Table of Contents

- Space Asset Securitization Market Introduction

- How Growth is Impacting the Economy

- Impact on Global Businesses

- Strategies for Businesses

- Key Takeaways

- Analyst Viewpoint

- Use Case and Growth Factors

- Regional Analysis

- Business Opportunities

- Key Segmentation Overview

- Key Player Analysis

- Recent Developments

- Conclusion

Space Asset Securitization Market Introduction

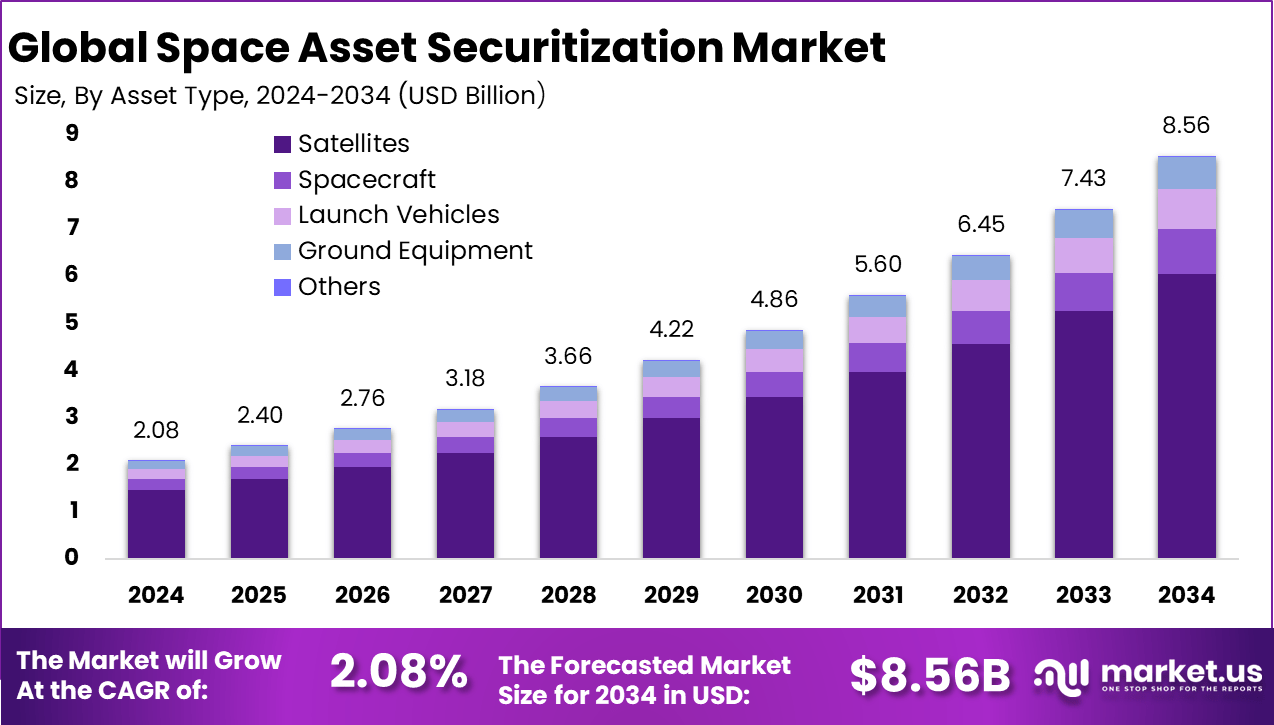

The global space asset securitization market is gaining traction as space infrastructure matures into a revenue-generating asset class. The market was valued at USD 2.08 billion in 2024 and is projected to reach around USD 8.56 billion by 2034, expanding at a CAGR of 15.2% during 2025 to 2034.

Space asset securitization enables satellites, launch assets, and space-enabled data streams to be converted into structured financial instruments. North America dominates the market with more than 46.4% share and USD 0.96 billion in revenue, driven by advanced space commercialization, private investment activity, and established capital markets.

How Growth is Impacting the Economy

Growth in space asset securitization is strengthening capital formation within the global space economy. By converting high value space assets into tradable financial instruments, securitization improves liquidity and reduces reliance on direct government funding. This enables private capital to flow into satellite constellations, launch services, and downstream space applications.

Economies benefit through increased investment efficiency, job creation in aerospace finance, legal services, and risk analytics, and faster deployment of space infrastructure. Governments also gain from reduced fiscal pressure while maintaining strategic space capabilities. Over time, securitization supports broader digital economies by accelerating space based services such as connectivity, earth observation, and navigation that enhance productivity across agriculture, logistics, and disaster management.

➤ Year-End Sale: Hurry Enjoy Upto 60% off @ https://market.us/purchase-report/?report_id=169752

Impact on Global Businesses

Rising Costs and Supply Chain Shifts

Space operators face higher structuring, compliance, and risk assessment costs when securitizing assets. However, supply chains are shifting toward long term financing models that lower capital intensity and stabilize cash flows. This reduces dependency on single source funding and improves project bankability.

Sector-Specific Impacts

Satellite operators gain access to diversified funding for constellation expansion. Telecommunications companies benefit from faster deployment of space enabled connectivity. Financial institutions expand into structured space finance products. Insurance and risk management sectors see rising demand for space asset valuation and performance analytics.

Strategies for Businesses

Businesses are focusing on structuring space assets with predictable revenue streams to improve securitization viability. Transparent performance data, long term service contracts, and robust risk modeling are becoming essential. Companies are partnering with financial institutions and legal experts to design compliant securitization frameworks. Diversification across satellite types and orbits is also used to reduce risk exposure and attract institutional investors seeking stable returns.

Key Takeaways

- Space asset securitization is unlocking private capital for space infrastructure

- Market growth is supported by a 15.2% CAGR through 2034

- North America leads due to mature space and finance ecosystems

- Securitization improves liquidity and reduces funding concentration risks

- Long term demand is driven by satellite based services expansion

➤ Unlock growth! Get your sample now! @ https://market.us/report/space-asset-securitization-market/free-sample/

Analyst Viewpoint

Currently, space asset securitization is transitioning from experimental financing to a structured investment approach. Adoption is strongest in regions with advanced space commercialization and capital markets. Looking ahead, the outlook remains positive as satellite revenues become more predictable and risk assessment improves. Over the forecast period, securitization is expected to play a central role in scaling large constellations and downstream applications, positioning space assets as a mainstream infrastructure investment category.

Use Case and Growth Factors

| Use Case | Description | Key Growth Factors |

|---|---|---|

| Satellite revenue securitization | Monetizing long term satellite service contracts | Growth in recurring satellite data and connectivity revenues |

| Constellation financing | Funding large scale satellite deployments | Rising demand for low earth orbit constellations |

| Space infrastructure investment | Structuring launch and ground assets | Increasing private participation in space economy |

| Risk transfer mechanisms | Distributing operational and performance risks | Development of advanced space risk analytics |

| Institutional investment access | Creating tradable space backed securities | Growing investor appetite for alternative assets |

Regional Analysis

North America dominates the space asset securitization market with more than 46.4% share, supported by strong private space investment, advanced legal frameworks, and deep capital markets. Europe follows with growing interest in satellite-backed financing aligned with commercial space programs. Asia Pacific is emerging as a growth region driven by expanding satellite launches and government-supported commercialization. Other regions are gradually exploring securitization as space activities scale.

➤ Explore Huge Library Here –

- Observability Market

- Robotics Training Services Market

- Travel Rewards Credit Card Market

- Self-Reconfigurable Robots Market

Business Opportunities

Significant opportunities exist in structuring securitization models for downstream space services such as earth observation data and satellite connectivity. Financial technology platforms enabling transparent asset performance tracking offer additional value. Emerging markets present long-term opportunities as regional satellite programs mature. Advisory, legal, and analytics services focused on space finance are also expected to see sustained demand as securitization adoption increases.

Key Segmentation Overview

The market is segmented by asset type into satellites, launch infrastructure, and ground systems, with satellites representing the largest segment. By securitization structure, asset-backed securities and revenue-backed instruments are widely adopted. By application, telecommunications and earth observation dominate, followed by navigation and scientific services. End users include satellite operators, financial institutions, and infrastructure investors, with operators leading market participation.

Key Player Analysis

Market participants focus on asset valuation accuracy, revenue predictability, and regulatory compliance. Competitive differentiation is driven by financial structuring expertise, risk mitigation frameworks, and transparency in asset performance. Continuous improvement in legal clarity and data analytics strengthens investor confidence. Long term competitiveness depends on scalability, cross-border investment compatibility, and the ability to support complex multi-asset portfolios.

- SpaceX

- SES S.A.

- Intelsat S.A.

- Eutelsat Communications

- OneWeb

- Iridium Communications Inc.

- Viasat Inc.

- Telesat

- Planet Labs PBC

- Maxar Technologies

- Inmarsat

- Hughes Network Systems

- EchoStar Corporation

- Blue Origin

- Lockheed Martin

- Airbus Defence and Space

- Northrop Grumman Corporation

- Thales Alenia Space

- Others

Recent Developments

- Increasing use of satellite revenue-backed securities

- Expansion of private capital participation in space finance

- Improved risk modeling for orbital and operational performance

- Growing collaboration between space operators and financial institutions

- Development of standardized frameworks for space asset valuation

Conclusion

Space asset securitization is transforming how space infrastructure is financed. Strong growth, led by North America, highlights rising investor confidence, positioning securitization as a key enabler of scalable, sustainable, and commercially driven space ecosystems through 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)