Table of Contents

Tax Software Market Size

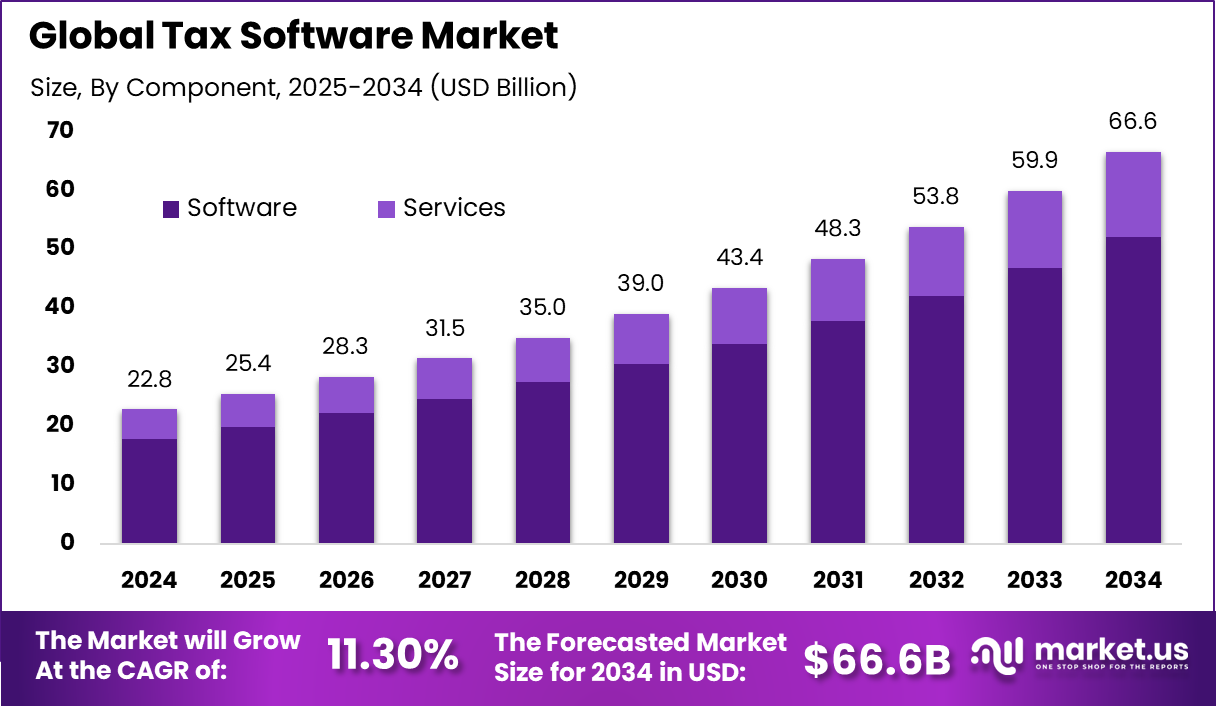

The global Tax Software market generated USD 22.8 billion in 2024 and is expected to grow steadily over the forecast period. Market revenue is projected to rise from USD 25.4 billion in 2025 to approximately USD 66.6 billion by 2034, registering a CAGR of 11.30% throughout the forecast span. This growth is driven by increasing adoption of automated tax solutions, rising complexity of tax regulations, and the need for enhanced compliance and reporting capabilities across businesses and individuals.

In 2024, North America held a dominant position in the global market, accounting for more than 38.2% of total revenue. The region generated around USD 8.72 billion, supported by widespread adoption of tax software among both businesses and consumers. North America’s mature financial ecosystem, high regulatory requirements, and strong presence of tax technology providers strengthened regional leadership. As a result, North America continues to influence trends and innovation in the tax software market.

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 22.8 Bn |

| Forecast Revenue (2034) | USD 66.6 Bn |

| CAGR(2025-2034) | 11.30% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Market Overview

Tax Software Market refers to the range of digital solutions designed to support individuals and organisations in managing tax-related functions such as calculation, compliance, reporting, filing, and recordkeeping. These systems automate repetitive processes that were historically manual, helping users ensure accurate tax submissions across jurisdictions. Tax software encompasses direct and indirect tax management, compliance tracking, audit preparation, and integration with broader financial systems for seamless data flow. The market includes both cloud-based and on-premise platforms that serve enterprises of various sizes, reflecting the global shift toward digital financial operations.

The adoption of tax software is driven by the increasing volume and complexity of financial transactions and the need to manage tax obligations efficiently. Businesses face evolving tax rules and frequent updates that are difficult to track manually, prompting investment in automated solutions that maintain accuracy and audit readiness. Cloud delivery models are particularly prevalent, providing scalable access, real-time updates, and integration with enterprise resource planning systems. As a result, tax software has become an essential component of modern finance functions across industries.

Top driving factors include heightened regulatory compliance requirements and the complexity of tax codes across multiple jurisdictions. Organisations are under pressure to comply with regulations such as income tax, sales tax, VAT, and international reporting standards, which change frequently and vary by region. Automation through tax software reduces the risk of human error, supports timely compliance reporting, and diminishes administrative burden. These forces collectively elevate the strategic importance of digital tax solutions for finance teams.

Top Market Takeaways

- Software accounted for 78.3% of the tax software market, driven by its role in automating calculations and filings.

- Cloud-based SaaS solutions held 71.5% of the market share, offering easy access and auto-updates.

- Indirect tax led with 56.4% of market share, covering sales, VAT, and GST compliance.

- Large enterprises represented 53.81% of end-user adoption, addressing complex global tax needs.

- North America captured 38.2% of the global market, with the U.S. market reaching USD 7.95 billion in 2025, growing at a CAGR of 8.4%.

Demand Analysis indicates strong uptake from businesses that manage high transaction volumes or operate across multiple tax jurisdictions. These organizations require systems that can handle indirect taxes, direct taxes, and reporting obligations in parallel. Small and mid-sized enterprises are also contributing to demand as digital compliance becomes mandatory in many regions. The preference is shifting toward solutions that are easy to deploy and maintain with limited internal resources.

Demand is also supported by the increasing role of finance teams in strategic planning rather than only compliance execution. Tax software provides structured data that can be used for forecasting, scenario analysis, and internal reporting. This expands the role of tax management from a reactive function to a proactive financial discipline. As a result, tax software is being adopted not only for compliance but also for operational insight.

Increasing Adoption Technologies include cloud computing, artificial intelligence, and advanced analytics embedded within tax platforms. Cloud-based architectures allow continuous updates to tax rules and enable remote access for distributed teams. Artificial intelligence supports error detection, exception handling, and pattern recognition in large tax datasets. Analytics tools enhance visibility into tax positions and compliance status.

Integration technologies also play an important role in adoption. Modern tax software is designed to connect with accounting, payroll, and enterprise finance systems to ensure data consistency. Automated data exchange reduces duplication and minimizes reconciliation issues. These technological foundations improve reliability and user confidence in automated tax processes.

Driver Analysis

The tax software market is being driven by the increasing complexity of tax regulations and the growing need for automation in compliance and reporting processes. Organisations and individual taxpayers face frequent changes in tax codes, cross‑border tax rules, and evolving compliance standards that make manual calculation and filing processes prone to error and resource intensive.

Tax software solutions streamline computation, return preparation, data validation, and submission workflows, improving accuracy and reducing administrative burden. Integration with enterprise financial systems, real‑time updates, and built‑in rule engines further enhance the ability of organisations to maintain compliance, reduce risk, and improve operational efficiency in tax functions.

Restraint Analysis

A notable restraint in the tax software market relates to data security concerns and the perceived risk of storing sensitive financial and personal information on digital platforms. Tax systems manage highly confidential data, including income details, taxpayer identifiers, and financial transactions, which can be attractive targets for cyber threats.

Organisations may hesitate to adopt cloud‑based or third‑party solutions without robust encryption, access controls, and compliance with data protection standards. Ensuring secure integration with existing accounting and ERP systems while protecting sensitive information adds technical complexity and may slow adoption, particularly among security‑conscious users.

Opportunity Analysis

Emerging opportunities in the tax software market are linked to the incorporation of artificial intelligence, machine learning, and predictive analytics to improve tax planning, anomaly detection, and scenario modelling. AI‑enabled tools can analyse large datasets to identify optimisation opportunities, forecast tax liabilities, and flag potential compliance issues before they arise.

There is also potential for specialised solutions tailored to distinct segments such as indirect tax, international tax, transfer pricing, and industry‑specific regulatory requirements. Enhanced reporting features, visual dashboards, and self‑service capabilities further extend the value of tax software by supporting strategic decision making and cross‑functional collaboration.

Challenge Analysis

A central challenge facing this market involves maintaining accuracy and regulatory alignment amid frequent legislative changes and jurisdictional differences. Tax authorities periodically revise rules, thresholds, and filing requirements, which requires software providers to update logic and compliance engines rapidly.

Global organisations operating across multiple tax regimes face additional complexity in harmonising local tax rules with centralised systems. Delays or errors in implementing regulatory updates can expose users to compliance risks, penalties, and reputational damage. Ensuring timely updates, rigorous testing, and clear communication of changes is essential to maintaining solution reliability.

Emerging Trends

Emerging trends in the tax software market include the adoption of cloud‑native platforms that enable scalable processing, remote access, and seamless updates without on‑premise infrastructure. Another trend is the integration of tax software with broader finance and enterprise management suites to support unified data flows, reduce duplication of effort, and improve audit readiness.

Advanced automation, such as robotic process automation for data extraction and AI‑driven rule engines for compliance checks, is gaining traction to reduce manual workload and improve accuracy. Collaboration features that support shared workflows between tax, finance, and audit teams are also becoming more common.

Growth Factors

Growth in the tax software market is supported by the increasing volume and complexity of financial transactions, globalisation of business operations, and heightened regulatory focus on transparency and compliance. Organisations seek solutions that reduce risk, enhance reporting accuracy, and support strategic tax planning in dynamic regulatory environments.

Advances in data analytics, artificial intelligence, and cloud computing make tax software more capable, accessible, and cost‑effective for organisations of varied sizes. The rise of digital finance functions and demand for real‑time tax insights further reinforce investment in intelligent tax systems as essential tools for modern financial management.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud-based

- On-Premises

By Tax Type

- Direct Tax

- Indirect Tax

By End-User

- Individual

- Small Businesses

- Large Enterprises

- Accounting and Tax Firms

- Other End-Users

Top Key Players in the Market

- Intuit Inc.

- HandR Block Inc.

- Wolters Kluwer N.V.

- Thomson Reuters Corporation

- Sage Group plc

- Xero Limited

- Avalara Inc.

- Vertex Inc.

- Sovos Compliance LLC

- TaxSlayer LLC

- Drake Software LLC

- TaxAct Inc.

- Stripe Tax (TaxJar)

- ClearTax (Defmacro Software Pvt Ltd)

- Canopy Tax Inc.

- Bluenose Analytics Inc.

- ONESOURCE Indirect Tax

- Quicko Infosoft Pvt Ltd

- IRIS Business Services Ltd.

- TaxCloud

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)