Table of Contents

Introduction

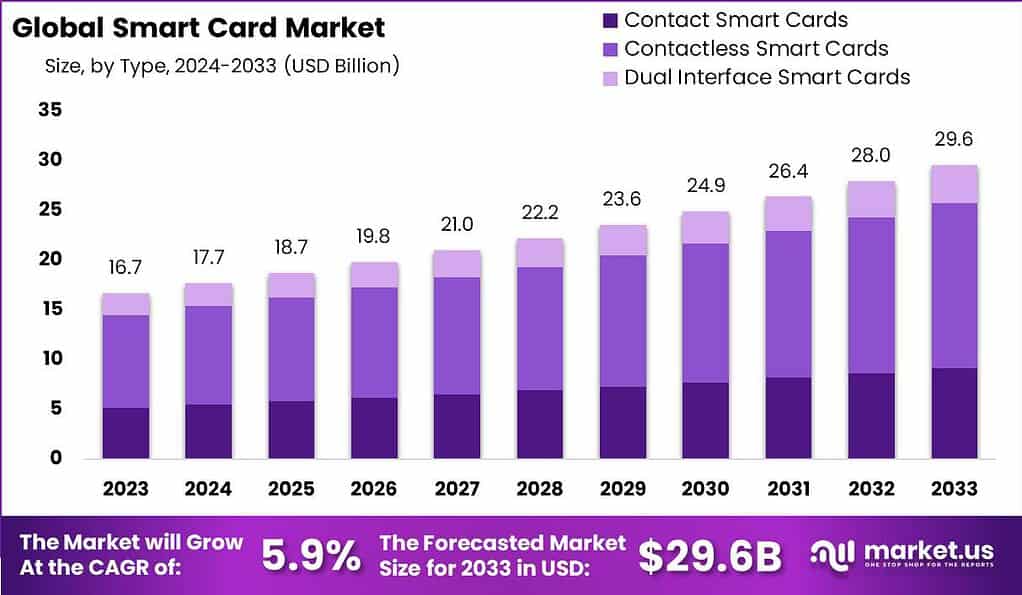

According to Market.us, The Smart Card Market is poised to grow significantly, reaching approximately USD 29.6 billion by 2033, with a steady CAGR of 5.9% from 2024 to 2033. Smart cards, incorporating embedded integrated circuit chips, are crucial for secure data storage and processing across sectors like banking, telecommunications, healthcare, and government. The market’s expansion is driven by technological advancements, increasing adoption of contactless payment solutions, and government initiatives for secure identification.

The smart card market has witnessed significant growth in recent years, driven by the increasing demand for secure and convenient payment solutions, identification systems, and access control applications. Smart cards are embedded with integrated circuits that store and process data securely, making them resilient against tampering and counterfeiting. This technology has found widespread adoption in various sectors such as banking, telecommunications, healthcare, transportation, and government.

One of the key growth factors for the smart card market is the rising need for secure payment systems. As digital payment methods gain popularity, consumers and businesses alike seek reliable and secure options to protect their financial transactions. Smart cards offer enhanced security features such as encryption and authentication, making them an ideal choice for payment applications. Additionally, the increasing penetration of smartphones and contactless payment systems has further fueled the demand for smart cards, as they can be integrated into mobile devices for seamless transactions.

Another factor driving the market growth is the growing emphasis on identity verification and access control. Smart cards are widely used for identity cards, passports, and employee access cards, among others. They provide a secure and tamper-proof solution for storing personal information and enable efficient authentication processes. As governments and organizations strive to enhance security measures, the adoption of smart cards for identification and access control is expected to increase.

To learn more about this report – request a sample report PDF

Despite the positive growth prospects, the smart card market also faces certain challenges. One of the major challenges is the presence of alternative payment methods such as mobile wallets and digital currencies. As these technologies gain traction, some users may prefer them over traditional smart card-based payment systems. To stay competitive, smart card manufacturers need to innovate and offer additional value propositions such as enhanced security features, compatibility with emerging technologies, and seamless integration with digital platforms.

However, there are still ample opportunities for growth in the smart card market. The increasing adoption of Internet of Things (IoT) devices and smart city initiatives present new avenues for smart card applications. IoT devices require secure and efficient communication protocols, and smart cards can play a crucial role in ensuring secure data exchange and authentication. Moreover, the expansion of e-commerce and online banking presents opportunities for smart card-based authentication and secure online transactions.

Smart Card Statistics

- The Smart Card Market is anticipated to reach USD 29.6 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period from 2024 to 2033.

- In 2023, Contactless Smart Cards held over 56% of the global smart card market share due to their convenience and security in transactions. They are widely used in retail, banking, and public transport sectors.

- In 2023, the Telecommunications segment dominated the market, capturing more than 41% share. Smart cards, particularly SIM cards, play a crucial role in mobile communications, subscriber authentication, and network connectivity.

- Asia-Pacific held a dominant market position in 2023 with a 38% share, driven by technological advancements, digital transactions, and government initiatives.

- According to a report published by the World Bank on June 29, 2022, 40% of adults in low- and middle-income economies made merchant in-store or online payments using a card, phone, or the internet for the first time since the start of the pandemic.

- By 2025, smart card penetration in transportation is expected to reach 78%.

- In 2022, more than 2.6 billion smart cards were shipped globally.

- Additionally, smart cards with biometrics are projected to grow at a CAGR of 17.4% over the next six years.

Emerging Trends

- Biometric Integration: The smart card market is seeing significant growth due to the integration of biometric technologies such as fingerprint scanning, iris recognition, and facial recognition. These features enhance security by ensuring accurate user identification and are being increasingly adopted in various sectors like government, healthcare, and finance.

- Contactless Smart Cards: There is a noticeable shift towards contactless smart cards, driven by their convenience and the demand for swift transactions. This trend is expected to see the highest growth, particularly in BFSI, government, healthcare, and transportation sectors.

- Blockchain Utilization: Smart cards are being increasingly used in blockchain applications for secure transactions. They manage cryptographic keys effectively, providing a secure method for user authentication and reducing cyber theft incidents.

- Sustainability Initiatives: The industry is moving towards sustainable solutions with innovations like recycled plastic cards and cards designed for environmental resilience, reflecting a growing emphasis on eco-friendly practices within the technology sector.

- Digitalization and IoT Integration: As IoT devices proliferate, there is a growing need for secure smart card solutions capable of handling complex interactions and data security, which is pushing the market towards more sophisticated smart card technologies.

Top Use Cases of Smart Cards

- Personal Identification and Access Control: Smart cards are widely used for personal identification, offering robust security features that are crucial in today’s digital world. They are utilized extensively in sectors requiring high security such as government and corporate settings.

- Banking and Financial Services: In the BFSI sector, smart cards facilitate secure banking transactions and are integral to the functioning of credit and debit card operations. This is a dominant application due to the high volume of card payments globally.

- Healthcare Systems: Smart health cards store critical patient data and are used to secure access to electronic health records, streamlining operations and improving the efficiency of healthcare services

- Transportation: Smart cards are employed in public transport systems to simplify fare payments and enhance the efficiency of ticketing systems across buses, metros, and trains, particularly in regions like the Asia Pacific.

- Government Applications: Used for government services, smart cards facilitate the secure access to and management of government-provided services, ranging from welfare benefits to public sector access controls.

Major Challenges

- Privacy and Security Concerns: As the utilization of smart cards expands, particularly in sectors like banking and healthcare, concerns regarding the security and privacy of the data stored on these cards are significant. The risk of data breaches and the challenge of ensuring robust encryption standards are ongoing concerns.

- Integration and Standardization Issues: The need for standardization across different systems and technologies poses a challenge. Compatibility between various card readers and the global diversity in technology standards complicates the integration process.

- High Initial Setup Costs: The initial costs for setting up smart card systems, including readers and the technology infrastructure, can be prohibitive, especially for small to medium enterprises and in developing regions.

- Technological Disruption: Rapid technological advancements may lead to newer forms of authentication and payment systems that could disrupt the smart card market. Staying ahead of technology trends and continuously innovating is necessary but challenging.

- Reliance on Physical Cards: In an era where digital and mobile wallet technologies are gaining prominence, the dependence on physical cards might limit the growth potential of the smart card market in some segments.

Market Opportunities

- Expansion in Emerging Markets: There is significant growth potential in emerging markets, particularly in Asia Pacific regions, driven by increasing digitalization and government initiatives towards secure digital identities and financial inclusion.

- Healthcare Sector Applications: The healthcare sector offers substantial opportunities for smart cards in patient identification, secure access to medical records, and streamlining insurance claim processes, contributing to enhanced data security and operational efficiency.

- Contactless Payment Solutions: With the growing consumer preference for contactless transactions, especially highlighted during the COVID-19 pandemic, there is a burgeoning demand for contactless smart cards in retail and banking sectors.

- Transportation and Mobility Solutions: Smart cards are increasingly being used in transportation for seamless travel experiences, such as in metro systems and bus networks, facilitating easy access and cashless transactions.

- Government and Public Sector Applications: The adoption of smart cards for government IDs, electoral processes, and public welfare schemes can drive market growth. These applications ensure secure authentication and streamline administrative processes.

Recent Developments

- Infineon Technologies Collaboration with Mastercard (March 2024): Infineon announced a collaboration with Mastercard to develop new biometric smart cards aimed at increasing payment security. This partnership focuses on integrating Infineon’s security solutions with Mastercard’s payment technology to create secure and user-friendly payment methods.

- Introduction of STPay-Topaz-Bio (November 2023): STMicroelectronics launched the STPay-Topaz-Bio, a biometric payment card solution that integrates fingerprint authentication to offer secure and contactless payment experiences.

- Launch of Samsung Pay Card (April 2023): Samsung Electronics introduced the Samsung Pay Card, a new smart card solution integrated with Samsung Pay’s digital wallet. This card aims to provide users with secure and convenient payment options through advanced authentication features.

- Partnership with Mastercard on Biometric Cards (September 2023): Samsung partnered with Mastercard to develop biometric payment cards incorporating Samsung’s security technology and Mastercard’s payment solutions. This partnership aims to enhance the security and user experience of contactless payments

Conclusion

The smart card market, while facing challenges like security concerns and high initial costs, stands on the brink of numerous growth opportunities. The expanding applications in healthcare, transportation, and government sectors, coupled with the push towards contactless payment technologies and the potential in emerging markets, present significant avenues for expansion. Continual innovation and addressing the integration challenges will be key for stakeholders in the smart card industry to leverage these opportunities effectively. The dynamic nature of this market, driven by technological advancements and shifting consumer preferences, suggests a promising future for smart card technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)