Table of Contents

- Strategic Smart City Investment Perspective

- Key Takeaways

- Quick Market Facts

- Increasing Adoption Technologies

- Drivers Impact Assessment

- Restraints Impact Assessment

- Technology Risk Factors Impact Analysis

- Climate Related Infrastructure Loss Exposure Assessment

- U.S. Market Size

- Investment and Business Benefits

- Key Market Segments

- Report Scope

Strategic Smart City Investment Perspective

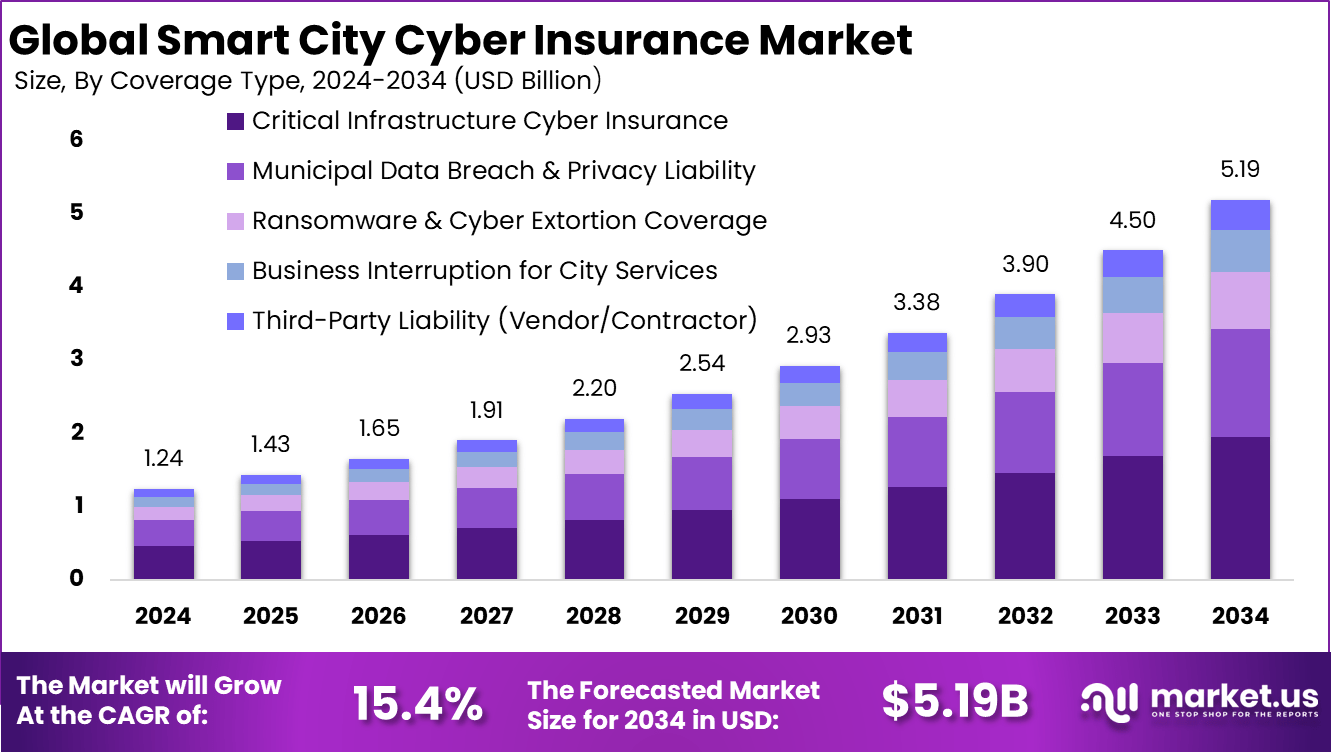

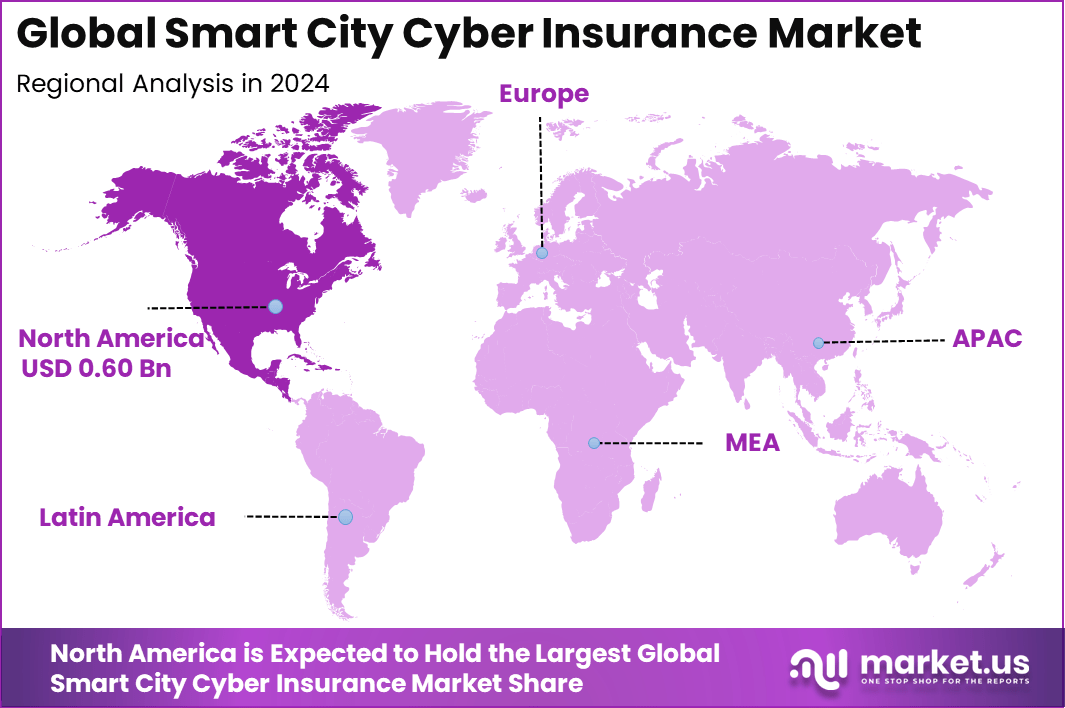

The Global Smart City Cyber Insurance Market represents a compelling smart infrastructure investment opportunity, expanding from USD 1.43 billion in 2025 to nearly USD 5.19 billion by 2034, growing at a CAGR of 15.4%. North America’s dominant market position, capturing more than 48.7% share and USD 0.60 billion in revenue, underscores strong regional leadership in cyber insurance solutions for connected urban ecosystems.

Smart city cyber insurance is a specialised form of cyber risk coverage designed to protect digitally connected urban systems from cyber threats. It focuses on risks linked to smart infrastructure such as connected traffic systems, public surveillance networks, energy grids, water management platforms and digital public services. As cities increasingly rely on data exchange and real time connectivity, the financial exposure from cyber incidents has grown, making dedicated insurance coverage essential. This insurance acts as a financial safeguard against losses caused by cyberattacks, system failures and data compromise across city operations.

One major factor driving smart city cyber insurance adoption is the sharp rise in cyber incidents targeting public infrastructure. Cybersecurity agencies report that cyberattacks on government and public sector systems increased by over 40% globally in recent years, highlighting growing vulnerability. Smart cities deploy thousands of connected devices, which increases entry points for attackers and raises the potential financial impact of breaches. This risk environment has pushed city authorities to seek structured financial protection through insurance.

Demand for smart city cyber insurance is rising as digital infrastructure becomes central to urban development strategies. Cities investing in intelligent transport systems, smart grids and digital governance platforms recognise that traditional risk management tools do not adequately address cyber threats. Insurance is increasingly viewed as a core component of cyber resilience strategies, complementing technical security controls. This demand is particularly visible in cities with high levels of sensor deployment and cloud based service platforms.

Key Takeaways

- Critical infrastructure cyber insurance led coverage types with a 37.6% share, reflecting rising concern over cyber risks targeting smart city utilities, transportation networks, and public services.

- Municipal governments and agencies dominated insured entities at 58.3%, driven by deeper digitalization of city operations and higher exposure to ransomware and system outages.

- Smart grid and energy systems accounted for 32.8% of technology applications, as power networks remain among the most cyber sensitive assets within smart cities.

- Annual policies represented 79.4%, showing preference for predictable and recurring coverage aligned with public sector budgeting cycles.

- North America held a leading 48.7% share, supported by advanced smart city deployments, higher cyber risk awareness, and established insurance frameworks.

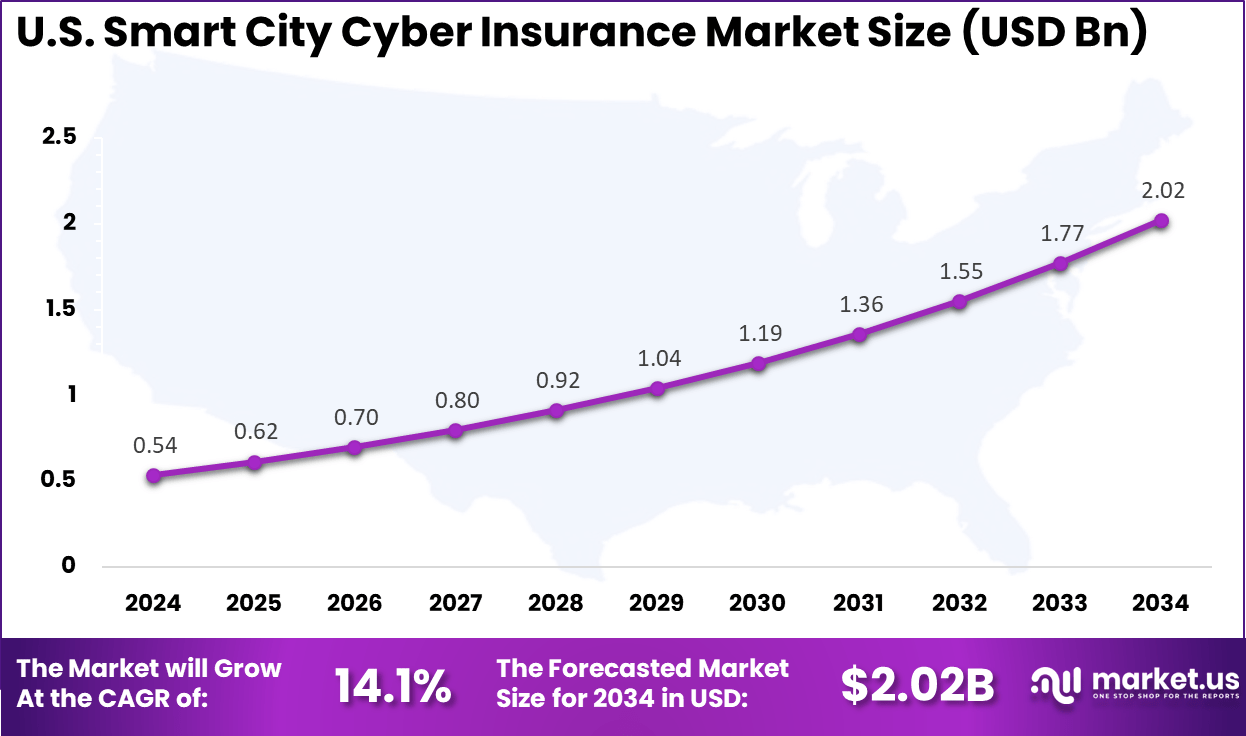

- The US market reached USD 0.54 billion in 2024 and is expanding at a 14.1% CAGR, driven by growing cyber threats to urban infrastructure and increased uptake of specialized cyber insurance products.

Quick Market Facts

Adoption by Sector and Organization Size (2025)

- 78% of regional and local governments carry standalone cyber insurance policies, up from 61% in 2023.

- Adoption among large enterprises and smart city developers ranges between 70% and 80%.

- Only 17% of small businesses within the public supply chain hold cyber insurance coverage.

- Small businesses account for 46% of reported cyber breaches in 2025.

- Healthcare organizations lead sector adoption with an 82% coverage rate.

Usage and Coverage Statistics

- 68.3% of policies are standalone cyber insurance products.

- 81% of active policies include data recovery coverage.

- Ransomware accounts for 41% to 44% of total insurance claims.

- Incident response clauses are triggered in 73% of claims.

- Large claim frequency declined by 30% in early 2025.

Increasing Adoption Technologies

Advanced data analytics is a key technology shaping smart city cyber insurance adoption. Insurers increasingly use network telemetry, incident data and threat intelligence feeds to assess cyber exposure. Artificial intelligence models help identify risk patterns and estimate potential loss severity across interconnected systems. These capabilities enable more accurate underwriting and continuous risk assessment.

Automation and digital insurance platforms also support adoption by simplifying policy management and claims handling. Smart city operators can integrate insurance monitoring with cybersecurity dashboards and asset management systems. This allows insurers to assess risk dynamically rather than relying on periodic assessments. Technology driven insurance models improve responsiveness in fast changing urban digital environments.

A key reason for adoption is financial protection against high impact service disruption. Cyber incidents affecting transportation, utilities or emergency services can cause significant economic loss and public safety risks. Insurance coverage supports system restoration, incident response costs and liability claims. This reduces pressure on public budgets during cyber emergencies.

Drivers Impact Assessment

| Key Growth Driver | Estimated CAGR Influence (%) | Primary Affected Regions | Expected Influence Period |

|---|---|---|---|

| Rising Cyberattacks on Smart City Infrastructure | +4.6% | North America, Europe | Near Term |

| Expansion of Smart City IoT and Connected Systems | +5.1% | Asia Pacific, Europe | Mid Term |

| Increasing Adoption of Cloud and Data Platforms by Municipalities | +2.7% | North America, East Asia | Mid to Long Term |

| Government Mandates on Cybersecurity and Risk Transfer | +1.9% | Europe, Asia Pacific | Mid Term |

| Growth of Public Private Partnerships in Urban Tech | +1.1% | Global | Long Term |

Restraints Impact Assessment

| Key Market Constraint | Estimated CAGR Drag (%) | Most Impacted Regions | Constraint Time Horizon |

|---|---|---|---|

| High Cost of Comprehensive Cyber Insurance Policies | -3.2% | Emerging smart cities | Near Term |

| Limited Cyber Risk Awareness at Municipal Level | -2.1% | Developing economies | Near to Mid Term |

| Inconsistent Cyber Risk Assessment Frameworks | -1.6% | Global | Mid Term |

| Regulatory Fragmentation Across Jurisdictions | -1.3% | Europe, Asia Pacific | Mid Term |

| Limited Historical Loss Data for Smart City Systems | -0.9% | Emerging regions | Long Term |

Technology Risk Factors Impact Analysis

| Technology Risk Factor | CAGR Sensitivity Impact (%) | Risk Concentration Regions | Risk Evolution Timeline |

|---|---|---|---|

| IoT Device Vulnerabilities and Firmware Gaps | -2.2% | Global smart city deployments | Near Term |

| Cloud Misconfiguration and Data Exposure | -1.7% | North America, Europe | Mid Term |

| Legacy System Integration Risks | -1.4% | Europe, Asia Pacific | Mid Term |

| Ransomware Attacks on Urban Control Systems | -2.0% | North America | Near to Mid Term |

| Skills Shortage in Municipal Cybersecurity Teams | -1.1% | Emerging smart cities | Long Term |

Climate Related Infrastructure Loss Exposure Assessment

| Climate Linked Risk Category | Estimated Loss Exposure Impact (%) | High Risk Regions | Exposure Outlook |

|---|---|---|---|

| Flooding Impacting Data Centers and Control Rooms | -2.9% | Southeast Asia, Coastal Europe | Near Term |

| Extreme Heat Affecting Network Reliability | -2.4% | Middle East, Southern Europe | Mid Term |

| Storm and Power Disruption Related Cyber Failures | -2.1% | North America, Europe | Mid Term |

| Long Term Climate Stress on Urban Digital Assets | -1.6% | Global | Long Term |

| Combined Physical Cyber Risk Events | -1.3% | Global | Long Term |

U.S. Market Size

The United States reached USD 0.54 Billion with a CAGR of 14.1%, reflecting steady expansion. Growth is driven by increased cyber incidents and infrastructure digitization.

North America accounts for 48.7%, supported by widespread smart city initiatives and digital infrastructure.

Investment and Business Benefits

Investment opportunities in smart city cyber insurance are emerging around data driven and adaptive insurance models. Platforms that link real time cyber risk monitoring with dynamic coverage structures are gaining attention. These solutions align insurance costs with actual risk exposure, which is attractive for large scale smart city deployments. Such innovation improves efficiency for both insurers and insured entities.

Opportunities also exist in integrated cyber risk ecosystems that combine cybersecurity services, incident response and insurance coverage. Smart cities increasingly prefer bundled solutions that reduce complexity and improve coordination during cyber incidents. Investments in these integrated models benefit from long term municipal contracts and recurring service revenues. This creates stable investment potential linked to urban digital expansion.

Smart city cyber insurance delivers clear business benefits by reducing financial uncertainty linked to cyber threats. Coverage for data breaches, system outages and third party liabilities helps cities manage unexpected expenses without derailing long term infrastructure plans. This financial stability is critical for large scale urban digital projects with multi year investment cycles. Insurance enables continuity even after major cyber incidents.

In addition, insurance strengthens strategic planning and stakeholder confidence. By transferring part of the cyber risk, city authorities can focus on innovation and service improvement rather than risk avoidance. Insurance supported risk frameworks encourage responsible digital growth while protecting public interests. This balance is essential for the sustainable success of smart city initiatives.

Key Market Segments

By Coverage Type

- Critical Infrastructure Cyber Insurance

- Municipal Data Breach & Privacy Liability

- Ransomware & Cyber Extortion Coverage

- Business Interruption for City Services

- Third-Party Liability (Vendor/Contractor)

By Insured Entity

- Municipal Governments & Agencies

- Public Utility Operators

- Smart Infrastructure Vendors/Operators

- Public Transit Authorities

By Technology Application

- Smart Grid & Energy Systems

- Intelligent Transportation Systems

- Public Safety & Surveillance Networks

- Smart Water & Waste Management

By Policy Duration

- Annual Policies

- Multi-Year/Project-Based Policies

Top Key Players in the Market

- AXA SA

- Allianz SE

- Zurich Insurance Group, Ltd.

- Chubb, Ltd.

- American International Group, Inc. (AIG)

- Travelers Companies, Inc.

- Beazley plc

- Munich Re (Münchener Rückversicherungs-Gesellschaft AG)

- Swiss Re, Ltd.

- Liberty Mutual Insurance Company

- The Hartford Financial Services Group, Inc.

- Axis Capital Holdings, Ltd.

- CNA Financial Corporation

- Sompo Holdings, Inc.

- Tokio Marine Holdings, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.2 Bn |

| Forecast Revenue (2034) | USD 5.1 Bn |

| CAGR(2025-2034) | 15.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)