Table of Contents

Introduction

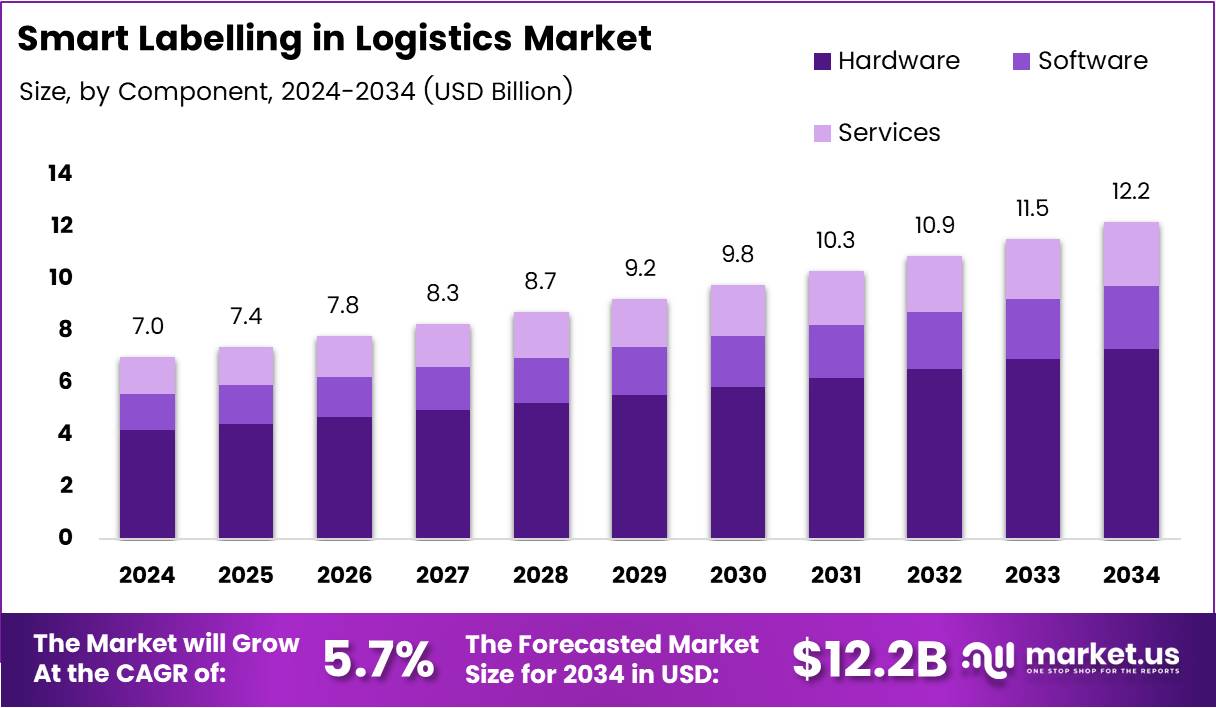

The Global Smart Labelling in Logistics Market is poised for substantial growth, projected to reach USD 12.2 Billion by 2034 from USD 7.0 Billion in 2024, at a steady CAGR of 5.7% during the forecast period (2025–2034).

The rising need for real-time visibility, automation, and error-free logistics operations is accelerating the adoption of smart labeling technologies worldwide. Leveraging RFID, IoT, and QR codes, smart labeling solutions are transforming traditional logistics into more efficient, transparent, and data-driven ecosystems.

The growth trajectory is further supported by increasing e-commerce volumes, demand for contactless systems post-pandemic, and government-led initiatives promoting digital logistics infrastructure. With the majority of companies seeking to eliminate shipment delays and enhance customer satisfaction, smart labeling is emerging as a pivotal innovation shaping the future of supply chain management.

Key Takeaways

- The global Smart Labelling in Logistics Market is expected to hit USD 12.2 Billion by 2034, growing at a CAGR of 5.7%.

- In 2024, the Hardware segment dominated with a 57.9% share.

- RFID Labels captured the largest product share of 49.7% in 2024.

- Inventory Management led the application segment with a 39.3% share in 2024.

- North America accounted for 41.8% of the market, valued at USD 2.9 Billion.

Market Segmentation Overview

- By Component:

- Hardware (57.9% share in 2024) remains the largest category, driven by RFID tags, scanners, and printers.

- Software contributes significantly by managing and analyzing data but lags behind due to high hardware adoption.

- Services, including installation and maintenance, play a supporting role.

- By Product:

- RFID Labels dominate with 49.7% market share in 2024, ensuring seamless tracking and identification.

- NFC Labels are gaining ground for interactive logistics but remain less adopted compared to RFID.

- Electronic Shelf Labels (ESL) show promise in retail logistics but currently hold a smaller presence.

- Other niche labels contribute marginally.

- By Application:

- Inventory Management leads with 39.3% share in 2024, streamlining stock accuracy and reducing errors.

- Asset Tracking supports utilization improvements and loss reduction.

- Parcel Tracking & Delivery ensures last-mile visibility.

- Cold Chain Monitoring plays a vital role in pharmaceuticals and perishables, though with limited share.

Drivers

- Demand for Real-Time Tracking – Businesses require constant monitoring from warehouse to customer, ensuring transparency and reliability.

- IoT Adoption – IoT-enabled smart labels transmit instant updates on product condition and location.

- Enhanced Accuracy – Reducing manual errors, smart labels significantly improve inventory efficiency.

- E-commerce Expansion – The surge in online retail is driving demand for precise and timely deliveries, making smart labeling indispensable.

Use Cases

- Inventory Management: Real-time stock visibility helps businesses avoid overstocking or understocking, ensuring operational efficiency.

- Asset Tracking: High-value goods, machinery, and containers can be continuously monitored to prevent theft or misplacement.

- Parcel Tracking & Delivery: Enhances last-mile transparency, providing customers with timely updates.

- Cold Chain Monitoring: Maintains temperature-sensitive goods like vaccines and fresh produce under stringent conditions, reducing spoilage.

Major Challenges

- High Integration Costs – Smart labeling systems require significant upfront investments in RFID and supporting infrastructure.

- Technological Complexity – Integrating with legacy systems poses operational challenges for logistics providers.

- Regulatory Barriers – Different countries have varied compliance requirements, making standardization difficult across international supply chains.

Business Opportunities

- Sustainability Push – Smart labels contribute to recycling and eco-friendly packaging, aligning with global green initiatives.

- Emerging Markets – Developing economies in Asia, Africa, and Latin America are investing heavily in modern logistics, creating untapped growth potential.

- Technological Advancements – Innovations in RFID, QR codes, and AI-driven predictive analytics are unlocking new efficiencies.

- Blockchain Integration – Ensures authenticity and transparency in logistics, preventing fraud and counterfeit risks.

Regional Analysis

- North America: Leading with 41.8% share and valued at USD 2.9 Billion, thanks to advanced RFID and IoT adoption across retail and pharma sectors.

- Europe: Strong regulatory frameworks and e-commerce expansion fuel steady growth.

- Asia Pacific: Rapid adoption in China and India due to booming e-commerce, government-backed logistics modernization, and rising manufacturing output.

- Middle East & Africa: Gradual adoption, supported by infrastructure investments in UAE and Saudi Arabia.

- Latin America: Growth driven by Brazil and Mexico, with e-commerce players increasingly deploying smart labeling solutions.

Recent Developments

- In February 2025, Tive secured a USD 40 Million funding round to expand its real-time supply chain visibility solutions.

- In October 2024, MCC acquired Starport Technologies, strengthening its smart labeling portfolio in logistics.

- In July 2025, IN Groupe finalized the acquisition of IDEMIA Smart Identity, boosting its secure identity verification and authentication technologies.

Conclusion

The Global Smart Labelling in Logistics Market is on a transformative journey, reshaping the way supply chains operate. With its ability to reduce errors, enhance visibility, and streamline processes, smart labeling has become indispensable for modern logistics. While challenges such as high costs and regulatory complexities persist, the opportunities in sustainability, emerging markets, and technological innovation present a strong growth outlook.

As companies continue to prioritize efficiency, accuracy, and customer satisfaction, smart labelling is set to play a pivotal role in shaping the future of global logistics.