Table of Contents

Tour Operator Software Market Size

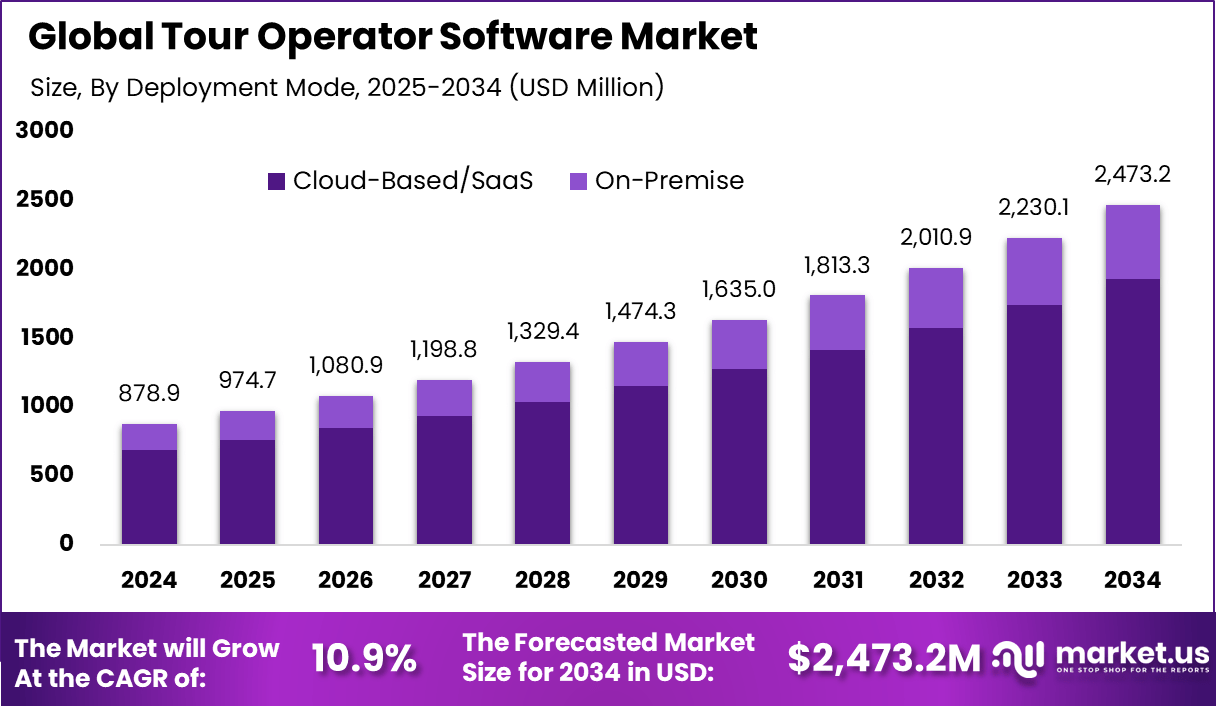

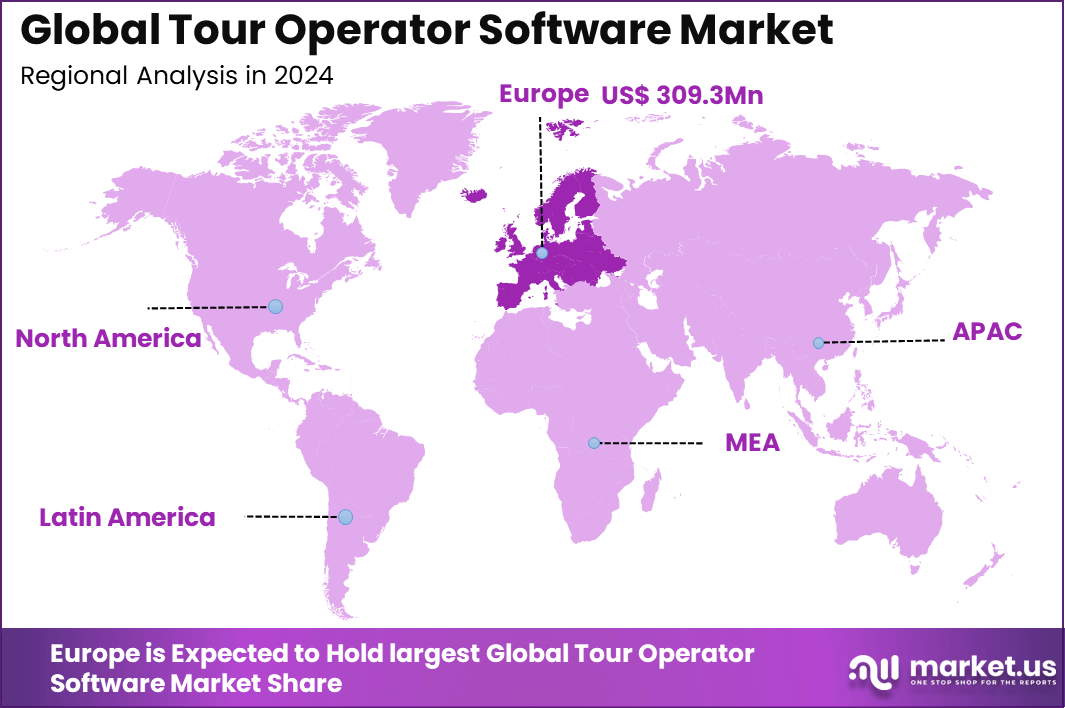

The global tour operator software market generated USD 878.9 million in 2024 and is expected to grow from USD 974.7 million in 2025 to approximately USD 2,473.2 million by 2034, registering a CAGR of 10.9% over the forecast period. In 2024, Europe held a dominant position with more than 35.2% market share, generating around USD 309.3 million in revenue, supported by strong adoption of digital booking and itinerary management systems across the travel industry.

The tour operator software market includes digital platforms that help tour operators manage bookings, itineraries, pricing, suppliers, and customer communication. These systems support end-to-end tour operations from planning to post-trip service. Tour operators use software to improve accuracy, reduce manual work, and manage high transaction volumes. The market supports both inbound and outbound travel operations.

Tour operator software is used by small tour agencies, large travel companies, and destination management firms. The software integrates inventory management, payment processing, and customer records into one system. As travel operations become more complex, reliance on digital tools increases. The market continues to expand with the recovery and growth of global travel activity.

Demand Analysis

Demand accelerates with surging global tourism recovery and online bookings, as operators handle higher volumes without proportional staff growth. Digital-savvy travelers expect seamless experiences, pushing adoption in regions like Europe and Asia-Pacific with expanding middle-class travel. Eco-tourism and personalized packages further strain traditional systems, favoring automated solutions.

Small to mid-sized operators lead uptake amid competitive pressures, seeking tools for 24/7 availability and mobile access. Government digital initiatives in emerging markets boost infrastructure for cloud platforms. Overall, market expansion ties to smartphone penetration and rising customized travel preferences.

Top Market Takeaways

- Cloud-based and SaaS deployment led with 78.3%, driven by demand for flexible, cost-efficient, and easily accessible travel management platforms.

- Booking and reservation management accounted for 30.5%, reflecting its role in automating itineraries, managing real-time availability, and enabling integrated payments.

- Monthly subscription pricing held 62.7%, showing strong preference for predictable costs and lower upfront investment.

- Tour operators and destination management companies captured 55.1%, highlighting reliance on digital tools to manage large customer volumes and complex travel operations.

- Small and medium enterprises led adoption with 80.6%, as SaaS platforms help smaller players streamline workflows and remain competitive.

- Europe represented 35.2% of the global market, supported by a mature tourism industry and ongoing digital transformation.

- Germany reached USD 45.79 million in 2024 and is growing at an 8.5% CAGR, driven by wider use of cloud-based systems for tour management and customer engagement.

Europe Market Size

Europe holds approximately 35.2% of the tour operator software market, supported by advanced digital adoption and strong tourism infrastructure. European operators use specialized tools to handle multilingual content, cross-border payments, and regulation-compliant travel management.

Emerging Trends

In the tour operator software market, a prominent trend is the integration of real-time booking and inventory management across multiple channels. Modern software platforms are enabling tour operators to synchronise availability, pricing, and reservations instantly across websites, third-party marketplaces, and mobile apps. This capability supports improved customer satisfaction by reducing overbookings and ensuring that customers access accurate information at the time of purchase.

Another emerging trend is the incorporation of artificial intelligence and automation into customer engagement and operations. Tour operator systems are embedding automated communication tools, chatbots, and intelligent itinerary suggestions that can personalise offers based on traveller preferences. These intelligent capabilities help operators deliver tailored experiences while reducing manual workload, particularly for repetitive tasks such as ticket confirmations, reminders, and post-booking support.

Growth Factors

A key growth factor in the tour operator software market is the expanding demand for seamless digital travel experiences. Travellers increasingly expect convenient online booking, clear itinerary details, secure payment options, and integrated customer support. Software that delivers these digital experiences empowers operators to meet evolving traveller expectations and improve conversion rates.

Another important factor supporting growth is the rise of customised and niche travel offerings. Tour operators are creating specialised packages for adventure tourism, cultural experiences, eco tours, and thematic retreats. Software solutions that enable flexible package design, modular pricing, and dynamic bundling help operators create differentiated products that attract diverse customer segments.

Driver

A principal driver of the tour operator software market is the need for operational efficiency and cost optimisation. Manual scheduling, invoicing, and itinerary management can be time-consuming and error prone. Software platforms automate key processes, centralise data, and streamline workflows, which reduces administrative overhead and supports faster response times during peak travel periods.

Another driver is the increasing emphasis on data insights and performance measurement. Operators are using analytics embedded within software to track booking trends, customer behaviour, revenue streams, and marketing campaign effectiveness. These insights help inform strategic decisions and support targeted promotions that improve customer acquisition and retention.

Restraint

A significant restraint in this market is the variation in technology adoption across small and medium sized tour operators. Smaller operators may rely on manual systems or basic digital tools due to budget constraints or limited technical expertise. This uneven adoption slows overall modernisation and can limit the competitive advantage gained from advanced software solutions.

Another restraint arises from integration challenges with legacy systems and third-party suppliers. Tour operators often work with multiple service providers such as hotels, transport companies, and activity vendors. Ensuring seamless connectivity between disparate systems, data formats, and booking platforms can require specialised expertise and careful coordination.

Opportunity

A clear opportunity exists in the development of mobile-first and traveller-centric interfaces. Mobile apps that support real time itinerary updates, document storage, in-destination guidance, and on-the-go communication can enhance traveller engagement and satisfaction. Empowering travellers with intuitive tools improves overall experience and can lead to stronger brand loyalty.

Another opportunity lies in enhancing integration with payment, loyalty, and CRM systems. Tour operator software that can securely support varied payment methods, track customer preferences, and link to loyalty programmes can strengthen customer relationships and encourage repeat business. These expanded capabilities help operators offer more personalised and cohesive travel experiences.

Challenge

One of the main challenges for the tour operator software market is maintaining data security and compliance. Systems that handle booking information, personal identification data, and payment details must provide robust protections to safeguard privacy and prevent unauthorized access. Compliance with global and regional data protection regulations adds complexity to software design and governance.

Another challenge involves ensuring scalability and performance during peak demand periods. Tour operators frequently experience spikes in bookings during holiday seasons and promotional events. Software platforms must be capable of handling high volumes of concurrent transactions without performance degradation to maintain user satisfaction and operational continuity.

Key Market Segments

By Deployment Mode

- Cloud-Based/SaaS

- On-Premise

By Application

- Booking & Reservation Management

- Inventory Management

- Customer Relationship Management (CRM)

- Financial Management & Accounting

- Supplier Management

- Others

By Subscription Type

- One-time Subscription

- Monthly Subscription

- Annual Subscription

By End-User

- Tour Operators & Incoming Agencies (DMCs)

- Activity & Experience Providers

- Travel Agencies

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Top Key Players in the Market

- Traveltek

- Sabre

- FareHarbor

- Amadeus IT Group SA

- Infotree Solutions Ltd.

- GP Solutions GmbH

- WeTravel Inc.

- TraveloPro Ltd.

- Qtech Software Pvt Ltd.

- Rezdy Pty Ltd.

- Dolphin Dynamics Ltd.

- SAN Tourism Software Group

- Trawex Technologies Private Limited

- Globe Track.

- Checkfront Inc.

- Techno Heaven Consultancy Pvt Ltd.

- Tourwriter

- Travelogic

- Travefy Inc.

- Centaur Systems LLC

- Adventure Bucket List LLC

- Vacation Labs Private Limited

- ResRequest

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 878.9 Mn |

| Forecast Revenue (2034) | USD 2,473.2 Mn |

| CAGR(2025-2034) | 10.9% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)