Table of Contents

Introduction

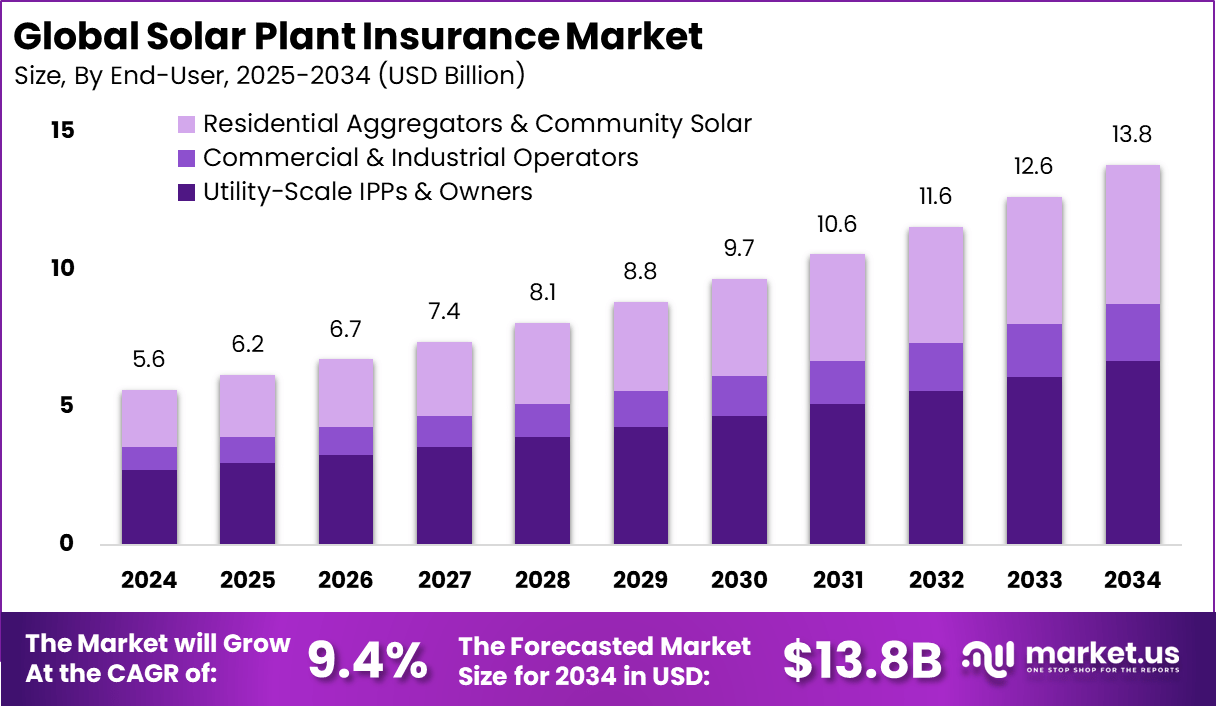

The Global Solar Plant Insurance Market reached USD 5.6 billion in 2024 and is projected to grow from USD 6.2 billion in 2025 to approximately USD 13.8 billion by 2034, expanding at a CAGR of 9.4%. North America dominated the market with a 36% share, accounting for USD 2.0 billion in revenue. Growth is primarily driven by the global transition toward renewable energy, the increasing number of large-scale solar installations, and the rising need for risk management solutions against weather-related damages, equipment failures, and revenue losses caused by operational disruptions.

How Growth is Impacting the Economy

The growth of the solar plant insurance market is significantly contributing to the global economy by supporting the renewable energy transition and stabilizing financial investments in solar infrastructure. As more nations shift toward clean energy to meet sustainability targets, insurance solutions mitigate financial risks for investors and operators, promoting steady project development. Economic benefits include improved capital flow in renewable sectors, enhanced investor confidence, and protection of national energy assets against natural disasters and technical failures.

This growth drives employment in solar engineering, risk assessment, and asset management sectors. Moreover, the increased availability of specialized insurance products enhances the financial resilience of solar developers, helping governments achieve climate goals while fostering economic stability through sustainable energy financing and infrastructure protection.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/solar-plant-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs and Supply Chain Shifts: The global surge in photovoltaic (PV) installations has led to increased equipment costs and longer project timelines, raising insurance premiums and operational expenses. Supply chain disruptions from raw material shortages, especially in polysilicon and glass, are prompting insurers to adjust coverage models and risk assessments.

Sector-Specific Impacts: The utility-scale solar segment is witnessing high insurance demand for asset protection and business interruption coverage. In the commercial and industrial sectors, the focus is on performance guarantees and liability coverage. Residential solar projects are driving micro-insurance adoption, offering protection against theft and weather-related damages.

Strategies for Businesses

- Integrate parametric insurance models to manage weather and climate risks.

- Collaborate with renewable developers for tailored insurance frameworks.

- Leverage AI and IoT technologies for predictive risk monitoring and claims assessment.

- Expand into emerging solar markets through flexible premium structures.

- Promote ESG-linked insurance products aligned with sustainability financing.

Key Takeaways

- Market to reach USD 13.8 billion by 2034, growing at 9.4% CAGR.

- North America leads with a 36% revenue share in 2024.

- Demand rising due to renewable energy adoption and asset protection.

- Digital risk assessment tools transforming solar insurance models.

- Emerging markets in Asia-Pacific creating new growth avenues.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162883

Analyst Viewpoint

The solar plant insurance market is entering a dynamic growth phase, driven by surging renewable investments and climate risk awareness. Presently, insurers are focusing on data-driven underwriting models and performance-based policies. Looking forward, increased digitalization and smart risk analytics are expected to enhance claim efficiency and reduce underwriting uncertainty. With governments investing heavily in solar infrastructure and climate adaptation, the market outlook remains strongly positive for both insurers and renewable developers, ensuring long-term growth potential and financial resilience.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Utility-Scale Solar Farms | High asset value and exposure to natural disasters increase insurance demand |

| Rooftop Solar Systems | Rising residential solar adoption requires theft and damage protection |

| Solar Equipment Manufacturers | Product liability and warranty coverage for panels and inverters |

| Solar Project Developers | Business interruption and revenue loss insurance for project stability |

| Emerging Markets | Expansion of renewable investments in Asia and Africa driving insurance penetration |

Regional Analysis

North America dominates with a 36% market share in 2024 due to strong renewable infrastructure, favorable insurance regulations, and growing public-private energy partnerships. Europe follows closely, emphasizing green energy security and weather-resilient insurance models. Asia-Pacific is the fastest-growing region, led by China, India, and Japan, as solar capacity and investments expand rapidly. Latin America and the Middle East are also emerging as key regions, driven by government-backed renewable financing initiatives.

➤ More data, more decisions! see what’s next –

- Data Center Immersion Cooling Market

- Database Management Analytics Market

- Interactive Display Market

- BYOD (Bring Your Own Device) Market

Business Opportunities

Growing renewable energy commitments and climate financing programs create lucrative opportunities for insurers. The emergence of ESG-linked insurance products, data analytics-driven risk management, and performance-based solar coverage is reshaping industry dynamics. Expansion in developing markets with rising solar deployment, particularly in Africa and Southeast Asia, offers high potential. Insurers that adopt AI-based risk assessment and remote monitoring tools will gain a competitive edge by reducing operational risks and offering cost-efficient, tailored policies for global solar stakeholders.

Key Segmentation

The market is segmented by Type (Property Insurance, Liability Insurance, Business Interruption, Performance Warranty, Others), Coverage (Equipment Damage, Natural Disaster, Theft, Operational Risk, Financial Risk), End-User (Utility-Scale, Commercial, Residential), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). Property and business interruption insurance dominate due to their importance in protecting large-scale solar infrastructure and ensuring revenue continuity.

Key Player Analysis

Market participants are focusing on developing data-centric and climate-adaptive insurance products. Strategic alliances with renewable developers and technology providers are enabling insurers to deliver customized, value-based policies. Investments in predictive analytics and satellite-based monitoring enhance underwriting precision. Players are expanding their footprint in high-growth renewable regions through tailored risk portfolios, competitive pricing, and sustainability-focused coverage models that align with the global energy transition and climate resilience goals.

- Allianz

- Munich Re

- Zurich Insurance Group

- Chubb

- AIG

- Liberty Mutual

- AXA XL

- Generali

- Swiss Re

- Hannover Re

- Tokio Marine

- Sompo International

- Others

Recent Developments

- March 2025: Launch of AI-powered predictive risk management tool for solar asset insurers.

- February 2025: Partnership announced to integrate parametric weather-based insurance for solar farms.

- January 2025: Expansion of solar asset protection programs in Asia-Pacific.

- November 2024: Introduction of ESG-linked insurance products promoting sustainable financing.

- September 2024: Investment in a blockchain-enabled claim settlement platform for renewable insurance.

Conclusion

The solar plant insurance market is accelerating alongside global renewable expansion, offering financial protection, sustainability alignment, and risk resilience. Its continued growth underscores the vital role of insurance in ensuring the long-term stability of the global clean energy transition.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)