Table of Contents

Smartphone Envelope Tracker IC Market Size

The global Smartphone Envelope Tracker IC market was valued at USD 1.28 billion in 2024 and is projected to reach approximately USD 3.77 billion by 2034. The market is expected to grow at a steady CAGR of 11.4% during the forecast period from 2025 to 2034. This growth is mainly supported by rising smartphone shipments and increasing demand for efficient power management components.

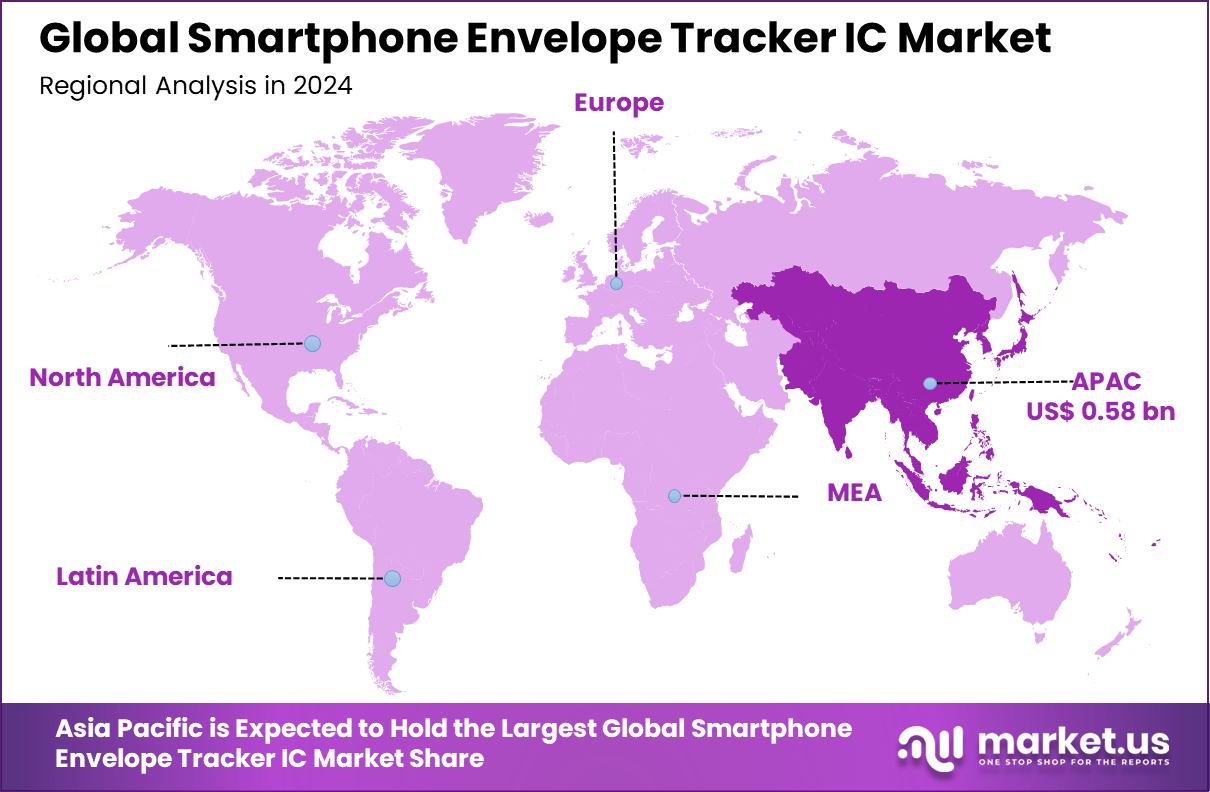

In 2024, Asia Pacific held a dominant position in the market, accounting for more than 45.7% of the global share. The region generated around USD 0.58 billion in revenue, supported by strong smartphone manufacturing activity and a large consumer electronics base. High concentration of semiconductor production and rapid adoption of advanced mobile technologies further strengthened regional leadership.

The smartphone envelope tracker IC market refers to the segment of semiconductor components designed to improve power efficiency in radio frequency front end systems of mobile devices. Envelope tracker ICs regulate power amplifier supply in real time based on signal requirements, reducing energy wastage and heat generation. These components are crucial in maintaining battery performance while supporting high speed data transmission. The integration of envelope tracker ICs has become more common as smartphones evolve to support advanced communication standards.

Growth in this market has been influenced by the increasing demand for longer battery life and improved network performance. Smartphone manufacturers are prioritizing power efficient designs to meet user expectations for extended usage between charges. Envelope tracker ICs support this objective by optimizing power consumption during variable signal conditions. As mobile networks advance, the role of power management innovations is emphasized within device architecture.

One factor driving the envelope tracker IC market is the widespread adoption of high speed communication technologies such as fourth generation and fifth generation networks. These technologies require dynamic power control to handle variable signal peaks without compromising performance. Envelope tracker ICs fulfil this need by adjusting power amplifier supply rapidly, thereby enhancing energy efficiency. This capability aligns with industry goals for improved signal quality and reduced energy consumption.

Another driving factor is the competitive pressure on smartphone manufacturers to differentiate through battery life performance. Consumers increasingly prioritize devices that maintain functionality over extended periods, particularly in emerging markets. Power management innovations such as envelope tracker ICs support prolonged battery duration without increasing battery size. This trend has encouraged investment in advanced IC solutions within mobile device platforms.

Demand for envelope tracker ICs has been shaped by the global proliferation of smartphones and mobile data usage. As data consumption increases, devices are required to maintain efficient communication under varying network loads. Envelope tracker ICs enable devices to handle these demands with optimized power supply. This has driven interest from original equipment manufacturers seeking to enhance overall device efficiency.

Demand is also influenced by regional variations in network infrastructure and user behavior. In regions with expanding mobile broadband coverage, devices must adapt to fluctuating signal conditions that affect power requirements. Envelope tracker ICs provide the adaptability required for such environments. As network coverage and data usage grow, the demand for advanced power management components remains strong.

Key Insights

- 5G Envelope Tracking ICs emerged as the leading segment, accounting for 71.6%, as device makers increasingly focused on power efficiency to support advanced 5G smartphone designs.

- Mid-range smartphones priced between $200 and $500 represented 52.4% of adoption, reflecting strong consumer preference for cost-effective devices that still deliver reliable 5G performance and longer battery life.

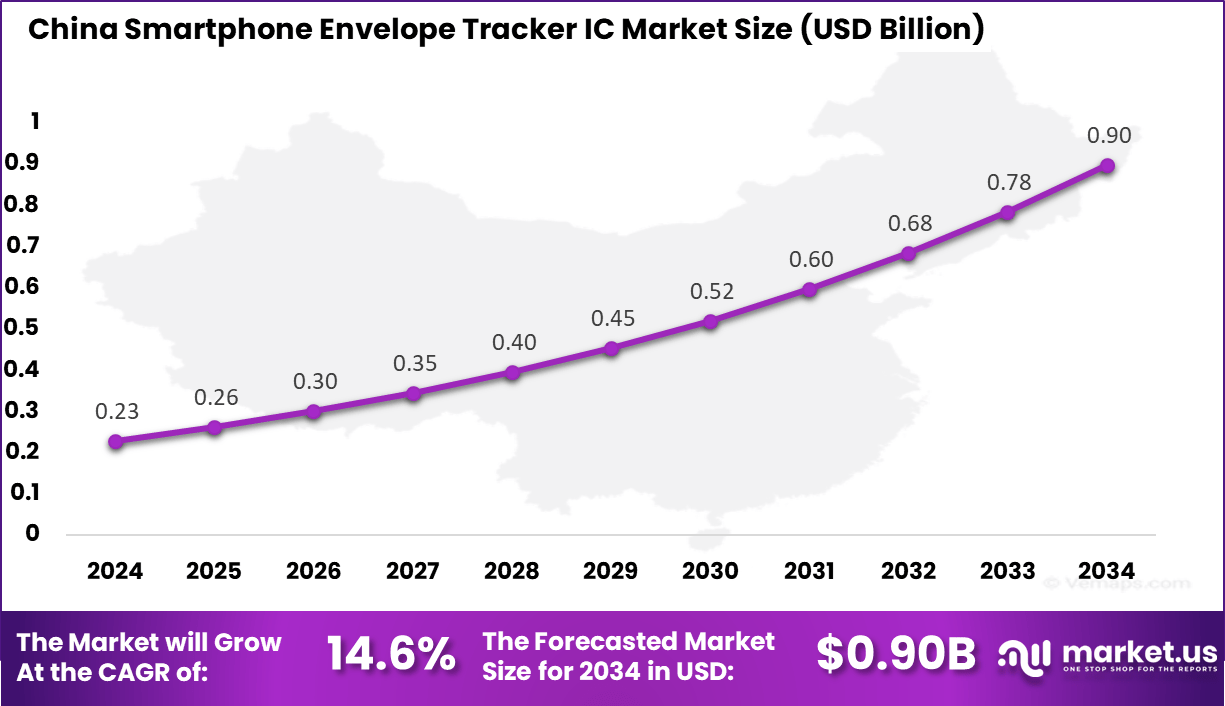

- China reached a market value of USD 0.23 billion in 2024 and is expanding at a 14.6% CAGR, supported by large-scale smartphone manufacturing and faster adoption of energy-efficient components.

- Asia-Pacific held the largest global share at 45.7%, driven by high smartphone production volumes, rapid 5G network expansion, and a well-established semiconductor supply ecosystem across the region.

Drivers Impact Analysis

| Driver Category | Key Driver Description | Estimated Impact on CAGR (%) | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Rising 5G smartphone adoption | Higher RF complexity increases demand for envelope tracking | ~3.4% | Asia Pacific, North America | Short to Mid Term |

| Power efficiency requirements | Need to extend battery life in high performance smartphones | ~2.8% | Global | Short Term |

| Integration of advanced RF modules | Growth in compact and integrated RF front end designs | ~2.2% | Asia Pacific | Mid Term |

| Smartphone shipment recovery | Stabilization and gradual growth in global handset volumes | ~1.8% | Global | Mid Term |

| OEM focus on thermal control | Envelope tracking reduces heat generation during transmission | ~1.2% | Global | Long Term |

Risk Impact Analysis

| Risk Category | Risk Description | Estimated Negative Impact on CAGR (%) | Geographic Exposure | Risk Timeline |

|---|---|---|---|---|

| Smartphone demand volatility | Cyclic demand affects IC shipment volumes | ~2.3% | Global | Short Term |

| RF design complexity | Integration challenges with multi band architectures | ~1.8% | Global | Mid Term |

| Cost pressure from OEMs | Margin pressure due to aggressive pricing | ~1.5% | Asia Pacific | Mid Term |

| Technology substitution risk | Alternative power management techniques | ~1.1% | Global | Long Term |

| Supply chain disruptions | Semiconductor manufacturing constraints | ~0.9% | Asia Pacific | Short Term |

Investor Type Impact Matrix

| Investor Type | Adoption Level | Contribution to Market Growth (%) | Key Motivation | Investment Behavior |

|---|---|---|---|---|

| Smartphone OEMs | Very High | ~46% | Battery life and RF performance | Long term supplier agreements |

| Semiconductor manufacturers | High | ~29% | RF component portfolio expansion | Capacity and R&D investment |

| Foundries | Moderate | ~13% | Advanced node utilization | Volume driven contracts |

| Mobile operators | Low to Moderate | ~7% | Network performance optimization | Indirect influence |

| Research institutions | Low | ~5% | RF innovation | Limited scale |

Technology Enablement Analysis

| Technology Layer | Enablement Role | Impact on Market Growth (%) | Adoption Status |

|---|---|---|---|

| Envelope tracking architecture | Dynamic RF power control | ~4.1% | Mature |

| Integrated RF front end | Compact and efficient signal chain | ~3.0% | Growing |

| 5G NR support | High frequency power optimization | ~2.2% | Growing |

| Advanced CMOS nodes | Improved power efficiency | ~1.4% | Developing |

| AI assisted power tuning | Adaptive performance optimization | ~0.7% | Early |

Increasing Adoption Technologies

Integration of advanced semiconductor process technologies has supported the adoption of envelope tracker ICs in smartphones. Smaller fabrication nodes and novel materials enable higher performance and lower power consumption. These technological improvements allow envelope tracker ICs to be embedded within compact mobile designs. As semiconductor innovation continues, envelope tracker IC capabilities are expected to improve further.

Software defined radio and digital predistortion technologies are also linked with envelope tracker IC adoption. These technologies work in concert to enhance signal fidelity and minimize distortion during transmission. Envelope tracker ICs contribute by adapting power levels in real time to match signal dynamics. This integrated technological framework supports more efficient and reliable mobile communication systems.

One key reason for adopting envelope tracker ICs is the enhancement of battery efficiency in smartphone devices. Power consumption related to wireless communication is a major contributor to overall battery drain. Envelope tracker ICs reduce unnecessary energy loss by aligning power amplifier supply with instantaneous signal requirements. This results in measurable improvements in device battery performance.

Investment and Business Benefits

Investment opportunities in the envelope tracker IC market exist in research and development of next generation power management solutions. As mobile networks advance toward higher frequencies and greater bandwidths, more sophisticated envelope tracking techniques will be needed. Investment in novel circuit designs and materials science can yield performance gains. These developments can help suppliers address future market requirements.

Another area of opportunity lies in collaboration with smartphone manufacturers and chipset vendors. Strategic partnerships can help integrate envelope tracker ICs seamlessly into broader system on chip and radio frequency modules. This can reduce design complexity and lower manufacturing costs. Investments that support co development and co optimization can strengthen competitive positioning.

Adoption of envelope tracker ICs provides smartphone makers with measurable improvements in device power efficiency. Better power management can translate to longer battery life and enhanced user satisfaction. These advantages can differentiate products in competitive mobile markets. As a result, brands can achieve stronger market positioning and customer loyalty.

Manufacturers also benefit from improved thermal performance related to optimized power usage. Reduced heat generation increases device reliability and user comfort. This can lower warranty costs and improve overall product quality perception. Enhanced thermal profiles also support thinner and lighter device designs without sacrificing performance.

Regulatory Environment

The regulatory environment affecting the envelope tracker IC market includes compliance with international communication standards. Devices incorporating these components must meet electromagnetic compatibility and radio frequency emission requirements. Regulatory bodies set limits to ensure safe and interference free operation. Compliance ensures that products can be marketed and used across regions without legal issues.

Environmental and electronic waste regulations also influence component design and manufacturing. Power efficient components contribute to broader energy conservation objectives and reduced carbon footprints. Regulations related to hazardous substances and recycling may affect material choices and production processes. Adherence to these frameworks supports sustainable practices within the semiconductor industry.

China Market Size

The market for Smartphone Envelope Tracker IC within China is growing tremendously and is currently valued at USD 0.23 billion, the market has a projected CAGR of 14.6%.

In 2024, Asia-Pacific held a dominant market position in the Global Smartphone Envelope Tracker IC Market, capturing more than a 45.7% share, holding USD 0.58 billion in revenue. This dominance is due to the presence of major smartphone manufacturers and suppliers in countries like China, South Korea, and India.

Key Market Segments

By Transmission Type

- 5G Envelope Tracking

- 4G/LTE Envelope Tracking

By Smartphone Price

- Mid-Range Smartphones ($200 – $500)

- Flagship & Premium Smartphones (>$500)

Top Key Players in the Market

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Maxim Integrated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Qorvo, Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

- Efficient Power Conversion Corporation

- Keysight Technologies, Inc.

- Murata Manufacturing Co., Ltd.

- Nujira

- Qoro, Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.28 Bn |

| Forecast Revenue (2034) | USD 3.77 Bn |

| CAGR(2025-2034) | 11.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)