Table of Contents

Introduction

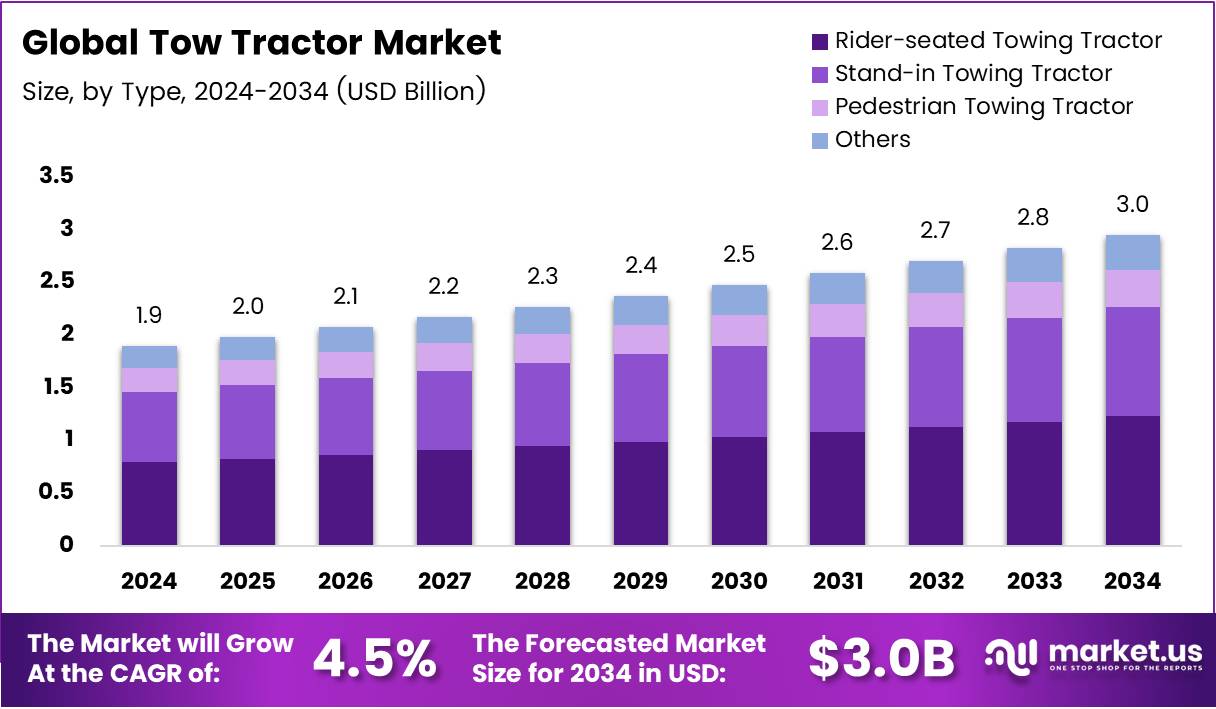

The Global Tow Tractor Market is poised for substantial growth, projected to reach USD 3.0 Billion by 2034, up from USD 1.9 Billion in 2024. The market is anticipated to expand at a CAGR of 4.5% between 2025 and 2034.

Tow tractors, essential in industries such as manufacturing, logistics, and warehousing, are witnessing increasing demand due to the global push toward automation. Moreover, the rise of e-commerce and large-scale logistics operations is significantly driving market expansion.

Transitioning toward sustainable mobility, electric tow tractors are gaining strong momentum. Governments worldwide are encouraging the adoption of low-emission vehicles, further boosting the appeal of electric and automated towing systems in modern industrial environments.

Key Takeaways

- The Global Tow Tractor Market is expected to reach USD 3.0 Billion by 2034, growing at a CAGR of 4.5% from 2025 to 2034.

- In 2024, Rider-seated Towing Tractor holds a dominant position in the By Type segment with a 48.9% share.

- Electric tow tractors dominate the By Power Source segment in 2024 with a 67.3% share.

- Below 5 Tons is the leading segment in the By Load Capacity analysis with a 58.1% share in 2024.

- Warehouses hold the largest share of 45.8% in the By Application segment in 2024.

- North America dominates the Tow Tractor Market with a 42.9% share, valued at USD 0.8 Billion in 2024.

Market Segmentation Overview

The By Type segment is led by Rider-seated Towing Tractors, commanding 48.9% market share. These tractors are widely preferred for their ergonomic designs and high comfort levels, enabling operators to work efficiently over long durations, thus improving productivity across logistics and manufacturing sectors.

In the By Power Source category, Electric Tow Tractors dominate with 67.3% share. The surge in adoption is fueled by government incentives and growing environmental awareness. Electric models offer lower operational costs, minimal maintenance, and align well with sustainability mandates across industries.

By Load Capacity, the Below 5 Tons segment leads with 58.1%. This category’s flexibility and ease of operation make it suitable for warehouses, airports, and factories. Its lightweight design allows for smooth navigation in confined spaces, making it ideal for diverse industrial applications.

The By Application segment is topped by Warehouses, accounting for 45.8% share. Warehouses rely heavily on tow tractors to streamline internal transport, boost productivity, and optimize material flow. Airports and rail stations follow, utilizing tow tractors for ground handling and cargo movement.

Drivers

Increasing Demand for Efficient Airport Ground Support

The growing focus on airport modernization and efficiency is driving the need for advanced tow tractors. Airlines are adopting high-performance models to manage aircraft movement, luggage towing, and cargo transfer. This results in reduced delays, enhanced operational safety, and improved ground handling performance.

Surge in E-commerce and Logistics Operations

E-commerce expansion is creating massive demand for warehouse automation. Tow tractors streamline internal logistics by efficiently transporting goods, reducing manual labor, and increasing throughput. As supply chains scale globally, these vehicles become vital for maintaining operational speed and accuracy.

Use Cases

Streamlining Warehouse Operations

In large distribution centers, tow tractors are used to move heavy materials, optimize inventory management, and improve efficiency. They support continuous workflow in automated storage systems and reduce reliance on manual handling, resulting in faster turnaround times and lower operational costs.

Enhancing Airport Ground Handling

Tow tractors play a pivotal role in towing luggage carts, equipment, and aircraft tugs at airports. With the adoption of electric models, airports can ensure quieter, emission-free operations while meeting strict sustainability and noise-reduction standards.

Major Challenges

Regulatory and Emission Compliance

Stringent government regulations on emissions compel manufacturers to invest in green technologies. The shift increases development and production costs, which may result in higher prices for end-users, slowing adoption in cost-sensitive markets.

High Cost and Skill Barriers

Advanced tow tractors with automation and AI features demand skilled operators and regular maintenance. However, the shortage of trained personnel and high maintenance costs can hinder deployment, particularly among small and mid-sized enterprises.

Business Opportunities

Integration of AI and IoT Technologies

The integration of AI and IoT in tow tractors enables predictive maintenance, route optimization, and data-driven decision-making. Smart fleet management helps operators reduce downtime, improve efficiency, and maximize return on investment.

Growing Demand for Electric and Sustainable Solutions

As industries transition toward eco-friendly operations, electric tow tractors present significant opportunities. Manufacturers investing in battery technology, fast-charging solutions, and hybrid innovations are well-positioned to capture market share.

Regional Analysis

North America Leads the Global Market

North America, valued at USD 0.8 Billion in 2024, holds a 42.9% share. The region benefits from widespread adoption of automation technologies, government support for electric mobility, and robust infrastructure investments in logistics and airport modernization.

Asia Pacific Shows Rapid Expansion

Asia Pacific is projected for the fastest growth, driven by urbanization, e-commerce expansion, and large-scale infrastructure projects. Countries such as China, India, and Japan are heavily investing in warehouse automation and airport upgrades, creating substantial demand for tow tractors.

Recent Developments

- September 2025: Norea Capital acquired Motrec International, strengthening its portfolio in airport ground support and electric vehicle sectors.

- September 2025: CSI Leasing obtained a majority stake in Aeroservicios USA, expanding ground support capabilities in Latin America.

- September 2024: JLG Industries completed the acquisition of AUSA, enhancing its ground support equipment portfolio.

- April 2024: OMG Industry secured full ownership of the Fiora brand, reinforcing its industrial equipment offerings.

Conclusion

The Global Tow Tractor Market is on a strong upward trajectory, fueled by automation, electrification, and sustainability trends. With significant growth in logistics, airports, and warehousing, the market offers robust opportunities for manufacturers investing in green and smart technologies. As regulatory frameworks favor eco-friendly equipment, electric and AI-driven tow tractors are set to redefine industrial material handling, ensuring efficiency, safety, and environmental compliance.