained a core market in 2024, supported by a large active merchant base and higher awareness of ecommerce related operational risks.

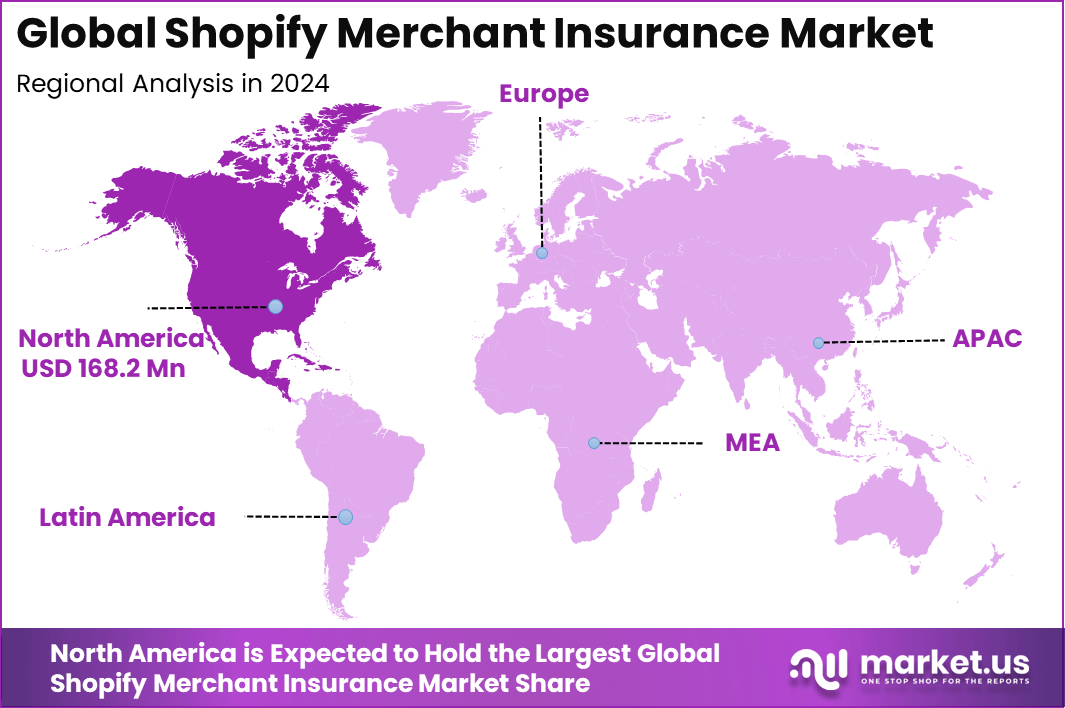

- North America led globally with more than a 35.6% share, driven by mature digital commerce ecosystems, strong compliance requirements, and widespread adoption of embedded insurance models.

Key Insights Summary

Insurance and Risk Exposure

- Cyber risk remained a major financial concern, with average cyber insurance claims near USD 205,000. When business interruption occurred, losses escalated to almost USD 1 million, underscoring the financial impact of operational downtime.

- Delivery related risks continued to affect merchants, as about 1 in 10 shipped packages in the U.S. arrived damaged, while nearly 1 in 3 consumers experienced package theft.

- Insurance penetration among small businesses showed moderate coverage levels. Around 65% carried liability insurance, 39% held property insurance, and 32% maintained professional liability coverage.

Merchant Insurance Adoption and Costs

- Among small and midsize merchants, 65% adopted general liability insurance, while 39% invested in property insurance to protect physical and digital business assets.

- Monthly premium levels remained manageable. General liability averaged about USD 42, business owner policies ranged between USD 57 and USD 95, cyber liability averaged USD 140, and professional liability stood near USD 61.

Shipping and Parcel Insurance Insights

- Customer retention was closely linked to delivery performance, as 40% of shoppers avoided returning to retailers after a poor delivery experience.

- Damage and theft rates remained elevated, with 1 in 10 packages damaged and nearly 1 in 3 consumers reporting theft incidents.

- Coverage availability supported risk mitigation, as qualifying merchants received up to USD 200 in included shipping insurance. Standard premium rates averaged USD 0.89 per USD 100 of coverage for domestic shipments and USD 1.29 per USD 100 for international shipments.

Regional Analysis

North America held a dominant position in the global market, accounting for more than 35.6% of total revenue. The region generated around USD 168.2 million, supported by a large base of Shopify merchants and strong adoption of digital insurance platforms. Advanced fintech ecosystems and favorable regulatory environments strengthened regional leadership. As a result, North America continues to influence growth and innovation in the Shopify merchant insurance market.

The United States reached USD 151.2 Million with a CAGR of 13.9%, reflecting steady growth. Expansion is driven by small business participation. Embedded insurance adoption continues to rise. Merchants focus on risk protection. Market growth remains consistent.

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Small and medium merchants | Very High | ~58.7% | Risk protection and platform trust | Embedded policy purchase |

| Large Shopify brands | High | ~22% | Brand and liability protection | Customized coverage |

| Insurance providers | High | ~11% | New digital distribution | Platform partnerships |

| Brokers and intermediaries | Moderate | ~6% | SME insurance access | Referral based |

| Logistics partners | Low to Moderate | ~2% | Shipment risk mitigation | Bundled offerings |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Embedded insurance APIs | In platform policy issuance | ~4.1% | Growing |

| Digital underwriting engines | Fast risk assessment | ~3.3% | Growing |

| Claims automation tools | Faster claim resolution | ~2.7% | Developing |

| Data analytics | Merchant risk profiling | ~2.1% | Developing |

| AI fraud detection | Claim validation and prevention | ~1.6% | Developing |

Driver Analysis

The Shopify merchant insurance market is being driven by the increasing reliance of small and medium online retailers on risk management tools that protect against the unique exposures of digital commerce. Insurance offerings tailored for Shopify sellers encompass general liability, product liability, cyber coverage, business interruption protection, and other risk solutions designed for the ecommerce environment.

With the rise in online sales operations and complex supply chains, merchants encounter everyday risks such as theft, shipping damage, regulatory liability, and data breaches. The demand for insurance support reflects a growing recognition among digital retailers that structured risk coverage is essential to protect financial stability and sustain operations amidst unpredictable disruptions.

Opportunity Analysis

Emerging opportunities within this market are linked to the development of modular and scalable insurance products that evolve with merchant business maturity. Flexible policies that begin with essential protections and allow incremental enhancements can attract a broader base of Shopify sellers who seek affordable entry-level coverage with options to expand as operations grow.

Additionally, embedded insurance models and digital distribution channels that integrate directly into the Shopify platform or ecommerce workflows enable smoother onboarding and real-time risk assessment. This integration fosters convenience and makes insurance adoption more accessible to merchants balancing limited time and resource constraints in a competitive digital marketplace.

Challenge Analysis

A central challenge confronting the Shopify merchant insurance market is balancing product complexity with usability and educating merchants about tailored risk profiles. Insurance products must address nuanced threats such as cyber vulnerabilities associated with ecommerce platforms, chargeback exposures, and return-related liabilities while remaining comprehensible and cost-effective for users.

Merchants may lack the expertise to assess which coverage types are most relevant to their business, which can lead to underinsurance or overinsurance. Insurers must therefore enhance transparency, risk-profiling tools, and merchant education to optimise policy relevance and claims satisfaction.

Emerging Trends

Emerging trends in the Shopify merchant insurance landscape include the tailoring of coverage options to address ecommerce-specific risks such as cyber incidents, chargebacks, package loss, and payment disputes. Insurers are increasingly offering digital-native risk products that align with online retail operations and integrate directly with ecommerce platforms.

Another trend is the rise of embedded insurance solutions that merchants can purchase at the point of platform onboarding or through specialised brokers, reducing friction in the adoption process. These trends reflect a broader shift toward bespoke insurance experiences that cater to the diverse and dynamic needs of digital sellers.

Growth Factors

Growth in the Shopify merchant insurance market is anchored in the expanding number of online sellers embracing digital commerce through platforms like Shopify and the associated rise in operational risks that accompany increased ecommerce activity. As merchants scale their businesses, exposure to issues like cyberattacks, product defects, shipping challenges, and business interruptions grows, prompting demand for comprehensive risk mitigation measures. The proliferation of digital storefronts and evolving consumer expectations for secure, reliable service reinforce the strategic role of insurance as part of broader risk management and brand trust strategies for ecommerce enterprises.

Key Market Segments

By Coverage Type

- Product Liability Insurance

- General Liability Insurance

- Professional Liability (E&O) Insurance

- Cyber Liability & Data Breach Insurance

- Others

By Business Revenue/Size

- Micro-Merchants (<$250K revenue)

- Small Merchants ($250K – $5M revenue)

- Medium Merchants ($5M – $20M revenue)

By Product Category

- Apparel & Fashion

- Health, Beauty & Wellness

- Home & Garden

- Electronics & Gadgets

- Food & Beverage

By Policy Duration

- Annual Policies

- Monthly/Subscription Policies

By Sales Channel

- Embedded/App-Based

- Brokers & Independent Agents

- Direct from Carrier

Top Key Players in the Market

- Next Insurance, Inc.

- The Hartford Financial Services Group, Inc.

- Chubb, Ltd.

- Hiscox, Ltd.

- Berkshire Hathaway GUARD Insurance Companies

- biBERK Insurance Services (a Berkshire Hathaway company)

- Simply Business, Ltd.

- CoverWallet, Inc. (an Aon company)

- Thimble Insurance Agency, Inc.

- Travelers Companies, Inc.

- Markel Corporation

- Liberty Mutual Insurance Company

- Coterie Insurance

- Acuity Insurance

- Pie Insurance Holdings, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2025) | USD 472.6 Mn |

| Forecast Revenue (2035) | USD 2,049.2 Mn |

| CAGR(2025-2035) | 15.8% |

| Base Year for Estimation | 2025 |

| Historic Period | 2020-2024 |

| Forecast Period | 2025-2035 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)