Table of Contents

Introduction

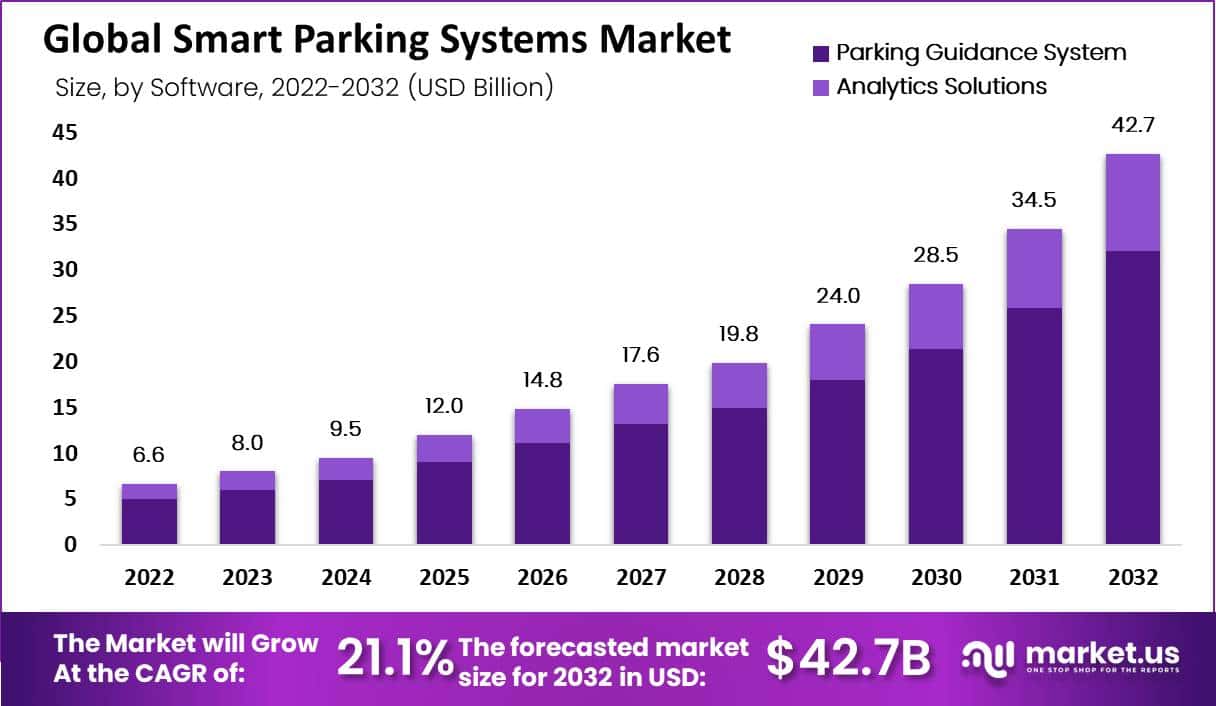

The Global Smart Parking Systems Market size is projected to reach approximately USD 42.7 billion by 2032, up from USD 8.0 billion in 2023, registering a CAGR of 21.1% over the forecast period from 2023 to 2033.

The Smart Parking Systems Market encompasses a range of innovative technologies designed to improve parking efficiency and management through automation, connectivity, and data-driven insights. These systems utilize advanced sensors, cameras, IoT devices, and software platforms to monitor parking spaces in real-time, directing drivers to available spots and optimizing parking resource allocation.

The market includes hardware components (such as parking meters and sensors) and software solutions that provide analytics, mobile app integrations, and cloud-based services for parking management. With urbanization increasing and the focus shifting towards smart city infrastructure, the smart parking systems market is emerging as a critical component of intelligent transportation systems (ITS).

The growth of the Smart Parking Systems Market is primarily driven by several key factors, including rapid urbanization, the rise in vehicle ownership, and the need for optimized space utilization in congested urban areas.

Cities worldwide are increasingly adopting smart city initiatives that prioritize efficient transportation solutions, with smart parking being a critical aspect. Furthermore, advancements in IoT and AI technologies enable more sophisticated parking management solutions, enhancing operational efficiency and user convenience.

The integration of these systems with electric vehicle (EV) charging stations also provides a dual benefit, supporting both traffic management and the shift towards sustainable transportation. Government regulations promoting reduced carbon emissions and efficient use of urban space further propel market growth, as smart parking systems help to minimize idle driving time and fuel consumption.

The demand for smart parking solutions is accelerating due to the pressing need for better parking management in densely populated urban centers. As cities grow and parking spaces become increasingly scarce, both municipalities and private operators are investing in smart parking technologies to manage traffic flow, reduce congestion, and enhance the overall driver experience. Additionally, consumers are showing a growing preference for digital and automated solutions that offer real-time information, seamless payment options, and minimal friction in finding parking spaces.

Businesses, including shopping centers and airports, are also seeking smart parking solutions as a means of enhancing customer satisfaction and optimizing their facilities. This rising demand is further supported by an expanding base of tech-savvy consumers who are accustomed to the convenience offered by mobile apps and connected systems.

The Smart Parking Systems Market presents significant opportunities, particularly in the context of smart city initiatives and sustainable urban development. The increasing deployment of 5G networks and IoT devices is expected to enhance the capability and scalability of smart parking systems, allowing for more precise data analytics and integration with other smart city services, such as traffic management and public transport systems.

Additionally, the growing adoption of electric vehicles opens up new revenue streams, as integrating EV charging stations with smart parking facilities becomes a priority for cities and commercial entities alike. Emerging markets, particularly in Asia-Pacific and Latin America, are also ripe with opportunities due to their rapid urbanization and the proactive implementation of smart city frameworks, which often include smart parking as a key focus area.

Key Takeaways

- The global Smart Parking Systems Market is expected to expand from USD 8.0 billion in 2023 to USD 42.7 billion by 2032, achieving a CAGR of 21.1%. This growth is driven by increasing urbanization and rising vehicle ownership.

- Smart Meters led the hardware segment in 2022, capturing 42% of the market share due to their extensive application in managing urban parking solutions.

- Parking Guidance Systems dominated the market, accounting for over 75% of the share in 2022, as they effectively assist drivers in finding parking spaces, significantly reducing search times.

- The Engineering Service segment accounted for over 60% of the market share in 2022, propelled by the growing need for infrastructure to support autonomous and semi-autonomous vehicles.

- The Commercial Segment held the largest share in 2022, exceeding 40%, mainly due to the deployment of smart parking systems in shopping centers, corporate buildings, and public spaces.

- North America led the global market with over 37% share in 2022, driven by increasing smart city projects and collaborative efforts between public and private sectors to manage urban traffic congestion.

- Restraining Factor: High infrastructure costs remain a significant barrier to the broad adoption of smart parking systems, particularly for smaller municipalities and operators.

Smart Parking Systems Statistics

- In 2023, North America held the largest share of the global smart parking market, making up about 35% of revenue.

- The U.S. smart parking market is valued at around $700 million in 2024, with a 20.5% growth rate per year until 2034.

- Europe’s market is projected to grow at 14.5% annually from 2023 to 2028.

- In 2023, 30% of urban car emissions were from drivers searching for parking spots.

- Smart parking solutions can cut the time spent finding parking by up to 43%.

- Off-street parking made up over 60% of the market share in 2023.

- On-street parking is set to grow at 15.2% yearly from 2023 to 2028.

- By 2024, 11% of all parking spaces worldwide will use smart technology.

- IoT in parking systems may reduce traffic congestion by 20-30% in cities by 2025.

- In 2023, about 40% of smart parking systems used sensors for detecting spaces.

- AI and machine learning in parking solutions are expected to grow by 25% annually from 2023 to 2028.

- Over 50% of smart parking systems in 2024 offer mobile app integration.

- Smart parking hardware, including sensors and cameras, will grow at 11.5% annually from 2023 to 2028.

- In 2023, installing a smart parking system cost between $250 and $800 per space.

- Revenue Increase: Smart parking can boost revenue by 20-30% through better pricing and space usage.

- By 2024, 65% of U.S. cities with over 100,000 people will have smart parking technology.

- The number of smart parking spaces worldwide is projected to reach 115 million by 2025.

- This sector made up 25% of smart parking market revenue in 2023.

- It is expected to grow at 13.5% per year from 2023 to 2028.

- By 2024, over 70% of systems will provide real-time parking availability.

- Smart parking can cut parking-related emissions by up to 30%.

- In 2023, the average implementation time for smart parking dropped to 6-8 months.

- By 2024, 40% of smart parking systems will include EV charging points.

- Smart parking software is expected to grow at 14.8% yearly from 2023 to 2028.

- Smart parking boosted space use by 15-20% on average in 2023.

- By 2024, around 55% of systems will connect with navigation apps and in-car systems.

- Smart parking tech can reduce parking time by 5-7 minutes per vehicle.

- By 2025, 30% of new parking projects will use smart technology.

- In 2023, the global market for smart parking sensors was worth $1.8 billion, and it could reach $3.2 billion by 2028.

- The average daily parking fee in Manhattan, NYC, is $69.

- Building a new parking spot in NYC can cost up to $36,000, excluding land costs.

- The U.S. has over 2 billion parking spaces for about 250 million cars.

- Residential areas dedicate 35% of land to parking, while urban areas use 50-70%.

- Over 90% of EV drivers worry about charging availability, with 44% having run out of charge.

- Americans spend $73 billion annually searching for parking, costing each driver an average of $345 per year.

- The average commuter in NYC spends 107 hours per year parking, costing $2,243.

- Drivers will spend over 2,000 hours in their life searching for parking.

- 95% of a car’s time is spent parked, showing the parking industry’s significance.

Emerging Trends

- Integration of Electric Vehicle (EV) Charging Stations: With the growing adoption of electric vehicles globally, smart parking systems are increasingly integrating EV charging capabilities. Parking facilities are evolving into multi-functional mobility hubs that provide both parking and EV charging options, making them essential components of sustainable urban planning. This trend is particularly strong in North America and Europe, where governments are incentivizing the deployment of EV infrastructure as part of broader smart city initiatives.

- Use of Artificial Intelligence (AI) and Machine Learning for Predictive Analytics: AI and machine learning technologies are being leveraged to predict parking demand and optimize space utilization. By analyzing historical data and real-time information from IoT sensors, these systems can forecast peak parking periods and dynamically adjust availability, improving traffic flow and reducing congestion. This trend supports the shift toward data-driven decision-making in urban mobility management, enhancing the efficiency of smart parking operations.

- Growth of Autonomous and Automated Parking Solutions: Autonomous vehicles (AVs) and self-parking technologies are becoming integral to smart parking development. Some cities and technology companies are experimenting with fully automated parking facilities that can accommodate self-driving cars. These facilities require less space, as vehicles are able to park more precisely without the need for traditional entry/exit pathways. Such advancements are expected to reshape parking lot designs, making them more efficient and capable of housing more vehicles within the same footprint.

- Mobility-as-a-Service (MaaS) and Integrated Mobile Platforms: The MaaS model is gaining momentum, with smart parking systems being integrated into broader mobility solutions via mobile platforms. Users can book, pay for, and navigate parking spaces through apps, often coupled with other transportation services like car sharing or bike rentals. These platforms create a seamless experience, aligning with the increasing consumer demand for convenience and efficiency in urban mobility.

- Adoption of License Plate Recognition (LPR) Technology: License Plate Recognition (LPR) systems are becoming widespread in parking facilities, improving security and enabling frictionless, automated entry and exit. This technology supports contactless payment systems and efficient enforcement, enhancing both the user experience and operational efficiency. LPR systems are particularly prevalent in commercial spaces and densely populated areas where managing large volumes of vehicles is critical.

Top Use Cases

- Urban City Parking Management: In densely populated urban areas, smart parking systems are used to reduce congestion and emissions. By implementing real-time monitoring technologies such as sensors and cameras, cities like Cologne, Germany, have managed to decrease traffic caused by drivers searching for parking, which can account for up to 30% of urban traffic. These systems optimize space usage and direct drivers to available spots, cutting down on time spent circling and reducing CO2 emissions by approximately 1.3 kilograms per vehicle per search session.

- Commercial and Office Complexes: Smart parking solutions are also widely used in commercial environments like office buildings and corporate campuses. For instance, companies such as EnBW in Germany implemented smart systems that use parking apps and real-time data feeds to allocate spaces dynamically. These systems reduce the time employees spend searching for parking, thereby boosting workplace efficiency and morale. Businesses adopting these solutions report reduced congestion and enhanced space utilization by up to 50%, showing significant operational and employee satisfaction improvements.

- Airport Parking Management: Airports, facing high vehicle turnover and demand fluctuations, are prime candidates for smart parking technologies. Smart parking systems at airports leverage dynamic pricing models and real-time reservation capabilities through mobile apps, improving both space management and revenue generation. Implementing such systems can increase occupancy rates by 20-30%, as drivers benefit from knowing they have a guaranteed space and the convenience of contactless payments.

- Tourist Destinations and Event Venues: Tourism hotspots and event venues often experience spikes in traffic during peak seasons or events. Smart parking systems can handle these fluctuations effectively by providing real-time availability updates through digital signage or apps, directing visitors to underutilized spaces. For example, coastal areas in Germany have utilized these systems to manage over 1.5 million visitors annually, enhancing visitor experience while minimizing local congestion issues. These technologies have been shown to reduce parking search times by up to 43% during peak periods.

- Train Stations and Mobility Hubs: To encourage public transport use and reduce car dependency, many cities are integrating smart parking solutions at train stations and mobility hubs. These systems facilitate seamless transitions from personal vehicles to public transport by ensuring quick and easy parking access. For example, in the municipality of Kerken, Germany, a smart parking system was deployed to manage commuter flows efficiently, reducing search times significantly and increasing train usage. Such systems are crucial for enhancing multimodal transportation and supporting sustainable urban mobility initiatives

Major Challenges

- High Implementation and Maintenance Costs: Implementing smart parking solutions requires substantial investments in infrastructure, such as sensors, cameras, and data management systems. The cost of these technologies, along with the need for ongoing maintenance and skilled personnel to operate them, can be prohibitive, particularly for smaller municipalities and emerging markets. In some cases, the total deployment cost can be up to 30-50% higher compared to traditional parking systems.

- System Integration Issues: Smart parking systems often involve integrating diverse hardware and software components, such as IoT sensors, mobile apps, and cloud services. The lack of standardization across these technologies can lead to compatibility issues, making system integration complex and time-consuming. This challenge is especially prevalent in larger cities where legacy systems need to be upgraded and synchronized with newer technologies, leading to delays and additional costs.

- Data Privacy and Cybersecurity Concerns: The reliance on data collection in smart parking systems raises significant privacy and security concerns. These systems gather sensitive information such as vehicle location, license plate numbers, and payment details. Without robust cybersecurity measures, they are vulnerable to hacking and data breaches, which can compromise user information. Ensuring compliance with privacy regulations and implementing high-level security protocols increases both the complexity and cost of smart parking operations.

- Limited Adoption in Emerging Markets : While smart parking technologies are growing in developed regions like North America and Europe, their adoption in emerging markets remains slow due to cost barriers and limited digital infrastructure. In countries where urban planning and technological investment are not as advanced, the initial capital required for setting up smart parking systems poses a significant hurdle, limiting their deployment to only high-income urban centers.

- Dependence on Internet Connectivity and Power Supply: Smart parking systems rely heavily on stable internet connectivity and consistent power supply to function effectively. In areas with poor network infrastructure or frequent power outages, these systems can experience significant disruptions, leading to operational inefficiencies. This dependence makes it difficult to deploy smart parking solutions in regions where these resources are unreliable, which limits market expansion in such areas.

Top Opportunities

- Expansion Through Smart City Initiatives: Governments worldwide are heavily investing in smart city projects, creating substantial opportunities for smart parking solutions. For instance, China and India are channeling billions of dollars into developing smart infrastructure, which includes implementing intelligent parking systems. By 2034, India’s smart parking market is expected to grow significantly, driven by projects like the Smart Cities Mission, which has a $25 billion allocation for urban mobility and digitization efforts. These initiatives enhance urban mobility, reduce traffic congestion, and open doors for extensive deployments of smart parking technologies.

- Rising Demand for EV Charging Integration: As electric vehicle (EV) adoption grows, integrating EV charging stations within parking facilities is becoming a crucial growth area. Many regions, including Europe and North America, are focusing on expanding EV infrastructure as part of their green mobility strategies. By combining EV charging with smart parking, facilities can attract a broader customer base and generate additional revenue streams. This trend is especially prominent in the European Union, where sustainable urban mobility solutions are gaining traction and supporting market expansion.

- Adoption of AI and IoT Technologies: The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies into smart parking systems offers a competitive advantage. AI-driven predictive analytics and IoT-based sensors allow operators to manage parking space utilization more efficiently. For example, IoT vehicle detection systems can help reduce parking search times by 20-30% in cities like Hangzhou, China. As cities and private operators seek to optimize parking management, these technologies are increasingly becoming essential components of smart parking solutions, presenting a significant growth opportunity for tech companies and solution providers.

- Growth in Automated and Autonomous Parking Solutions: The emergence of autonomous vehicles (AVs) is creating demand for fully automated parking facilities. Companies like ParkPlus are testing robotic parking valets and self-parking garages, which are expected to become more widespread as AV technology advances. This evolution not only enhances parking efficiency but also minimizes space requirements, making it a lucrative segment for smart parking developers to explore. Forward-thinking municipalities and private developers are investing in these innovations to future-proof their urban infrastructure.

- Regional Expansion in Emerging Markets: The Asia-Pacific region, especially countries like China, Japan, and South Korea, presents vast opportunities due to rapid urbanization and the increasing rate of vehicle ownership. As these countries expand their smart city frameworks, there is a growing need for smart parking solutions to address congestion and limited parking space issues. By 2030, the Asia-Pacific market is projected to capture around 35% of the global smart parking market share, highlighting the untapped potential for technology providers and developers to expand their services and products in these rapidly developing regions.

Key Player Analysis

- Cisco Systems, Inc.: Cisco is a leader in smart parking solutions, leveraging its expertise in IoT and networking to provide integrated systems for smart city initiatives. The company offers solutions that connect sensors, mobile apps, and data analytics, enhancing real-time parking management and user convenience. Cisco’s global footprint and strategic partnerships, such as those with automotive giants like General Motors, help them maintain a competitive edge in the market.

- BMW AG (ParkNow GmbH & Parkmobile LLC): BMW operates through its subsidiaries ParkNow and Parkmobile, focusing on digital parking solutions that integrate with its vehicles. These services include mobile apps for parking reservations and cashless payments. In 2023, BMW partnered with local municipalities in Europe to implement guided park assist systems, optimizing parking efficiency in multi-level facilities. The company’s influence in the automotive industry enhances its ability to deploy innovative smart parking technologies across its global network.

- Altiux Innovations: Altiux is a technology-driven company specializing in IoT-based smart parking solutions. The firm provides customized platforms that integrate sensors, cameras, and mobile applications for real-time parking management. Altiux focuses heavily on R&D, allowing it to introduce cutting-edge technologies that support both private and public sector projects, particularly in emerging markets like Asia-Pacific.

- CivicSmart, Inc.: CivicSmart focuses on urban mobility solutions, offering advanced parking meters and sensor-based systems designed to manage urban parking efficiently. The company has deployed its solutions across North America, enabling smart meter installations that support real-time data collection and cashless payments. CivicSmart has seen significant growth, with its solutions contributing to over 10% of the North American smart parking market by 2022.

- INDECT Electronics & Distribution GmbH: INDECT specializes in providing smart parking guidance systems, particularly for airports and commercial properties. Their technologies use camera and sensor networks to manage large-scale parking facilities, enhancing space utilization and traffic flow. The company’s strong presence in Europe, particularly in Germany and the UK, has made it a key player in the region, capturing a substantial share of the market’s commercial segment

Recent Developments

- In May 16, 2024, Metropolis Technologies, Inc., a leader in AI-based checkout-free payment systems, announced the acquisition of SP Plus Corporation (SP+), North America’s largest parking and mobility service provider. SP+ serves diverse sectors including aviation, commercial, hospitality, and institutions. This acquisition allows Metropolis to integrate its technology into SP+’s extensive network, enhancing automated and seamless payment experiences for millions of parking spaces across the continent.

- In Atlanta, Georgia and Austin, Texas, on September 17, 2024, ParkMobile, a major player in smart parking and part of the EasyPark Group, partnered with Flash, an expert in off-street parking and EV charging technologies. This collaboration aims to manage over a billion annual transactions in North America, updating parking infrastructure in millions of locations. The combined expertise and resources of both companies focus on modernizing payment experiences, providing more convenience for drivers, property owners, and cities alike.

- In September 9, 2024, in Austin, Texas, Flash, a leader in parking technology, closed an $85 million debt financing deal for a new special purpose vehicle (SPV). The funding, arranged by Vantage Infrastructure, is designed to accelerate the adoption of Flash’s platform, with the possibility of expanding to $100 million. This capital will support the rollout of more flexible payment options, enhancing Flash’s ability to offer cutting-edge solutions to its parking clients.

- In 2024, EasyPark Group entered a partnership with Q-Park to enhance parking systems across Germany. By integrating advanced technologies, the collaboration aims to create efficient, barrier-free parking experiences in densely populated areas. This partnership addresses the growing demand for smart and user-friendly parking solutions in urban German markets, enhancing mobility and convenience for drivers.

Conclusion

The Smart Parking Systems market is positioned for robust growth, driven by increasing urbanization, rising vehicle ownership, and the global push towards smart city development. As cities face the challenges of congestion and limited parking spaces, smart parking solutions are becoming essential to improve urban mobility and reduce carbon emissions. Advanced technologies like IoT, AI, and data analytics are central to these systems, providing real-time information that enhances efficiency, optimizes space utilization, and elevates the overall user experience.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)