Table of Contents

Smart Waste Routing AI Market Size

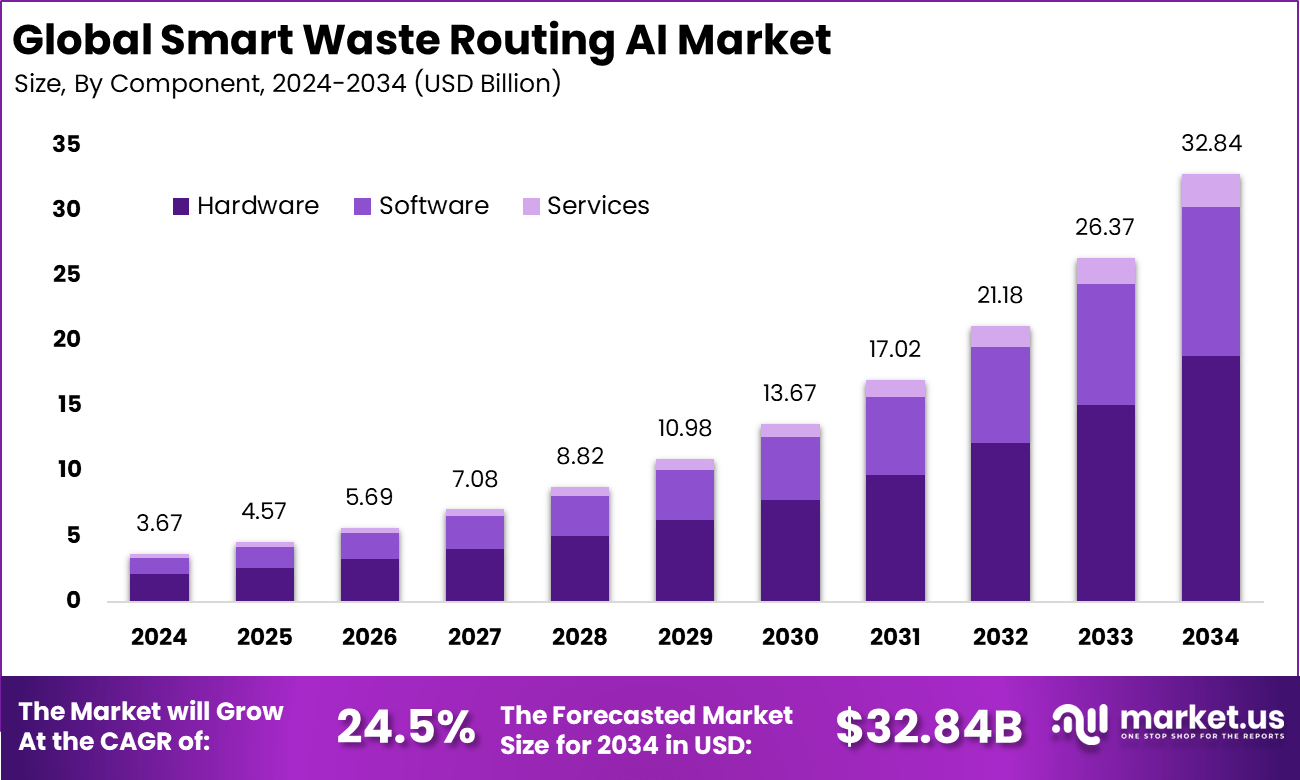

The global smart waste routing AI market was valued at USD 3.67 billion in 2024 and is projected to reach approximately USD 32.84 billion by 2034, expanding at a CAGR of 24.5% during the forecast period from 2025 to 2034. In 2024, North America led the market with more than 37.5% share, generating around USD 1.37 billion in revenue, supported by smart city initiatives and increased adoption of AI driven waste management systems.

Smart Waste Routing AI Market involves AI-powered platforms that optimize waste collection routes using real-time data from IoT sensors, GPS, and predictive analytics. These systems analyze bin fill levels, traffic, and waste patterns to generate dynamic schedules, reducing unnecessary trips and fuel use. They serve municipalities, waste firms, and industries aiming for efficient, sustainable operations. Hardware like smart sensors and software for route algorithms form the core, with services for integration and maintenance. Deployments favor on-premises for data security in public sectors. The market addresses urban waste surges through scalable, adaptive intelligence.

Demand for smart waste routing AI is increasing among city governments and private waste management companies. Organizations seek solutions that improve efficiency and reduce environmental impact. Demand is strong in urban and densely populated areas. These regions require dynamic routing capabilities. Demand is also growing from sustainability-focused initiatives. Waste operators aim to lower emissions and fuel consumption. AI-driven routing supports environmental goals. This aligns with broader smart city strategies.

Key Takeaway

- In 2024, hardware led with a 57.4% share, driven by strong demand for IoT sensors, smart bins, GPS units, and field-level routing equipment.

- Municipal waste management dominated with 45.5%, reflecting wide adoption of AI-driven routing to optimize collection schedules, cut fuel use, and improve efficiency.

- On-premises deployment held 64.5%, showing municipal preference for locally managed systems to ensure data security and continuous operations.

- Municipal authorities accounted for 40.6%, highlighting large-scale use of AI routing platforms at the city level.

- The U.S. market reached USD 1.16 billion in 2024 and is growing at a 20.5% CAGR, supported by sustainability targets and smart city investments.

- North America remained the leading region with over 37.5% share, backed by strong digital infrastructure, environmental mandates, and early AI adoption.

Key Statistics

- AI-based route optimization can reduce waste collection travel distance by up to 36.8% using real-time data analysis.

- Municipalities and private operators report up to 30% savings in collection costs, with some cases showing 7.4% lower total costs versus traditional routing.

- Fuel consumption drops by 15.5%–32% due to shorter routes, directly lowering greenhouse gas emissions.

- AI-supported scheduling saves up to 28.22% in operational time by reducing total collection hours.

- Smart bins and predictive analytics enable an 80% reduction in overflow incidents and a 60% decline in public complaints.

- Predictive models achieve overflow risk detection accuracy of up to 94.1%.

- Decentralized smart waste systems reach 92.5% overall efficiency, compared with 75.4% for traditional systems.

Emerging Trends

In the smart waste routing AI market, a key trend is the integration of artificial intelligence with real-time sensor networks to optimise waste collection routes. Smart bins and IoT sensors are being deployed to monitor fill levels, enabling AI systems to prioritise pickups based on actual need rather than fixed schedules. This data-driven routing minimises unnecessary truck travel, reduces fuel consumption, and improves overall efficiency of waste collection operations.

Another emerging trend is the adoption of predictive analytics to forecast waste generation patterns. AI platforms analyse historical data alongside external variables such as weather, events, and seasonal cycles to anticipate waste volumes across neighbourhoods. By predicting high load periods, operators can adjust routes, allocate vehicles proactively, and enhance responsiveness to fluctuations in waste demand. This trend supports more resilient and adaptive waste management strategies.

Growth Factors

A principal growth factor in the smart waste routing AI market is the increasing pressure on municipalities and waste service providers to improve operational efficiency. Urbanisation and population growth are creating greater waste volumes, challenging traditional collection methods. AI-driven routing solutions help address these pressures by reducing route distances, optimising fleet utilisation, and lowering operational costs.

Another important factor supporting growth is the focus on sustainability and environmental performance. Communities and regulatory bodies are prioritising reductions in greenhouse gas emissions, traffic congestion, and resource wastage. Smart routing systems contribute to sustainability goals by reducing the carbon footprint of waste collection through improved routing and lower fuel usage.

Driver

A central driver of the smart waste routing AI market is the need for cost savings and resource optimisation. Waste collection constitutes a significant portion of municipal operating budgets. AI-enabled route optimisation allows agencies to allocate fewer vehicles and drivers for the same service coverage while maintaining service quality. This economic advantage supports wider adoption among budget-constrained public and private waste management entities.

Another driver is the advancement of smart city initiatives that prioritise digitisation and intelligent infrastructure. As cities invest in connected systems for transportation, utilities, and public services, smart waste routing solutions fit into broader digital transformation agendas. The ability to leverage existing IoT deployments and integrate route optimisation into municipal platforms enhances operational coherence and value.

Restraint

A notable restraint in this market is the upfront investment and technical complexity associated with sensor deployments and AI integration. Cities and waste haulers must invest in infrastructure such as smart bins, network connectivity, and data platforms before they can realise full benefits. Smaller communities or organisations with limited budgets may find these entry costs prohibitive.

Another restraint relates to data quality and interoperability challenges. Effective AI routing relies on accurate, real-time data from disparate sources such as sensors, vehicle telemetry, and GIS information. Ensuring that these systems communicate smoothly and produce reliable data for AI analysis can demand significant integration effort and ongoing technical support.

Opportunity

A strong opportunity exists in the expansion of predictive maintenance and fleet performance monitoring within smart waste routing systems. AI platforms that analyse vehicle usage, wear patterns, and sensor feedback can schedule maintenance proactively, reducing downtime and extending asset life. These capabilities add operational value beyond routing optimisation.

Another opportunity lies in customising solutions for diverse waste streams and service models. Residential, commercial, recycling, and organic waste each present unique routing and scheduling challenges. AI platforms that support multi-stream optimisation and tailored service levels can help operators manage complex waste portfolios more effectively and offer differentiated services.

Challenge

One of the main challenges for the smart waste routing AI market is ensuring scalability and adaptability across varied geographic and demographic contexts. Urban centres, suburban areas, and rural regions each have distinct route dynamics, infrastructure constraints, and service expectations. AI solutions must be flexible enough to deliver value across these diverse environments without requiring extensive custom engineering.

Another challenge involves balancing data privacy and public transparency. Routing systems use geolocation data and operational insights that may intersect with privacy considerations for drivers, residents, and third parties. Establishing clear governance, data handling policies, and transparent communication about data use is essential to maintain trust while deploying intelligent routing solutions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)