Table of Contents

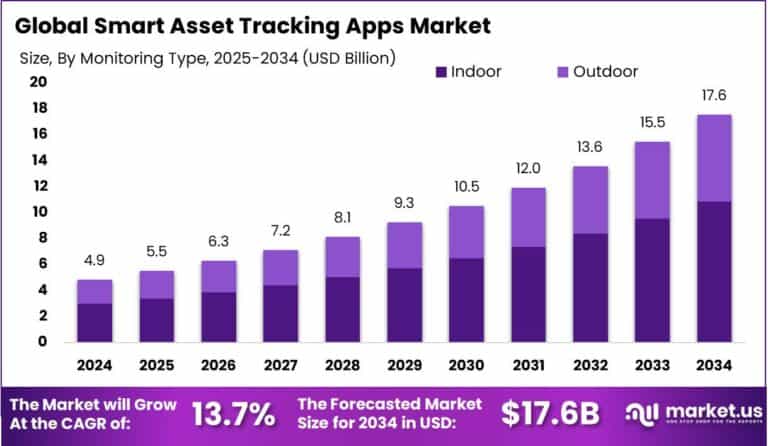

The global Smart Asset Tracking Apps Market is anticipated to reach USD 17.6 billion by 2034, up from USD 4.87 billion in 2024, growing at a robust CAGR of 13.70% from 2025 to 2034. In 2024, Asia-Pacific led the market, holding over 38.9% of the share, generating USD 1.89 billion in revenue.

China’s market specifically was valued at approximately USD 0.75 billion and is projected to grow at a CAGR of 15.1%. The increasing demand for digital asset management, real-time tracking, and operational transparency is driving this market expansion, particularly in sectors like livestock monitoring and indoor tracking.

How Tariffs Are Impacting the Economy

The imposition of tariffs has substantially impacted global economies, with rising costs and inflation taking center stage. In the United States, the implementation of new tariffs on imported goods has caused a significant surge in consumer prices, particularly in sectors like electronics, apparel, and automotive. U.S. GDP is projected to experience a loss of approximately 1.1%, which translates to a $170 billion reduction in economic output.

Moreover, the tariffs have eroded consumer purchasing power, with households expected to lose about $3,800 annually. These measures have forced businesses to reevaluate their supply chains and cost structures, further influencing the global trade environment. As inflation rises, central banks, including the U.S. Federal Reserve, face growing pressure to manage the economic fallout, balancing inflation control with economic growth.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/smart-asset-tracking-apps-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Businesses globally are experiencing rising operational costs as tariffs increase prices for raw materials and imported goods. Many companies are seeking alternative suppliers to avoid higher tariffs, leading to supply chain shifts.

This restructuring can result in inefficiencies, delays, and higher transportation costs. Additionally, many businesses are considering reshoring or nearshoring manufacturing operations to mitigate risks and reduce tariff exposure.

Sector-Specific Impacts

Different sectors have been impacted differently by tariffs. The electronics sector, reliant on imports, faces significant cost increases due to tariffs on key components. The automotive industry is also heavily affected, as production costs rise with the implementation of tariffs on essential materials. Similarly, the agriculture and textiles industries are seeing price hikes and supply disruptions, forcing businesses to adjust their sourcing and pricing strategies.

➤ Get Full Access Purchase Now @ https://market.us/purchase-report/?report_id=147538

Strategies for Businesses

To cope with the challenges posed by tariffs, businesses are adopting several key strategies:

- Supply Chain Diversification: Businesses are exploring new suppliers and manufacturing locations to reduce reliance on tariff-impacted regions.

- Nearshoring: Relocating production closer to home markets to minimize logistics costs and avoid tariffs.

- Product Innovation: Developing alternative products or modifying existing products to reduce tariff exposure.

- Cost Absorption: Absorbs some of the increased costs to avoid passing them entirely to consumers.

Key Takeaways

- Market Growth: The Smart Asset Tracking Apps Market is projected to grow at a CAGR of 13.70% from 2025 to 2034.

- Regional Leadership: Asia-Pacific held a dominant 38.9% share of the market in 2024, with China expected to grow at a 15.1% CAGR.

- Technological Trends: Cellular and indoor monitoring solutions are the dominant segments in the market.

- Sector-Specific Applications: Livestock monitoring plays a critical role, accounting for 31.7% of the market share.

Analyst Viewpoint

The present market conditions indicate robust growth, driven by technological advancements and increasing demand for digital asset management. Businesses are responding well to shifting market dynamics through strategic adaptations, such as supply chain diversification and nearshoring.

In the future, this market is likely to see continued growth as industries leverage smart asset tracking solutions to improve operational efficiency and transparency. Positive market expansion is expected, particularly in emerging markets like China and India.

➤ Discover More Trending Research

- Real-time Monitoring Solutions For Cold Chain Market

- Crowdfunding Market

- Digital Inspection Market

- AI-powered Humanoid Robots Market

Regional Analysis

In 2024, the Asia-Pacific region was the market leader, capturing 38.9% of the global smart asset tracking apps market share, generating USD 1.89 billion. This region is expected to continue its dominance, with China projected to see significant growth, growing at a 15.1% CAGR.

The North American and European markets are also expected to show substantial growth, driven by the demand for asset tracking solutions in sectors such as logistics and healthcare. As digital transformation accelerates across industries, these regions will likely invest heavily in smart tracking technology.

Business Opportunities

The Smart Asset Tracking Apps Market presents several opportunities for businesses, particularly in industries like logistics, healthcare, and agriculture. Companies can capitalize on the growing demand for real-time tracking solutions to enhance supply chain transparency and operational efficiency.

Additionally, the push for sustainability and the adoption of Industry 4.0 technologies open avenues for businesses to integrate asset tracking into broader digital transformation strategies. The livestock monitoring segment also offers significant potential as the need for accurate and real-time tracking of livestock increases.

Key Segmentation

The Smart Asset Tracking Apps Market is segmented by product type, including:

- Cellular: This segment dominates the market, accounting for 33.4% of market share, driven by the demand for real-time, remote asset tracking.

- Monitoring Type: The Indoor segment holds a significant share, making up 61.8% of the market as industries invest in tracking systems for warehouses, factories, and other indoor environments.

- Application Type: The Livestock Monitoring segment is a key application, contributing 31.7% of the market, driven by the demand for efficient and accurate tracking of agricultural assets.

Key Player Analysis

Key players in the Smart Asset Tracking Apps Market are focusing on innovation and expanding their offerings across sectors. These companies are integrating advanced technologies like IoT, AI, and machine learning into their tracking solutions to enhance asset visibility, security, and management.

By offering customizable solutions tailored to different industry needs, these players are gaining a competitive edge. Additionally, strategic partnerships and acquisitions are strengthening their market presence, allowing them to broaden their customer base and expand their product portfolios.

Top Key Players in the Market

- Samsara Inc.

- Azuga, Inc.

- Fleet Complete Inc.

- Digital Matter

- Geotraq

- Quectel Wireless Solutions Co., Ltd.

- Fibocom Wireless Inc.

- u-blox

- Telit Cinterio

- Semtech Corporation

- Laird Connectivity

- Nordic Semiconductor

- Advanced Tracking Technologies, Inc.

- Solera Holdings, Inc.

- Sequans Communications S.A.

- Others

Recent Developments

In 2024, significant advancements in the smart asset tracking industry have been made, with a surge in IoT integration and the rise of real-time tracking solutions. These developments are enhancing the market’s overall growth potential, particularly in the Asia-Pacific region.

Conclusion

The Smart Asset Tracking Apps Market is on a promising growth trajectory, driven by technological advancements and sector-wide adoption.

As businesses increasingly recognize the need for real-time tracking solutions, the market will continue to expand, presenting lucrative opportunities for companies to innovate and adapt to evolving consumer demands. The future outlook remains positive, with sustained market growth and new technological breakthroughs on the horizon.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)